Today’s data and other developments show just how difficult reining in the economy has been for central banks. U.S. data released earlier today shows that durable goods orders, consumer confidence and new home sales are growing while also beating analysts’ expectations despite the Fed’s aggressive rate increase campaign. As frustrated as the Fed may be, it can at least find comfort in knowing it isn’t alone, with European Central Bank President Christine Lagarde casting a cautious tone this morning by saying it’s too soon in the tightening cycle to say when the bank will reach its peak interest rate.

Durable Goods Orders Continue to Grow

In the U.S., the Fed’s aggressive rate tightening is slowing economic growth, but durable goods orders are continuing to grow. May’s 1.7% rate exceeded the consensus expectation of a 0.9% decline and was the third-consecutive month in which orders rose. While most of the growth was attributable to passenger aircraft and automobiles, new orders for nondefense capital goods, which is a benchmark for business investment, climbed 0.7% month-over-month (m/m). The increase followed the 0.6% m/m increase in April, illustrating that businesses are continuing to plan for longer term growth despite higher financing costs and the potential for the Fed’s rate hikes to spark a recession. Additionally, as many companies onshore manufacturing, they are purchasing new equipment to help lower labor costs.

The transportation sector was the largest contributor to the headline number. Without this category, which includes automobiles and passenger aircraft, the headline number would be only 0.6%. Supply chain issues, such as a lack of semiconductor chips, had previously snarled delivery of new automobiles and created pent up demand. Consumers unleashed that demand in May as inventories on a y/y basis jumped nearly 70% from 1.1 million to 1.9 million vehicles, according to NAC, which represents the convenience store and fuel retailing industries. Passenger aircraft orders continue to benefit from airlines preparing for growing demand as consumers travel more now that they are no longer constrained by stay-at-home or shelter-in-place orders during the pandemic.

New Home Sales and Consumer Confidence Jump

New Home Sales and Consumer Confidence also posted big beats, flashing green lights for central bankers to continue tightening policy.

New Home Sales rose to 763,000 seasonally adjusted annualized units in May, the highest rate since February 2022, the month before the Fed began raising rates. May’s level trounced predictions calling for 675,000 and leaped from April’s 680,000. New Home Sales rose 12.2% on a month-over-month basis (m/m) with the Northeast and West regions driving big gains of 17.6% and 17.4% amidst broad strength at the national level. The South and Midwest regions came in lighter at 11.3% and 4.1%, but achieved substantial progress nonetheless.

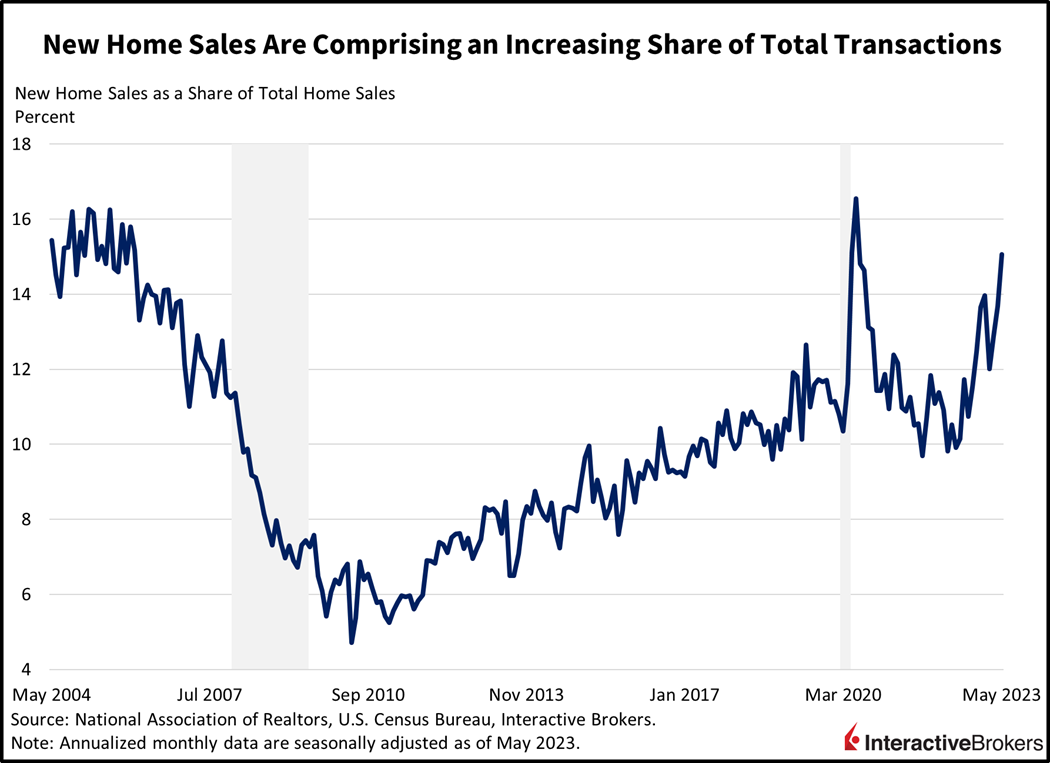

New home sales now make up over 15% of total transactions, as existing homeowners have little incentive to offer concessions, sell and replace their homes at much higher interest rates. Heightened demand for housing was also reflected in S&P’s Case Schiller Home Price Index, leaping 1.3% in April and threatening to boost the largest component of the Consumer Price Index, shelter.

