TLDR:

It will have been a very brief pause if, as expected, the Fed raises interest rates by 25 bps on Wednesday. The Fed snapped a streak of 10 consecutive rate increases to – after an intense debate – stop for basically a single meeting. What was the point of it all, you might ask?

Officials have made it clear in recent speeches they’re not done raising interest rates. Actually, the Fed’s latest Summary of Economic Projections suggests there might be as many as two more quarter-point rate increases this year.

So why did they stop?

Two key data points – June inflation and labor market reports – that were going to provide clues about the resilience of the economy against tightening credit conditions, and progress in the fight against inflation.

Both had the potential to extend the pause. Neither achieved that.

Nonfarm payrolls increased 209,000 in June, below the consensus estimate for 240,000. In the minutes, Fed officials did worry that job growth – as gleaned from private-sector data – may have been weaker than indicated by payroll employment.

They wanted to see if that came through in June. It didn’t. 200k+ payroll growth per month and average hourly earnings growth at 4.4% is still an economy that is above the speed limit consistent with a 2% inflation.

Then there is inflation.

The hope was for a steep drop in inflation, partly driven by declining housing costs.

That’s not quite what happened (though shelter inflation DID ease). The good news is that the decline was pretty broad based: food inflation slowed to almost zero, and used vehicle prices, a primary source for the inflation surge in the early part of 2022, declined 0.5%. Airline fares also fell 8.1% on the month and now are down 18.9% on an annual basis.

But …

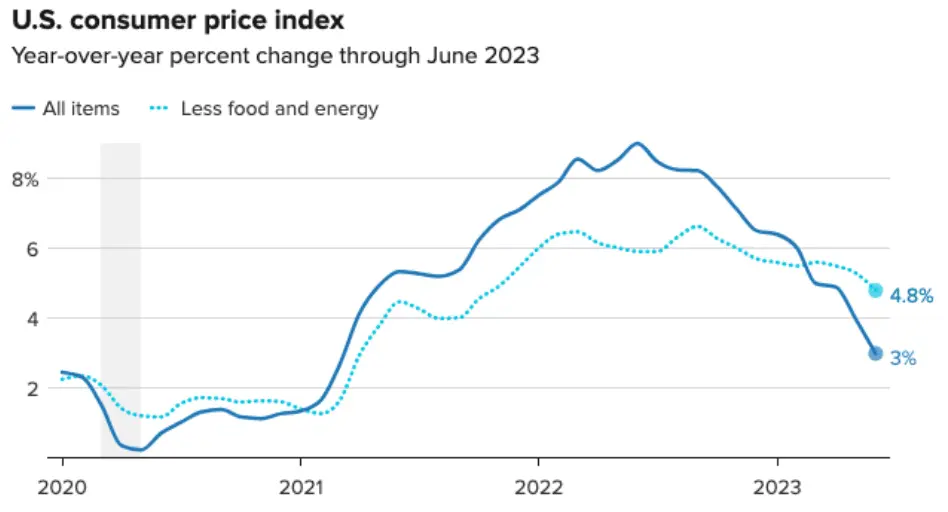

Core CPI, which removes food and energy from the equation, stayed at 4.8%, well above the Fed’s target of 2%. And energy prices are looking a lot perkier again.

So where does that leave us?

If the trend in the chart above is right, and inflation continues a steep decline, current projections for a one-and-done after this Wednesday’s meeting are likely correct. Officials are already expecting a mild recession later in the year. Now we need to find out how rapid this descent has to be.

The Fed’s words more than actions will be guiding market prices on Wednesday.

What’s happening in the markets?

This section is powered by Open AI connected to TOGGLE AI

Over the weekend, people flocked to the cinemas in excitement for the release of Barbenheimer, featuring both Barbie and Oppenheimer.

Despite the immense hype surrounding these blockbuster movies, the film industry is facing challenges due to ongoing labor disputes and uncertainty, which may limit the potential growth of movie stocks.

The Cinemark company is among those affected by the industry strike, resulting in disrupted production schedules and a rise in analyst down ratings. In contrast, Netflix has benefited from delayed production schedules, leading to reduced operating costs and a projected free cash flow of at least $5 billion for 2023. This surplus cash has prompted Netflix to announce plans for a stock buyback.

Additionally, AMC shares experienced a significant surge of more than 60% after hours on Friday, following a judge’s decision to block the planned share conversion.

Aggregated Leading Indicators!

Subscribe to Pro here to receive our pre-market Leading Indicator newsletter and access all Leading Indicators online!

Learn more about the Leading Indicators in the Learn Center!

Earnings Update: Tech earnings incoming!

Alphabet and Microsoft report quarterly earnings tomorrow – look our for the latest updates on their AI tools and its direct impact on revenues. Click here to observe how Alphabet stock could perform after earnings.

Discover how other companies could react post earnings with the help of TOGGLE’s WhatIF Earnings tool.

Asset Spotlight: Exxon forward P/E at a recent low

TOGGLE analyzed 7 similar occasions in the past where valuation indicators for Exxon Mobile were at a recent low and historically this led to a median increase in price over the following 1W. Read full insight!

General Interest: Twitter is gone

Well, it was bound to happen. The balance sheet was overladen with unsustainable debt, the best workforce had left, the management style was so eccentric to make Willy Wonka look like a conservative fund manager at Fidelity. It was a matter of time … and now Twitter is gone.

Nah we’re joking.

It’s only the name that is going. Elon stated that Twitter is going to be rebranded as X, and so X.com will now send you back to Twitter.

So now we have a key question: if “tweeting” is gone, what’s the new verb for posting on X.com? “Xeeting”? “Xetting”? Sounds like a bodily function – which is fitting with the content one can expect in the crucible of free speech that Musk is creating.

In fact one wonders if Musk chose the wrong letter: he should have gone with Q.com in celebration of his QAnon-rich fanbase.

Anyways, you can read about the latest Musk drama here on the Verge.

—

Originally Posted July 24, 2023 – Do as I say, not as …

Disclosure: Toggle AI

IB Global Investments LLC, a subsidiary of Interactive Broker Group Inc., the parent company of Interactive Brokers LLC, is a minority owner of Toggle AI.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Toggle AI and is being posted with its permission. The views expressed in this material are solely those of the author and/or Toggle AI and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.