The time is coming close for the communications blackout period around the October 31-November 1 FOMC meeting. It will start at midnight on Saturday, October 21 and run through midnight on Thursday, November 2. Thus, anything Fed officials have to say regarding the outlook for the economy and monetary policy will shape expectations for the outcome of the meeting. At this writing, there’s a good chance that the FOMC will not hike interest rates as economic data are broadly moving as anticipated, and tighter financial market conditions may be doing some – or all – of the work that another 25 basis point increase would do. If the FOMC does extend the pause taken at the September 19-20 meeting, it does not mean that rate hikes are at an end, merely that policymakers are taking a little extra time to examine the data and the impacts of past rate increases.

One important source of information for that decision will be the contents of the Fed’s Beige Book set for release at 14:00 ET on Wednesday. The next summary of anecdotal evidence about the US economy across the 12 Fed districts will cover the period of late August through early October. The tone of Beige Books over the past year have been consistent with soft economic conditions, but the last few reports seem to suggest that there is a little upward momentum to growth. Another firming in conditions will help ease worries about a possible recession, although recent factors like large strikes and geopolitical events present heightened risks to the outlook.

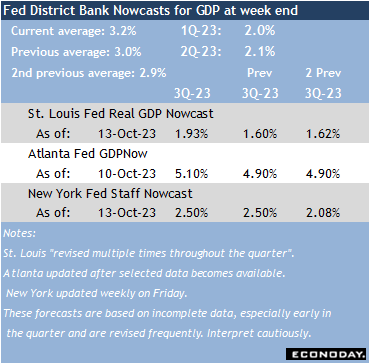

Data on retail and food services sales in September at 8:30 ET on Tuesday is the last report that has potential to alter the outlook for the advance estimate of third quarter GDP at 8:30 ET on Thursday, October 26. The retail data in July and August showed solid increases of 0.5 and 0.6 percent. September could look similar and end the quarter on an up note. If so, GDP Nowcasts should reflect anticipation of another quarter above trend growth. September retail spending should get a lift from sales of motor vehicles and higher gasoline prices.

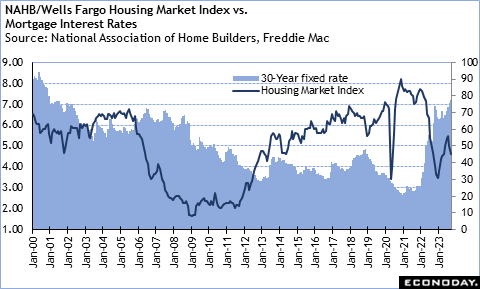

The NAHB/Wells Fargo housing market index for October at 10:00 ET on Tuesday will feel the impact of recent gains in mortgage interest rates to 22-year highs. Homebuilders will be feeling the pinch in present sales, anticipating slower future sales, and seeing less buyer traffic. The Freddie Mac rate for a 30-year fixed rate mortgage averaged 7.07 percent in August, rose to 7.20 percent in September, and for October to-date has reached 7.53 percent. This is likely to cool demand for new homes somewhat, although not entirely. Many potential homebuyers are opting for adjustable rate mortgages to keep initial monthly payments lower and almost certainly hoping for a drop in rates before a reset allows them to refinance to a more affordable fixed rate.

—

Originally Posted October 13, 2023 – High points for economic data scheduled for October 16 week

Disclosure: Econoday Inc.

Important Legal Notice: Econoday has attempted to verify the information contained in this calendar. However, any aspect of such info may change without notice. Econoday does not provide investment advice, and does not represent that any of the information or related analysis is accurate or complete at any time.

© 1998-2022 Econoday, Inc. All Rights Reserved

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Econoday Inc. and is being posted with its permission. The views expressed in this material are solely those of the author and/or Econoday Inc. and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.