Consumer Confidence came in at 109.7, beating forecasts of 104 and similar to New Home Sales, also achieving the highest reading since February. Confidence also rose notably from May’s 102.7 figure, as sentiments regarding current and future conditions gained strongly. The Present Situations Index grew to 155.3 from May’s level of 148.9 while the Expectations Index jumped strongly to 79.3 from 71.5 during the period. Still however, a reading below 80 on expectations signals consumer caution and an economic slowdown within the next year when reviewing historical data points.

Accelerating optimism among consumers and prospective home buyers threatens to unleash a new leg in inflationary pressures with the Cleveland Fed’s Inflation Nowcast warning of a 0.42% rise in consumer prices during the month of June, a rate far in excess of the Fed’s 2% annualized inflation target.

Investors’ Optimism Grows

Yields were muted but popped at 10:00 am Eastern Time, immediately after the release of New Home Sales and Consumer Confidence data. With the entire curve higher, the 2- and 10- year Treasury maturities are up 8 and 5 basis points (bps) to 4.75% and 3.77%. Despite higher yields, however, the Dollar Index is down 20 bps to 102.54, as investors still only price in one more interest rate hike from the Fed all year. Equities are gaining, with all major indices higher on strong economic data. The S&P 500 Index is up 0.3% with all sectors higher ex healthcare. Home builders are the star of the group, with the sector up 2.3% amidst growing demand for new homes. WTI crude oil is down 0.3% to $69.16 per barrel on demand concerns stymied by hawkish central bankers.

Sintra Forum Starts with Cautious Tone

While this morning’s data releases are causing U.S. investor sentiment to strengthen, the ECB Forum on Central Banking in the Portuguese town of Sintra kicked off with a cautious tone as Lagarde maintained that it’s too soon to call a peak in the central bank’s rate tightening. Her comments underscore that policy leaders are united by their fight against stubborn inflation that is making it difficult to engineer economic soft landings.

ECB members will seek to strike a consensus on the future of the organization’s monetary policy following disappointing data from Germany and France. Members of the Bank of England will likely focus on the impact of the organization’s surprisingly high rate hike while Federal Reserve Bank Chairman Jerome Powell will likely seek to convince investors that the central bank will continue with its hawkish policies. More broadly speaking, the forum will provide participants with the opportunity to gain insights into the impact of aggressive monetary tightening and strong labor markets on the global economy.

Contrary to Lagarde’s comments, ECB Vice President Luis de Guindos recently said the organization is probably nearing the end of its rate hikes, but Europe still faces inflation pressure from a tight labor market. He believes that higher interest rates are causing consumers and businesses to take out less credit, which will help slow down demand and price increases. The eurozone’s headline inflation recently fell to 6.1% from 7% and core inflation dropped from 5.6% to 5.3%. The ECB has ushered in 400 basis points (bps) of increases, bringing its rate to 3.50%. The tightening appears to have throttled Germany and France considerably. According to PMI data released last week, Germany’s service sector, while still growing, has weakened while the country’s manufacturing sector has slipped deeper into contraction. France’s PMI has also contracted, fueling speculation that the country is experiencing negative GDP.

While Jerome Powell recently explained that the Fed is slowing its rate hike campaign much like a driver approaching a parking spot at the end of a journey, the BoE’s campaign is like a Formula 1 car, still racing on its journey of rate hikes and speeding by a local fish and chips restaurant in Liverpool.

The Bank of England (BoE) joins the forum after having made little progress in fighting inflation. May’s year-over-year (y/y) core inflation climbed to 7.1%, the highest rate since March 1992. The core inflation rate excludes volatile alcohol, tobacco, energy and food prices and climbed substantially from April’s 6.8% y/y rate. The UK’s y/y headline inflation rate of 8.7% for May was unchanged from April. While Jerome Powell recently explained that the Fed is slowing its rate hike campaign much like a driver approaching a parking spot at the end of a journey, the BoE’s campaign is like a Formula 1 car, still racing on its journey of rate hikes and speeding by a local fish and chips restaurant in Liverpool. Indeed, the bank recently responded to high inflation readings by enacting a surprisingly high 50-bp rate hike, which brought its key rate to 5%.

Fed Chairman Jerome Powell will likely use the event to reinforce the central bank’s belief that it needs to remain hawkish to bring inflation under control. Powell’s recent hawkish comments last week before Congress sent U.S. markets tumbling. Many investors have expected the Fed to cut rates by year end, but the majority of Fed members believe two more hikes this year are warranted.

Visit Traders’ Academy to Learn about New Home Sales and Other Economic Indicators

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.

Leave a Reply

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

thanks

You’re welcome! We hope you continue to read Traders’ Insight.

until rates are at par with real inflation it’s not going to drop. so that’s more like 10% or 7% base rate.