On November 30, 2022, OpenAI publicly launched ChatGPT and kicked off the generative artificial intelligence (AI) boom that is quickly reshaping the technology industry and consumer behaviors. We believe that generative AI represents the start of an innovative era poised to fuel economic growth and broaden the scope of possibilities in nearly every industry. Early breakthroughs associated with ChatGPT and other large language models (LLMs) offer only a mere glimpse of what’s possible with generative AI, but to us, they clearly demonstrate that we are on the cusp of a new technological paradigm shift.

Key Takeaways

- ChatGPT’s remarkable user growth and integration with major cloud services within its first year reflect the swift adoption and scalability of generative AI.

- The emergence of new business models like Model-as-a-Service (MaaS) and application programming interface(API)-based monetization is changing the way AI technology is monetized and commercialized, enabling businesses of all sizes to leverage AI without significant upfront investments.

- AI is on the brink of further advancements in language understanding, multi-modal functionalities, and the creation of more personalized and context specific LLMs.

One Year In, Generative AI Adoption Already Spans Far and Wide

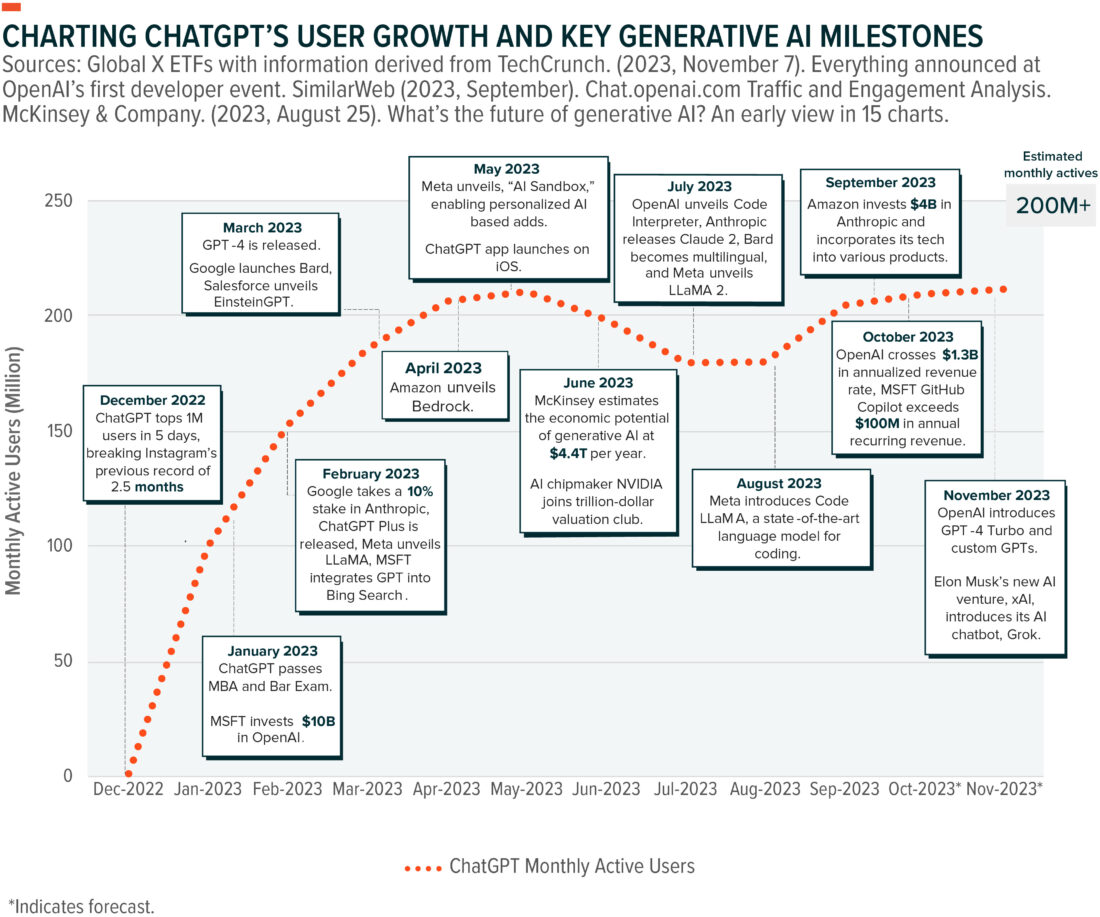

ChatGPT gained 100 million monthly active users (MAUs) in under 2 months, becoming the fastest-growing consumer internet app of all time after its launch one year ago. TikTok, for example, took around 9 months to reach 100 million users.1 The platform now boasts 100 million weekly active users and an estimated 200 million plus MAUs, including 2 million developers, spanning 92% of Fortune 500 companies.2

