Mixed economic data are marginally improving investor sentiment despite lackluster earnings reports following strong equity market gains yesterday. Nevertheless, stocks are on track to close out October firmly in the red. October marks the third consecutive month of losses for equity indices, as elevated interest rates, nose-bleed valuations and uninspiring earnings prospects weigh on buying activity. As we flip the calendar and look forward to the rest of the week, however, Federal Reserve Chairman Powell’s presentation, earnings from Apple and Nonfarm Payrolls data may propel the bulls as we enter a seasonally strong period.

Consumers Become Less Optimistic

The Conference Board’s Consumer Confidence Index declined for the third consecutive month in October, as households expressed concerns regarding rising prices, elevated food and gasoline costs, lofty interest rates and uncertainty regarding the political and geopolitical outlook. Consumer confidence came in at 102.6 this month, above expectations calling for 100 but below September’s 104.3. Both the Present Situation and Expectations indices declined, coming in at 143.1 and 75.6 compared to September’s 146.2 and 76.4. While views on current and future business conditions, future labor market strength, and future income prospects worsened, perceptions of the current labor market remained steady.

Workers Get a Raise

Higher compensation is likely to have supported consumers’ views of a strong labor market. This morning’s Employment Cost Index from the U.S. Bureau of Labor Statistics showed third quarter combined wages and benefits climbed 1.1% quarter-over-quarter (q/q), beating projections for an unchanged 1% figure from the previous quarter. The increase primarily reflected a drastic rise in state and local government worker compensation of 1.5% q/q. Meanwhile, the private sector compensation increase was unchanged at 1% q/q, as wages accelerated from 1.0% to 1.1% while benefit expenses decelerated from 0.9% to 0.8%.

