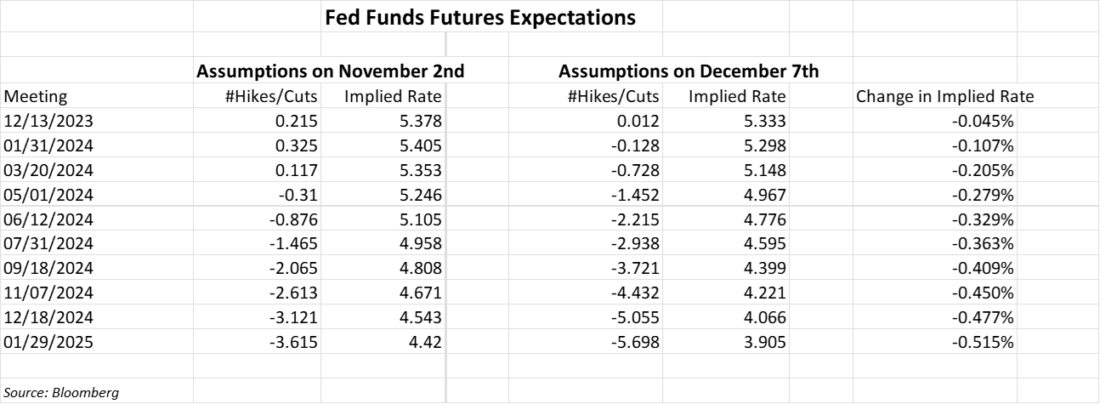

Yesterday we highlighted just how rapidly the market has adjusted its expectations for rate cuts. We pointed out that in the aftermath of the last FOMC meeting, Fed Funds futures were pricing in a high likelihood for a 25-basis point cut by June and three 25bp cuts by December, but we are now pricing in a high likelihood for a rate cut as early as March and five cuts by the end of 2024. Our assertion was, and is, that while equity investors are enamored with the prospect of a soft landing for the economy, the bond market is pricing in something much worse. We’ve updated yesterday’s table with this morning’s data, though the changes are quite modest:

Even though this morning’s Continuing Jobless Claims were much lower than expected, coming in at 1.861 million against a 1.91 million consensus, there was little to dent the belief that aggressive rate cuts would be coming soon. Even though the recent persistence of elevated continuing claims was seen as a sign that the labor market is cooling, a one-week hiccup was insufficient to change the market’s thesis ahead of tomorrow’s employment report. We’ll know if that changes by this time tomorrow.

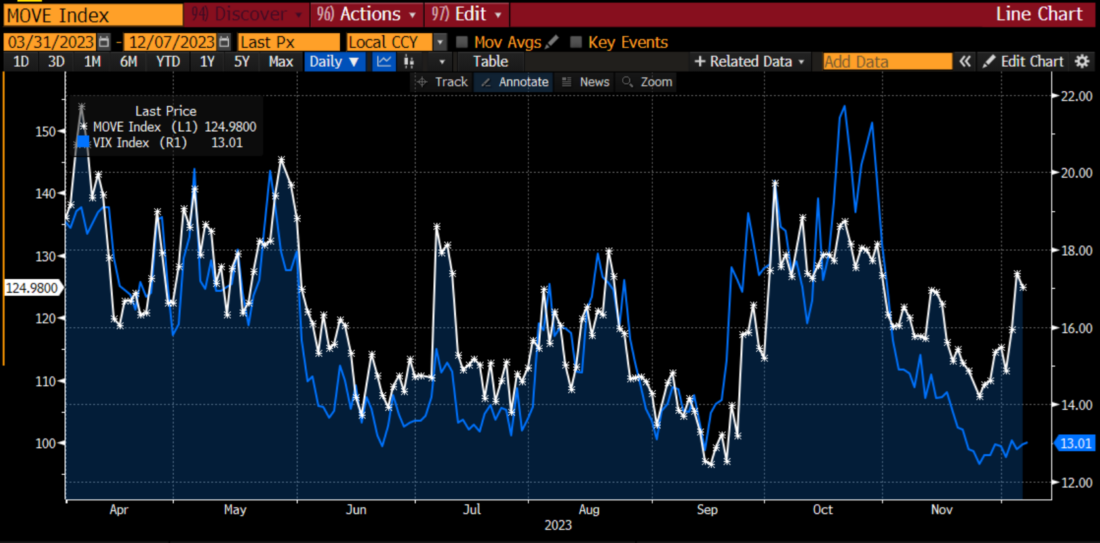

Popular volatility measures highlight the different lenses through which stock and bond traders view the market landscape. Although the historical correlation between the Cboe Volatility Index (VIX) and the ICE BofA MOVE Index (MOVE) is not particularly high on a long-term basis, they have been moving largely in tandem since the resolution of March’s banking crisis. That is, until this month began. Notice how MOVE has been climbing steadily in recent sessions even as VIX languishes:

Line Chart Since March 31st – MOVE (white) vs. VIX (blue)

Source: Bloomberg

At the risk of sounding flippant, bonds are showing nervousness about the economy and the path of rates, while stocks are simply content that they’ve been going up. Bonds seem to be recognizing that we have some important events that could induce some significant volatility – the aforementioned payrolls report and next week’s FOMC meeting. Stock traders seem quite content to look past these “known unknowns” and seem unwilling to jinx the likelihood of a “Santa Claus” rally. Perhaps it is the case that we already saw the bulk of that rally already, meaning we front-ran Santa.

And Goldilocks can turn into the Grinch if Chair Powell decides next week that he is unhappy with the aggressive rate cut assumptions.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.

Leave a Reply

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

I would expect the bond market to still be considering the possibility of a government shut down. That card is still on the table.

Also, how do we square a Santa rally with tax loss harvesting ? Can we do both ?

Two things are clear:- First, the Fed is historically reluctant to move in an election year, even more so as the election approaches. This is normally credited to the Fed wishing to appear to be non political, although not changing rates can also have its own political consequences. Second, Powell has an extremely held position that he doesn’t want to be seen failing due to an unwillingness to keep rates high in order to fight inflation.

The consensus among investors is that Powell will have to accept lower rates because the economy will slow and unemployment will rise too much and too fast.” During the whole Covid lockdown, we have been surprised by the resilience of the economy, and that it hasn’t weaken to any extent that has been feared.

I suspect that Republicans will stifle any stimulative measure, and Biden and the Democrats will use what they have available administratively to counter that. Powell will continue to walk on the edge of a knife, verbally warning that rates must be maintained. So baring an outside catastrophe, I imagine 2024 will be similar to 2023 at least from an economic perspective. This however doesn’t mean the Mag Seven will have a similar rise as this year, but I also don’t think that year will be negative for them.