Stocks are getting punished today against the backdrop of intensifying labor strikes and an upcoming funding deadline that may shut down the federal government. Yields are taking a break from the selloff, however, as lighter-than-expected data on consumer confidence and new home sales brought in some dip buyers. Still, yields remain at 16-to-17-year highs and the S&P 500 has dropped below 4300 for the first time since early June.

Inflation Hurts Consumer Sentiment

The Conference Board’s Consumer Confidence Index fell in September as elevated interest rates alongside rising food and gasoline prices took a bite out of household budgets. Folks also reflected concerns over a possible government shutdown and the nation slipping into recession. September’s confidence reading of 103 is the second consecutive decline, as the aforementioned headwinds weighed on the expectations segment while the present situation segment was essentially unchanged from August. This month’s figure missed the consensus estimate of 105.5 and dropped from last month’s 108.7 reading. Consumers were less optimistic about six-month prospects regarding business conditions, labor market opportunities and income possibilities while their household’s current economic health deteriorated during the period.

New Home Prices Drop

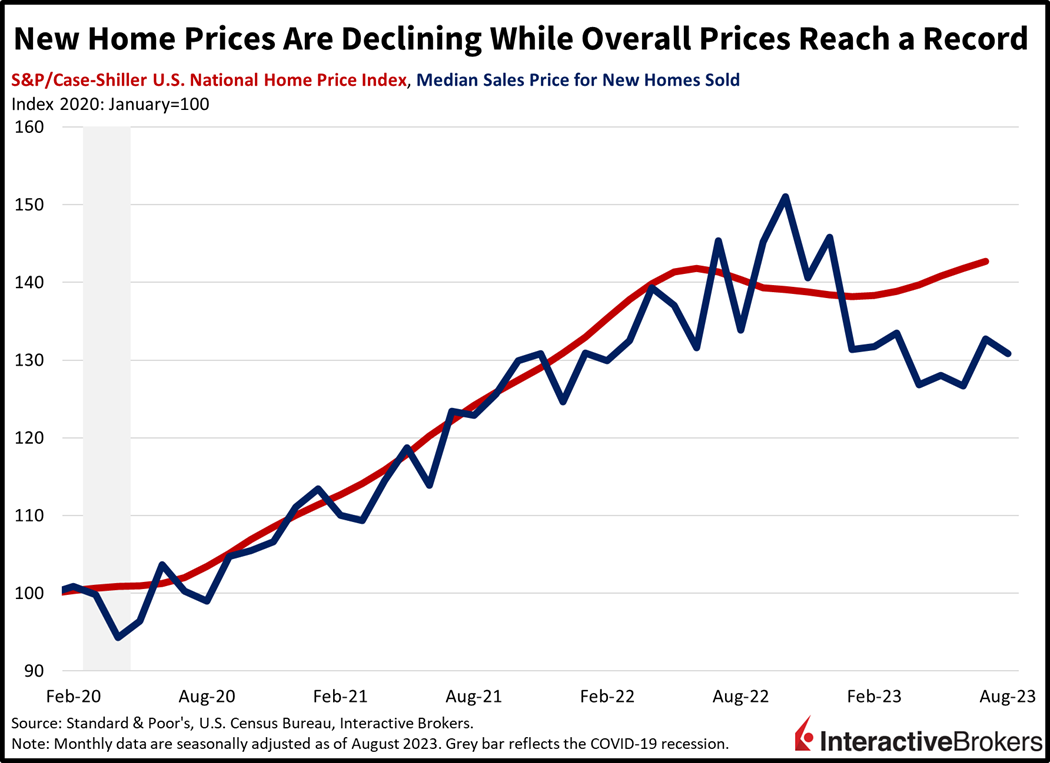

Food and gasoline prices aren’t the only headwind for consumers, with lofty mortgage rates and towering housing prices in August causing new home sales to hit the lowest level since March. Sales fell 8.7% month-over-month to 675,000 seasonally adjusted annualized units, less than July’s 739,000 and missing projections for 700,000. Sales were mixed across regions, with the Midwest, West and South slipping 17.2%, 9.4% and 7.5% while Northeast sales climbed 6.7% during the period. Builders had to offer concessions, with the median sale price falling from $436,600 in July to $430,300 last month. The bifurcation between new home prices and existing homes is tremendous, with new homes significantly off their October 2022 peak of $496,800. Overall homes are back at all-time highs, however, with this morning’s S&P/Case Schiller National Home Price Index reflecting 0.8% price growth during July, marking a new all-time high as year-to-date (ytd) gains mount to 3.1%. Indeed, overall home prices are on a tear, growing every single month this year.

