The March 4 week has two reports that are likely to inform the tone of the deliberations at the upcoming March 19-20 FOMC meeting. However, these will be overshadowed by Fed Chair Jerome Powell’s upcoming semiannual monetary policy testimony – what old hands still call the Humphrey-Hawkins testimony. Powell will appear before the House Financial Services Committee at 10:00 ET on Wednesday, and the Senate Banking Committee at 10:00 ET on Thursday.

Beyond what any of the economic data say, markets will be listening carefully to see if Powell’s testimony has any give on the outlook for monetary policy which has been firmly one of keeping the fed funds target rate range at 5.25-5.50 percent until inflation is tamed and price stability reestablished. However, even if that side of the dual mandate is achieved, Fed policymakers may be taking a closer look at the maximum employment side. The US labor market remains tight in the historical context. The FOMC may be reluctant to add any stimulus to the economy via looser monetary policy which could spark more demand for workers at a time when labor supplies are still stretched. It could bring on another round of escalation in wage competition. This would be an unwanted source of inflation and unwelcome to businesses that are still dealing with rising costs of attracting and retaining workers.

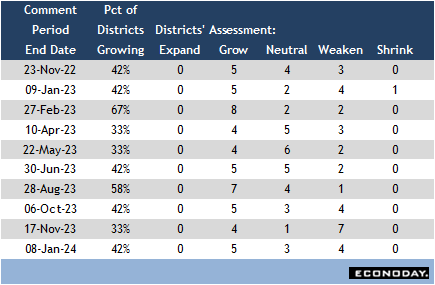

Policymakers will comb through the anecdotal evidence in the next Beige Book at 14:00 ET on Wednesday. The report will cover the period between early January and late February. While FOMC forecasts have anticipated a slowing in growth in the US, the GDP numbers continue to come in above expectations, largely due to strong consumer spending. With the FOMC due to update its quarterly forecasts at the March meeting, policymakers will be trying to assess if the expected slowdown is still on the near horizon or if growth looks to remain at or above the FOMC’s longer-run forecast of 1.8 percent. GDP Nowcasts are pointing to growth above 2 percent in the first quarter 2024. Recent Beige Books have been consistent with growth across the 12 Districts running from slowing to unchanged to modest expansion. On net, the numbers would signal a US economy in recession except that the strength in the labor market, moderation in inflation, and easing in upward wage pressures are keeping it out of a downturn.

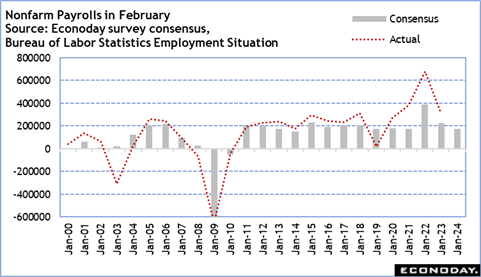

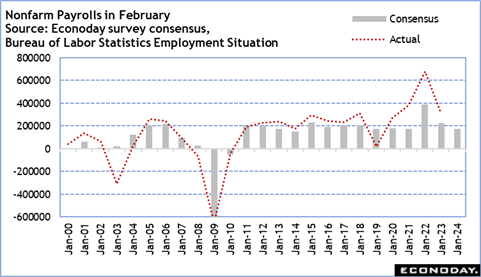

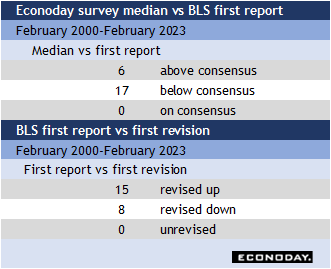

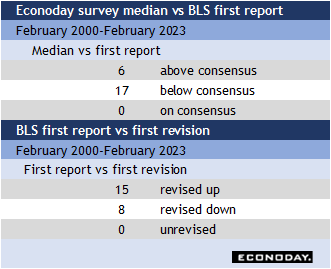

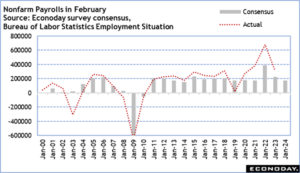

The monthly employment report for February on Friday at 8:30 ET is expected to see the unemployment rate little changed from the 3.7 percent in the prior month, while nonfarm payroll growth should moderate significantly from the up 353,000 in January. Early forecasts put payroll increases at around 150,000-175,000, a level that does not point to any fundamental weakness for the labor market. There may be fewer job openings and the pace of hiring may have decelerated, but businesses are not passing up an opportunity to hire if they can find a qualified worker. Businesses are not laying off current employees unless necessary because they cannot be sure of finding a replacement later, especially one that will cost more to attract and retain.

—

Originally Posted March 1, 2024 – High points for US economic data scheduled for March 4 week

Disclosure: Econoday Inc.

Important Legal Notice: Econoday has attempted to verify the information contained in this calendar. However, any aspect of such info may change without notice. Econoday does not provide investment advice, and does not represent that any of the information or related analysis is accurate or complete at any time.

© 1998-2022 Econoday, Inc. All Rights Reserved

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Econoday Inc. and is being posted with its permission. The views expressed in this material are solely those of the author and/or Econoday Inc. and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.