Treasury yields are soaring to their loftiest levels of the year on the back of this morning’s GDP report which depicted slowing economic growth amidst accelerating price pressures. The stagflationary combination is particularly troublesome for stocks, whose fundamental prospects are generally driven by a robust economy while their relative valuations are tied to rates. Also pushing up the cost of capital were today’s reports on unemployment claims and pending home sales, with both beating on the hotter side. Investors are currently digesting corporate earnings while they accept the probable reality of rate cuts later rather than sooner.

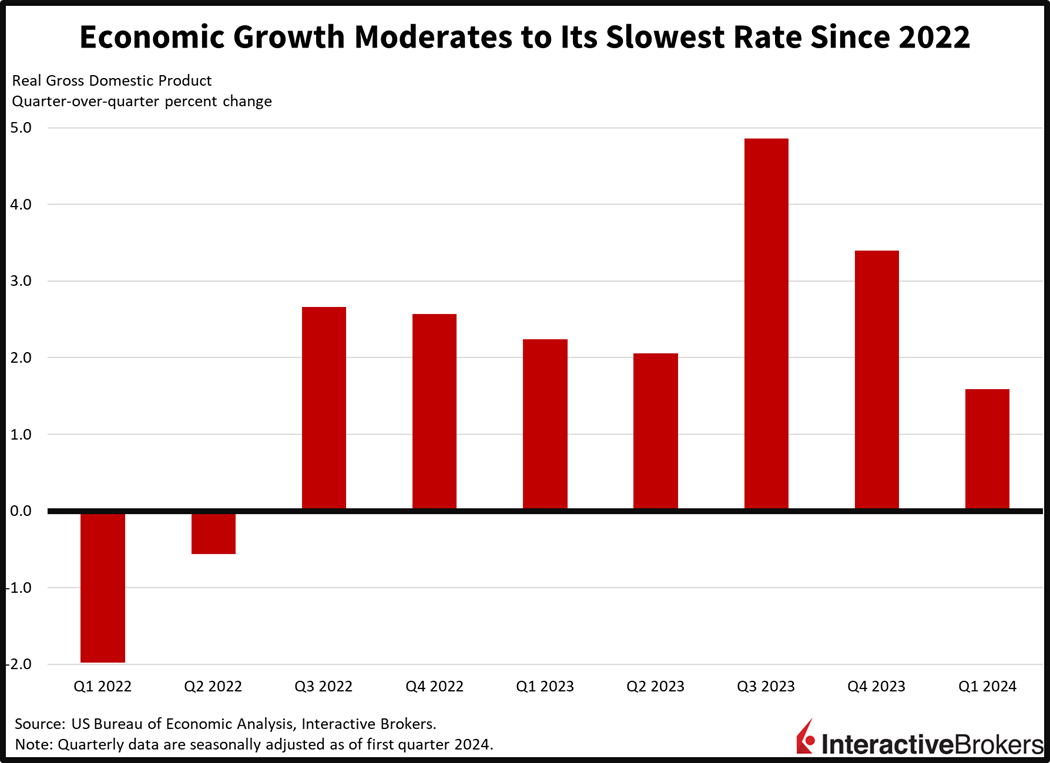

Economic Growth Cools Off

Economic growth moderated in the first quarter as consumers curbed spending. This morning’s gross domestic product (GDP) print from the Bureau of Economic Analysis reflected quarterly growth of 1.6%, slowing to almost half of the previous quarter’s 3.4% clip while missing the median projection of 2.5%. Driving the deceleration were a decline in goods outlays and a significant drag on net exports, which were partially offset by an acceleration in services consumption. Private investment also picked up some of the slack, as homebuilders rushed to add supply in the beginning of the year due to the prospect of lighter rates. The residential segment led investment gains amidst a modest slowdown in capital expenditures on the corporate side. Government spending also increased.

Price Pressures Build

Unfortunately, however, lighter growth didn’t translate to reduced price pressures, with the quarterly, annualized reads on the headline and core versions of the Personal Consumption Expenditures Price Index rising to 3.1% and 3.7% from 1.7% and 2% in the fourth quarter. Wall Street expected numbers closer to 3% and 3.4%. The services sectors, which haven’t cooperated on the inflationary front this cycle, continue to be pressured by elevated labor intensity, which is contributing to firms passing on higher costs to consumers. Goods and commodities, similar to last year, meanwhile, may begin to provide disinflationary pressures in future months if geopolitical concerns are kept at bay.

