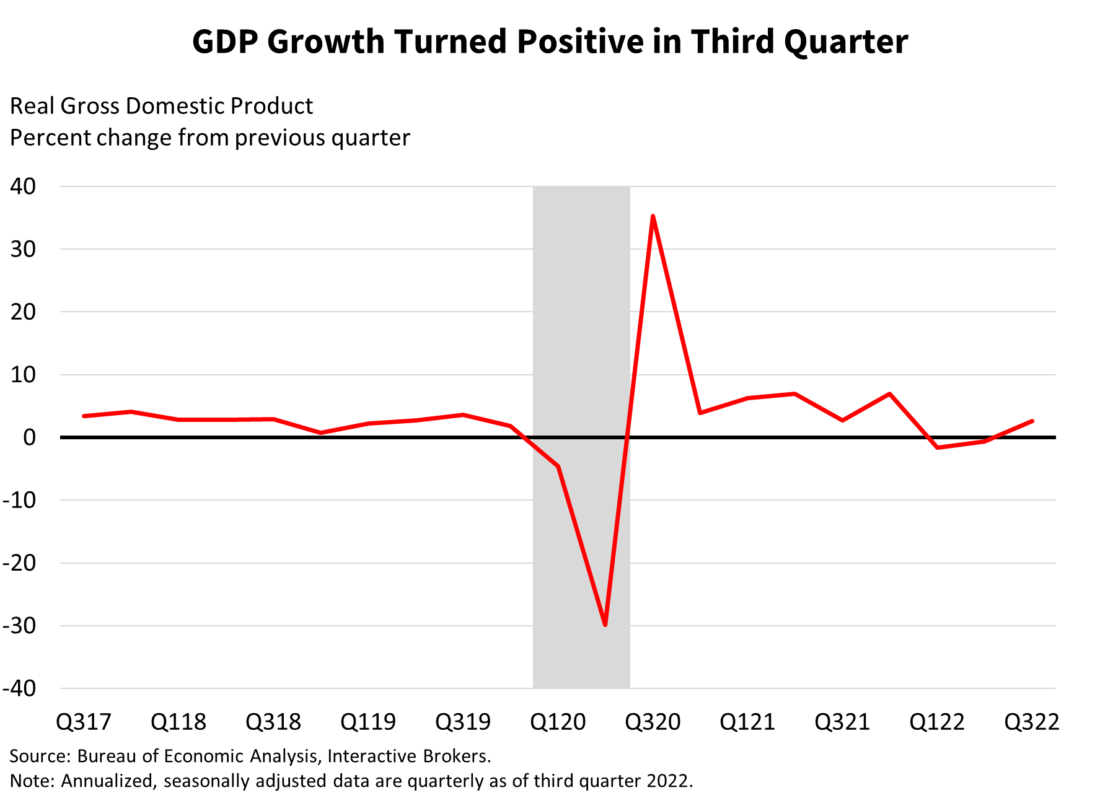

The Federal Reserve’s challenging position of being caught between a rock and hard place doesn’t appear to be easing with today’s gross domestic product (GDP) reading showing strong economic growth just days after the Flash Purchasing Managers Index (PMI) contracted and showed a troubling trend of strong pricing pressures and weak hiring within the services sector. US GDP grew at a 2.6% rate in the third quarter, the first positive GDP reading this year. Growth exceeded consensus expectations of 2.4% and was much higher than the second- quarter decline of 0.6%. While the GDP release drove optimism among investors of a potential soft landing, I believe it shows the Federal Reserve (the Fed) still faces a huge hurdle in fighting inflation, making a soft landing unlikely.

Broad gains were reported in all categories except for investment, which was negatively impacted by the decline in real estate activity. Consumer and business spending and investment has remained buoyant against the backdrop of the Fed aggressively raising interest rates and decades high inflation. These trends may drive consumption growth that can fuel inflation and pressure the Fed to remain aggressive with monetary policy with hopes of getting Americans to tighten their purses and wallets. That may be easier said than done: Even though the services-PMI weakened from 49.3 in September to 46.3 in October, digging deeper into contraction territory, the services industry still reported increased price pressures. The services segment is pivotal to price stability and these price pressures could imply that inflation may be becoming entrenched in the economy.

The positive GDP reading was supported by exports growing 14.4% while imports contracted 6.9%. The contraction in imports occurred for the first time since the depths of the pandemic in the second quarter of 2020. Services spending, business investment and government spending were also strong, growing 2.8%, 3.7% and 2.4%, respectively. Business investment, government spending and net exports growth accelerated from the previous quarter while growth of services spending slowed. Services spending was led by health care and other services; business investment was led by equipment and intellectual property products; exports were led by industrial supplies and materials, travel and financial services; and government spending was led by defense spending and higher wages for state and local government employees.

A handful of leading indicators, some covering real estate and manufacturing, imply tighter monetary policy is slowing down the economy, but the Fed is likely to deliver another super-sized 75 basis point rate hike at its meeting next week while the market is now expecting a 50 basis points increase in December, a slowdown in the pace of rate hikes.

The persistent nature of inflation exists even as third quarter residential investment and goods spending declined 26.4% and 1.2%. This was the sixth-consecutive quarter of contraction for residential investment and the third consecutive quarter for goods spending. Real estate and manufacturing activity serve as leading indicators of future economic growth and are typically hit first from the adverse effects of monetary policy tightening because most buyers require financing to complete their purchases. Tighter monetary policy constrains credit availability and makes credit more expensive, slowing down activity in these economically cyclical, interest rate sensitive, capital-intensive industries. Contracting home and rental prices alongside sharp declines in single-family home construction confirm the decline in real estate, while a contracting manufacturing-PMI and declining durable goods orders confirm the slowdown in manufacturing. Additionally, strong business investment growth may cushion the inflationary blow by increasing productivity, which is at its lowest level in decades. Progress on that front and potential improvements with geopolitical tensions could help the Fed in reducing inflation.

The dollar is up, equities are mixed, while bond yields are down in reaction to the GDP news. The equity market has hopes for a soft landing as Fed rate hikes and moderating inflation in some sectors haven’t caused continued GDP deceleration. Leading indicators do suggest, however, that the economy is losing momentum quickly and that the odds for recession in 2023 are high. The robustness of consumer spending and business investment will be the main drivers of continued economic expansion. For now, however, the market will be looking to see which former Fed chairmen Fed Chairman Powell resembles the most at the press conference next Wednesday, Arthur Burns, who was an inflation dove, or Paul Volcker, an inflation hawk.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.