Monday, February 19 is a federal holiday in the US but will have minimal impact on routine release schedules.

Most of the economic data will take a backseat to the release of the minutes of the January 30-31 FOMC meeting at 14:00 on Wednesday. The minutes will be closely parsed to try to discern if the FOMC is considering rate cuts. However, the minutes will reflect conditions three weeks prior to the meeting. As such, hopes for a dovish turn in FOMC sentiment will be too soon. At the time of the meeting, Fed policymakers lacked some pivotal pieces of economic data. Without the annual revisions to the CPI numbers or the January employment report, assessing the inflation outlook and condition of the labor market would have been premature. At most, the minutes will be consistent with a hawkishly optimistic outlook. The FOMC would much prefer to wait for the March 19-20 meeting before signaling, if appropriate, any change in monetary policy. Markets should not get ahead of themselves in anticipating rate cuts even if the minutes hint that sentiment among policymakers is closer to considering a rate cut. Though the FOMC may see progress in reaching their two percent inflation objective, restrictive policy has not materially harmed the labor market or hampered moderate economic expansion. Policymakers will be in no hurry to reduce the fed funds target range of 5.25-5.50 percent set back in July 2024.

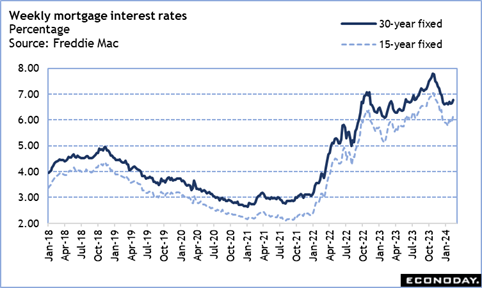

Markets are behaving as if they believe that the FOMC is not going to cut rates in the near future. Importantly, mortgage interest rates have come down below the 7 percent-mark over the past two months, but that downward trend is ending. The Freddie Mac rate for a 30-year fixed rate mortgage is at a monthly average of 6.64 percent for January and 6.77 percent for February to-date. This is down from the near-term peak of 7.65 percent in October. This is good news for the housing market as it enters the spring months traditionally associated with higher activity. Homebuyers may be facing the reality that the sub-5 percent mortgage rates over the long recovery from the Great Recession and the Covid pandemic are not coming back in the foreseeable future.

Sales of existing homes in January at 10:00 ET on Thursday are likely to look a bit weak at the start of the year, but this will be due to two factors. The first is that the stock of homes available for resale – especially in the more affordable price ranges – remains limited. The second is that the January data will reflect mortgages taken out in November and December when rates were higher, and therefore more of a drag on the pace of sales.

—

Originally Posted February 16, 2024 – High points for US economic data scheduled for February 19 week

Disclosure: Econoday Inc.

Important Legal Notice: Econoday has attempted to verify the information contained in this calendar. However, any aspect of such info may change without notice. Econoday does not provide investment advice, and does not represent that any of the information or related analysis is accurate or complete at any time.

© 1998-2022 Econoday, Inc. All Rights Reserved

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Econoday Inc. and is being posted with its permission. The views expressed in this material are solely those of the author and/or Econoday Inc. and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.