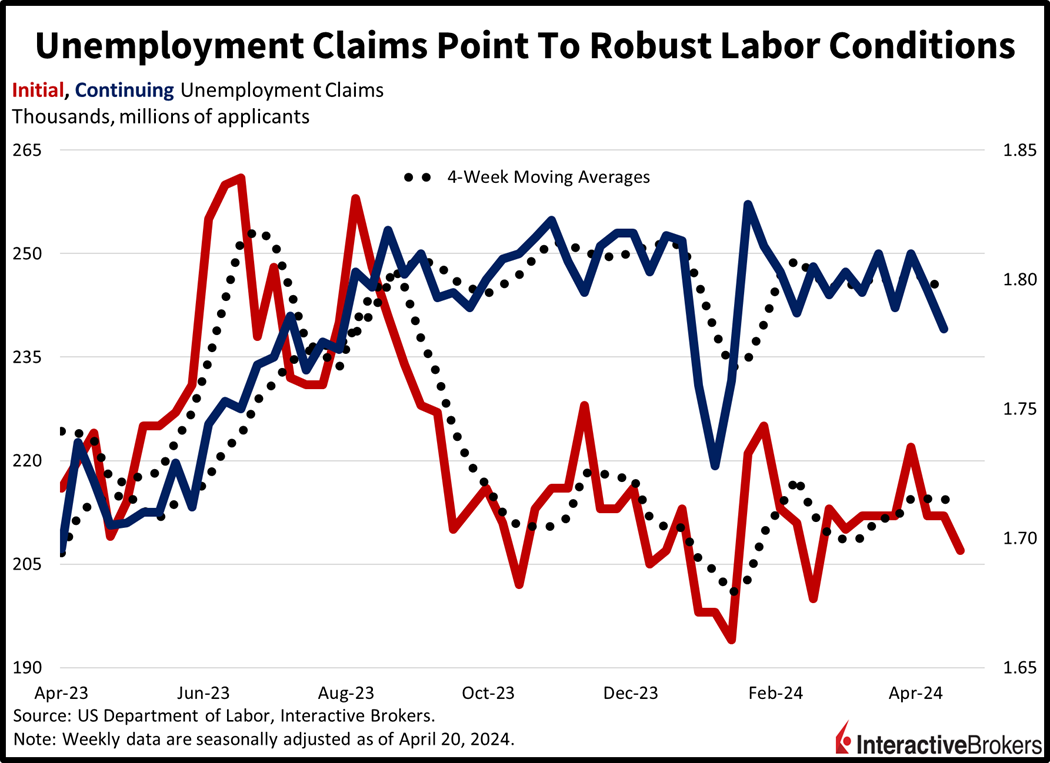

Labor Tightness Lingers

We received further confirmation today that labor conditions remain tight, with both initial and continuing unemployment claims declining on a week over week basis and coming in beneath estimates. Initial claims dropped to 207,000 during the week ended April 20 versus the projected 214,000 and the previous period’s 212,000. Continuing claims for the week ended April 13 fell to 1.781 million from 1.796 million the week before while economists were expecting a number closer to 1.814 million. Both figures are indeed trending lower, with the four-week moving averages moving down to 213,250 and 1.794 million from 214,500 and 1.801 million during the prior weeks.

