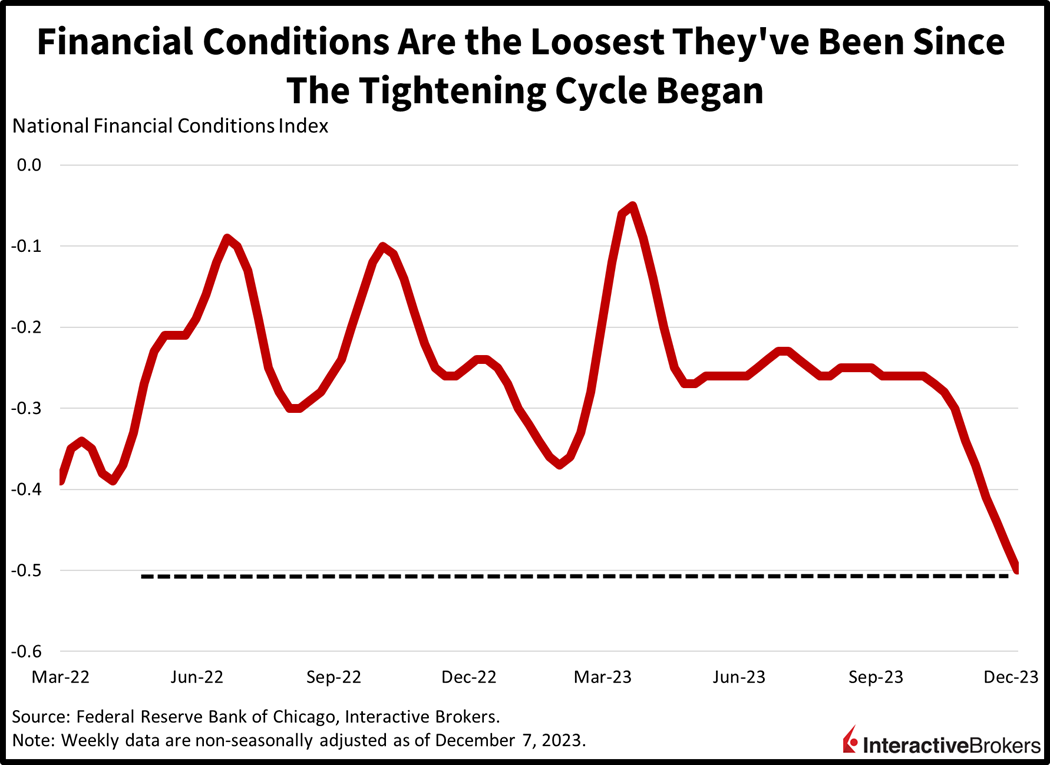

Fed Chairman Powell’s comments yesterday pointing to rate cuts on the horizon ignited a strong market rally with the Dow Jones Industrial soaring to an all-time high while bond yields and the dollar dropped significantly. While investors are cheering the Fed’s pivot to a more accommodative posture, the shored-up sentiment among market participants has caused financial conditions to become the loosest they have been during the central banks tightening campaign, which is likely to create a renewed bout of inflation. Indeed, all commodities are sharply higher in response to the prospect of re-accelerating inflation in the coming months, a development that I’m incredibly concerned about. I thought Powell was too early in discussing rate cuts, something he remarked as premature just two weeks ago.

Fed Offers 3, Markets Take 6 and a Half

Even though the Fed’s updated Summary of Economic Projections (SEP) called for only three rate cuts in 2024, investors reacted to his comments with strong enthusiasm–futures contracts are pointing to market participants expecting six and a half rate cuts in 2024. Prior to the meeting the market was expecting about five. Even though the SEP denied the five cuts market players were looking for, penciling in only three, Powell’s dovish tone still caused investors to dial up 2024 rate cut expectations to six and a half. Additionally, the Fed’s policy statement now says that recent data reflects slowing economic activity, whereas it previously said data suggested economic activity expanded at a strong pace. Rather than saying inflation remains elevated, the statement now says inflation has eased over the year but remains elevated. Today–less than 24 hours after his presentation–retail sales, while being only one report, didn’t reflect slowing at all, with consumer spending fully recovering from October’s weakness.

Consumption Resurges in November

Retail Sales recovered from October’s dip last month as consumers increased their spending despite diminishing savings and the resumption of student loan repayments. Impressively, sales, which are measured in dollars and not volumes, rose 0.3% month-over-month (m/m) despite gasoline prices declining significantly. The growth flew past both the projected 0.1% decline and October’s 0.2% contraction. Retail sales excluding automobiles and gasoline rose a sharp 0.6% m/m, but when only excluding automobiles, the figure rose just 0.2%.

