Hawkish comments from Federal Reserve members and a red-hot ISM Services Index showing strong price increases are leading to a soaring dollar, rising yields and tanking equities as investor optimism for a less restrictive central bank wanes.

Fed Governor Christopher Waller told CNBC yesterday that recent labor market data, including a decline in job openings, moderating wage increases and slower job growth in August are encouraging. He added, however, that it’s unclear if recent progress on inflation is a firm downward trend or a short-term episode of progress, like in the recent past. Having said that, he left the door open for another rate hike because he doesn’t think one more would weaken economic growth significantly given risks remain tilted towards not doing enough.

On the heels of Waller, Boston Federal Reserve President Susan Collins echoed his concerns this morning, emphasizing that more evidence is required to show that inflation is on a consistent decline to the central bank’s 2% target. She noted that patience is needed while the Fed may proceed cautiously with more rate hikes.

ISM Data Sparks More Turbulence

A hotter-than-expected ISM Services Index release this morning is increasing investors’ fears that the Fed will remain hawkish longer than anticipated. Prior to the release, investors placed the likelihood of a fed funds rate hike at 43% during the central bank’s October 31-November 1 meeting. After the ISM release, however, the likelihood increased to 47.2%. Investors continued to anticipate no rate increase at the Fed’s next meeting scheduled for September 19-20, with only 9% odds of a surprise.

This morning, the Institute for Supply Management reported that its August Services Purchasing Managers’ Index hit 54.5, crushing estimates of 52.5 and July’s reading of 52.7. The 10:00 am Eastern Time report pushed bond yields even higher and equities lower on the heels of the hawkish commentary from Waller and Collins. Indeed, services prices accelerated their pace of growth, gaining further ground with an index score of 58.9, up from 56.8 in the previous period. New orders and employment depict a similar trend, with consumers buying and employers hiring. The figures rose to 57.5 and 54.7, faster than the previous month’s 55 and 50.7.

Oil Supply Concerns Fuel Further Inflation Fears

Going forward, higher oil prices are likely to support overall inflation and have a less direct but nonetheless notable impact on core inflation. Riyadh and Moscow have agreed to extend their supply curbs that represent approximately 1.3 million barrels of oil a day until the end of this year, causing market players to sharpen their pencils and boost price targets for the essential commodity.

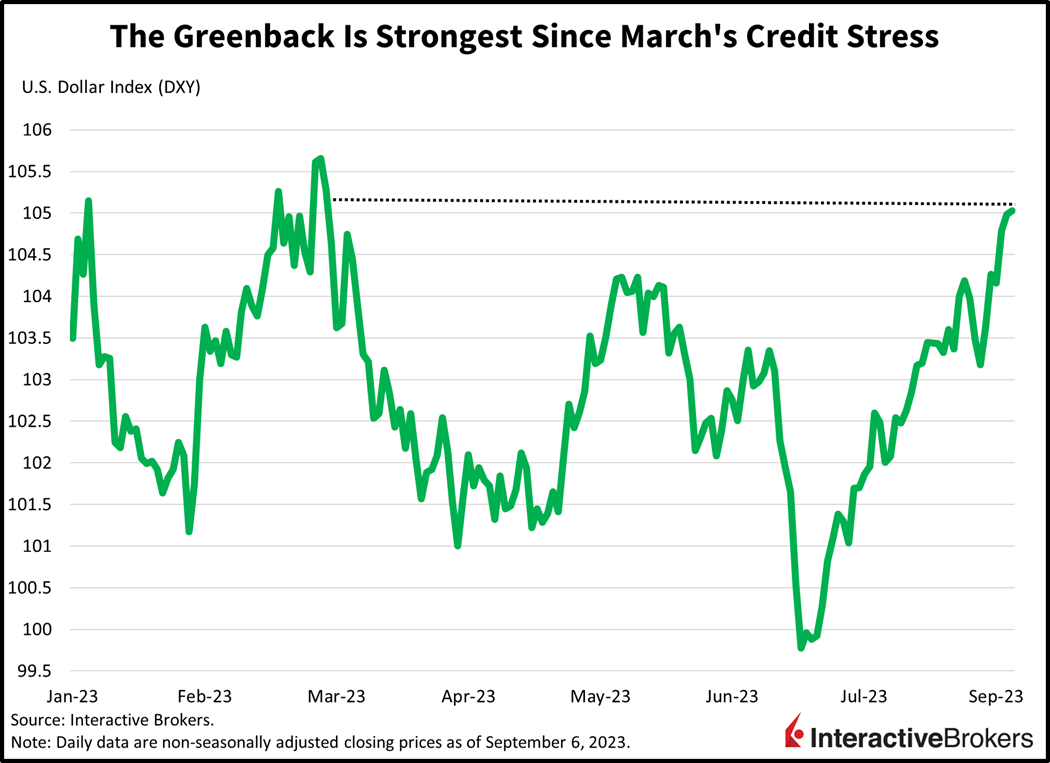

Markets are being punished as the seasonally weak September corresponds with a troubling start for the school year as 100-degree temperatures surge across many communities with schools that lack air conditioning, causing some students to be sent home for online learning. Educators, however, aren’t the only individuals who are frustrated this morning with market players having a tough time due to plunging equities, loftier yields and a firmer greenback. Equities are broadly lower with almost every sector down minus energy and homebuilders. The interest-rate sensitive technology sector is leading the way lower with the Nasdaq Composite Index down 1% while the Dow Jones Industrial Average and the S&P 500 Index are down about 0.7%. The dollar is at a six-month high as the United States’s central bank is taking a tighter stance on monetary policy relative to its international peers. The stronger dollar is occurring alongside a dramatic rise in yields, with 2- and 10-year Treasury maturities up 14 and 11 basis points (bps) to 5.02% and 4.29% while the Dollar Index climbs 24 bps to 105.02. WTI Crude oil is adding to yesterday’s sharp rally on the back of continued teamwork from Riyadh and Moscow to limit production: it’s up $0.35 to $87.04 per barrel.

Say Goodbye to TINA

I’m afraid that long-term rate jumps have further to go due to reduced demand from typical buyers.

This morning’s rise in long-term yields is a significant risk to the equity market’s valuation metrics, making shares less attractive relative to other asset classes and pointing to an end to There is No Alternative, or TINA. The firmer dollar also hurts earnings for global corporates due to inferior currency impacts when converting global revenues back to U.S. bank notes. I’m afraid that long-term rate jumps have further to go due to reduced demand from typical buyers. The Fed is no longer buying Treasuries for the time being, banks are holding on to cash reserves dearly to preserve capital ratios and China and Japan have cut back on buying U.S. debt to protect their currencies. Also propping up yields is persistent inflation in services, strong job growth, and yo-yo price pressures in commodities that are fueling uncertainty amidst geopolitical tensions. I believe equities aren’t priced for these risks, a topic I covered during a recent Yahoo Finance appearance.

Visit Traders’ Academy to Learn More About Economic Indicators.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.