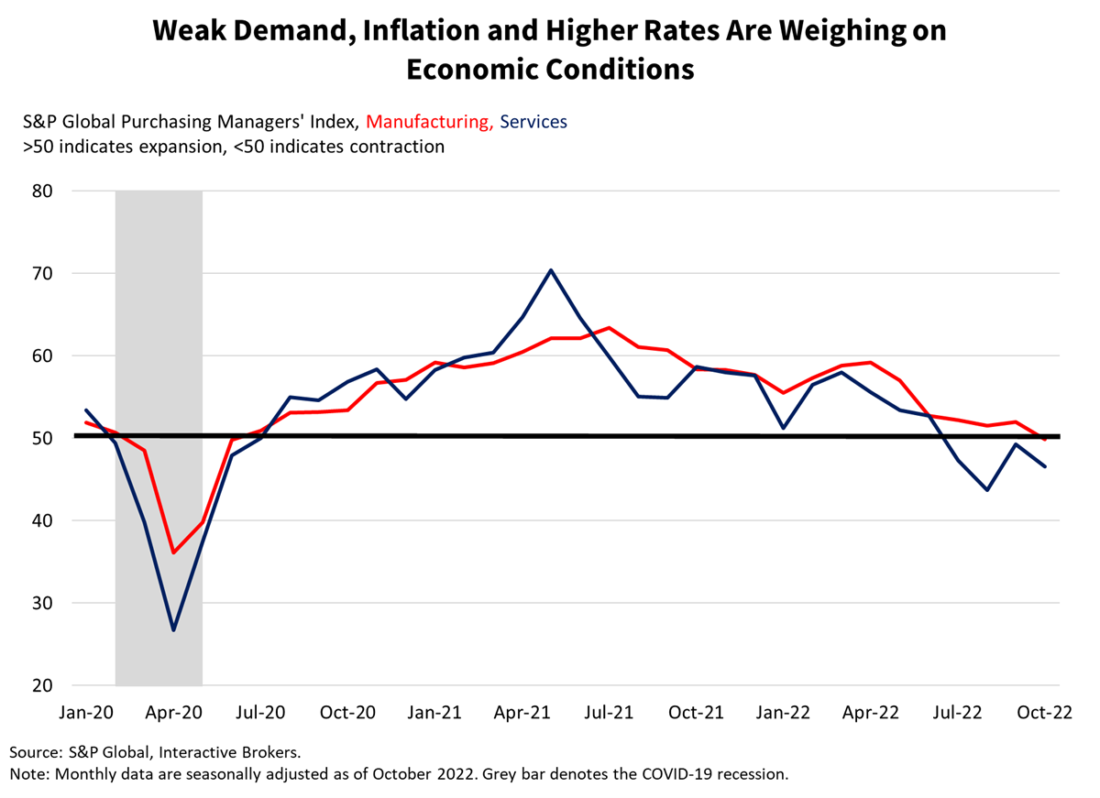

Various drivers of inflation are easing, but in a potentially troubling matter, the important services sector is still struggling with considerable price pressure, according to October’s Flash PMI. Even though the report shows declining demand for goods and services, it illustrates that the Federal Reserve (the Fed) is caught between a rock and hard place. The weakening demand is pivotal for lowering inflation, but it is also a detriment to economic growth.

The overall October Flash PMI readings weakened for both manufacturing and services, which is favorable for moderating inflation, but services industry businesses reported increased price pressures that they have partially passed on to consumers. These price pressures are troubling because the services segment is pivotal to price stability and could imply that inflation is becoming entrenched in the economy. To that end, it is a large concern for the Federal Reserve.

More broadly, the overall Flash PMI reading for the services sector was 46.6, down from 49.3 in September and weaker than the consensus forecast of 49.2. October was the fourth consecutive month of the services sector contracting as defined by a reading below 50. The report shows that disappointing new orders contributed to overall weakness, a result of consumers facing the one-two punch of inflation and higher financing costs. Services businesses also reported a decline in employment, driven by not replacing job leavers and layoffs.

The manufacturing segment, meanwhile, came in at 49.9, the lowest reading since July 2020. October’s read is also down from 52 in September and weaker than the consensus forecast of a decline to 51. The manufacturing sector entered contraction territory for the first time since the heights of the pandemic in 2020. In the manufacturing sector, new orders returned to contraction territory in October after being the main driver of September’s expansion. New orders serve as a leading indicator of not just the manufacturing sector, but of the entire economy. Orders were weak due to customer concerns of high inflation and global economic weakness as the strong dollar led to a sharp decline in export orders. Delivery times continued to extend albeit, at a slower pace than in recent months, weighing on the headline number. Price pressures softened against the backdrop of falling demand and discounting as well as falling materials prices, including plastics and chemicals. Production gained slightly for the second consecutive month as supply chain difficulties and materials shortages eased, helping manufacturers fill work backlogs. Manufacturers have responded by not replacing job leavers and slowing hiring, since new orders are declining alongside work backlogs. Manufacturers can only stay busy filling work backlogs for so long–they need new orders to stay busy for the long haul. Production expectations in the future have weakened significantly to the lowest level since the pandemic era as slow demand and inflationary pressures weaken the business outlook.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.