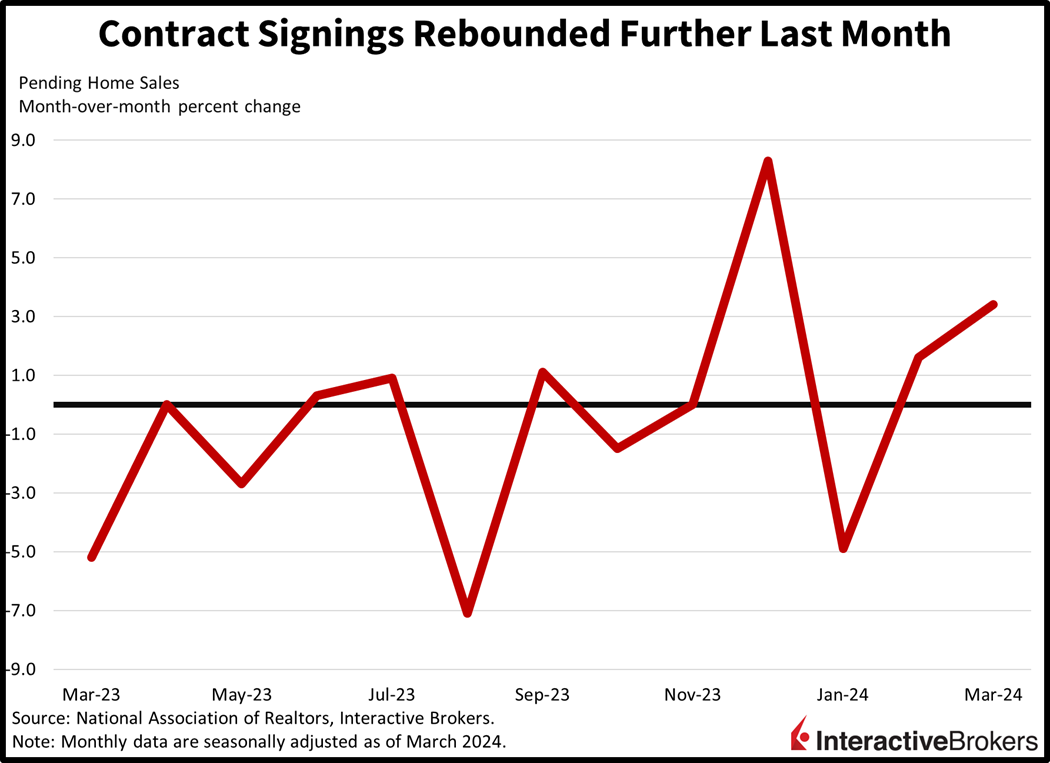

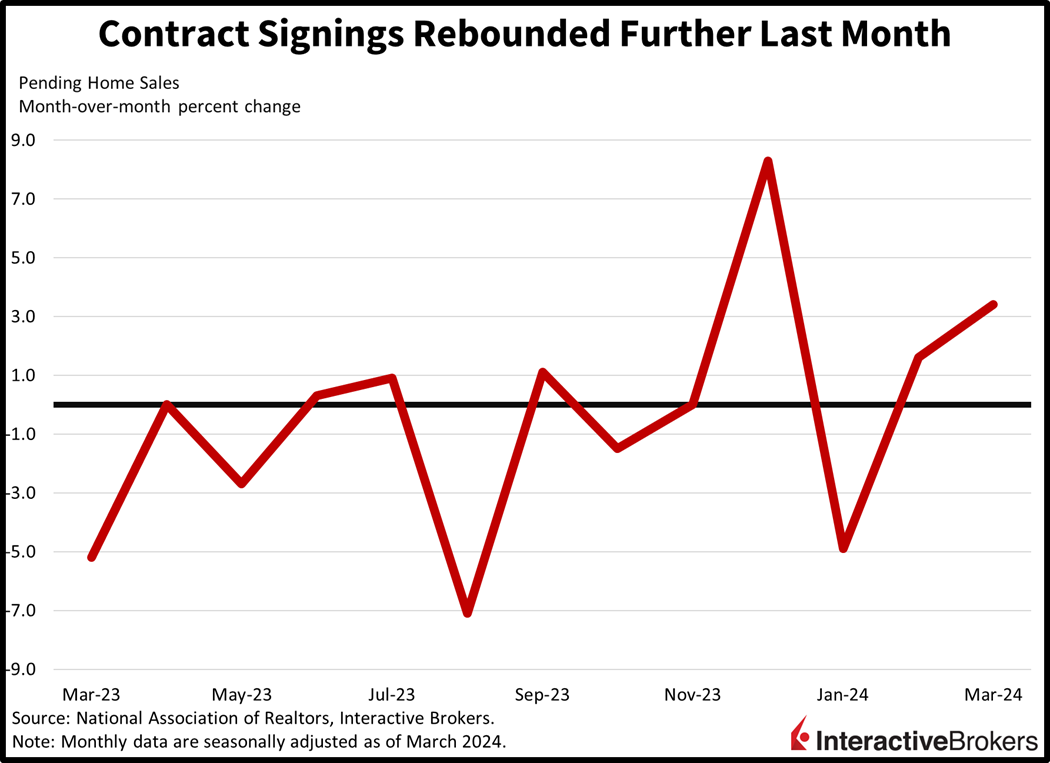

Home Searching Activity Increases

Potential home buyers dove into the market last month with the pace of contract signings gaining steam from February’s recovery. The National Association of Realtors reported that pending home sales grew 3.4% month over month, exceeding estimates of 0.3% by a wide margin and the prior month’s 1.6%. On a year-over-year (y/y) basis, though, pending sales rose just 0.1%, a return to longer-term growth following February’s 7% y/y decline. Pending home sales are a leading indicator of completed transactions, as contracts are signed prior to keys being turned over.