Conditions in Eurozone and Canada Weaken

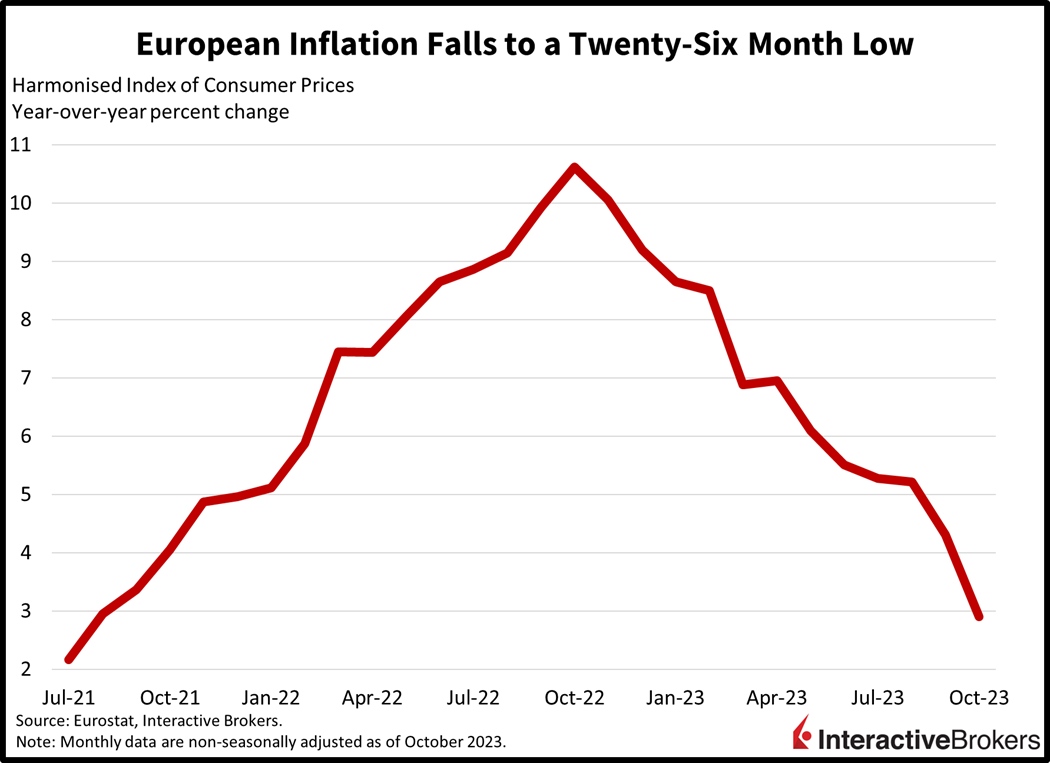

Across the Atlantic, inflation in the eurozone slowed dramatically to its lowest rate in twenty-six months, but not without denting economic growth. While an inflation report with lighter than expected results is great news, the region’s third quarter GDP, according to a separate report released at the same time this morning, was negative and worse than expected. GDP experienced a 0.1% q/q contraction, worse than the consensus’s expectation for a donut and the second quarter’s 0.2% growth rate. Meanwhile, euro inflation rose only 0.1% month-over-month (m/m) and 2.9% year-over-year (y/y), lighter than expectations of 3.1% y/y. Compared to September, the figures slowed from 0.5% and 4.3%. Price pressure relief was provided by a sharp 1.1% m/m decline in energy costs and unchanged prices for services. Prices for food, alcohol and tobacco and non-energy industrial goods rose 0.2% and 0.1% m/m. Tighter credit conditions, weaker international demand and elevated energy costs continued to weigh on the region’s economic prospects while helping to subdue inflationary pressures.

In other economic news, Canada GDP was also lighter than expectations. August economic growth was flat m/m for the second-consecutive month, and weaker than estimates of 0.1%.

U.S. Home Prices Gain, But Outlook for Consumers and Construction Declines

Here in the states, home prices continued rising in August, with the S&P Case Schiller Home Price Index gaining 0.9% m/m and 2.6% y/y, compared to growth rates of 0.7% and 1% in July. As house prices climb, consumer spending, broadly speaking, has been surprisingly strong, but certain consumer-focused companies have issued disappointing guidance. At the same time, the construction industry appears to be facing challenges with a potential pullback in proposed new electric vehicle plants. These developments are illustrated by the following:

- VF Corp., which provides North Face, Timberland and Vans branded clothing and outdoor equipment, is experiencing a 14% stock price decline after it reported a disappointing fiscal second quarter that concluded on September 30. The company’s revenue declined 2% to $3.0 billion, but in constant currency the decline was double that amount. Sales of the company’s Vans branded clothing dropped 21% although sales of North Face items increased 19%. Sales for the company’s direct-to-consumer channel declined 3% and wholesale revenues dropped 1%. The company produced an adjusted earnings per share (EPS) of $0.63 compared to $0.73 in the year-ago quarter. When including irregular items, such as a tax case ruling, the company produced a $1.16 loss per share compared to the $0.31 loss from a year ago. VF expects a full-fiscal year EPS of $2.00 to $2.20 compared to its estimate from just a few weeks ago, when it guided for an EPS ranging from $2.40 to $2.50. It generated an EPS of $3.18 during its last fiscal year. The company attributes the disappointing results to weak consumer demand.

- JetBlue Airways also provided disappointing guidance, which caused its share price to tank 11%. JetBlue says its current-quarter loss will range from between $0.35 and $0.55 a share compared to the $0.21 loss anticipated by analysts. JetBlue also said its revenue will decline in a range of 6.5% to 10.5%, which is worse than the analyst expectation. The airline has faced air traffic control issues, congestion at certain airports, weather problems and weakening demand for domestic traveling. For the third quarter, JetBlue experienced an adjusted loss per share of $0.39, much worse than the analyst consensus expectation of $0.38 cents. Its revenue of $2.35 billion missed the analyst expectation of $2.38 million.

- Caterpillar saw its share price decline approximately 5.5% after the company provided disappointing guidance despite it beating expectations for the third quarter. While analysts were expecting guidance calling for a 5% y/y revenue increase for the current quarter, Caterpillar, which provides earth movers and heavy construction equipment, said it expects sales to be only slightly higher than the year-ago period. The company’s order backlog dropped by approximately $1.96 billion y/y. Additionally, the surge in construction of EV factories appears to be easing with Ford recently announcing it was postponing construction of its $12 billion Kentucky facility and higher mortgage rates amidst lofty prices are a headwind for new residential construction. For the third quarter, Caterpillar produced an EPS $5.45 and an adjusted EPS of $5.52. Analysts expected an adjusted EPS of $4.72. Its third-quarter revenues increased 12% to $16.8 billion, in part because the company has increased its prices but it has also benefited from strong demand from the Bipartisan Infrastructure Act and other legislation, such as the Inflation Reduction Act, which has been encouraging construction of EV plants, and Chips and Science Act, which has been encouraging construction of semiconductor plants.

