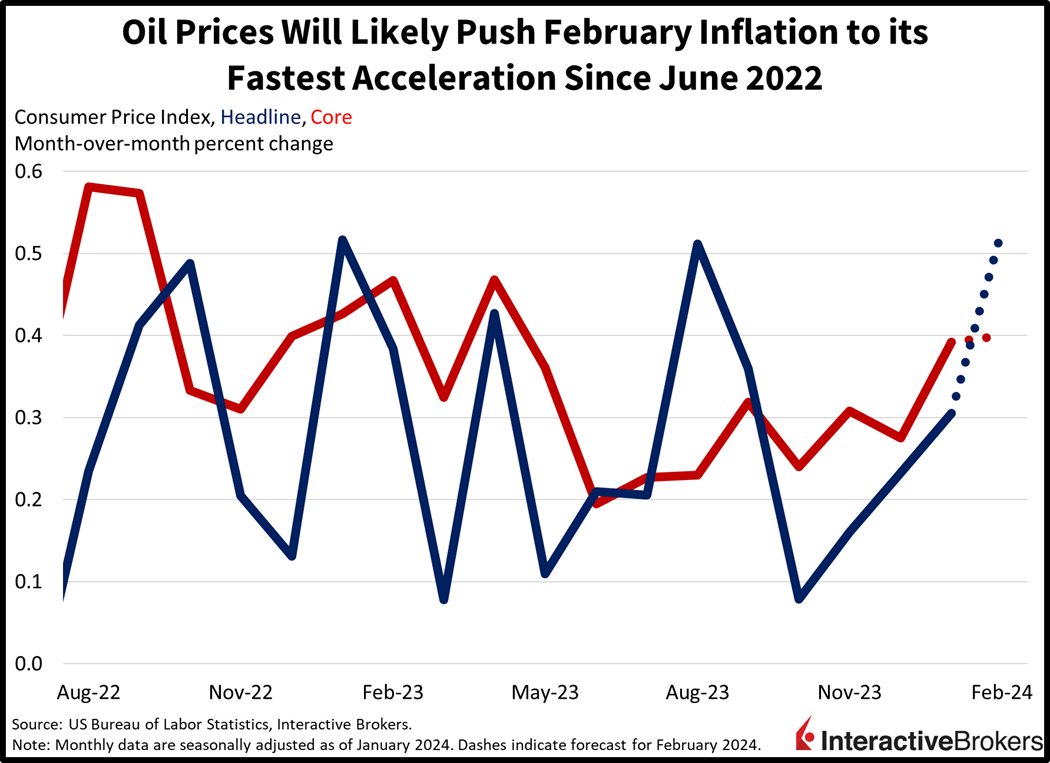

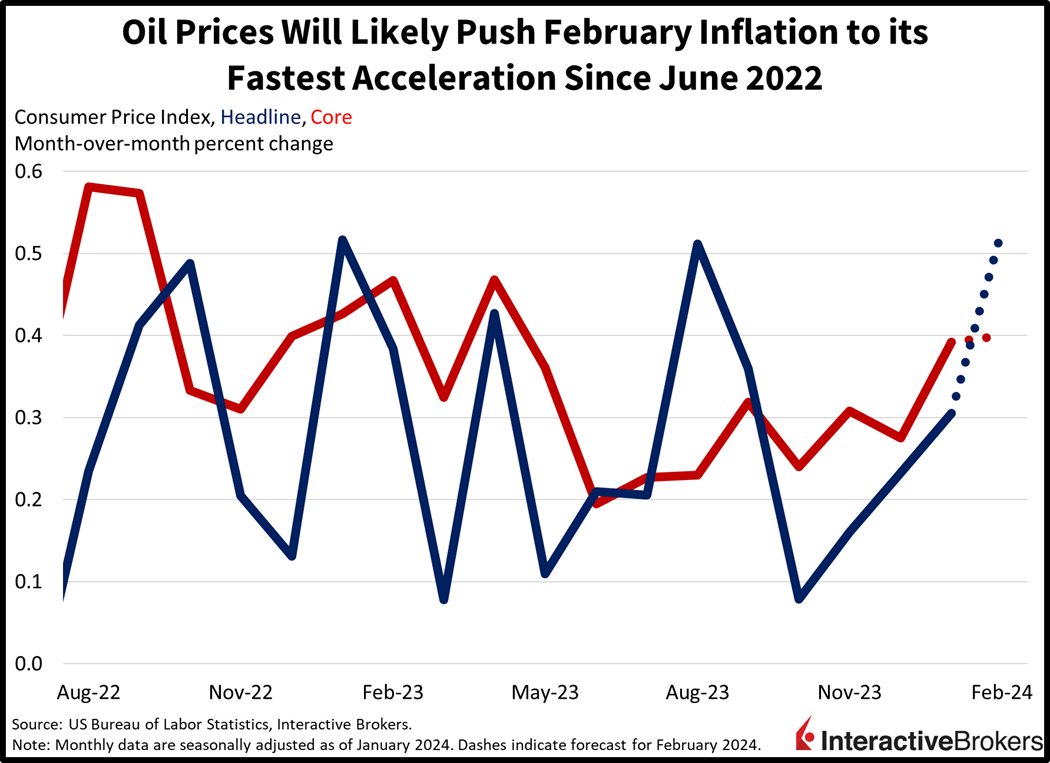

Economic data this morning points to accelerating inflation stateside and in Europe. Market participants ignored yesterday’s fiery January PCE inflation report and are paying no mind to today’s February data depicting scorching European inflation and a pickup in US goods inflation. Last year, goods and commodities supported disinflation, a result of strengthening supply chains and high base effects, but those developments have reversed, pushing inflation higher this year. Inflation for the services sectors, meanwhile, which comprise the majority of economic activity and are generally not rate sensitive, accelerated throughout 2022, 2023 and 2024. Indeed, services inflation as calculated by the Consumer Price Index never achieved a month-over-month (m/m) increase below 0.3% in 2022, 2023 or 2024, illustrating that disinflation was entirely catapulted by commodities and goods, which comprise only a minority of the economy.

