Key News

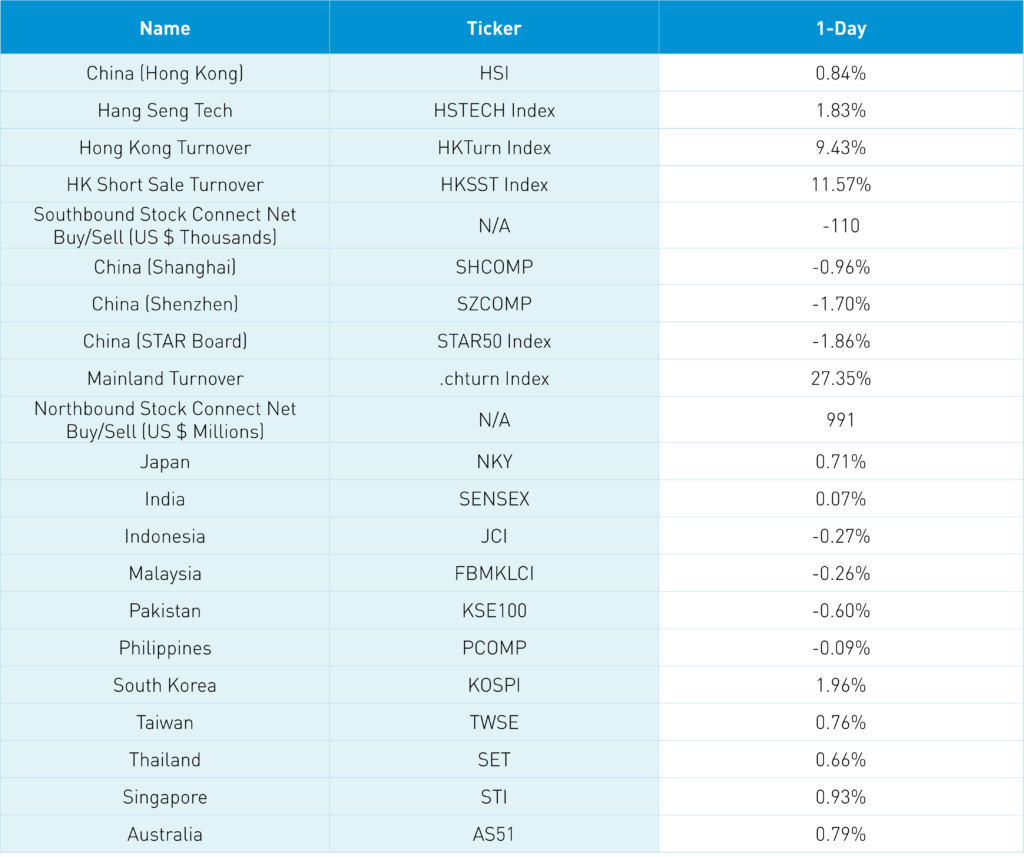

Asia equities were higher overnight as Hong Kong and South Korea outperformed, while Mainland China underperformed.

