Yesterday morning, somewhat lost amongst the pre-FOMC anticipation, the ADP Employment Change statistics were released. The Bureau of Labor Statistics (BLS) typically releases its monthly payroll report on the first Friday of the month, and ADP precedes it by two days. In theory, the ADP report should offer a predictive look at the BLS report. As we have found earlier, the track record on that front is somewhat spotty. Taken in light of the equity markets’ recent performance, it’s not clear that the normally crucial non-farm payrolls report will matter all that much anyway.

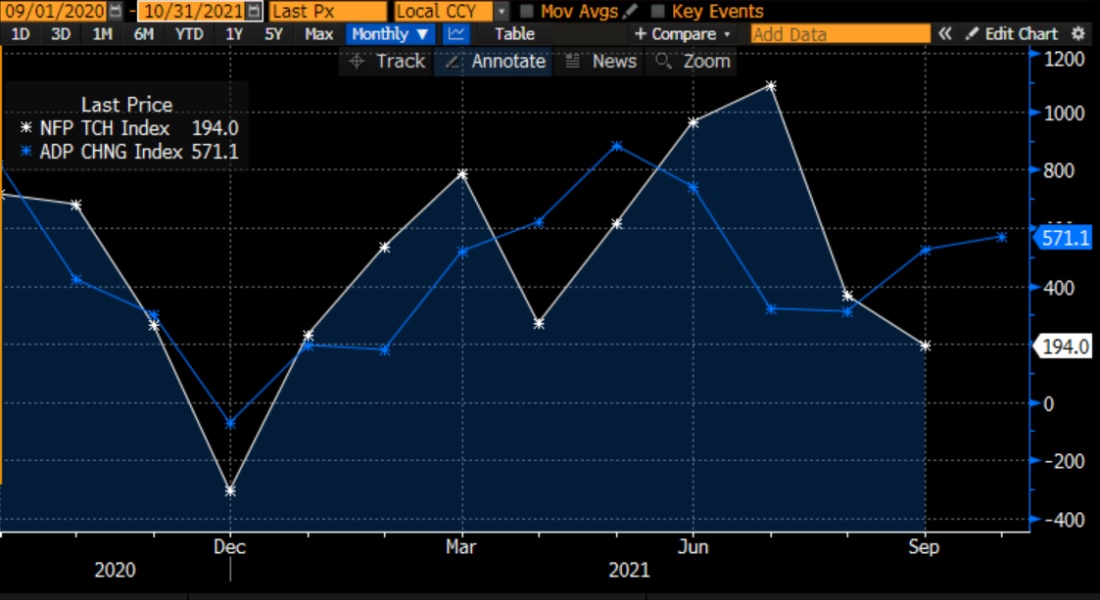

The following chart shows the relationship between the ADP and BLS reports:

BLS Nonfarm Payrolls (white) vs. ADP Employment Change (blue)

Source: Bloomberg

Since September 2020, when labor markets began to normalize after Covid-related lockdowns, we see that the reports have generally followed each other. But a more granular look shows that in a given month, one index may rise while the other falls, leading to a false signal. Note that in February, June and July we see the blue line decline while the while line rises. That meant that ADP declined ahead of a rise in the BLS report. Conversely, in April and September (the prior report) we saw ADP rise ahead of a BLS fall. In other words ADP moved in a different direction than BLS for 5 of the last 8 reports. Does that seem like a good predictor to you? Perhaps this is why the ADP report took a back seat yesterday.

