Investors are dumping assets today in response to yesterday’s hot wholesale inflation data and this morning’s slightly weaker consumer sentiment report. Yields are continuing their upward march as bond traders dial up inflation expectations while incrementally pushing expectations for the Fed’s first cut to July from June. Stocks and crypto assets are under some additional pressure, with market participants questioning whether it’s time for the asset classes’ record runs to take a break.

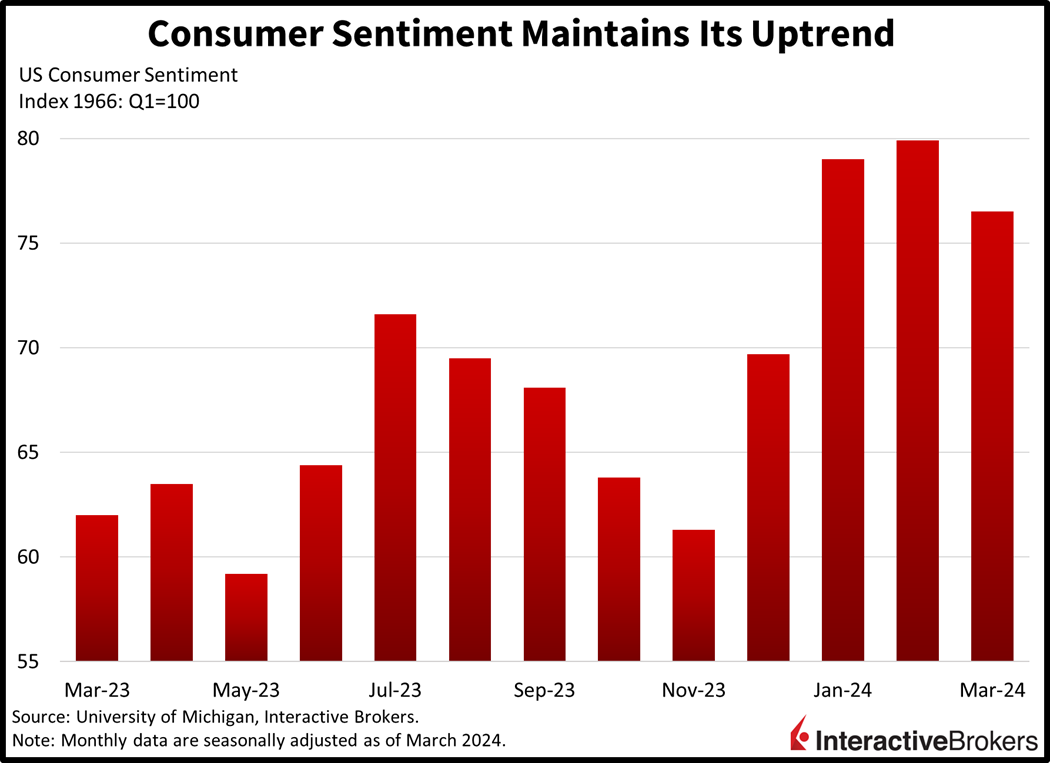

Consumer Sentiment Drops Marginally

Consumer sentiment was little changed this month as reported by the University of Michigan with households anxiously awaiting presidential election results later this year. The 76.5 index slipped slightly from February’s 76.9, which was also the anticipation for this month. Weighing on the headline were consumer expectations, with the sub-index dipping from 75.2 to 74.6. The current conditions index supported results though, with the 79.4 figure matching the level from last month. Inflation expectations were also a snoozer, with 1- and 5-year digits remaining unchanged from last month at 3% and 2.9%. Survey respondents did report a modest uptick in personal financial health while noting a narrow deterioration in business conditions.

After a Strong Quarter, Adobe Guidance Disappoints

While consumers perceive business conditions declining, large enterprises have been splurging on design and graphics software, at least in the case of Adobe. The company last night released strong results for the quarter ended March 1 with earnings and revenue that beat analysts’ expectations. Additionally, it said it secured contracts with numerous large enterprises. Following the earnings release, however, its share price dropped approximately 10% due to its current quarter guidance for 9% y/y earnings growth falling below investors’ estimates. The company said its strong sales momentum is likely to continue but results will be challenged by the current macroeconomic environment.

Risk Assets Lose Their Luster

Markets are weaker this session on a big quarterly options expiration with risk-assets under pressure and interest rates gaining upside momentum. All major US equity indices are lower, led by the tech-heavy Nasdaq Composite, which is down 0.7%, while the S&P 500, Dow Jones Industrial and Russell 2000 benchmarks are lower by 0.5%, 0.3% and 0.1%. Sectoral breadth is mildly negative as cyclicals are outperforming growth: just 4 out of 11 sectors are higher on the session. Energy, industrials and financials are leading with gains of 0.6%, 0.2% and 0.2%. Technology, communication services and consumer discretionary are pushing the tape lower with the segments down 1.5%, 0.7% and 0.7%. In fixed-income land, the 2-and 10-year Treasury maturities are trading at 4.72% and 4.31%, both gaining 2 basis points (bps) since yesterday’s close. The dollar is up slightly with its index up 8 bps to 103.4. The greenback is appreciating relative to the euro, pound sterling, yen, yuan and Aussie dollar but is losing ground versus the franc and Canadian dollar. Crude oil was lower but is now pushing higher as the International Energy Agency warns of undersupplied conditions amidst resilient demand.

Brace for a Busy Week

Next week is a packed calendar for investors with the Nvidia AI forum, the Bank of Japan rate decision and the Federal Reserve’s meeting and update to its Summary of Economic Projections expected to take center stage. But down the hall, there’s also real estate data coming in, flash PMIs and a potential clash between both aisles of Congress ahead of a government shutdown deadline next Friday. Overall, though, the potential for market volatility has been strongly reduced by fiscal stimulus offsetting monetary policy tightening. Also, the Fed’s positioning regarding rate cuts being around the corner has been a powerful driver of financial conditions and investor sentiment, strongly supporting asset prices and limiting downside moves. The duo of fiscal stimulus and dovish Fed talk is probably going to continue for the rest of the year regardless of inflationary pressures, sustaining a lid on equity volatility and keeping market bears at bay. As for the bond vigilantes that have driven the long-end higher while punishing risk premiums in protest of inflation in the past, the Fed is already talking about slowing down its quantitative tightening program while looking to modify rules that will allow banks and primary dealers to purchase an increasing share of Treasury securities relative to the capacity they have under the current risk and regulatory framework. Still though, a slew of sunny months may lead investors to forget what a rain shower looks and feels like. Can the Fed and Treasury prevent rain?

Visit Traders’ Academy to Learn More About Consumer Sentiment and Other Economic Indicators

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.