Risk Off Sentiment Continues

Markets are suffering today as the United Auto Workers strike, the looming government shutdown deadline and the higher-for-longer melody triggers losses. Fears of another downgrade of the country’s credit rating are also weighing on sentiment. Interest-rate sensitive technology is leading the charge lower, as the Nasdaq Composite Index shaves 1.3%. All major indices are lower in fact, with the S&P 500, Russel 2000 and Dow Jones Industrial Average down 1.2%, 1.1% and 0.9%. All sectors are lower today with technology, utilities, consumer discretionary, industrials and real estate all down between 1% and 1.6%. Yields are roughly unchanged as weak economic data bring in some bidders with the 2- and 10-year Treasury maturities at 5.14% and 4.54%. The Dollar Index is up 11 basis points to 106.06, as the greenback appreciates against the euro, pound sterling, franc and Aussie and Canadian dollars while it trades close to parity with the yen and yuan. Oil prices are up slightly, as bulls and bears brawl it out near the pivotal battleground of $90. WTI crude has climbed 26 cents to $90.10 per barrel, as American oil production this month is on track to match a record reached in November 2019 of 13 million barrels per day. Concerns about potentially weakening demand stemming from tighter monetary policies and persistent inflation alongside booming American oil production are curtailing Riyadh and Moscow’s efforts to boost prices for the essential commodity.

The Far Reach of Unions

While wage increases have recently outpaced inflation, Americans’ incomes during the past few years haven’t kept up with overall price increases. Wage pressures could escalate because of a tight labor market and unions increasingly striking to achieve higher compensation for their members. The Cornell University School of Industrial and Labor Relations reports that 362,000 workers nationwide have participated in strikes ytd as of September 15 compared to only 123,000 and 37,000 for the same time periods last year and in 2021, respectively.

This trend could create a considerable tailwind for inflation. Companies are likely to pass the higher labor costs onto customers in the forms of increasing prices and the rising wages could boost consumer spending, which could lead to a wage-price spiral. The United Auto Workers union ongoing strikes against the big three car manufacturers are seeking a 36% pay increase, a four-day workweek, fully paid medical insurance and other improved benefits. A success by the UAW could motivate other unions to strike and could be a compelling selling point for having non-union workers approve unionizing at a time when onshoring is increasing demand for manufacturing employees and the labor market is tight. In some instances, such as foreign battery manufacturers, many of the newer facilities are being located in right-to-work states, which could help dampen wage pressures from unions. Even if strikes fail to gain significant wage increases, they could potentially snarl the supply chain, which could sustain inflation at the margins by reducing the efficiency of goods and services deliveries.

Budget Woes and Credit Rating Fears

An increasingly likely government shutdown at the end of this week could cause Moody’s Credit Services to become the third organization to downgrade the U.S. government’s credit rating. In a statement yesterday, Moody’s said a shutdown would illustrate constraints on fiscal policymaking associated with increasing political polarization. The warning occurs as the U.S. government’s coffers experience declining fiscal strength caused by expanding fiscal deficits and deteriorating debt affordability, according to Moody’s. The rating agency currently has its highest rating, or AAA, for the U.S. government. Moody’s issued the warning as the 10-Year Treasury yield climbed to the highest level since 2007. The warning, furthermore, comes less than two months after brinkmanship over the country’s debt ceiling caused Fitch, which claimed an erosion in confidence in the country’s fiscal management, to downgrade the U.S. credit rating one notch to AA+. Fitch also downgraded the banking operating environment in August, citing gaps in regulations and uncertainty around monetary tightening. S&P had already dropped its U.S. government credit rating a notch and has maintained the lower rating since 2011 after a debt ceiling battle in Washington, D.C.

Despite an unemployment rate that has lingered below 4%, U.S. debt has been soaring. The fiscal year ending this month is likely to have a $1.7 trillion deficit, or roughly 6.5% of GDP. The federal debt is estimated to climb to more than $26 trillion, or approximately 98% of GDP, not including money owed to federal trust accounts. That’s up from an annual deficit of 5.5% of GDP in 2022 and total debt comparable to 97.1% of GDP. Additionally, it’s unlikely that a budget compromise between Congress and the White House will reduce the deficit for the coming fiscal year and the country’s practice of using short-term debt means its debt service costs are increasing as interest rates increase.

Employment Checks for Four Million Workers Uncertain

Investors and civil servants are bracing for a potential government shutdown that could occur if Washington, D.C. doesn’t strike a budget deal by the end of this week. In the House of Representatives, conservative republicans are seeking spending cuts beyond what was agreed upon by congress and the White House. They are also seeking limits on aid for Ukraine, tougher border policies, and a restructuring in the Defense and Justice departments. The federal government employs approximately 4 million workers. Essential workers will be required to work, but they will have their pay suspended until the government shutdown ends while non-essential workers will be unemployed during the shutdown.

Searching for a Positive Catalyst

Capital markets are no strangers to risk, but recent events have created an unusually challenging time for investors. Union activism threatens to support inflationary pressures by propelling wages and consumer spending while hindering supply chains. In Washington, increasing political polarization could lead to a government shutdown and another credit downgrade. Meanwhile, record low levels of housing affordability have caused the real estate market to hit a standstill, despite a housing shortage of between 5.5 and 6.8 million units, according to the National Association of Realtors. This gap began growing after the global financial crisis as homebuilders responded to the event by delivering less units after being sent to the cleaners due to aggressive discounting amidst oversupplied conditions. The list of challenges may appear insurmountable as investors ponder what potential event could spark a turnaround in capital markets. Other factors, however, are somewhat encouraging with a strong job market sustaining low levels of unemployment and a business community that is determined to earn returns despite a challenging macroeconomic environment.

Visit Traders’ Academy to Learn More About New Home Sales, Consumer Confidence and Other Economic Indicators.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.