This week’s strong labor data is favoring wounded market bears and monetary policy hawks. First it was job openings, then unemployment claims, ADP employment and then today’s BLS payrolls, which all depicted conditions that threaten the Fed’s 2% inflation objective. The bears are indeed looking to go on a run, after equity bulls launched a nine-week winning streak, finishing a strong 2023. The first week of January provides an important preview for the rest of the year and so far, the tone is reflecting more turbulence than last year’s smoother sailing.

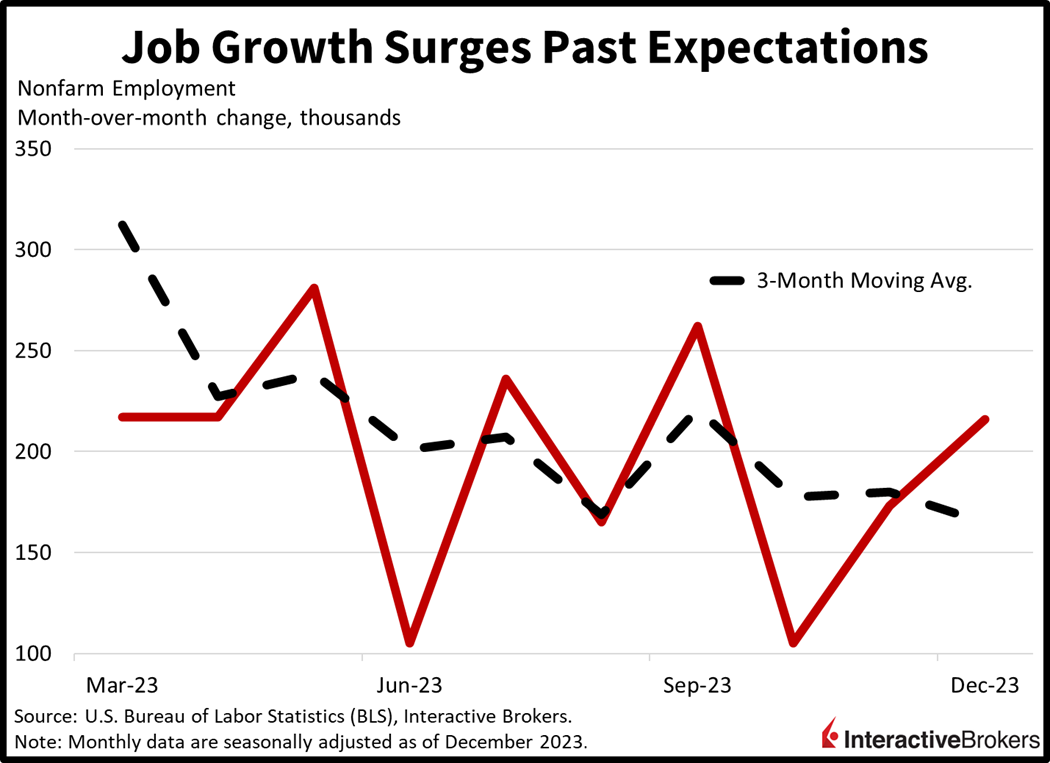

Hiring Accelerates Sharply

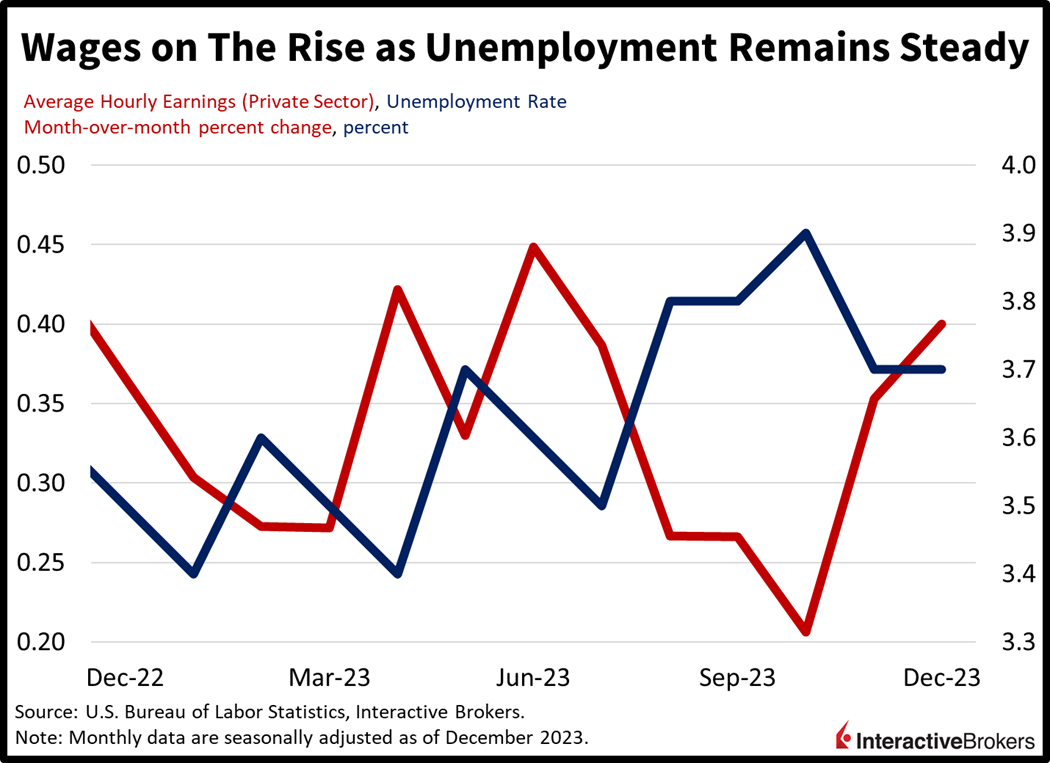

Employers in December added workers at the fastest pace since September, echoing yesterday’s beat on ADP employment, according to the US Bureau of Labor Statistics. December’s whopping 216,000 new jobs was much higher than the 170,000 expected and November’s 173,000. Conditions were tighter than projected under the surface as well, with average hourly earnings growing 0.4% month-over-month (m/m) despite economists expecting a slowdown to 0.3%. The unemployment rate, furthermore, didn’t increase the tenth of a percent the street anticipated, remaining unchanged at 3.7% instead.