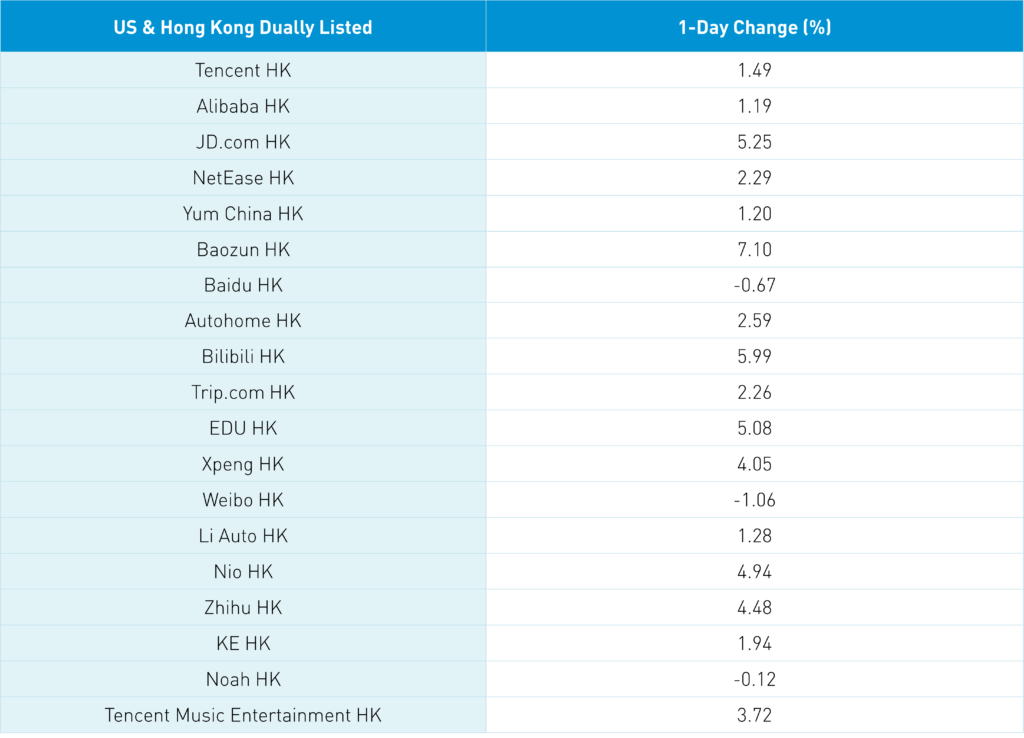

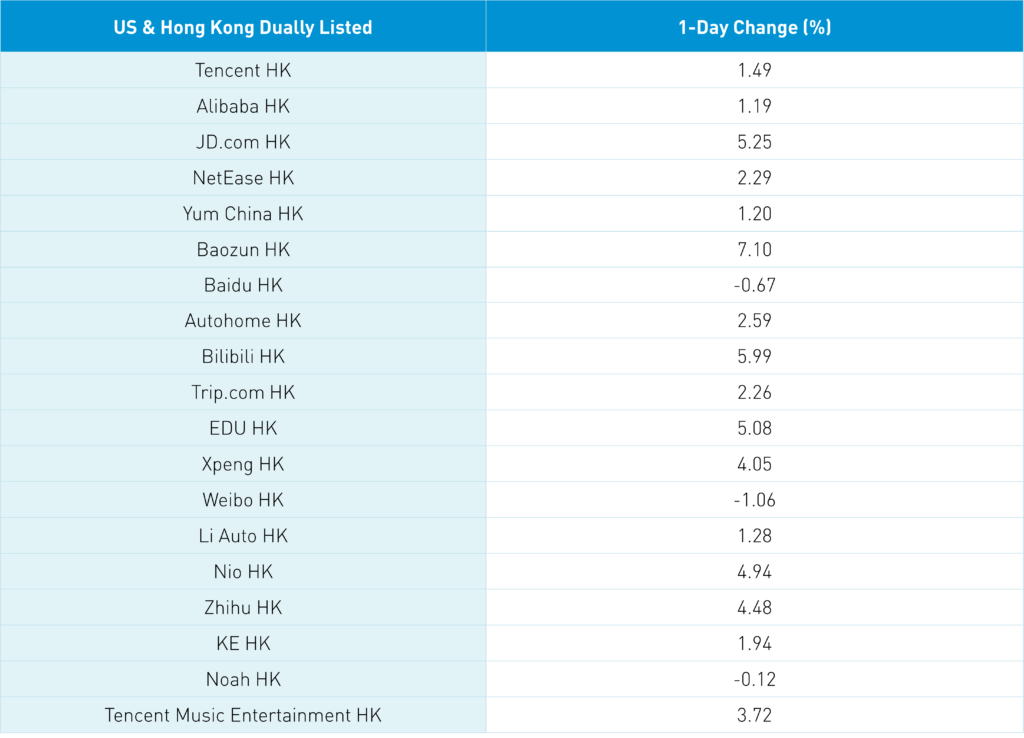

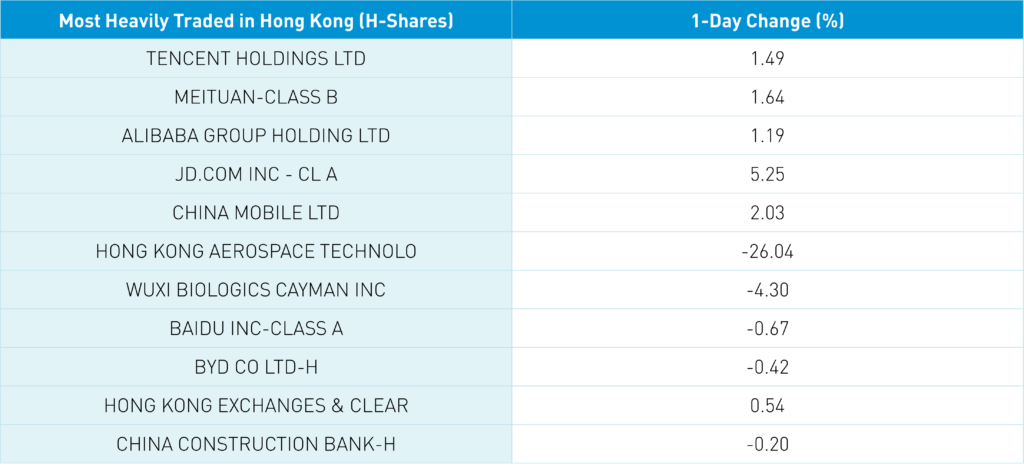

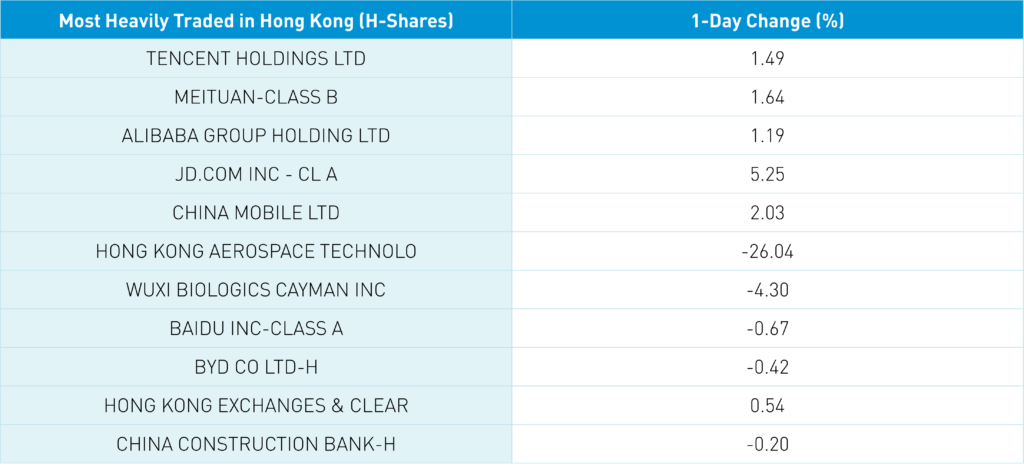

Hong Kong internet stocks shook off yesterday’s ADR decline broadly, with Hong Kong’s most heavily traded Tencent +1.49%, Meituan +1.64%, Alibaba HK +1.19%, and JD.com HK +5.25%. The Hang Seng and Hang Seng Tech closed +0.84%, just below the 21k level and +1.83% though sold off intra-day highs of +2.38% and +4.32% in late afternoon trading. Shanghai and Shenzhen also gave up intra-day gains of +0.86% and +0.58%, selling off aggressively on profit-taking to close -0.96% and -1.7%, pushing the indices back to support levels. What triggered the afternoon sell-off? Difficult to say.

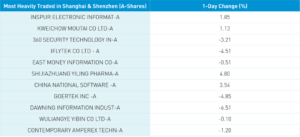

There was a fair amount of good news as President Xi’s December speech was re-released from the CEWC economic meetings emphasizing consumption and policy support. This should lead to further policy at the Two Sessions government meetings, which will occur on March 4 and 5. PBOC injected cash into the financial as taxes are due in China, with some chatter about another bank reserve requirement ratio cut or the loan prime rate. The Foshan Health Commission announced expanded maternity and paternity leave as the government pivots to raising China’s birthrate. Shenzhen Health Commission has proposed paying parents a subsidy for having a third child RMB 19,000. Both Ji’nan and Harbin have proposed similar policies. More to come on this issue! We’ve had some ChatGPT/AI mania in Mainland China that appeared to trigger a bout of selling that spread broadly to equities as only 474 stocks advanced.