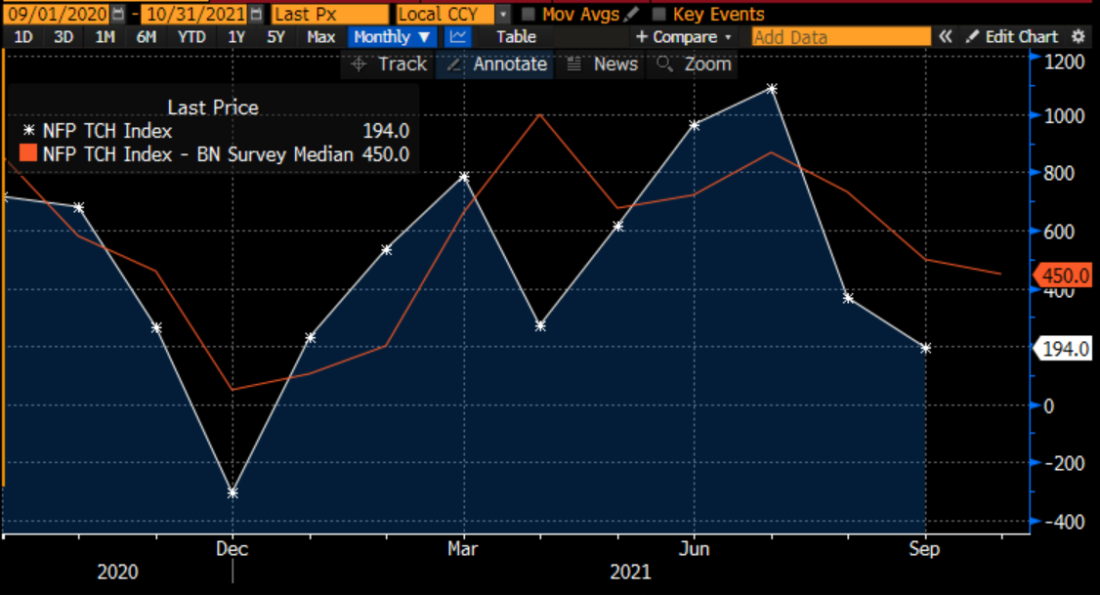

That leads us to wonder whether economists do a better job than the ADP report. In general, yes, though the chart below shows that they have their flaws too:

BLS Nonfarm Payrolls (white) vs. Economist Survey (red)

Source: Bloomberg

While the survey of economists never quite nailed the BLS number (though they got very close in May after a big miss in the prior month), they’ve tended to get the general direction correct. It appears that the survey hews closer to the general trend than the statistics do, but that is a tendency that is hardly unique to economic predictions.

That leads us to an interesting question ahead of tomorrow morning’s report. While the economists’ survey is more conservative than last month’s, if correct it would result in a substantial increase to 450,000 from last month’s 194,000. In theory, markets should be expecting a consensus result. But as we see, we rarely get a consensus result. So traders need to anticipate what might result if the result diverges significantly from the anticipated report.

Here’s the crazy part: I’m not sure that it will matter much, no matter what the result. If the number is light, like it was last month, we could make the case that we’re seeing stagflation. But we could also make the case that a tepid labor market keeps the Federal Reserve on the sidelines a bit longer. (For perspective, SPX was -0.19% and NDX was -0.51% after last month’s miss.) If the number is above consensus, we could start to worry that we are getting closer to the Fed’s definition of full employment, bringing forward the likely start of interest rate hikes. But we could make the case that the report would show a stronger economy, which is good for corporate earnings.

In light of the recent market melt-up, is there much doubt that unless the report is a true outlier like a negative number or over a million, that traders will interpret the result in a bullish light, no matter what? We can’t know that for sure, of course, but just as we noted that economists’ predictions tend to follow trends, so do traders. And the trend for risk assets has been relentlessly higher for the past few weeks.

In my experience, trends remain in place until something triggers a reversal. Chair Powell could have done so during his press conference after yesterday’s FOMC meeting, but his words convinced traders that the well-telegraphed tapering of asset purchases was hardly a precursor to rate hikes and the rally continued. We recently called him Goldilocks in a suit, and his magic touch was in evidence yesterday. There is currently a broad consensus that the trend in equities points higher, and it seems likely that markets will attribute a positive interpretation to tomorrow’s payrolls numbers under a broad range of outcomes.

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.