Equities are responding in stride this morning on optimism concerning the debt ceiling as warnings from credit rating agencies successfully generate urgency in Washington. Both sides of the political aisle have commented that meaningful progress has been made with a deal possibly completed in the next few days against the backdrop of an identified deadline of June 1. Meanwhile, today’s economic data was scorching, with the Federal Reserve’s (Fed) preferred measure of inflation going the other way on both a month-over-month (m/m) and year-over-year (y/y) basis. In fact, odds of another interest rate hike in June have risen from the ashes and is now the most likely outcome with market players raising wagers consistent with a 53% probability of another 25-basis point (bp) hike at the June 14th meeting.

Members of Congress and the White House appear close to securing a deal on the debt ceiling with probable concessions made on both sides. Top Republican Congressional representative Patrick McHenry of North Carolina however, has implied that the final aspects of the deal are likely to be the most challenging, with sensitive issues that have yet to be reconciled. Meanwhile, top Democrats including Hakeem Jeffries of New York and Steven Horsfod of Nevada have pushed back against a deal that in their view sells out the American people by mandating work requirements to claim certain benefits and by reducing the budget for tax enforcement. And while House conservatives are furious that Speaker Kevin McCarthy of California is making concessions to try and get a deal done, the Speaker has remarked that everyone is unlikely to be satisfied at the end of the day, with hardliners on both sides upset about concessions. The Speaker however, promised to be loyal to the rule that provides members of Congress 72 hours to review the bill, giving negotiators a short window from today to this Thursday’s June 1 deadline. With the far-left of the Democrats and the far-right of the Republicans likely to be upset about the agreement, it’s unclear if a deal can even pass both chambers.

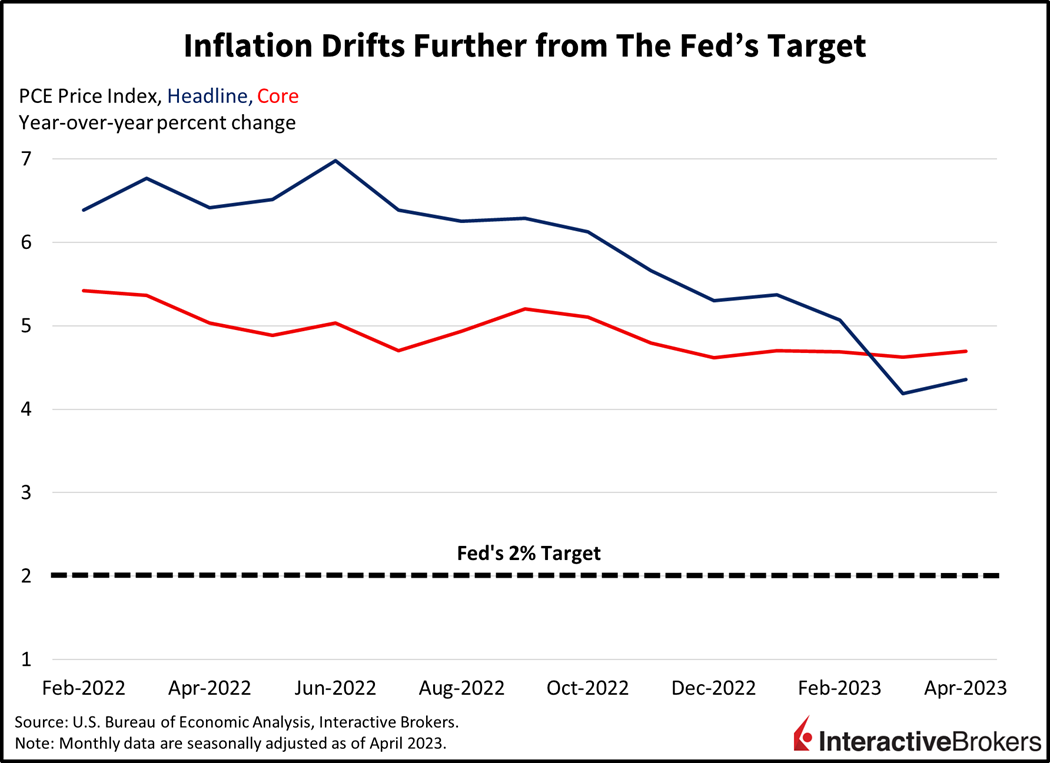

The economic front was certainly eventful this morning as well, with the 8:30 am Personal Income and Outlays report from the U.S. Bureau of Economic Analysis showing robust consumer spending during April and accelerating inflation. Consumption was on fire, jumping a whopping 0.8% m/m, trouncing expectations calling for 0.4% and recovering from March’s 0.1% rate of growth. Strong consumers didn’t thrive without fueling inflationary pressures however, with the Fed’s preferred inflation measure, the Core Personal Consumption Expenditures (PCE) Price Index rising 0.4% m/m and 4.7% y/y, accelerating from the previous month’s 0.3% and 4.6%. Including food and energy (non-core), PCE inflation came in at 0.4% m/m and 4.4% y/y, also accelerating from the previous month’s 0.3% and 4.2%.

