Wall Street was anticipating today’s third-quarter GDP report to be a monster print, but the figure arrived even hotter than expectations. The report showed persistent consumer spending, which is anchoring hawkish monetary policy expectations despite the data providing favorable inflation news. The sharp pick up in last quarter’s growth alongside disappointing commentary from Meta is weighing on stocks, with the S&P 500 at a five-month low as major indices are on track for their third monthly decline.

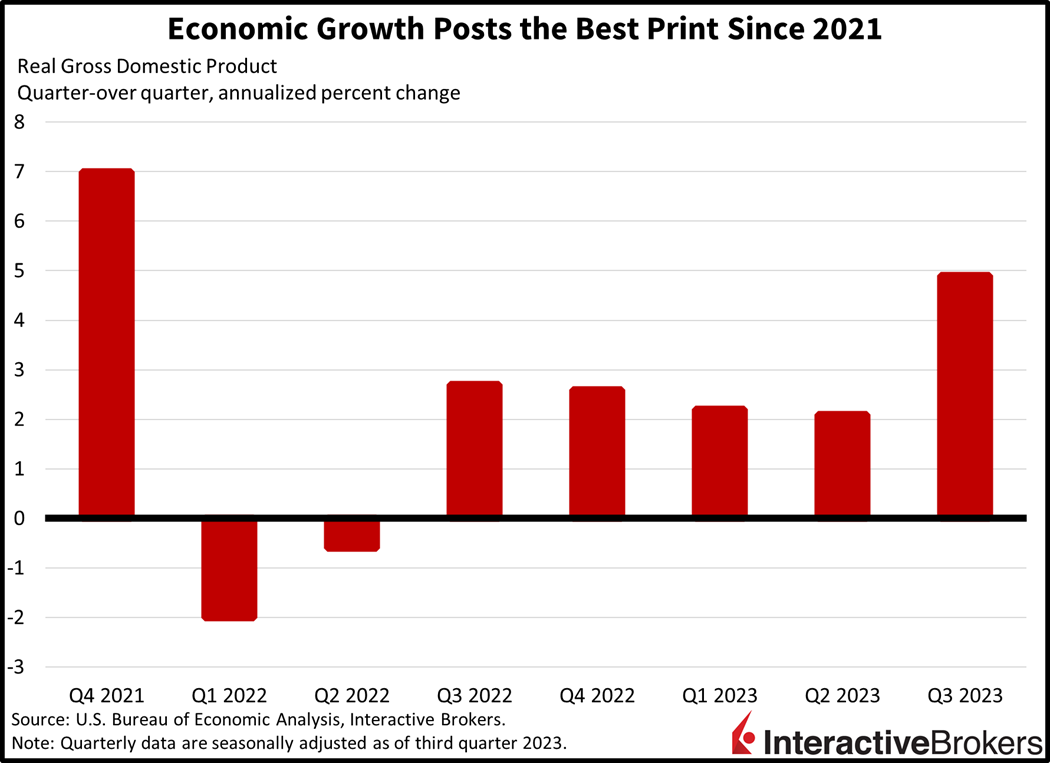

Economic Growth Posts the Best Print Since 2021

Third-quarter real GDP grew at an annualized 4.9% rate, the fastest growth since the 7% recorded in the fourth quarter of 2021. The third-quarter rate beat projections calling for 4.7% and accelerated meaningfully from the second quarter’s 2.1% rate. Robust consumer outlays on goods and services, a pickup in residential construction investment, growing inventories and heightened government spending were the growth drivers during the third quarter. Business investment weighed on results, however, as an uncertain economic outlook led to reduced capital expenditures.