Foreign investors bought a healthy $991mm of Mainland stocks via Northbound Stock Connect. In a meeting with a visitor from Hong Kong, they felt Northbound Connect inflows were from brokerage firms/market makers/high-frequency traders. I would lean that the AI bubble burst, leading to a sell-off stampede, was the culprit for the Mainland’s fall. However, the sell-off coincided with Iranian President Ebrahim Raisi’s visit to Beijing included an offer for President Xi to visit Iran, which he accepted. There was some chatter that a US-China meeting in Europe might be harder to pull off following the balloon incident.

After the close, Raytheon and Lockheed Martin were banned from doing business in China due to arms sales to Taiwan which is inconsequential though Boeing avoided a similar fate. An idea for an activist investor would be to lobby Boeing to split its military and commercial efforts into two companies. The tit-for-tat escalation is unfortunate and only enforces why the two sides should get on a plane and meet. Hong Kong internet stocks held up as investors appear to check their calendars and see that Baidu reports next Wednesday, Alibaba, and NetEase Thursday.

This morning online auto seller Autohome (ATHM US) reported Q4 results, with revenue and adjusted net income beating estimates while adjusted EPS missed. The company did up its dividend and buyback program in a positive for investors.

Worth noting that Alibaba shareholders include Charlie Munger and now Michael Burry of Big Short fame, who also owns JD.com. Domestic travel numbers are climbing quickly while outbound/international travel is ramping up! Munger had some kind words about BYD from his Daily Journal conference yesterday.