February Reality Check

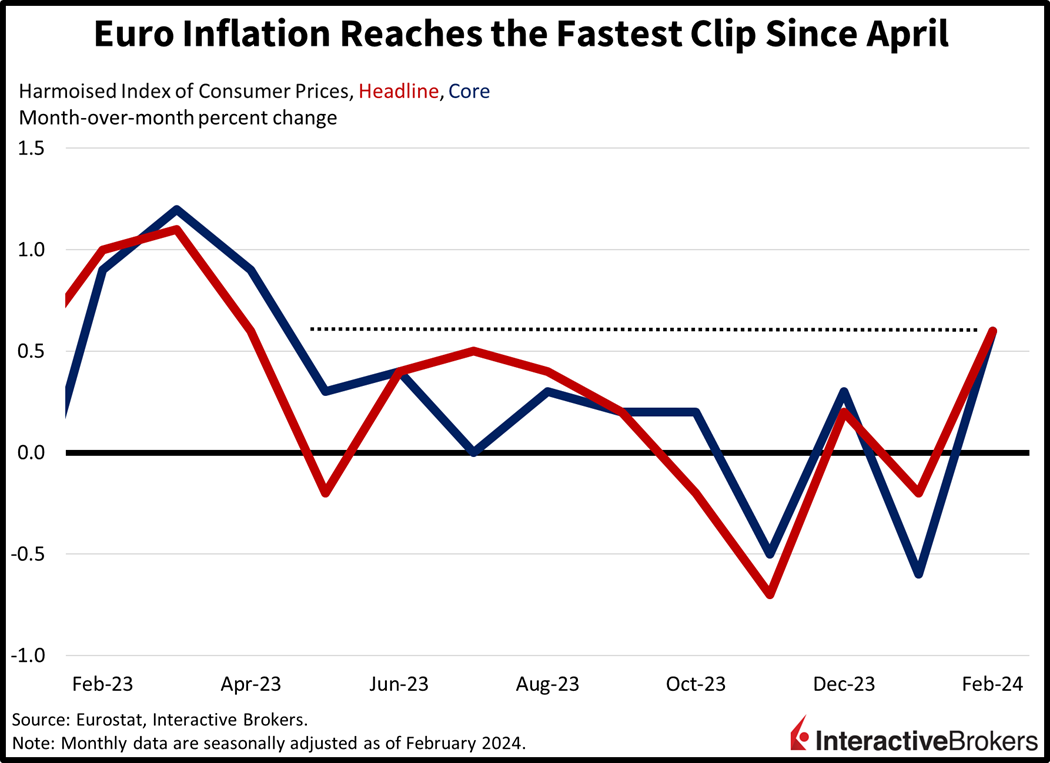

European Union inflation soared last month to its fastest speed since April as services and energy costs rose sharply. Overall prices rose a sharp 0.6% m/m and 2.6% year over year (y/y), above expectations of 2.5%. The core calculation, which excludes food and energy, increased 0.6% m/m and 3.1% y/y, also above projections of 2.9%. Price pressures were broad based with energy and services up 1.5% and 0.8% m/m. Fees for the industrial goods and the food, alcohol and tobacco category gained at more tempered rates of 0.3% and 0.1%. The unprocessed food subsegment provided some relief, however, as costs dropped 1% during the month.