Highlights from the GDP report include the following:

- Consumer spending rose 4% annualized from the second quarter, matching the growth seen in 2021’s fourth quarter as households enjoyed shopping sprees

- Residential investment grew 8.4% as builders and prospective home buyers adjusted to higher interest rates and marginally came off the sidelines

- Government spending grew 4.6% as federal outlays sported a rate of 6.2% while municipal spending rose at a pace of 3.7%

- A sharp increase in inventories added 1.3% to the headline figure

However, business investment fell 0.1%–its first decline since the 1.3% drop in the third quarter of 2021. Regarding inflation, overall prices rose 3.5% while core rose 2.4%, as the former accelerated from the previous quarter’s 1.7% while the latter decelerated from 3.7% against the backdrop of much higher gasoline prices and reduced pricing power from services and goods providers.

Durable Goods Orders Rise

In other news, September durable goods orders rose 4.7% month-over-month (m/m) after two months of declines, better than the 1.7% expected and August’s 0.1% decline. The volatile passenger aircraft category led the increase, rising 92.5% m/m after dropping 17.5% and 45.7% in the past two months. Transportation equipment was also a big gainer, with orders growing 12.7% during the period.

Employers Slow Hiring

On the labor market front, what else is new? Companies are slowing their hiring but are not letting go of employees with unemployment claims remaining at subdued levels. Initial unemployment claims rose to 210,000 for the week ended October 21, slightly higher than anticipations of 208,000 and the 200,000 notched in the prior week. Continuing claims reflect the slowdown in hiring, rising for the fifth-consecutive week to the highest level since May. Continuing claims came in 1.79 million for the week ended October 14, higher than the 1.74 million expected and the previous week’s 1.727 million. Laid off workers are taking longer to find jobs elsewhere as the labor market decelerates and companies right-size.

Investors Continue to Scale Back Risk

Risk-off sentiments are driving markets today with stock indices lower while bonds catch a bid. Technology is leading the way lower following Meta’s commentary regarding geopolitical risks possibly weighing on revenues. The Nasdaq Composite Index is down 1.4% while the S&P 500 and Dow Jones Industrial indices are lower by 0.8% and 0.5%, respectively. The small-cap Russell 2000 is the sole gainer, having climbed 0.5% as the regional banking and real estate sectors both gain 2.4% while biotech jumps 1%. Sectoral breadth is mixed, however, with communication services, technology, energy, consumer discretionary and consumer staples lower while the other six major sectors are higher. Yields are lower across the curve as players scoop up safe-haven assets. The 2- and 10- year Treasury maturity yields are 7 and 6 basis points (bps) lower to 5.06% and 4.9%. Lighter commentary this morning from the European Central Bank amidst an interest rate pause are weighing on currencies across the Atlantic and propping up the dollar, even in light of lower Treasury yields. The Greenback’s Index is up 30 bps to 106.87 as the Federal Reserve’s currency gains against the euro, pound sterling, franc, yen, yuan and Canadian and Aussie dollars. Crude oil is lower as market players focus on a bleaker demand outlook and are placing lower probabilities on a wider Middle Eastern conflict reducing scarce energy supplies. WTI crude is down $1.50 per barrel or 1.76% to $83.76.

Digital Advertising Gains, But Businesses Remain Cautious

Meta yesterday reported a strong revenue increase in its core advertising business, just one day after Alphabet said its advertising volume had grown significantly. Meta’s strong quarterly results initially caused its share price to surge, but the gain was quickly reversed after Chief Financial Officer Susan Li said the Middle Eastern conflict has already caused softness in fourth-quarter advertising and said revenues could range from $36.5 billion to $40 billion, which is an unusually wide range for the company.

Meta’s advertising increase resulted in the company’s third-quarter revenue reaching $34.15 billion, up 22% year over year (y/y) and above the consensus estimate of $33.58 billion. A combination of strong revenues and substantial cost cutting, including significant layoffs, resulted in the company generating $11.48 billion in net income, which exceeded the consensus estimate of $9.46 billion and increased y/y from $4.39 billion, a 164% boost. Additionally, the company’s earnings per share (EPS) of $4.39 soared past the analyst estimate of $3.64 and climbed y/y from $1.64. Meta has been focused on becoming more efficient and its employee head count is down 25% y/y. Additionally, Apple implemented privacy provisions that cost Meta approximately $10 billion in revenue in 2022. While Meta appears to have overcome challenges associated with the privacy provisions, businesses appear to be increasing their digital advertising. The WD-40 Company, for example, increased its third-quarter promotions and advertising outlays 27% y/y. Going forward, Meta’s biggest investment in 2024 will be developing artificial intelligence, according to the company’s earnings release.

