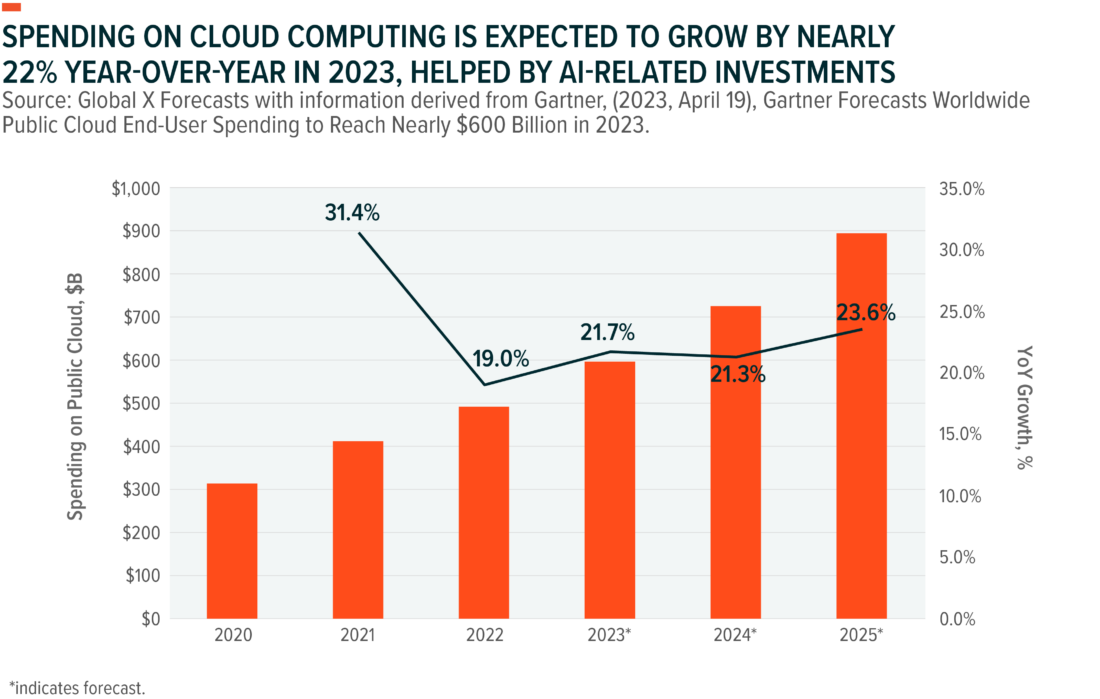

Cloud computing companies are charting a recovery following a tough 18-month period characterized by challenging macro conditions and reductions in enterprise budgets. We are now witnessing a turning point driven by improving fundamentals, such as profitability.1 Another driver is the growing importance of generative AI. Spending on cloud computing is expected to increase by nearly 22% in 2023, and we expect that cloud software and infrastructure giants can capitalize on this trend by offering AI-incorporated solutions to customers.2 The growing use of AI-as-a-service is also an opportunity for cloud computing companies to incrementally monetize their offerings by upselling additional cloud infrastructure and services. We believe that these factors can potentially position companies in the cloud computing theme for better-than-expected revenue and profit growth as AI adoption picks pace.

Key Takeaways

- Cloud spending optimization brought by tightening economic conditions appears to be partly negated by enterprise investment in AI solutions.

- Hyperscalers and large cloud software players are embracing generative AI-based solutions to strengthen product portfolios and monetize incrementally.

- As enterprise adoption of generative AI grows, we expect consumption of ancillary cloud compute, storage, and other services to tick up and boost the Cloud Computing theme.

Earnings Show Cloud Spending Optimization May Be Nearing Its End

So far this year, cloud computing companies are showing steady top-line growth and strengthened fundamentals. This is notable despite persistent headwinds in the first half of the year, including a weakening macro environment, a regional banking crisis weighing down IT budgets, and widespread corporate cost cutting.

Recent earnings reports offered evidence and further boosted investor sentiment. Amazon Web Services’ (AWS) growth stabilize at 12% year-over-year (YoY) in Q2 2023 as customers shifted from cost optimization to deploying new workloads.3 Revenue growth for Microsoft’s Cloud Infrastructure business, Azure, surged by 26% YoY in Q2, beating expectations for 25% growth.4 Google Cloud powered growth at Alphabet by generating $8.03 billion in revenue in Q2 2023, a robust 28% YoY increase.5 Also, the unit achieved profitability on an operating basis for the second quarter in a row.6

Software-as-a-service (SaaS) providers also reported strong growth in Q2, offering more evidence of an improving IT spending environment. Workday, a cloud application company with a focus on human resources, grew its top line by 17% YoY, slightly ahead of consensus expectations. Other companies had similar success: Salesforce grew 11% YoY, ServiceNow by 23% YoY, and Adobe by 10% YoY, all exceeding consensus expectations.7,8,9

While the cloud spending optimization trend will likely persist through the year in some sectors, we expect the cloud computing rebound to continue through the end of the year, enabled by low base effects and stabilized by growing corporate investments in AI.