Lukewarm Revenue Growth Hits Meta While Consumers Tighten Spending

Facebook and Instagram parent Meta reported disappointing revenue guidance, causing its share price to drop approximately 12% and pull down shares of other tech companies. Meanwhile, consumers appear to be increasingly pushing back against price increases as illustrated by earnings commentary from Comcast and Nestle. The earnings calls came shortly after PepsiCo also said customers were balking at price hikes. Other businesses, however, have been successful with boosting prices. Just this morning, Chipotle said it generated strong sales despite having increased its prices. The following highlights illustrate these points:

- Meta said its current-quarter revenue would range from $36.5 billion and $39 billion compared to the midpoint analyst estimate of $38.24 billion. It also increased the lower end of its guidance for 2024 capital outlays, citing higher infrastructure and legal costs. The company has been aggressively investing in artificial intelligence and virtual reality services. CEO Mark Zuckerberg explained that it will take time for the increased capital outlays to be monetized, but he maintained that Meta’s existing AI services have been profitable. Separately, investors have been scrutinizing Meta’s capital expenditures and are concerned that advertisers in China, which have been a growth area for the company, may scale back marketing budgets. However, Meta’s earnings and revenue for the first quarter exceeded analyst consensus expectations. The company’s share price tanked approximately 12% this morning, a result of the weak revenue guidance and expected increased capital outlays.

- Comcast reported first-quarter earnings and revenue that exceeded median analyst expectations, but said its revenue grew only 1.2% y/y. Revenue from US broadband increased, with higher prices helping to offset the impact of the company losing 65,000 customers. Comcast also lost 487,000 cable TV subscribers, a result, in part, from consumers moving to lower cost streaming services, but its wireless business services increased its customer base by 21%. In other business areas, high operating costs and promotions caused theme park earnings to decline, but the release of the movie “Oppenheimer” supported the results of NBCUniversal’s Peacock streaming service, which added three million paid subscribers. Comcast stock declined 6% this morning.

- Nestle, which raised its prices earlier this year, said its organic sales climbed 1.4%, missing analyst expectations and slower than the 9.3% growth in the year-ago quarter. Overall volumes in North America dropped 5.8% with US sales of frozen pizza and snacks weakening significantly due to soft consumer demand, price competition and retailers reducing inventories. Nestle’s results were also hurt by supply constraints for vitamins, minerals and supplements.

- Chipotle bucked the trend of consumers curtailing spending. Its first-quarter profits of $359.3 million climbed from $291.6 million in the year-ago quarter, a result of an increase in foot traffic to its stores. Overall sales climbed 14.1% and the average check size increased. The growth occurred across income categories despite the company increasing its prices last year. The company increased its full-year sales guidance.

Markets Hit by GDP and Inflation Fears

Markets are getting clobbered as a downside miss on economic growth meets an upward beat on inflation. All major US equity indices are down over 1% with the Dow Jones Industrial, Russell 2000, Nasdaq Composite and S&P 500 benchmarks lower by 1.6%, 1.5%, 1.4% and 1.2%. Sectoral breadth is deeply negative with every segment losing on the session. Leading the charge south are the communication services, technology and consumer discretionary sectors with the components down 4.4%, 1.4% and 1%. Yields are soaring to their highest levels of the year as the 2- and 10-year Treasury maturities trade at 5% and 4.7%, 7 and 6 basis points (bps) loftier on the session. The dollar is near the flatline though, with the greenback trading higher relative to the yen and Aussie dollar but lower versus the euro, pound sterling, franc, yuan and Canadian dollar. Oil prices are lower as traders dial down their demand prospects on the back of the softer GDP print and loftier fed funds rate expectations. WTI crude is down 0.7%, or $0.60, to $82.15 per barrel. Gold and copper are higher though, with prices up 0.7% and 1.3% so far this session.

A Glimmer of Hope

This morning’s GDP report does offer hope that softer consumer spending may lead to subdued price pressures in future months, as geopolitical conflicts did drive a sharp increase in commodity prices during the period. For now, though, our journey across the monetary policy bridge has been incrementally extended following this morning’s data, with market players now expecting to reach the other side in September. An important consideration related to a September cut is the close proximity to the November presidential election, as the central bank would want to avoid being perceived as taking one side or the other.

Visit Traders’ Academy to Learn More About Gross Domestic Product and Other Economic Indicators.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.

Leave a Reply

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

I don’t see SPX above 5000 at the close tomorrow, but who knows. This weekend also seems ripe for geopolitical risk given that the Rafah offensive is getting underway.