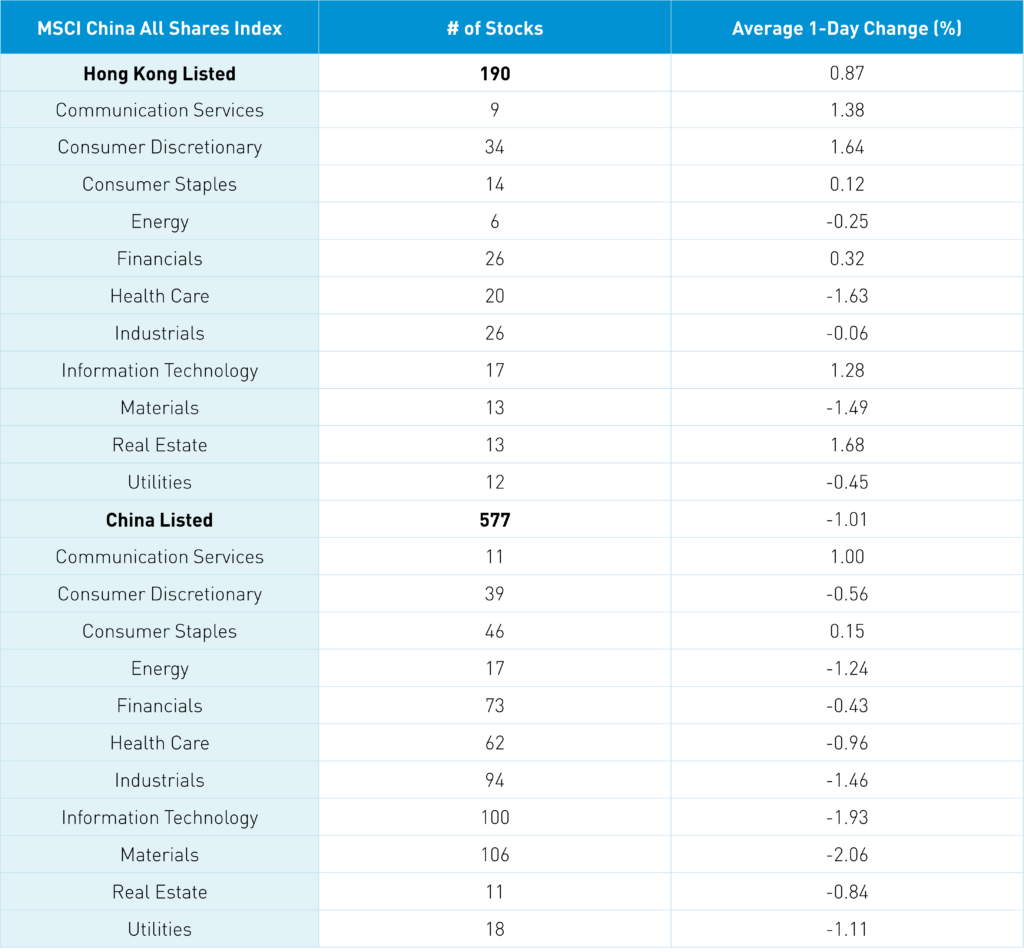

The Hang Seng and Hang Seng Tech gained +0.84% and +1.83% on volume +9.43% from yesterday, which is 97.6% of the 1-year average. 249 stocks advanced, while 227 stocks declined. Main Board short turnover increased +11.57% from yesterday, 92% of the 1-year average, as 16% of turnover was short turnover. Growth factors outperformed value factors as large caps outpaced small caps. The top sectors were real estate +1.68%, discretionary +1.64%, and communication +1.38%, while healthcare -1.63%, materials -1.49%, and utilities -0.45%. Top sub-sectors were food/staples, healthcare equipment, and telecom services, while semis, materials, and pharma/biotech were among the worst. Southbound Stock Connect volumes were light as Mainland investors sold -$110mm of HK stocks, with Tencent a small net sell, and Meituan and Kuaishou were both small net buys.