Hyperscalers and Software Giants Start to Experiment with AI

Large enterprises are looking at AI as a critical tool for productivity gains.10 Solutions aimed at simplifying repetitive processes in customer service, boosting administrative productivity, and improving risk management functions are expected to grow in popularity in the coming days.

Hyperscalers will likely play a central role in transitioning their customers into the AI future, and early indications are that their services are already bringing in revenues. For example, Microsoft’s Azure OpenAI Service added over 6,500 new customers in Q2.11 Microsoft guided for 25–26% YoY growth in the Azure vertical in Q3, with 2 points attributed to AI Services.12

AWS didn’t quantify AI revenues, but management underlined ongoing companywide efforts to identify areas to deliver AI-based solutions to cloud customers. AWS also announced a series of product announcements and partnerships in Q2, including the Amazon Bedrock platform, a service to help customers build and scale generative AI applications, and what could be as much as a $4 billion investment in Anthropic AI, an AI safety and research company.13 Large application vendors such as Salesforce, ServiceNow, Freshdesk, and others are all rolling out a breadth of AI functionalities and features to capture the incremental opportunity with existing customers.14,15,16

The data and information management layer is another area for new launches and partnerships. For example, Mongo dB added vector search functionality to its NoSQL database platform, Atlas, to help make it more conducive to AI development.17 Twilio, in a new partnership with OpenAI, will allow customers to leverage generative AI functionalities inside its customer data platform, Segment. These functionalities can power better tools that generate insights and analysis on customer data.18

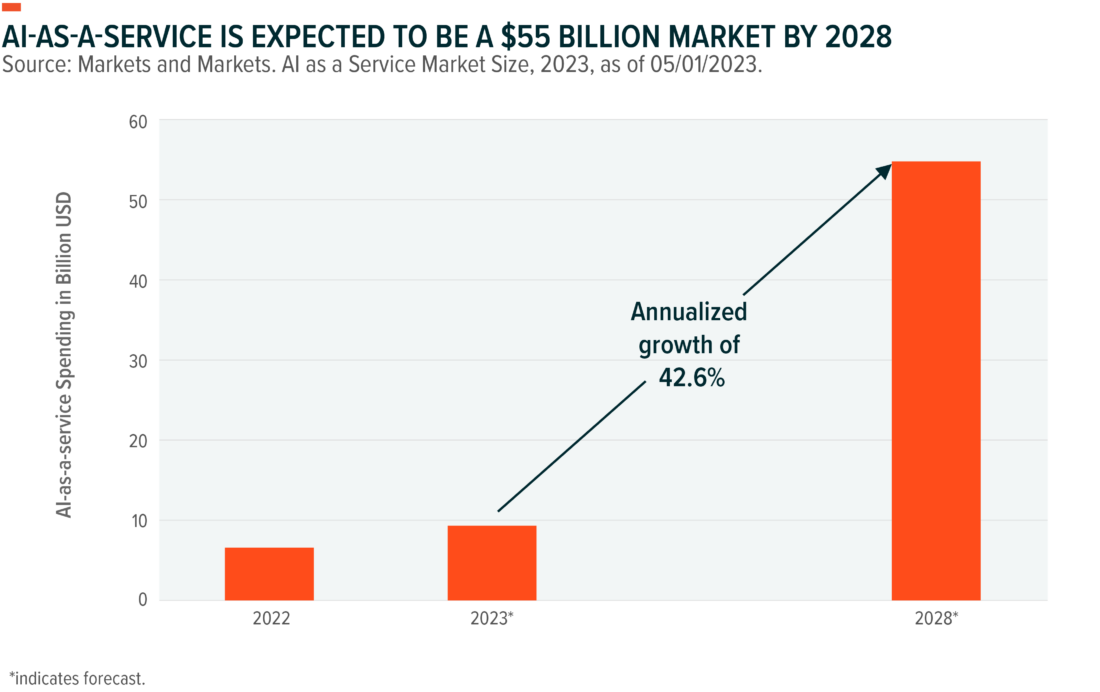

Also, well-funded venture startups are forming relationships with hyperscale vendors, promising cloud computing spending in exchange for access to hyperscalers’ distribution. This cohort could become a major driver of demand in cloud services. Overall, AI-as-a-service, or the business of developing and licensing AI models, is expected to be a $55 billion market by 2028.19

Conclusion: AI Spending Can Drive Cloud Computing Rebound

Total global IT spending in 2023 is expected to grow 4.3% YoY to $4.7 trillion marking a swift comeback from 2022.20 Continued investments supporting corporate digital transformations and newly announced AI investments are expected to support further growth. Also, spending on cloud computing is expected to grow 22% YoY to $600 billion for 2023.21 With overall cloud penetration under 20% and AI-related investments accelerating, we believe the Cloud Computing theme’s growth potential is robust.