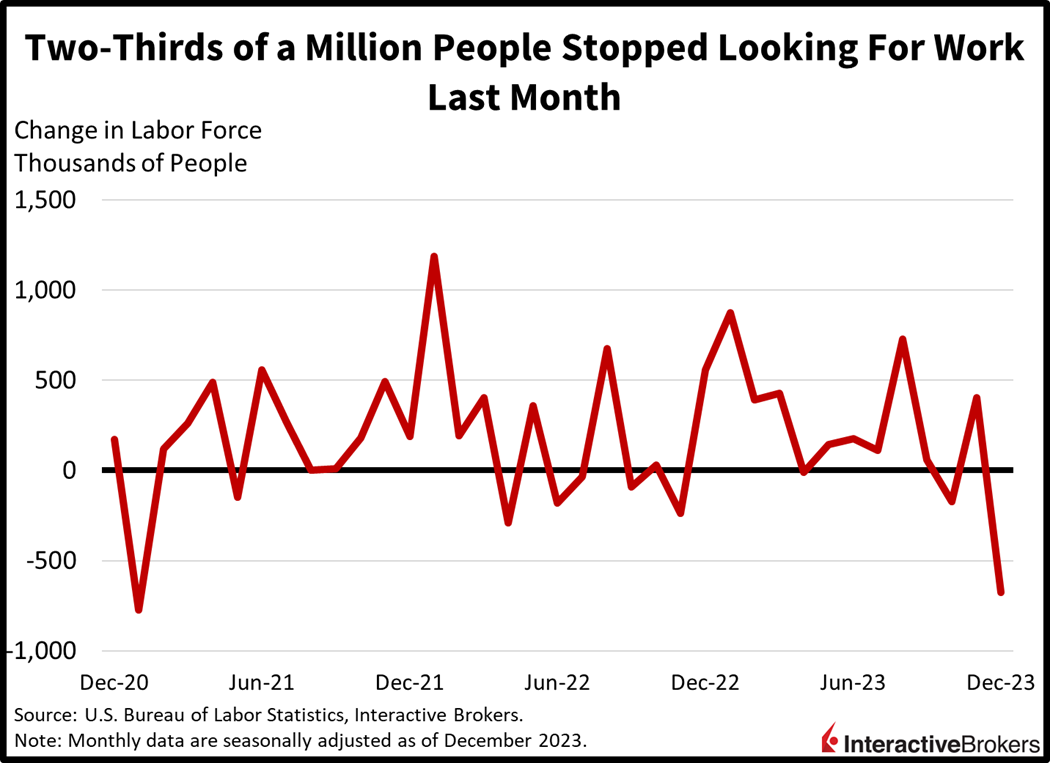

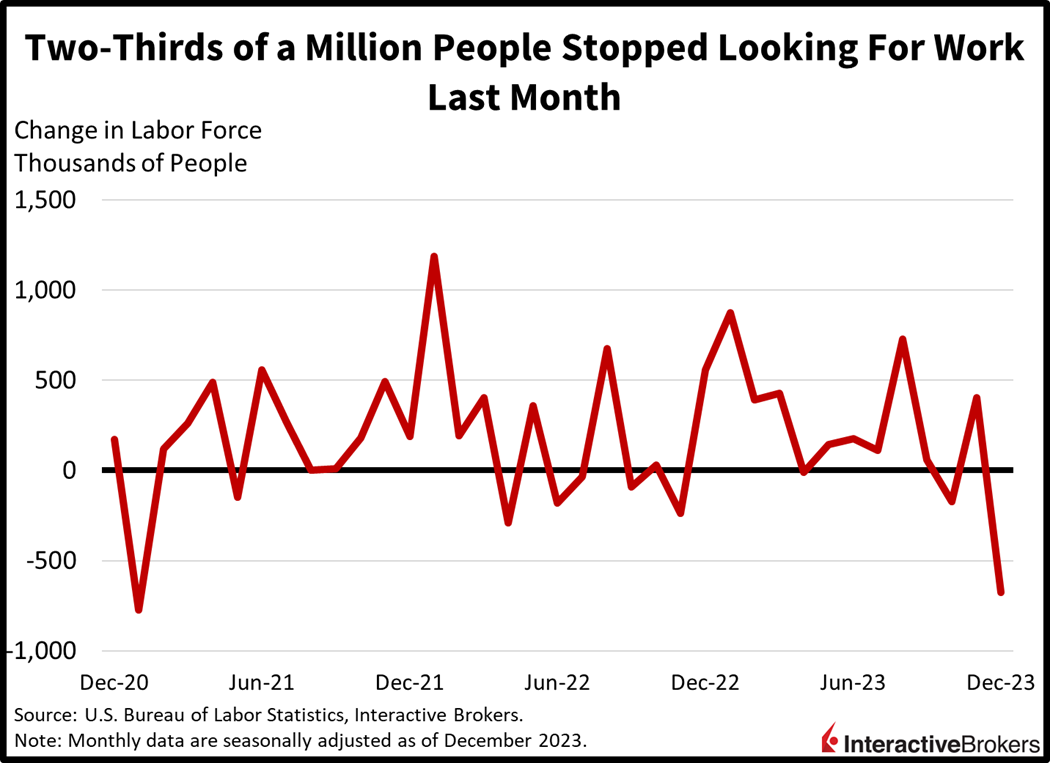

People Give Up on Jobs

A steep decline in the labor force participation rate contributed to the rise in wages while maintaining downward pressure on the unemployment rate. Labor force participation declined from 62.8% to 62.5% during the period, reaching the lowest level since last February. A staggering 676,000 people dropped out of the labor force, meaning they stopped working or gave up on looking for employment, the largest m/m decline since the COVID-19 era, namely January 2021. The shortage of prospective workers led to accelerating wage growth with average hourly earnings increasing 4.1% year-over-year (y/y), much higher than the 3.9% expected and slightly loftier than 4% in November.

Most Sectors Added Strongly, However

Job additions were broad based, with almost all sectors gaining during the period. Leading the charge in hiring were the education and health services sector, government category and leisure and hospitality, which added headcounts of 74,000, 52,000, and 40,000. Construction, retail trade, information, professional and business services, manufacturing, wholesale trade and financial activities added jobs at more tempered levels, however, with all coming in below 18,000. Four sectors did lose jobs, meanwhile, with the transportation and warehousing sector experiencing the sharpest decline of 23,000. Mining, other services and utilities all shed jobs marginally by about 1,000 positions.