Goods Inflation Mounts a Mean Comeback

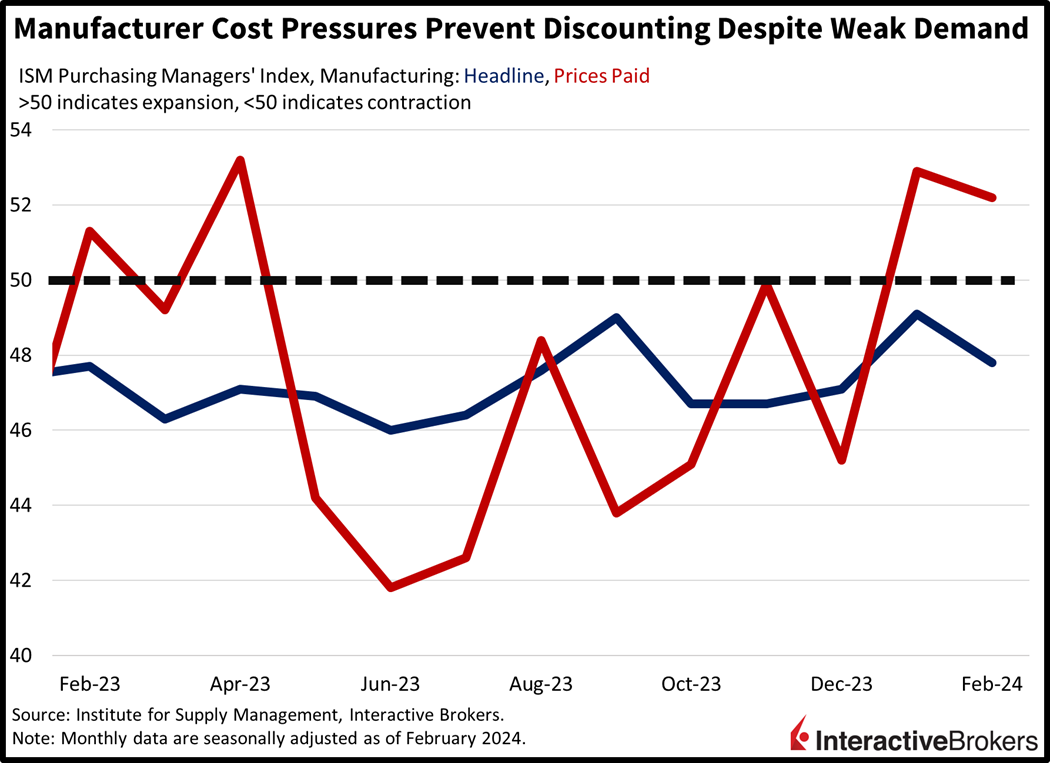

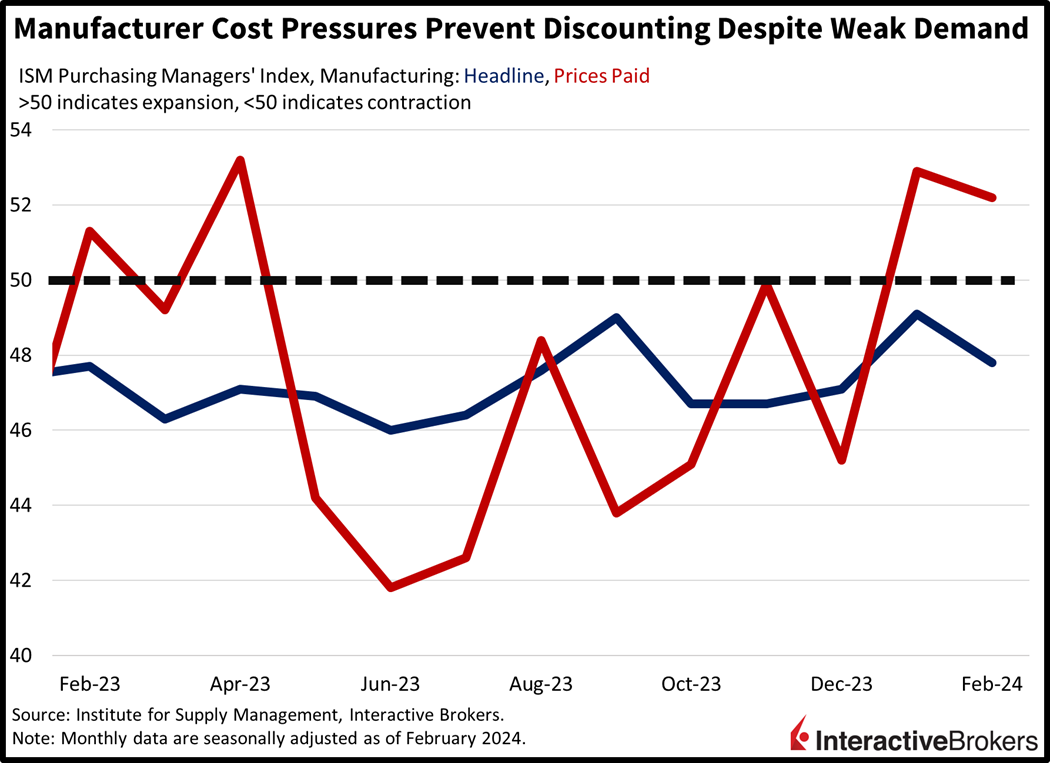

The Institute for Supply Management (ISM) this morning reported the 16th consecutive month of contraction in the manufacturing sector, as producer and consumer demand buckled in February amidst elevated interest rates, lofty prices and reduced credit availability. The organization’s Purchasing Managers’ Index (PMI) for manufacturing result of 47.8, was a big miss—analysts expected 49.5. The sector also contracted faster than January’s 49.1 figure. Despite contractions in orders, employment, production, inventories and backlogs, manufacturers weren’t able to discount their goods, with the prices paid component coming in at a strong 52.5, its second consecutive month of growth. Towering shipping rates, extended delivery durations and soaring oil prices, a result of geopolitical tensions and looser financial conditions, underpinned cost pressures. The sole bright spot in the report was an increase in export purchases. In a conflicting development relative to the ISM, S&P Global’s February PMI depicted manufacturing growth with a score of 52.2.

Construction Spending Weakens

In a separate report from the US Census Bureau, construction spending dipped 0.2% m/m in January. The residential sector gained 0.2% in aggregate, however, with single-family contributing 0.6% while multi-family dropped 0.4%. The non-residential segment underperformed, with investments slipping 0.4% as commercial projects, public safety works, highway and street, and water supply investments fell 3.1%, 2.9%, 2.2% and 2% m/m. Construction investments in the manufacturing and transportation areas did offset some of the decline, however, with figures gaining 2.1% and 0.8% during the period.

