A look at the impact of “deglobalisation” on some of our favoured themes: smart manufacturing, energy transition and climate change, and the circular economy.

A three-decade long process of globalisation is facing a number of challenges:

- Geopolitical tensions between the US and China have been growing for some time;

- Supply chain disruptions stemming from the Covid-19 pandemic have forced companies to consider whether resilience is more important than cost;

- Russia’s invasion of Ukraine highlighted the risks of relying on a small handful of suppliers for key commodities like natural gas.

Security is becoming a paramount concern, whether that be in terms of defence, energy supplies, or security of information or technological know-how. The result has been strengthening headwinds facing “globalisation” and an unpicking of some of the trends of recent decades. We believe this will have a knock-on effect on many aspects of corporate behaviour.

Certain investment themes will be particularly in the spotlight as a result. Here, we look at the impact of this process of deglobalisation on some of our favoured themes: smart manufacturing, energy transition and climate change, and the circular economy.

Smart manufacturers enable industrial independence

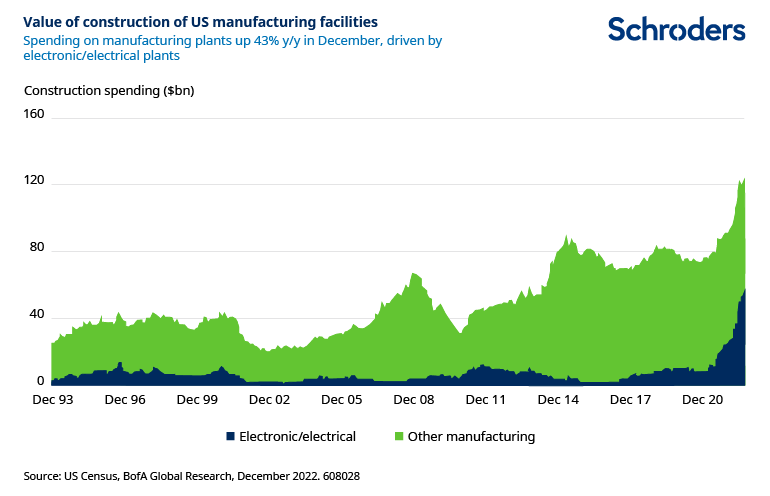

Manufacturing reshoring or “near shoring” – bringing production closer to a company’s home market – is already happening. Smart manufacturers stand to gain the most from this shift. They are the suppliers of sustainable new innovations in hardware, software and new materials, and therefore are the facilitators of this desired manufacturing independence.

The semiconductor sector is leading the reshoring charge. US concerns about overreliance on China for manufacturing high-end semiconductors led to the passing of the Chips Act in 2022. This includes $52.7 billion of incentives for semiconductor research & development and manufacturing.

And it goes beyond chips. The US has also passed the Inflation Reduction Act which envisages the mobilisation of $1.5 trillion of capital into clean energy, including advanced manufacturing production credits. Europe has followed suit with its Green Deal Industrial Plan which offers €390 billion of funding to enhance the EU’s manufacturing strength in strategic technologies like solar and wind energy, heat pumps, and batteries.

Part of the aim of these plans is to ensure secure supply of the critical technologies needed for major shifts in digitalisation and the transition to green energy. Part of it is also to create skilled jobs and “future-proof” the competitiveness of the US and European economies.

Smart manufacturers are also at the leading edge of the wave of innovation in artificial intelligence (AI) and robotics. Using robotics can bring down the cost of switching from a low labour cost destination to a higher cost one. This may be especially important in regions where there are already labour shortages.

Like many Western nations, China is facing a demographic challenge as the working age population shrinks. Labour shortages tend to push up wages, potentially encouraging companies to invest in automation.

Innovations such as embedded artificial intelligence and better vision systems, as well as price deflation, are making automation investments the most economically attractive they have ever been. Smart manufacturers producing equipment such as robotics or sensors will be the winners here.

Russia-Ukraine war highlights importance of energy security

The imperative to switch from fossil fuels to green energy in order to limit global warming is well understood. But part of the reason why governments are keen to invest in energy transition technologies is to ensure security of supply. The danger of relying on others for energy has been demonstrated by the impact of Russia’s invasion of Ukraine on natural gas prices.

Countries could be self-sufficient in energy if they rely on wind, solar, wave, or biomass power. This is part of what has prompted the wave of government stimulus directed at renewable energy – such as the US IRA or EU GDIP mentioned above.

Of course, just because governments are seeking to expand renewable energy capacity and attract renewables firms to their countries doesn’t mean that only companies domiciled in those countries will benefit. Many of the companies that will benefit from the push for energy security and investment are global operators.

The supply chain disruptions witnessed as a result of the pandemic have been detrimental for many of the companies operating in the energy transition space. Company earnings and valuations have suffered amid higher raw materials costs and logistical challenges. But those are short-term impacts compared to the long-term structural shift towards renewable energy.

Circular economy keeps goods and materials in use locally

The move towards a more local supply chain also plays into the circular economy theme.

A circular economy delivers what consumers need without accepting that materials will be discarded and pollution created in the process. It challenges the existing “take-make-waste” approach, which consumes finite resources that are used briefly, and then discarded, often directly to landfill. A circular economy designs products and services with efficiency, reusability and recyclability in mind.

Keeping products and materials in use locally reduces reliance on distant suppliers, enabling simpler logistics and reducing energy consumption.

—

Originally Posted July 25, 2023 – How will challenges to globalisation impact thematic investing?

The views and opinions contained herein are those of Schroders’ investment teams and/or Economics Group, and do not necessarily represent Schroder Investment Management North America Inc.’s house views. These views are subject to change. This information is intended to be for information purposes only and it is not intended as promotional material in any respect.

Disclosure: Schroders

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results. The value of an investment can go down as well as up and is not guaranteed. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Some information quoted was obtained from external sources we consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and this data may change with market conditions. This does not exclude any duty or liability that Schroders has to its customers under any regulatory system. Regions/ sectors shown for illustrative purposes only and should not be viewed as a recommendation to buy/sell. The opinions in this material include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realized. These views and opinions may change. Schroder Investment Management North America Inc. is a SEC registered adviser and indirect wholly owned subsidiary of Schroders plc providing asset management products and services to clients in the US and Canada. Interactive Brokers and Schroders are not affiliated entities. Further information about Schroders can be found at www.schroders.com/us. Schroder Investment Management North America Inc. 7 Bryant Park, New York, NY, 10018-3706, (212) 641-3800.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Schroders and is being posted with its permission. The views expressed in this material are solely those of the author and/or Schroders and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.