A stronger-than-expected jobs report this morning along with concerns about the financial stability of U.S. regional banks is accelerating a market selloff triggered by Federal Reserve Chairman Jerome Powell. The fed chair earlier this week suggested that strong economic data points to the central bank potentially becoming more aggressive in fighting inflation.

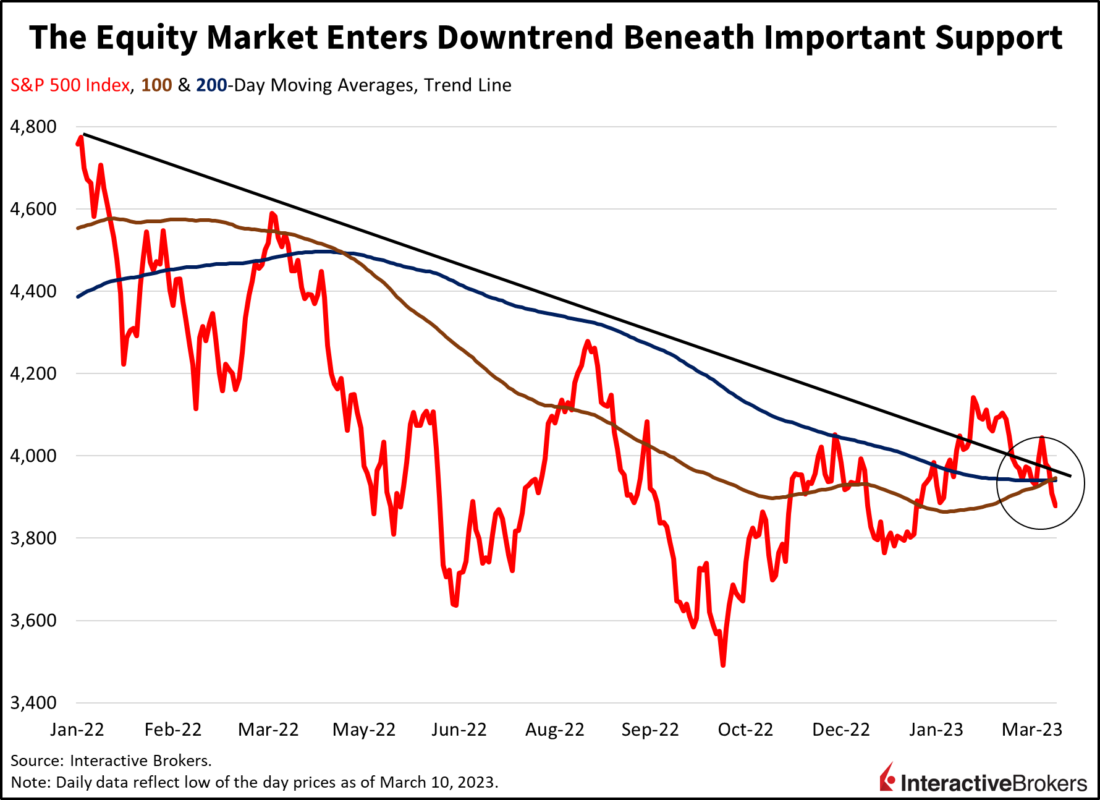

Equities this morning are intensifying yesterday’s fierce selloff, with the S&P 500 index down 0.6% to 3890 and significantly below important support levels at around 3941 corresponding with the 100- and 200-day moving averages. Yields are down significantly as well, with investors concerned about signals that unprecedented monetary policy tightening is now impacting the real economy in a concrete way. Market participants are betting that peak dollar is behind us, with lower yields pulling the Dollar Index down 1.2% to 104. Despite economic weakness, crude oil is roughly unchanged as declining supply from OPEC offsets worries about the potential impact of a recession on energy prices.

In some regards, the report provided a mixed picture of the job market, however, with people returning to the labor market in droves. In an encouraging development from an inflationary perspective, the return of absent workers drove the unemployment rate up to 3.6% from 3.4%, the labor force participation rate up to 62.5% from 62.4%, and the pace of month-over-month wage gains down to 0.2% from 0.3%. These developments signal that companies are having a much easier time finding workers, with labor shortages no longer as prevalent of a theme on company earnings calls.

Employment data this morning didn’t help weaken the selloff. Employers’ hiring binge continued in February, with companies snatching up 311,000 workers, a decline from 504,000 in January, but substantially above the Wall Street Journal analyst consensus expectation of 225,000. In some regards, the report provided a mixed picture of the job market, however, with people returning to the labor market in droves. In an encouraging development from an inflationary perspective, the return of absent workers drove the unemployment rate up to 3.6% from 3.4%, the labor force participation rate up to 62.5% from 62.4%, and the pace of month-over-month wage gains down to 0.2% from 0.3%. These developments signal that companies are having a much easier time finding workers, with labor shortages no longer as prevalent of a theme on company earnings calls.

The leisure and hospitality, education and health services, retail trade, professional business services, and government sectors led the job gains, adding 105,000, 74,000, 50,000, 46,000, and 45,000 workers respectively. Construction, other services, wholesale trade, and mining and logging also boosted the headline number to a more modest extent. High-profile layoffs in big tech finally made it to the official data, with the information sector shedding 25,000 jobs. Transportation and warehousing, manufacturing, utilities, and financial activities also weighed on growth, dropping 22,000, 4,000, 1,000, and 1,000.

Investors are also worried about the financial stability of U.S. regional banks that have invested in long-duration fixed-income investments as rising interest rates have caused bond values to plummet. On Wednesday, SVB reported a loss of $1.8 billion on the sale of investments as it sought to keep up with outflows of clients’ deposits against the backdrop of significant interest rate sensitivity. After failing to raise $2.25 billion by selling common and preferred stock, the bank holding company is now rumored to be up for sale. Prior to a halt in trading, SVB stock had tanked more than 60%. Fears about potential losses at other banks are surging, with strong selloffs hitting shares of JPMorgan, Bank of America, Wells Fargo, and Citigroup. The combined market values for those banks plummeted approximately $50 billion yesterday. The panic comes after a difficult year for banks’ fixed-income holdings, with the iShares Core U.S. Aggregate Bond ETF declining 13.03%, and FDIC Chairman Martin Gruenberg recently reporting that banks lost more than $620 billion in portfolio values in 2022.

For most of this week, investors have been assessing whether a potential 50 basis point fed funds rate hike this month could push the U.S. closer to a recession, or, at a minimum, cause further weakening of corporate revenues and profits due to higher business financing costs and consumers reeling in spending as credit card payments become overwhelming and interest rates climb. To that end, banking worries may serve as modest relief for investors who are anxious about the Fed becoming more aggressive in fighting inflation. It illustrates that the Fed has already curtailed liquidity as the bond rout has caused banks’ lending capacity to shrink. Raising the fed funds rate too fast could, furthermore, accelerate banks’ balance sheet losses, strengthen investors’ already strong fears about banks’ financial stability and create an economically stifling liquidity crunch.

Visit Traders’ Academy to Learn More about Payroll Jobs and Other Economic Indicators.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.