Monday, October 9 is a federal holiday to observe Indigenous People’s Day/Columbus Day in the US. However, this holiday is not universally observed. Bond markets are closed in the US, but stock markets are open. Government offices will be closed, but private businesses will mostly be open.

After the big upside surprise in the data on nonfarm payrolls in September, all eyes will be on the September CPI report on Thursday at 8:30 ET, and to a lesser extent the PPI for September at 8:30 ET on Wednesday. With labor markets experiencing good hiring and few layoffs, and early forecasts for third quarter GDP looking for brisk expansion (as of October 5 the Atlanta Fed’s GDPNow is up 4.9 percent for the third quarter), it is the unknowns about inflation that will shape the outlook for Fed monetary policy.

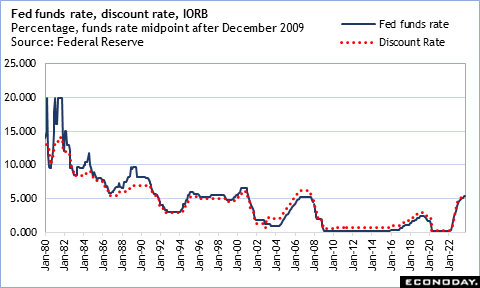

Recent increases in energy costs are likely spilling into underlying inflation, but other inflationary pressures may be easing. September should provide more evidence about the lagged effects of past rate hikes that Fed policymakers have been watching for. If inflation measures reflect more broad-based improvement in inflation, it is possible that the FOMC could extend the pause in rate hikes after the October 31-November 1 deliberations after doing so at the September meeting. However, this does not mean that another hike could not happen this year. There remains the December 12-13 meeting and a few more data points to consider in the intermeeting period.

There will also be a look at early September inflation expectations in the Atlanta Fed’s business inflation expectation report at 10:00 ET on Wednesday, the University of Michigan survey of consumers at 10:00 ET on Friday. Recent months have seen some minor ups-and-downs in the numbers, but generally expectations are consistent with inflation coming back toward the Fed’s two target over time, but it may be a longer process than previously thought.

—

High points for economic data scheduled for October 9 week

Disclosure: Econoday Inc.

Important Legal Notice: Econoday has attempted to verify the information contained in this calendar. However, any aspect of such info may change without notice. Econoday does not provide investment advice, and does not represent that any of the information or related analysis is accurate or complete at any time.

© 1998-2022 Econoday, Inc. All Rights Reserved

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Econoday Inc. and is being posted with its permission. The views expressed in this material are solely those of the author and/or Econoday Inc. and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.