Particularly notable about ChatGPT’s growth over the last 12 months is that spikes in MAUs align with key milestones, such as integrations with leading cloud providers, product upgrades, and the broadening of industry applications. For example, the user uptick in February and March 2023 corresponded to functionality improvements following the release of GPT-4 and integrations into Microsoft’s product suite. The launch of ChatGPT’s app on iOS in May 2023 drove another surge in usage. In September, with schools back in session, user engagement rebounded, setting the stage for the possibility of a new MAU record in the months ahead.3

Rapid user adoption has helped OpenAI cross $1.3 billion of revenue on an annualized basis in 2023, up over 4500% from 2022.4 This lucrative opportunity has effectively commenced a generative AI arms race among Big Tech giants.

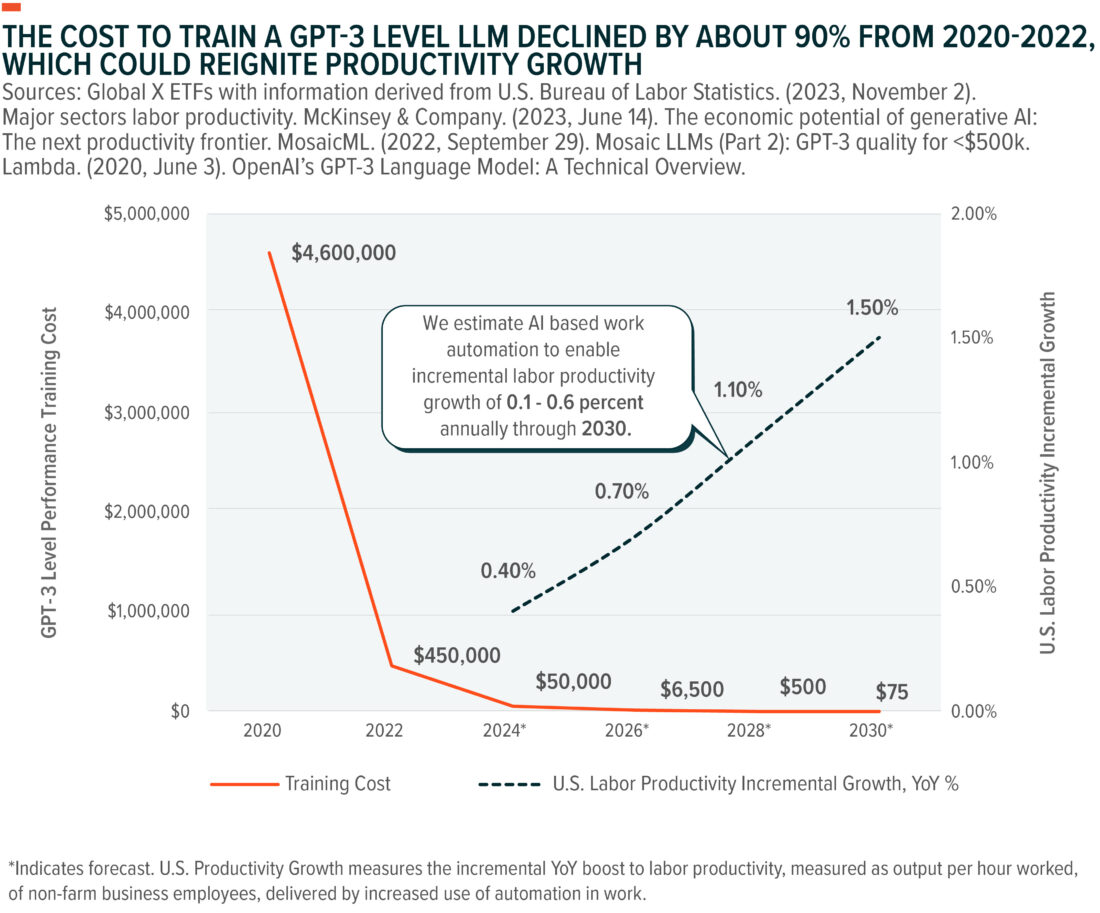

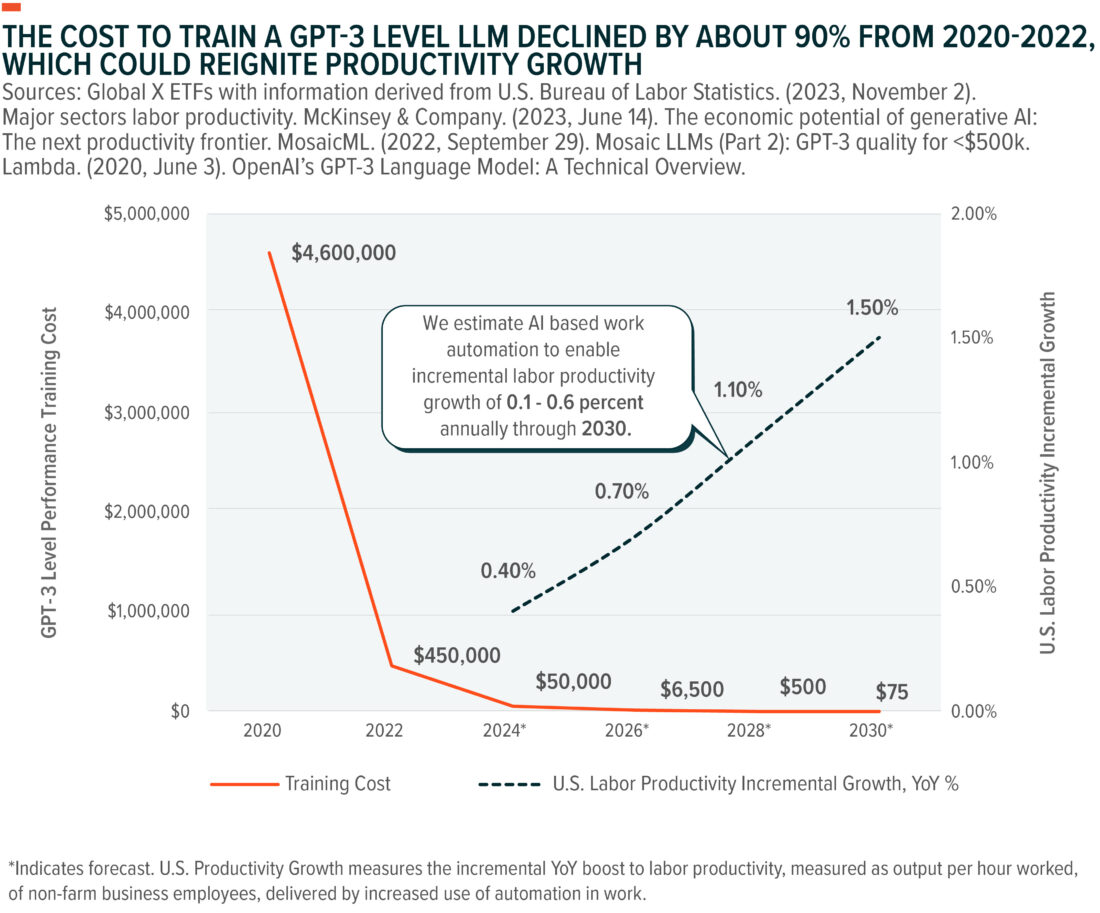

Fueling this competitive landscape are the productivity gains that generative AI offers and model training cost declines the industry broadly achieved. New models are dramatically increasing knowledge workers’ productivity, in some cases by up to 40%.5 Such efficiency gains are driving increased adoption, which in turn helps reduce model training and development costs and lowers the barriers to entry. This cycle of continual innovation is further democratizing access to AI technology.