Footnotes

1. Based on data accessed from Bloomberg for Indxx Global Cloud Computing Index, as of 10/05/2023.

2. Gartner. (2023, April 19). Gartner Forecasts Worldwide Public Cloud End-User Spending to Reach Nearly $600 Billion in 2023.

3. Amazon Inc. (2023, August 03). Amazon.com Announces Second Quarter Results.

4. Microsoft Inc. (2023, July 25). Microsoft Cloud Strength Drives Fourth Quarter Results.

5. Alphabet Investor Relations. (2023, July 25). Alphabet Announces Second Quarter 2023 Results.

6. Ibid.

7. Adobe. (2023, September 14). Adobe Reports Record Revenue in Q3 Fiscal 2023.

8. Salesforce. (2023, August 30). Salesforce Announces Strong Second Quarter Fiscal 2024 Results.

9. Workday. (2023, August 24). Workday Announces Fiscal 2024 Second Quarter Financial Results.

10. Mckinsey. (2023, July 14). The economic potential of generative AI: The next productivity frontier.

11. Yahoo Finance. (2023, July 26). Microsoft sees AI making ‘gradual’ growth contributions.

12. Microsoft Inc. (2023, July 25). Microsoft Cloud Strength Drives Fourth Quarter Results.

13. Amazon. (2023, September 25). Amazon and Anthropic Announce Strategic Collaboration to Advance Generative AI

14. ServiceNow Blog. (2023, September 21). How ServiceNow is using generative AI capabilities across its operations.

15. Freshworks. (2023, March 23). Freshworks Embeds Generative AI to Help Customer Support, Sales and Marketing Teams Improve Quality and Efficiency

16. Salesforce. (2023, March 7). Salesforce Announces Einstein GPT, the World’s First Generative AI for CRM.

17. MongoDB. (2023, July 24). Building generative AI applications using MongoDB.

18. Twilio Blog. (2023, August 03). Twilio To Deliver Customer-Aware Generative AI Through New OpenAI Integration

19. Markets and Markets. AI as a Service Market Size, 2023.

20. Gartner. (2023, July 19). Gartner Forecasts Worldwide IT Spending to Grow 4.3% in 2023

21. Gartner. (2023, April 19). Gartner Forecasts Worldwide Public Cloud End-User Spending to Reach Nearly $600 Billion in 2023.

—

Originally Posted October 13, 2023 – Generative AI Delivers a Boost to Cloud Computing

This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. This information should not be relied upon by the reader as research or investment advice regarding the fund or any stock in particular.

Investing involves risk, including the possible loss of principal. The investable universe of companies in which the Funds may invest may be limited. The companies in which the Funds invest may be subject to rapid changes in technology, intense competition, rapid obsolescence of products and services, loss of intellectual property protections, evolving industry standards and frequent new product productions, and changes in business cycles and government regulation. International investments may involve risk of capital loss from unfavorable fluctuation in currency values, from differences in generally accepted accounting principles or from social, economic or political instability in other nations. Emerging markets involve heightened risks related to the same factors as well as increased volatility and lower trading volume. The Funds are non-diversified.

Shares of ETFs are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. Brokerage commissions will reduce returns.

Carefully consider the fund’s investment objectives, risks, and charges and expenses before investing. This and other information can be found in the fund’s full or summary prospectuses, which may be obtained at globalxetfs.com. Please read the prospectus carefully before investing.

Global X Management Company LLC serves as an advisor to Global X Funds. The Funds are distributed by SEI Investments Distribution Co. (SIDCO), which is not affiliated with Global X Management Company LLC or Mirae Asset Global Investments.

Disclosure: Global X ETFs

Carefully consider the Fund’s investment objectives, risk factors, charges and expenses before investing. This and additional information can be found in the Fund’s full or summary prospectus, which may be obtained by calling 1-888-GX-FUND-1 (1.888.493.8631), or by visiting globalxfunds.com. Read the prospectus carefully before investing.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Global X ETFs and is being posted with its permission. The views expressed in this material are solely those of the author and/or Global X ETFs and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.