The July 3 week is shortened by what is effectively a holiday on Monday and the Independence Day observance on Tuesday. US stock and bond markets are open on Monday, but will both close early. Many businesses will have only a skeleton staff on Monday, or be closed entirely. Travel and leisure services as well as retailers are going to be open to take advantage of what is essentially a four-day weekend and peak summer activity period. While the normal economic data release schedule will be in place for Monday, the holiday on Tuesday will push back the timing of some releases.

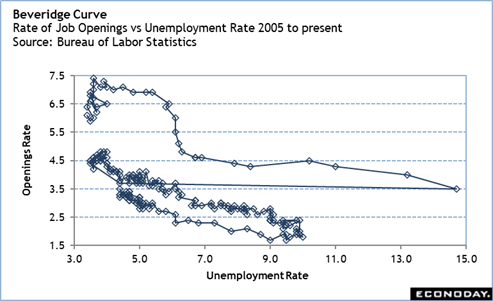

The major focus for the week’s economic reports will be the labor market. Thursday morning will have a crush of numbers to sort through before the Friday release of the June employment situation at 8:30 ET. Many of these numbers will inform the outlook for the next FOMC meeting on July 25-26. A little further cooling in the labor market will not be unwelcome as Fed policymakers look for the supply workers to come back into better balance with demand.

On Thursday there is a quick succession of important numbers in the Challenger report on layoff intentions in June at 7:30 ET, ADP national employment report for June at 8:15 ET, initial jobless claims for the week ending July 1 at 8:30 ET, and data on job openings and labor turnover (JOLTS) at 10:00 ET. Collectively, these are expected to show that businesses are eliminating open jobs rather than laying off current workers. Where layoffs are happening is in a few narrow sectors like retail where chains are closing underperforming stores or going out of business entirely, or where hiring done during the pandemic is giving way to more normal conditions which is particularly acute in technical fields. Smaller businesses have been gasping for workers in a highly competitive environment but may finally be getting some relief in the escalation of compensation costs and/or the availability of workers with the right skillsets.

The monthly employment report is expected to show some further slowing in the pace of hiring. A rough early consensus is for an increase of 200,000 in nonfarm payrolls in June when those numbers are released at 8:30 ET on Friday. This would put the average monthly pace at around 280,000 in the second quarter, a dip from the 317,000 average per month in the first quarter. This wouldn’t be a material drop and is quite similar to the monthly average of 264,000 in the fourth quarter 2022. It’s a consequence of the deficit in the supply of labor that despite slower economic conditions and risks to the outlook that businesses are still hiring.

The June numbers could be influenced by two special factors. First, there is a five week stretch between the May and June reference periods. This may mean that graduates that weren’t captured in the May survey will be in the June numbers. There could be more new entrants into the labor market, and these may have been quickly snapped up by employers. Second, the work stoppage by the Writers Guild of America affects 11,500 workers that will not count among the employed until the strike is settled, and could also idle other workers in the entertainment industry for the duration of the strike.

—

Originally Posted June 30, 2023 – High points for economic data scheduled for July 3 week

Disclosure: Econoday Inc.

Important Legal Notice: Econoday has attempted to verify the information contained in this calendar. However, any aspect of such info may change without notice. Econoday does not provide investment advice, and does not represent that any of the information or related analysis is accurate or complete at any time.

© 1998-2022 Econoday, Inc. All Rights Reserved

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Econoday Inc. and is being posted with its permission. The views expressed in this material are solely those of the author and/or Econoday Inc. and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.