IBM also generated stronger-than-expected earnings with an adjusted EPS of $2.20 compared to the $2.13 expected by analysts. Its revenue of $14.75 billion met the analyst consensus expectation. The company’s net income hit $1.70 billion, compared to the year-ago quarterly loss of $3.20 billion, that resulted from a $5.9 billion pension settlement. While the company’s software revenues increased 8% and met the analyst expectation of $6.27 billion, IBM’s Accenture consulting area generated $4.69 billion in revenue, a 6% increase but below the consensus expectation of $5.11 billion. IBM Chief Financial Officer Jim Kavanaugh said clients are still focusing on reducing costs, which is hurting outlays for discretionary projects.

Another Sign of Europe’s Economy Weakening

Whirlpool also exceeded consensus estimates for the third quarter despite high credit card interest rates discouraging consumers from buying durable goods and weak results in Europe. The company’s shares declined, however, because Whirlpool downgraded its guidance, citing an increase in sales promotions. For the third quarter, Whirlpool’s net sales of $4.93 billion beat the analyst consensus forecast of $4.81 billion and climbed 3.6% y/y. The company attributes the increase, in part, to new products, such as dryers with filters that remove pet hair and dishwashers with three racks. Those innovations helped the company increase its market share in North America. In a development that is impacting other companies, including Heineken, sales for Whirlpool weakened in Europe. Nevertheless, the company’s adjusted EPS of $5.45 exceeded the consensus estimate. Whirlpool had previously estimated its full-year adjusted EPS would fall between $16 and $18. It now expects an EPS of $16, which is marginally below the analyst consensus expectation.

The House Finds a Speaker

Contrary to the expression “the third time’s the charm” the House of Representatives took four tries to find a speaker with Representative Mike Johnson from Louisiana’s 4th district winning the post yesterday. Johnson, who is considered to be one of the more conservative members of Congress, has said he would support a stopgap spending resolution that would last until January 15 or even April 15 while legislators work out differences on 12 annual spending bills that make up the country’s budget. The resolution would avoid a painful government shutdown. Johnson is under a tight time constraint with the current spending resolution expiring on November 17 and thorny issues, such as reducing the national deficit and defense funding for Ukraine and Israel creating strong tension within a highly polarized Congress.

UAW Reaches Potential Ford Agreement as Pressure Grows for GM and Stellantis

Last night, the UAW called upon its members to return to work at Ford Motor Co. while the union moves toward ratifying a tentative agreement with the company. UAW International Vice President Church Browning, in a video presentation, said “We’re going back to work at Ford to keep the pressure on Stellantis and GM; the last thing they want is for Ford to get back to full capacity while they mess around and lag behind.” The proposed agreement would eliminate the tier system, which places new employees under a different and less generous, pay scale. The tier elimination would increase the lowest-paid temporary workers’ salaries by as much as 140% over the 4 ½ year contract. The agreement would also hike compensation by 33% over four years for full time workers when factoring in compounding and cost-of living-increases. It would also give union workers the right to strike over plant closures.

Inflation Data Tomorrow to Illustrate Fed Progress

While this morning’s GDP print provided a quarterly core PCE figure of 2.4%, which is near the Fed’s 2% target, market players appear to be front running the potential economic slowdown that is likely to result from victory on inflation. Indeed, tomorrow’s core PCE release expectation is 3.7% y/y, providing a different perspective of how close the Powell Fed is to reaching its inflation target. In the interim, pricing power will be integral, with the potential for consumers continuing to balk at higher prices being a predominant risk as we enter 2024. So far, we’ve seen mixed results from earnings reports regarding the corporate community’s ability to preserve margins.

Visit Traders’ Academy to Learn More About GDP, and Other Economic Indicators.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.