This morning’s hot Consumer Price Index (CPI) is effectively confusing investors with markets swinging from up to down several times already. The tug of war between bulls and bears occurs as gasoline prices were the main culprit in this morning’s report. As bulls argue that gasoline is traditionally volatile, only up temporarily, and that price gains in some of the other categories slowed, bears insist that continued geopolitical tension is a significant feature of the 2020s inflationary landscape warranting higher-for-longer interest rates. While this morning’s report wasn’t enough to push September’s Fed meeting to live mode, November remains a tossup.

August Is a Setback in the Inflation Battle

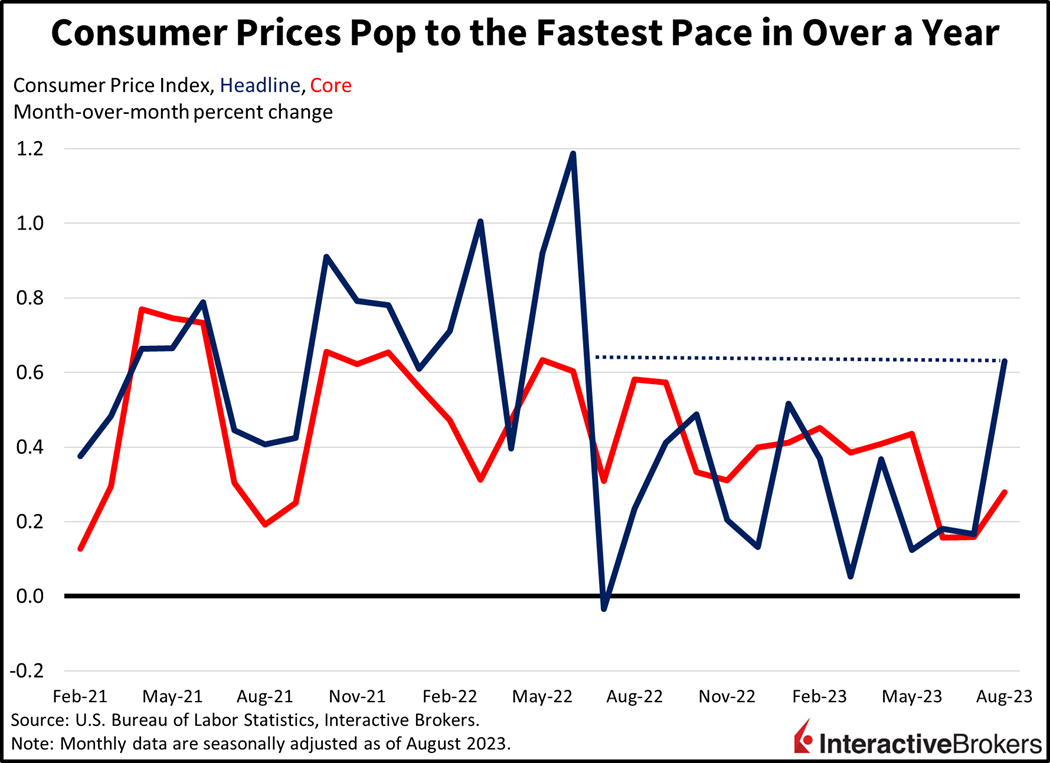

The CPI climbed in August, the biggest increase in 14 months as price jumps for gasoline, travel and shelter burdened consumers. August’s 0.6% month-over-month (m/m) result met expectations but was notably higher than July’s 0.2% increase. Year-over-year (y/y), the CPI rose 3.7%, hotter than the 3.6% anticipated and loftier than the 3.2% from the previous month. Core consumer prices, which exclude food and energy, rose 0.3% m/m, higher than projections for 0.2%, which would’ve been unchanged from the previous month. The y/y core figure rose 4.3%, exactly as expected and cooler than the previous month’s 4.7%.

August price gains were driven primarily by gasoline and transportations services with whopping 10.6% and 2% increases, respectively. Medical care commodities, shelter, new automobiles and food at dining establishments also rose strongly, gaining 0.6%, 0.3%, 0.3% and 0.3%, respectively. Electricity and heating, food at the supermarket, apparel and medical care services also experienced price gains of lesser degrees. Used automobiles was the only major category to experience deflation, with prices falling 1.2%. The category provided some relief for both headline and core segments.

Energy Inflation Likely to Worsen

Within the energy category, a combination of oil production cuts and inventory concerns has caused crude prices to climb. Russia and Saudi Arabia recently announced that they will extend production cuts totaling 1.3 million barrels a day to the end of this year. Meanwhile, low inventory levels in the U.S., including the Strategic Petroleum Reserve, are dampening expectations that existing supply can offset the impact of production cuts. While non-OPEC + countries are expected to increase production this year, a potential economic recovery in China would further increase demand. These factors have prompted the International Energy Agency to forecast a supply shortage during the final three months of this year that may increase energy price volatility.

Markets Lack Direction

Markets are mixed this morning with players having difficulty interpreting the CPI. Equity indices and Treasury yields have bounced from modest gains to modest losses. Among equities, sector breadth is split, with consumer discretionary, utilities, technology, healthcare and financials higher while the other six sectors are lower. Bond yields are roughly unchanged with the 2- and 10-year Treasury maturities at 5.01% and 4.28%. Energy markets are also unassertive, with WTI crude oil up a penny to $88.75 per barrel after rallying further this month on continued teamwork between Riyadh and Moscow. The dollar has moved decisively higher, unlike stocks, bonds and crude oil, with the currency’s index rising 19 basis points (bps) to 104.75. Part of the move has to do with investors expecting possible interest cuts later rather than sooner. The greenback is appreciating against the euro, pound sterling, yen, franc and Aussie dollar while depreciating against the yuan and the Canadian dollar.

CPI Creates Muddled Outlook for Fed Policy

This morning’s hot CPI is likely to cause the Federal Reserve to surprise investors later this month by releasing an updated Summary of Economic Projections (SEP) with upside adjustments for inflation and GDP but no change to the unemployment rate forecast. While the Fed is likely to leave the terminal rate forecast unchanged, signaling one more hike in November, it’s likely to adjust the federal funds rate outlook for 2024 and 2025 upwards closer to 5% and 4% from 4.6% and 3.4%. As the committee waits for the long and variable lags of monetary policy to effectively slow the economy and the labor market while hopefully battering inflation, its members are reminded of the significant geopolitical risks, including energy supply, within this morning’s CPI that can cloud the inflationary landscape. In fact, if energy prices continue their upward trajectory against the backdrop of constrained supply, it won’t be long until that boost is reflected more materially in the core categories of inflation and not just in headline results.

Visit Traders’ Academy to Learn More About the Consumer Price Index and Other Economic Indicators.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.