Transactions were mixed across categories while consumers rushed to dining and drinking establishments, with sales rising a whopping 1.6%.

The following also gained and produced the noted increases:

- Sporting goods retailers, 1.3%

- Ecommerce, 1%

- Furniture showrooms, 0.9%

- Health and personal care stores, 0.9%

- Apparel shops, 0.6%

- Automobile dealerships, 0.5%

- Food markets, 0.2%

On the other hand, gasoline stations, miscellaneous retailers, electronics and appliance stores, building materials establishments and general merchandise shops saw transaction dollars decline 2.9%, 2%, 1.1%, 0.4% and 0.2%.

Labor Remains Tight

Labor market data failed to reflect overall economic slowing this morning as well, with initial unemployment claims for the week ended December 9 totaling 202,000, dropping by 19,000 from the revised 221,000 for the preceding week and coming in well below expectations of 220,000. The four-week moving average of 213,250 dropped by 7,750 from the revised four-week moving average of 221,000. Meanwhile, continuing unemployment claims increased with the four-week moving average climbing to 1.874 million for the week ended December 2, up by 3,500 from the preceding period and reaching the highest level since December 11, 2021, when claims totaled 1.888 million. Claims for the one-week period ended December 2 also climbed, reaching 1.876 million up 20,000 from 1.856 million for the preceding week but arriving better than expectations of 1.887 million.

Markets Up While Commodities Warn

Markets are celebrating the Fed’s view of interest rate cuts on the horizon with stocks higher, yields lower and the dollar weaker. Commodities are sending an important warning signal though, which is consistent with stronger inflation in the coming months as a result of much looser financial conditions. Indeed, almost all commodities are sharply higher including oil, natural gas, gold, silver, copper, platinum, palladium, lumber, wheat, soybeans, cattle, and hogs. The list goes on and on.

Back to the good news–the small-cap Russell 2000 Index is leading with a whopping gain of 2.6% while the S&P 500 and Dow Jones Industrial indices are up 0.3% and 0.2%. The Nasdaq Composite Index is lower by 0.1% and appears exhausted after almost hitting its all-time high this morning. Sectoral breadth is positive with all sectors higher minus technology and the defensive health care and consumer staples sectors. The three sectors are down 0.3%, 0.4% and 0.7%. Energy, real estate and materials are leading, consistent with higher commodity prices and improved balance sheets following the dramatic fall in yields. The leading sectors are higher by 2.4%, 2.4% and 1.7%. Bond yields and the dollar are tumbling, with the 2- and 10-year Treasury maturities trading at 4.35% and 3.92%, as the instruments are lower by 8 and 10 basis points (bps) on the session. The Dollar Index is down 99 bps to 101.88 as the greenback loses value relative to the pound sterling, euro, yen, yuan, franc and Aussie and Canadian dollars. Indeed, the Fed’s dovish tilt and outlook for rate cuts is taking the pressure off of the world’s economies and freeing up economic activity. While the dollar fails to gain against any major currency, crude oil is spiking as a result of improving economic prospects driven by a lighter Fed. WTI is up a sharp 3.2%, or $2.22, to $72.03 per barrel.

We Never Know What Can Happen

Markets and sports share a common characteristic—the occasional and at times frequent occurrence of unexpected outcomes. In 2004, no one thought the Boston Red Sox could come back from being down 0-3 against the New York Yankees to win the American League Championship Series. Yet Boston hit a four-game winning streak and moved on to win the World Series. Yesterday, I underestimated the extent of Powell’s shift to a more dovish stance, but today I believe his pivot is a mistake. The resulting optimism among investors has caused financial conditions to loosen dramatically as interest rates decline, equity and commodity prices soar and credit spreads tighten. As portfolio values climb, household’s perception of having increased wealth is likely to spark another consumer spending spree, thereby supporting inflation. Lower financing costs and easing credit conditions, furthermore, are also likely to propel lending, support consumption and entice corporations to increase their capital expenditures. This increased demand could result in a continuation of a pattern in which looser financial conditions such as those occurring after the regional banking debacle have renewed inflation. If efficiencies and productivity offset accelerating inflationary pressures, a case I consider unlikely, then Powell may have snuck a pitch that is just barely within the strike zone, moving his team one step closer to the world series of monetary policy—a soft landing.

Visit Traders’ Academy to Learn More About Retail Sales and Other Economic Indicators.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.