By: Katrina S. Dudley, CFA, Mandana Hormozi, Tim Rankin, CFA, Todd Ostrow

After years lagging the tech-heavy US market, Franklin Mutual Series sees international value stocks coming back into the spotlight over the coming years as the traditional economy comes into sharper focus.

Global investing is facing a sea change. After a decade of low interest rates, slight inflation, and plenty of central bank support pushing US growth stocks to dizzying heights, international value stocks now look to us to be in the early days of a revival as these trends reverse. The international companies that finance, build and power the traditional global economy are overtaking the US firms that had dominated market performance. Companies in the more conventional value markets like Europe and Japan are back in style. Not only are these leading firms attractively valued, in our view, but they also offer economic exposure to both US and emerging markets and can benefit from recent government spending initiatives.

International companies are leading firms

For many US-based investors, international stocks can often be an afterthought. This home-country bias means that US investors ignore some of the leading companies in their fields that just happen to be listed in Europe or Asia in favor of their US equivalents.

Many of these non-US companies are at the forefront of industries such as luxury goods, advanced auto components, pharmaceuticals, consumer products, banking, machinery and industrial equipment, and payments. Technological advances are reverberating through many of these industries and the benefits of digitization, machine learning and artificial intelligence are increasingly driving productivity improvements beyond just the technology sector.

Additionally, international markets tend to be less efficient than the US stock market, meaning these best-in-class companies may have fewer analysts covering them, and information on them may be less readily available. Fewer analysts doing high-quality research can lead to more inefficient pricing, creating a valuation gap between US and non-US companies. Investors willing to do greater fundamental analysis can identify attractive investments that others might overlook. And with less investor and analyst focus, international markets can be a catalyst-rich hunting ground for finding undervalued stocks with the potential to unlock value for shareholders over time.