NYCB Forges Another Chapter in Regional Banking Debacle

The regional banking fiasco jumped back into the limelight with New York Community Bancorp (NYCB) announcing the discovery of ineffective oversight, risk assessment and monitoring of its loan review process and revamped its leadership. The company’s stock price collapsed 29% this morning resulting in a year-to-date loss of 66%. The news pulled the KRE SPDR S&P Regional Banking ETF down nearly 2% in trading. Alessandro DiNello, executive chairman, has taken the role of president and CEO from Thomas Cangemi. The regional banking sector has been under stress from marking down the value of long-term debt portfolios as interest rates have risen. Additionally, the banks have elevated exposures to commercial real estate, which is under distress due to low occupancy of office buildings, higher refinancing costs, loftier maintenance, labor and insurance costs, and in the case of NYCB, local rent control laws preventing apartment building owners from passing higher costs on to renters.

Tech Industry Hopes for AI Turnaround

Tech companies continue to express optimism about growing computer demand driven by the development of artificial intelligence (AI). Meanwhile, most companies are showing caution with expanding their technology, although cloud-computing continues to expand as certain businesses seek to become more efficient.

- Dell reported fourth-quarter results that surpassed the analyst expectation with earnings climbing 89% y/y despite a decline in revenues. The company’s results strengthened significantly from the third quarter, a result of strong orders for artificial intelligence-optimized servers. The product offering drove a 10% increase from the third quarter for the company’s infrastructure solutions group. Dell finished its fourth quarter with a $2.9 billion backlog in AI-optimized servers even as customers have been cautious about infrastructure spending due to an uncertain macroeconomy.

- Autodesk, which provides cloud-based 3D design software for architects, engineers, product developers and entertainment, exceeded expectations with strong results among entry-level customers and enterprises although its mid-size market was weak. Strong US results helped offset weakness in Asia-Pacific. The company issued earnings and revenue guidance that exceeded expectations and highlighted generative AI products that will help clients automate more routine tasks and assist with more complex design functions.

Euro Yields Pull a Roundtrip

US equity indices are reaching fresh all-time highs while bond yields plunge with very little explanation. What’s shocking is that European yields were a lot higher following the region’s hot inflation data but are now lower as they follow US Treasurys. It appears market players are in denial of inflation’s resurgence. All US stock indices are higher as the small-cap Russell 2000, Nasdaq Composite and S&P 500 indices lead with gains of 1%, 0.6% and 0.4%. The Dow Jones Industrial Average is also positive but near the flatline. Sectoral participation is positive with 7 out of 11 sectors higher as energy, technology and healthcare lead: they’re up 1.4%, 1% and 0.6%. Utilities, financials and consumer staples are today’s laggards, with the segments down 1.3%, 0.4% and 0.4%. Investors are scooping up fixed-income with the 2- and 10-year Treasury maturities trading at 4.56% and 4.21%, 7 and 4 basis points (bps) lower on the session. The dollar is lower though as European players assess that central bankers in Europe are less likely to tolerate inflationary pressures relative to the US Fed. The greenback’s index is down 17 bps to 103.97 as the US currency gains against the yuan and yen but depreciates versus the euro, pound sterling, franc and Aussie and Canadian dollars. Energy markets are moving sharply higher on pessimism concerning ceasefire negotiations in Gaza, continued geopolitical tensions in the Red Sea and expectations of extended production cuts from OPEC +. WTI crude oil is up a whopping 3.1%, or $2.45, to $80.68 a barrel.

Investors Are Beyond Exuberant

Market participants are in a state of denial as central bankers dismiss hot inflationary readings for January and focus on y/y figures that appear lower due to high comps last year. We’ve moved past the days of my economist colleagues referencing lower three and six-month annualized figures in efforts to control the narrative of Fed cuts. These m/m inflation numbers that we’re getting across segments, 0.3%, 0.4%, 0.5% and 0.6% drove the Fed to push rates to 5 and a half. February’s CPI is arriving in 11 days, just eight days before the next Fed decision on monetary policy and I believe we will see the headline rise 0.5% and core up 0.4%. A surprise 25 bp rate hike in March would signal to market participants that the central bank is serious about controlling inflation while admitting that jumping the gun in December was a grave mistake.

Visit Traders’ Academy to Learn More About ISM-Manufacturing and Other Economic Indicators.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.