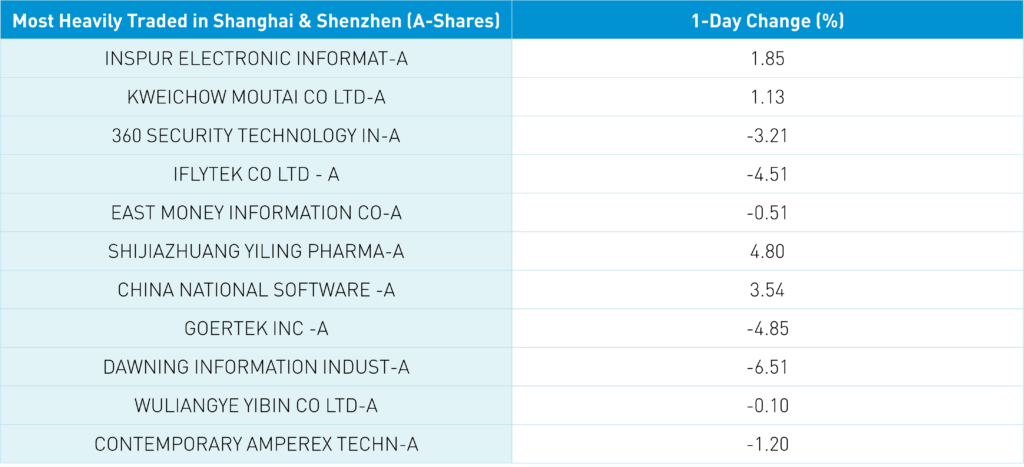

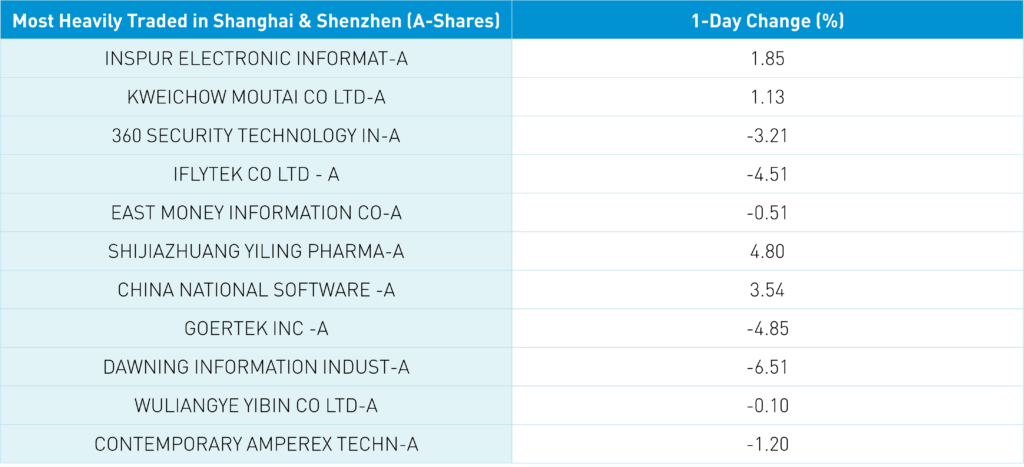

Shanghai, Shenzhen, and STAR Board fell -0.96%, -1.7%, and -1.86% on volume +27.35% from yesterday, which is 132% of the 1-year average. Only 474 stocks advanced, while 4,286 stocks advanced. Value factors outpaced growth factors, while large caps outperformed small caps. Communication and staples were the only positive sectors, +1% and +0.15%, while materials -2.06%, tech -1.93%, and industrials -1.46%. The top sub-sectors were telecom, catering, and liquor, while computer hardware, education, and packaging were among the worst. Northbound Stock Connect volumes were moderate as Mainland investors bought a healthy +$991mm of Mainland stocks. CNY was flat versus the US dollar. Treasury bonds rallied while copper fell and steel rallied.

Last Night’s Performance

Last Night’s Exchange Rates, Prices, & Yields

- CNY per USD 6.86 versus 6.81 yesterday

- CNY per EUR 7.33 versus 7.33 yesterday

- Yield on 10-Year Government Bond 2.89% versus 2.89% yesterday

- Yield on 10-Year China Development Bank Bond 3.06% versus 3.06% yesterday

- Copper Price -0.86% overnight

- Steel Price +1.23% overnight

—

Originally Posted February 16, 2023 – Declining Birthrate Policies Arrive as Hong Kong Internet Stocks Rise

Disclosure: KraneShares

Content on China Last Night is for informational purposes only and should not be construed as investment advice. This material represents an assessment of the market environment at a specific time and is not intended to be a forecast of future events or a guarantee of future results; material is as of the dates noted and is subject to change without notice. This information should not be relied upon by the reader as research or investment advice regarding the funds or any security in particular.

This material may not be suitable for all investors and is not intended to be an offer, or the solicitation of any offer, to buy or sell any securities. Investing involves risk, including possible loss of principal.

This material contains general information only and does not take into account an individual’s financial circumstances. This information should not be relied upon as a primary basis for an investment decision. Rather, an assessment should be made as to whether the information is appropriate in individual circumstances and consideration should be given to talking to a financial advisor before making an investment decision.

Forward-looking statements (including Krane’s opinions, expectations, beliefs, plans, objectives, assumptions, or projections regarding future events or future results) contained in this presentation are based on a variety of estimates and assumptions by Krane. These statements generally are identified by words such as “believes,” “expects,” “predicts,” “intends,” “projects,” “plans,” “estimates,” “aims,” “foresees,” “anticipates,” “targets,” “should,” “likely,” and similar expressions. These also include statements about the future, including what “will” happen, which reflect Krane’s current beliefs. These estimates and assumptions are inherently uncertain and are subject to numerous business, industry, market, regulatory, geo-political, competitive, and financial risks that are outside of Krane’s control. The inclusion of forward-looking statements herein should not be regarded as an indication that Krane considers forward-looking statements to be a reliable prediction of future events and forward-looking statements should not be relied upon as such. Neither Krane nor any of its representatives has made or makes any representation to any person regarding forward-looking statements and neither of them intends to update or otherwise revise such forward-looking statements to reflect circumstances existing after the date when made or to reflect the occurrence of future events, even in the event that any or all of the assumptions underlying such forward-looking statements are later shown to be in error. Any investment strategies discussed herein are as of the date of the writing of this presentation and may be changed, modified, or exited at any time without notice.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from KraneShares and is being posted with its permission. The views expressed in this material are solely those of the author and/or KraneShares and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Forex

There is a substantial risk of loss in foreign exchange trading. The settlement date of foreign exchange trades can vary due to time zone differences and bank holidays. When trading across foreign exchange markets, this may necessitate borrowing funds to settle foreign exchange trades. The interest rate on borrowed funds must be considered when computing the cost of trades across multiple markets.