International markets are cheap, cheap, cheap

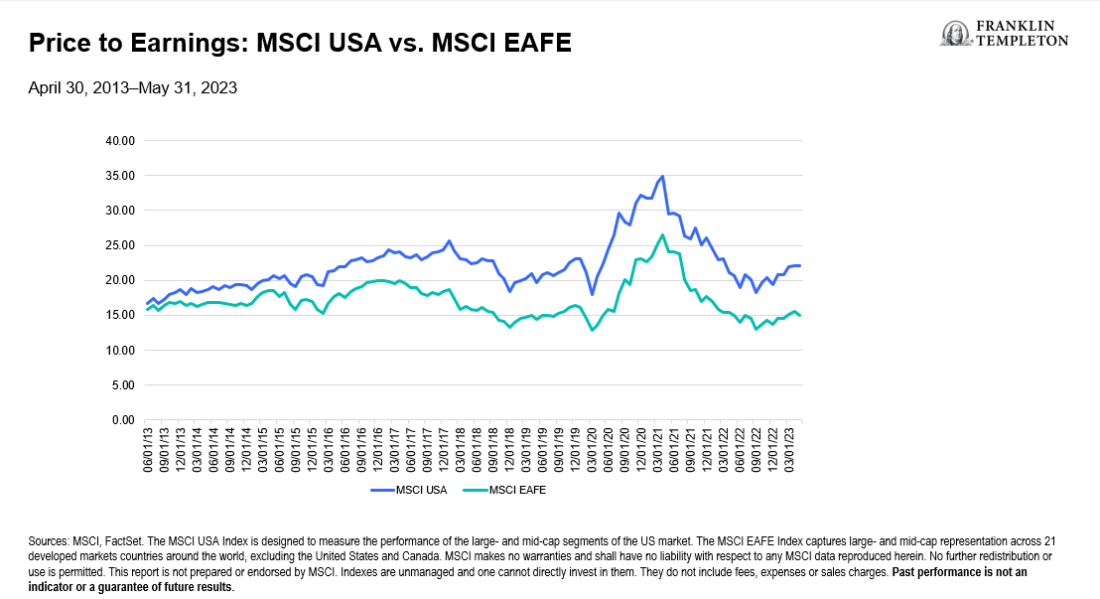

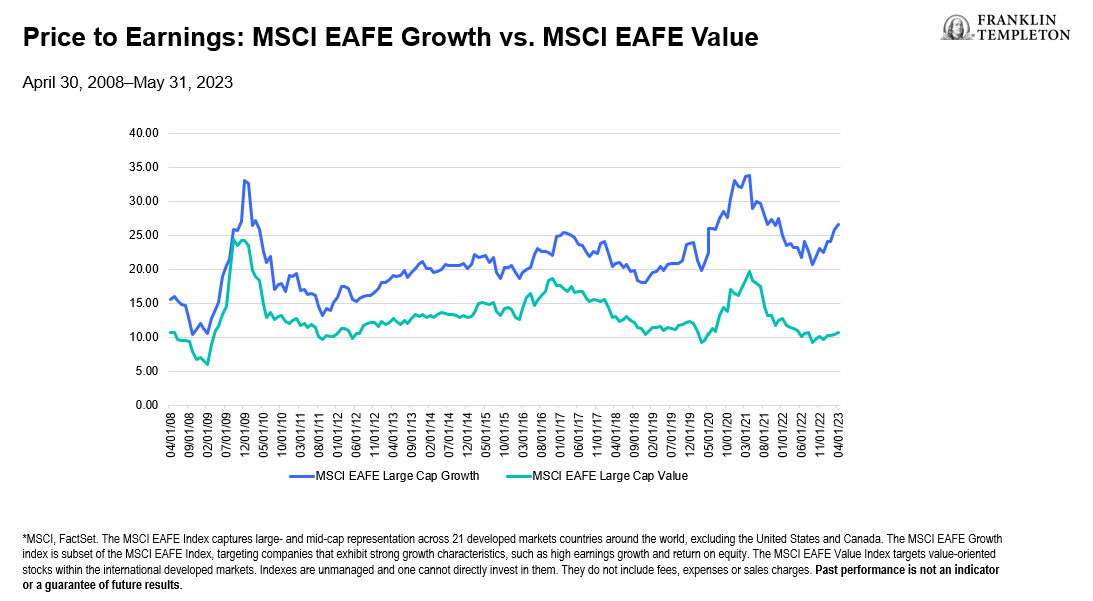

As a result of this inefficiency, US investors’ bias for homegrown companies, and the decade-long rush into the growthy technology stocks that dominate the US equity market, the valuation gap between the US market and international stocks has widened significantly.1 (See Exhibit 1.) We think this disparity suggests greater room for non-US companies’ valuations to improve over time, with additional tailwinds from the more favorable interest-rate regime and modest inflationary environment that tend to benefit value-type companies. Historically, we have seen value stocks outperform growth stocks as interest rates climb, and they tend to be better positioned than growth companies to pass higher prices along to customers.

Exhibit 1: Price to Earnings: MSCI USA vs. MSCI EAFE

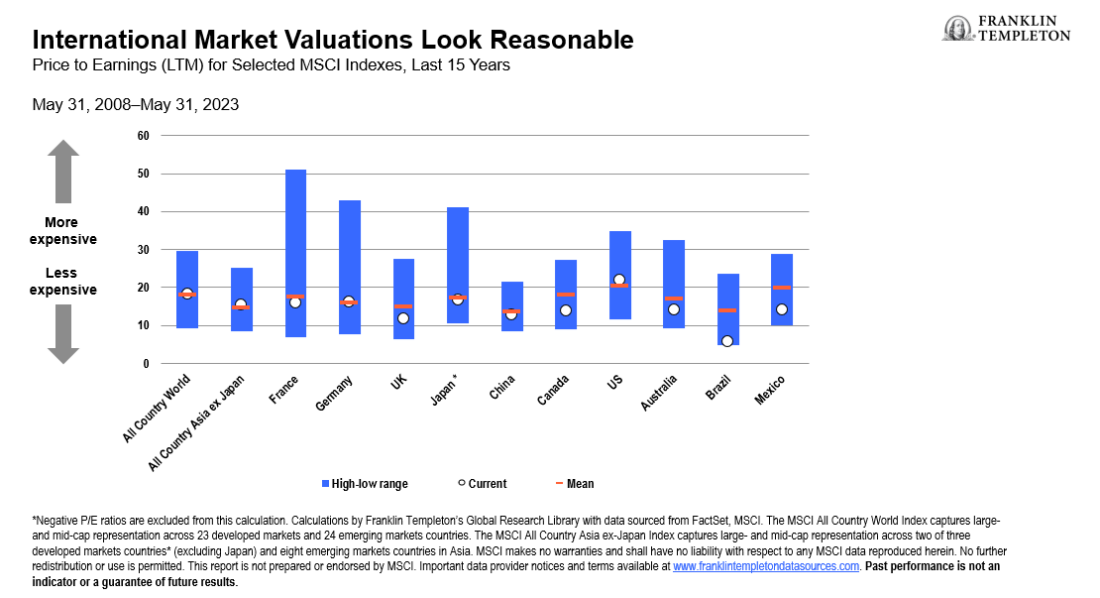

Furthermore, valuations for individual Asian and European markets are well below their mean and at the bottom end of the range seen over the past 15 years.2 (See Exhibit 2.) The US equity market, meanwhile, sits above both its mean and the valuations of other major developed markets, making it more expensive by comparison, with possibly less potential upside than Asian and European markets.