Euro Inflation Accelerates

In other economic news, Euro inflation accelerated sharply in December, which was expected. Overall prices in the Euro area rose 0.2% m/m and 2.9% y/y, sharp increases from November’s -0.6% and 2.4%. Core prices rose a faster 0.3% m/m and 3.4% y/y, with the latter figure slowing from the previous month’s 3.6% y/y. Driving the increase were the services and unprocessed foods segments, which gained 0.7% and 0.4% m/m. The energy, and processed food, alcohol and tobacco categories offset some of the pain with prices declining 1.5% and 0.2%. Goods came in unchanged during the period.

ISM Services Tells an Opposite Story

Stateside, ISM’s Services Purchasing Managers’ Index told a totally different story than labor reports received this week. The headline number for December slowed from 52.7 to 50.6, with the biggest drag coming from employment, which registered a contractionary figure of 43.3. New orders and prices expanded at a brisk pace, however, coming in at 52.8 and 57.4. The collection of data points coming from alternative sources totally contradicts this steep drop in employment.

Consumer Shy Away from Pricier Alcohol

Consumers are backing away from expensive alcohol, according to Corona and Modelo beer manufacturer Constellation Brands. The company beat earnings expectations for the fiscal quarter ended November 30, but its revenue missed estimates as sales of the company’s higher-priced wine and spirits products weakened. Without including irregular expenses, the company generated an earnings per share of $3.19, exceeding the consensus expectation of $3.01. Despite sales for the company’s premium wines and spirits dropping 7% y/y, overall price increases and a 4% growth of beer sales resulted in net sales climbing from $2.43 billion to $2.47 billion y/y. Budget minded consumers are favoring the company’s smaller packages and Modelo has become the nation’s largest selling beer after a conservative backlash against Anheuser-Busch InBev featuring transgender influencer Dylan Mulvaney in promotions of Bud Light. Despite the gain in beer sales, Constellation’s net sales missed the earnings consensus of $2.54 billion. The company maintained its full-year EPS guidance but said it expects annual sales of premium wines and spirits to decline as much as 9%. It previously said it expected the segment sales to decline only 0.5%.

Yield Recovery Is a Deceptive Pump-Fake

Markets are recovering today with stocks paring some recent losses while bond yields make a roundtrip back down following lighter-than-expected ISM services data. All US equity indices are higher with the Nasdaq Composite, S&P 500, Russell 2000 and Dow Jones Industrials up 0.6%, 0.5%, 0.4% and 0.3%. Sectoral breadth is impressive despite the clear direction of hot economic data, with all sectors higher. Consumer discretionary and communication services are leading; they’re each up 0.7%. Interest rates were a lot higher but have now reversed on the back of light ISM services data. My hunch tells me the move is a head fake. How could ISM services outweigh all the strong data releases from this week? It appears, players are using it to justify pushing the 10-year below 4%. How long could that last? Not long at all. Meanwhile, the 2- and 10-year Treasury maturities are trading at 4.35% and 3.97%, 4 and 3 basis points (bps) lower on the session. Softer yields are pushing the dollar lower, which again doesn’t make much sense, but nevertheless, the greenback’s index is down 31 bps to 102.11. The US currency is softer relative to the euro, pound sterling, franc, yen, yuan and Aussie and Canadian dollars. Crude oil is higher on heightening Middle East tensions amidst stronger economic data stateside. Indeed, shipping companies including Maersk and Hapag-Lloyd are avoiding the troubled Red Sea route for the foreseeable future. WTI crude is up 2.1%, or $1.48 to $73.82 per barrel on the news.

Next Week’s US Inflation

Next week’s CPI is likely to reflect inflationary pressures that are troughing at 3%. Today’s Euro numbers are indicative of the lack of short-term progress on inflation against the backdrop of loosening financial conditions. Market players may be trying to limit this week’s damage on a Friday prior to the inevitable reality of firmer inflation and higher yields in the coming weeks and months, driven by goods and services. In the interim, however, I’ll find it comical that ISM-Services is outweighing the impact of ADP Jobs, BLS Jobs, DOL Unemployment Claims and BLS Job Openings.

Join Me at The MoneyShow

I look forward to discussing the Federal Reserve’s challenging journey across the monetary bridge—or process of taming inflation while keeping growth positive—when I speak at the MoneyShow Virtual Expo. I will discuss economic and financial market conditions and place an emphasis on consumer spending, labor markets, equities, fixed-income, commodity trends, and monetary and fiscal policies. I will also cover the real estate, banking and manufacturing sectors. Please click below to receive a free pass to the online event, which is scheduled for 11:50 a.m. EST on Thursday, January 18. Register For Free Here

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.