ZINGER KEY POINTS

- Fed response to slowing inflation has driven a strong equity rally.

- Further gains depend on whether Fed pushes back against rate cut expectations.

The Federal Reserve came into 2023 with headline inflation at 6.5% and with interest rates already at 4.25%-4.5%. At this point, inflation had already come down from its peak of 9.1%, and analysts believed the central bank would only make one more hike — with the main rate peaking at 4.5%-4.75%.

With mortgage rates at multi-year highs and markets fearing a housing crash — there was every reason to believe stocks would have had a terrible year, while the U.S. dollar would rise to new highs.

However, the dollar index had already peaked at 114.78 in September 2022 as inflation sat around the 8% mark, while the S&P 500 hit its low a month later at 3,492.

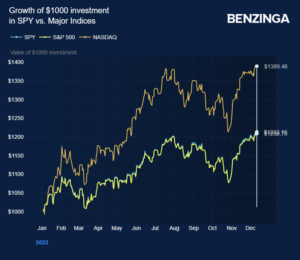

But a year ago, few were thinking Fed policy in 2023 could have driven such a strong subsequent performance for stocks. Below, we chart the turning points during 2023 that spurred such a performance.

January/February FOMC Meeting

On Feb. 1, the Fed raised the main rate to 4.5%-4.75% with inflation at 6.5%, but slowing. Stocks had risen into the New Year, but the hawkish message: “the Committee anticipates that ongoing increases in the target range will be appropriate,” put the skids on the stock market rally. Over the next month or so, stocks fell by 9%.

“Powell’s hawkish comments following the February FOMC have been more than offset by his decision not to push back aggressively against the recent loosening in US financial conditions,” said Jane Foley, senior FX strategist at Rabobank said at the time.

March FOMC Meeting

On March 22, the FOMC pushed the main rate up to 4.75%-5%, but sounded less hawkish. Powell noted that the banking system was resilient and that recent tighter credit conditions would weigh on households, economic activity and, therefore, inflation.

By March, the headline inflation rate had slowed to 5% and many economists were thinking this would be the peak of rates and stocks began a four-month rally that would put on nearly 20%.

“The market thinks it heard that the Fed was done hiking, even though Fed Chair Powell held out the possibility that ‘some additional firming may be necessary’,” said Marc Chandler, senior strategist at Bannockburn Global Forex said at the time.

July FOMC Meeting

While the Fed surprised some by raising another quarter point to 5%-5.25% in May, it didn’t deter the stock market rally. By that point, inflation was down to 4.1% and would then drop to 3% in June. The markets thought the Fed’s job was done.

But it wasn’t. At its July 26 announcement, the FOMC raised the rate to 5.25%-5.5%, causing stocks to drop and the dollar to resume its rally. Between July 27 and Oct. 27, the market fell by 9%.

“One risk for the Fed is that it is likely that US headline CPI inflation will tick higher again due to base effects. While we expect core inflation to trend lower in the months ahead, the slow pace of this fall is also likely to ensure the Fed retains a cautious outlook,” said Foley at the time.

Drop In Inflation Brings Out The Doves

While the Fed held rates at its September meeting, markets continued on a downward path, with many thinking — after inflation pipped back up to 3.7% in August and September — that the central bank could have further work to do.

Then, in late October, the stock market turned around as comments from some of the FOMC members began to suggest that rates had peaked at 5.25%-5.5%.

This sentiment was backed up in early November by CPI data that showed the headline rate had fallen back to 3.2%. The idea that the rate-hike cycle was now over was cemented and the S&P 500 has, since Oct. 27 rallied 12.2%.

And then on Tuesday this week, the final CPI reading for the year measuring November inflation, showed the headline annual rate dropping to 3.1%.

“We expect Chair Powell to repeat that the Fed is still prepared to hike again if necessary, and he likely will push back in the press conference when asked about the likely timing for the first easing,” said Ian Shepherdson, chief economist at Pantheon Macroeconomics.

He added: “But the data will tell them what to do, and we expect the core PCE and wages data to push the Fed into easing in the spring.”

—

Originally Posted December 13, 2023 – Fed’s 2023 Policy Twists: The Turning Points And Markets Reactions

Disclosure: Benzinga

© 2022 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Benzinga and is being posted with its permission. The views expressed in this material are solely those of the author and/or Benzinga and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.