Exhibit 2: International Market Valuations Look Reasonable

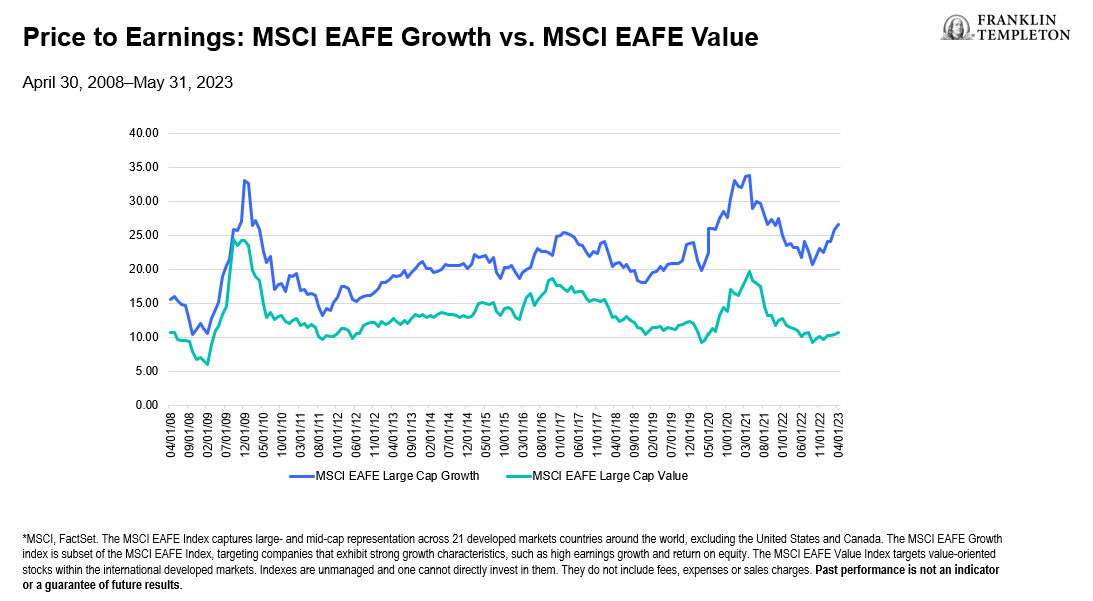

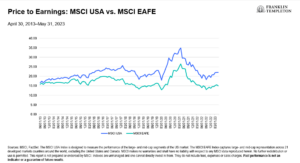

International value stocks are cheaper still, with the MSCI EAFE Value Index sitting near 10-year low valuation multiples, with a price/earnings (P/E) ratio of 10.4 times, compared to the 25.9 times for the MSCI EAFE Growth Index, according to data from FactSet.3 (See Exhibit 3). In our view, international value stocks offer further upside potential for investors willing to do in-depth fundamental research to find attractively valued companies with compelling ways to improve their valuations. Additionally, they can benefit from the higher inflation and interest rates seen in many non-US markets over the past year.

Exhibit 3: Price to Earnings: MSCI EAFE Growth vs. MSCI EAFE Value

Non-US companies offer global exposure

International stocks are not only relatively cheap with what we believe are better prospects to improve their valuations, but many companies in Europe and Asia are global businesses that offer both an anchor to the stability of the US economy and exposure to many attractive fast-growing emerging markets. The proportion of MSCI EAFE Index earnings that is generated outside of home countries is significant. About a fifth of all MSCI EAFE Index revenue is generated in the United States, while another 20% comes from emerging and frontier markets, according to data from FactSet.

Emerging markets are expected to contribute to 60% of global gross domestic product growth, according to data from the International Monetary Fund’s World Economic Outlook as of April 2023, making them important drivers of the world economy. For investors who like the growth emerging markets can bring, investing internationally can provide investors with greater exposure to those markets without the potential risks of investing in companies listed in sometimes more opaque and less-stable regions.

Furthermore, the international value index can offer exposure to recent strong performing markets such as Japan. Although Japan makes up almost 30% of MSCI EAFE Value Index, it accounts for more than 14% of index revenues, according to data from FactSet as of June 2023. As the economy continues to reopen after the pandemic and as inflation exerts itself a bit more forcefully, Japanese stocks could benefit as export-led growth gives way to more domestic consumption.