Markets Lack Direction

Markets are mixed as we close out October with bulls and bears lacking aggressiveness in either direction. However, the current lack of clarity on future earnings, monetary policy and additional economic points will likely shift as we gain more information throughout the week. The Russell 2000 and S&P 500 indices are up 0.9% and 0.1% while the Dow Jones Industrial and Nasdaq Composite indices have shed 0.1% and 0.2%. All sectors are green with real estate and financials leading, they’re up 1.3% and 0.5%, respectively. Weaker data from Canada and Europe alongside Tokyo’s hawkish shift on yield curve control allowing its 10-year to rise above 1% are weighing on foreign exchange markets. The dollar is gaining against the euro, franc, pound sterling, yuan, yen and Aussie and Canadian dollars. The Greenback’s Index is up 50 basis points (bps) to 106.67. Bond yields are relatively mixed and well-behaved, with the short-end higher while the long-end is lower. The 2-year is up a bp to 5.06% while the 10-year is down 3 bps to 4.856%. Weaker economic data amidst tight monetary policy is offsetting worries of supply constraints resulting from an escalation of the Middle Eastern conflict, with crude oil prices near the flatline. WTI crude is up 18 cents per barrel or 0.2% to $82.72.

UAW Success Could Ignite Surge in Labor Organizing

The slightly more than six-week-old United Auto Workers strikes against Ford, GM and Stellantis are wrapping up with the union announcing that it has reached tentative agreements with the Detroit companies. The agreements include 25% pay increases plus cost-of-living increases in the coming years. They also eliminated the tier system and provide better compensation for temp workers. In some instances, the agreements extend union representation to new EV plants, including battery manufacturing facilities. After announcing the success of the strikes, UAW president Shawn Fain has said the union will now seek to organize labor at other companies, such as Tesla and Toyota. Even if unsuccessful with spreading union membership to other companies, the threat of labor organizing may put upward pressure on compensation. In the meantime, analysts are expecting the higher wages to result in higher prices for cars as automakers say they will struggle with investing money in developing EVs while paying higher salaries.

Humanitarian Toll and Oil Fears Mount in Middle East

Fears that the Israel-Hamas war could turn into a regional war were highlighted recently when National Security Advisor Jake Sullivan said the potential escalation of the conflict is a real risk. Israel is currently conducting a ground attack against Hamas in the Gaza Strip and has resisted calls from various countries for a cease fire. The conflict has already caused thousands of deaths and a significant humanitarian crisis in Gaze with medical supplies, food and water in short demand. According to a recent survey of analysts by Reuters, slow global economic growth is likely to keep crude oil prices below $90 a barrel for the remainder of this year, but if the Middle East conflict widens to other countries and creates supply disruptions, Brent crude could easily climb to $115 a barrel.

Europe May Be a Preview of U.S.

Today’s European reports provide important insights regarding the tradeoffs between inflation and economic growth. The 2-handle headline is causing market players to take a victory lap regarding further tightening from the ECB. Here in the states, weaker October data may point to the same occurrence on this side of Atlantic, with a favorable read on payrolls and consumer prices possibly marking the end of Fed tightening this cycle. Following the victory lap, however, the next risk to contend with is bad news becoming bad news. Slower economic momentum is certainly welcome against the backdrop of an inflation fighting Fed, while a sharp decline in economic activity is not.

Visit Traders’ Academy to Learn More About Consumer Confidence and Other Economic Indicators.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Forex

There is a substantial risk of loss in foreign exchange trading. The settlement date of foreign exchange trades can vary due to time zone differences and bank holidays. When trading across foreign exchange markets, this may necessitate borrowing funds to settle foreign exchange trades. The interest rate on borrowed funds must be considered when computing the cost of trades across multiple markets.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.