In the December 4 week, Fed policymakers will be out of the public ear during the communications blackout period around the December 12-13 FOMC meeting. The blackout begins at midnight on Saturday, December 2 and runs through midnight on Thursday, December 14. While at this writing there is a solid chance that FOMC voters will opt to not raise the fed funds target rate again, the final decision could be swayed by the data in two reports for November – the Employment Situation at 8:30 ET on Friday, December 8 and the CPI at 8:30 ET on Tuesday, December 12.

Correctly interpreting the contents of the November employment report could be a bit tricky. The headline number for nonfarm payrolls is likely to be inflated by the return of 25,300 workers in the motor vehicle industry after the UAW strike with Ford, General Motors, and Stellantis was settled at the end of October, and 16,000 in the motion picture industry after the SAG-AFTRA strike was settled in early November. The November report on strike activity shows the net month-over-month change in the survey reference week for November – inclusive of Saturday the 18th – is down 37,600. At the present time 10,500 workers are on strike, which includes a new strike of 3,700 casino workers in Detroit started October 18 which should be visible in the leisure and hospitality sector. There remain continuing strikes of 1,700 by the United Steelworkers, 1,000 UAW workers at Blue Cross Blue Shield in Detroit, and 4,000 UAW workers at Mack Truck facilities. Depending on when these strike negotiations are done, the workers will come back on to payrolls, most probably in the December report.

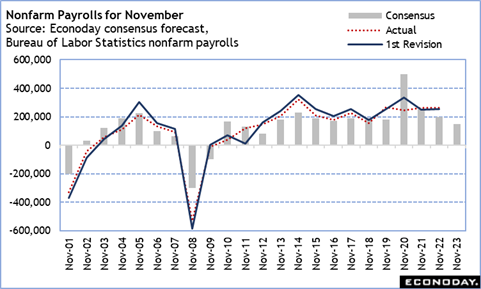

Early estimates for the November change in nonfarm payrolls have a median of 180,000. If this is about right, it points to continued cooling in hiring, although consistent with an economy in modest expansion. Historically, the November headline number is only slightly likely to come in above the median expectation as it is to come in below.

—

Originally Posted December 1, 2023 – High points for economic data scheduled for December 4 week

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.

Leave a Reply

Disclosure: Econoday Inc.

Important Legal Notice: Econoday has attempted to verify the information contained in this calendar. However, any aspect of such info may change without notice. Econoday does not provide investment advice, and does not represent that any of the information or related analysis is accurate or complete at any time.

© 1998-2022 Econoday, Inc. All Rights Reserved

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Econoday Inc. and is being posted with its permission. The views expressed in this material are solely those of the author and/or Econoday Inc. and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

thks for the info

Thanks for engaging!