Markets are choosing the glass half-full perspective following yesterday’s robust rally, and are focusing their attention on debt ceiling progress rather than fiery inflation pressures. The tech-heavy Nasdaq Composite Index is leading the way this morning, up 2% while all other major indexes are jumping higher by about 1%. Bond yields are jumping higher for the most part as well, due to expectations of a tighter Fed and rising inflation. The 2-year and 10-year Treasury yields are up 10 bps and 2 bps to 4.61% and 3.83%. The shortest-end is seeing some relief on debt ceiling progress but not consistent with the optimism in the equity market. The 1-month Treasury yield still trades at a lofty premium of 5.6%, its down 10 bps this morning. The dollar is continuing its run, up 9 bps to 104.34 with currency traders facing the high probability that the Fed will remain in the spotlight. WTI crude oil is up 1% recovering some of yesterday’s battering as players try to figure out the supply situation at the next OPEC + meeting on June 4. The meeting comes at a time of confusion for traders following bullish comments from Riyadh weighed against bearish comments from Moscow.

Recent earnings reports reflect consumers struggling with inflation while banks ratchet up provisions for loan losses as the economy slows and delinquencies tick up:

- Best Buy, which operates electronics and appliance stores, reported adjusted earnings per share (EPS) of $1.15, exceeding the consensus expectation of $1.11 but down from $1.57 in the year-ago quarter. Its net income of $244 million was down substantially from $341 million y/y. Revenue of $9.47 billion fell short of the $9.52 billion expected by analysts and the $10.65 billion generated by the company in the same quarter last year. Revenue in the U.S. declined 11%, largely due to weakening y/y comparable sales, and comparable domestic online sales dropped 12.1%. Best Buy CEO Corie Barry said customers are feeling the impact of inflation as they are more cautious in their spending on big-ticket items and discretionary products. Consumers are also accepting tradeoffs when selecting products. Best Buy expects this calendar year to be the low spot for sales, in part due to customers having a larger number of connected devices than before the pandemic. That will eventually need to be updated, which should drive an increase in sales next year. Additionally, new innovative products will entice consumers to increase spending on electronics. The company maintained its guidance from March, which calls for full-year revenue of between $43.8 billion and $45.2 billion, which would be a decline from the most recent fiscal year. Additionally, it expects comparable sales to decline between 3% and 6%.

- Costco, which operates warehouse stores that sell groceries and household items to the company’s members, reported earnings of $1.3 billion, or an adjusted EPS of $2.93 on a diluted basis for its fiscal quarter ended May 7. Earnings declined from $1.35 billion or an EPS of $3.04 for the year-ago quarter and missed the expected analyst consensus EPS of $3.30. Costco’s revenue of $53.65 billion, however, climbed from $52.60 in the year-ago quarter with both membership fees and net sales increasing. Despite the increase, revenue missed the consensus estimate of $54.66 billion. During the quarter, the company’s cost of merchandise sold increased from $46.35 billion to $47.17 billion y/y and selling, general and administrative expenses climbed from $4.45 million to $4.79 million. Comparable sales in the U.S. were virtually flat y/y but declined 1% in Canada. The company’s online sales, which typically consist of discretionary consumer goods rather than food or non-discretionary items, declined 10%. U.S. foot traffic at the company’s stores increased 3.5% but the average sales tick declined 3.5% due to weakness in sales of more expensive discretionary items.

- TD Bank Group posted a profit of $3.35 billion for its fiscal second quarter ended April 30, down from $3.81 billion in the year-ago quarter. After adjusting earnings for one-time events such as acquisition activities, TD’s earnings of $3.75 billion were up slightly from $3.781 billion y/y. Its reported diluted EPS was $1.72 compared with $2.07 in the first quarter of 2022. On an adjusted basis, TD Bank Group’s EPS of $1.94 missed the analyst consensus expectation of $2.08 and was down from $2.02 y/y. During the quarter, TD Bank Corp. took a $599 million provision for losses on credit compared to only $27 million during the fiscal second quarter of last year. However, TD Bank’s total revenue of $12.37 billion on a non-adjusted basis was up from $11.26 billion y/y.

With an S&P 500 Index at 4200, trading at a forward price-earnings ratio of roughly 18.5 while sporting an earnings yield of 5.4%, the risk-premium is in the basement considering short-term bond yields that offer greater than 5.4%. In fact, the fed funds rate itself, may very well hit that level on June 14.

Today’s equity emotions don’t match concerns in the fixed-income world, with stock investors unphased by threats to liquidity conditions and higher costs of capital. In fact, today’s news of a looming debt-ceiling resolution alongside a higher and tighter Fed support weakening liquidity conditions. As a flood of bond issuance hits the tape shortly after a possible debt deal alongside a possible hike at the Fed’s June meeting, dollars are likely to leave the equity market in pursuit of higher bond supply at higher rates. With an S&P 500 Index at 4200, trading at a forward price-earnings ratio of roughly 18.5 while sporting an earnings yield of 5.4%, the risk-premium is in the basement considering short-term bond yields that offer greater than 5.4%. In fact, the fed funds rate itself, may very well hit that level on June 14.

Visit Traders’ Academy to Learn More about Economic Indicators.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.

Leave a Reply

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Thank god