ChatGPT Paves the Way for Wider AI Monetization

Several new business models have emerged beyond the standard monthly consumer subscription fee over the last year. The Model-as-a-Service framework, where developers license their technology to other companies for a recurring fee, is a favored business model among AI players.

This strategy can be particularly lucrative when smaller companies license their solutions to larger tech firms with substantial user bases. OpenAI is a prime example. By licensing the GPT-3 AI model to Microsoft for use in its consumer and enterprise platform, OpenAI significantly extends its market penetration by tapping into Microsoft’s established distribution networks.

Like the subscription-based model that exists today for most software, the MaaS consumption-based pricing strategy allows businesses to leverage premier AI models and scale their AI use to their specific needs. And they can do so without the burdensome capital expenditure traditionally associated with developing such models in-house.

API-based monetization has also surfaced in the last year as a prevalent strategy for AI developers to broaden the reach of their AI capabilities. Through APIs, AI services are integrated seamlessly into a multitude of platforms on a scalable pay-per-use basis. This strategy not only generates recurring revenue streams for AI developers, but it also encourages widespread integration of AI. For example, ChatGPT’s APIs, which are priced at various rates based on input, can facilitate a range of experiences, including non-chat applications, like image generation. Among the early adopters of this functionality were Snapchat, Shopify, and Instacart.6

Multi-Modality and Custom-Built LLMs Can Bring AI Closer to Widespread Consumer Application

In the coming days, we anticipate LLM advancements in language understanding and multi-modal functionality that span image, video, and gaming.

Also likely is an explosion of custom-built LLMs and a deeper convergence of vertical integration from existing software-as-a-service (SaaS) providers. For example, Salesforce recently rolled out Einstein GPT, which is a new AI feature that helps auto-generate sales content, marketing, and personalization across channels.7 Another example is Microsoft Co-Pilot, a programming assistant trained on GitHub codebases, which currently boasts over 1 million active paid users.8

Upcoming iterations of these models are set to become increasingly personalized and context-specific, particularly as SaaS providers start to harness their proprietary data to refine model training and automate industry-specific tasks. OpenAI also recently rolled out functionality that empowers users, from individuals to large enterprises, to build ChatGPT variations that incorporate custom instructions, additional knowledge, and a tailored blend of skills.9

Conclusion: We Believe ChatGPT’s Inaugural Year is Just the Beginning

We feel ChatGPT’s successful first year symbolizes a seminal shift in technological adoption. Meaningful monetization evidence should offer further fuel for the industry to continue to invest. However, we are just scratching the surface of generative AI’s potential. We believe the progress we have witnessed so far is merely the precursor to a deeper, more substantial transformation that is set to redefine the interplay between technology and humans and reshape the economic landscape across industries.

—

Originally Posted November 27, 2023 – ChatGPT’s One-Year Anniversary: Generative AI’s Breakout Year

Footnotes

1. Reuters. (2023, February 2). ChatGPT sets record for fastest-growing user base – analyst note.

2. TechCrunch. (2023, November 6). OpenAI’s ChatGPT now has 100 million weekly active users.

3. SimilarWeb. (2023, October 30). ChatGPT Recovers to Near-Peak Levels.

4. The Information. (2023, October 12). OpenAI’s Revenue Crossed $1.3 Billion Annualized Rate, CEO Tells Staff.

5. MIT. (2023, October 19). How generative AI can boost highly skilled workers’ productivity.

6. TechCrunch. (2023, March 1). OpenAI launches an API got ChatGPT, plus dedicated capacity for enterprise customers.

7. Salesforce. (2023, March 7). Salesforce Announced Einstein GPT, the World’s first Generative AI for CRM.

8. Microsoft. (2023, October 24). Microsoft FY24 First Quarter Earnings Conference Call.

9. OpenAI. (2023, November 6). Introducing GPTs.

Disclosure: Global X ETFs

Carefully consider the Fund’s investment objectives, risk factors, charges and expenses before investing. This and additional information can be found in the Fund’s full or summary prospectus, which may be obtained by calling 1-888-GX-FUND-1 (1.888.493.8631), or by visiting globalxfunds.com. Read the prospectus carefully before investing.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Global X ETFs and is being posted with its permission. The views expressed in this material are solely those of the author and/or Global X ETFs and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.