Meanwhile, relying on the S&P 500 Index for global exposure may not give investors significant international exposure. The United States accounts for 60% of sales for S&P 500 Index constituents, with China the next largest market at about 7.5%, according to FactSet data as of June 2023. An investment in non-US markets may be a suitable alternative for investors looking for international exposure without becoming unmoored from US economic stability.

A boost from government spending

Beyond exposure to faster-growing regions, international companies stand to benefit from the massive government spending enacted over the past few years. The United States and European Union (EU) are looking to make their supply lines more secure, bring manufacturing closer to home and green their economies. International industrials, energy and materials companies are likely to be major beneficiaries of these efforts to invest in the more traditional economy. Companies are also looking to move manufacturing facilities closer to their customers and create more resilient supply chains following the lessons of the pandemic and heightened geopolitical tensions.

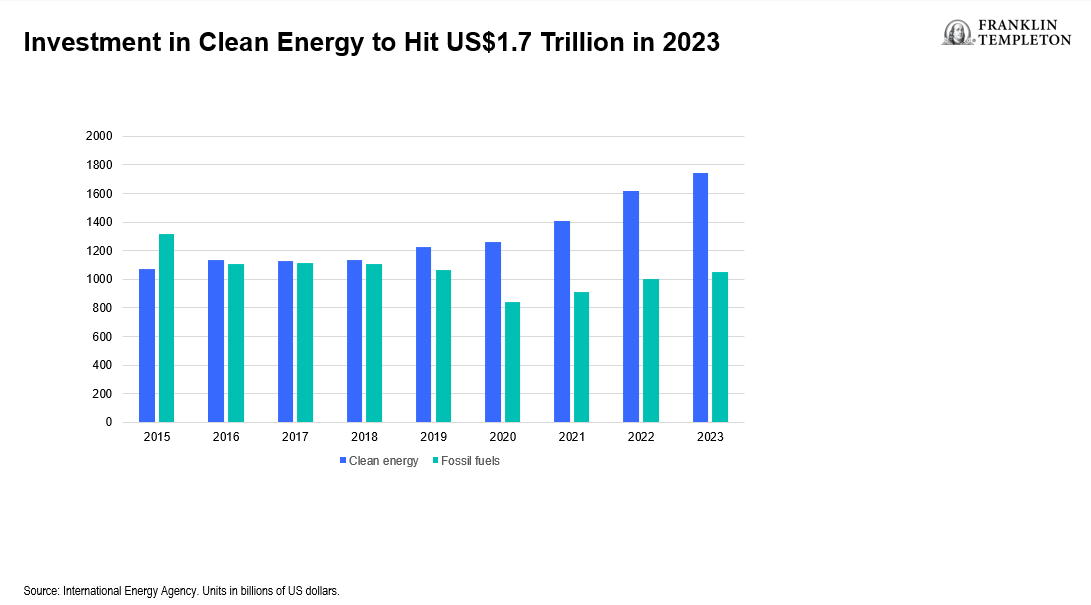

In energy, for instance, both the impact of Russia’s invasion of Ukraine and recent US climate-change mitigation and energy security legislation are likely to result in greater investment opportunities for those European companies focused on green energy and renewable power initiatives. The EU’s Green Deal, meanwhile, looks to reduce greenhouse gas emissions by 2050 through investments in cleaner energy, making buildings more energy efficient and establishing more public transportation. Even Japan, which has been reluctant to commit to ending its dependence on coal and other fossil fuels, has begun to talk about an eventual phase out of these fuels. Overall, clean energy investments are ramping up and could reach about US$1.7 trillion this year, according to the International Energy Agency. (See Exhibit 4.)

Exhibit 4: Investment in Clean Energy to Hit US$1.7 Trillion in 2023

Meanwhile, Japan is slowly improving its lackluster governance policies. Better corporate governance could lead to a greater focus on shareholder returns, meaning more emphasis on improving business returns as well as higher dividends or potentially larger share repurchases over time. One reason for the Japanese market’s paltry relative valuation is that, according to data from FactSet as of June 2023, returns on equity are among the lowest in the developed world.

From attractive fundamentals, cheap valuations, global reach, and the benefits of newly announced government spending programs, we think European and Asian stock markets are rich hunting grounds for attractive value companies poised to benefit from a changing investment regime. To find these international opportunities, we think a deep understanding of company valuations and the ways in which these firms can unlock value for shareholders is crucial.

—

Originally Posted July 3, 2023 – International value investing makes a comeback

WHAT ARE THE RISKS?

All investments involve risks, including possible loss of principal. The value of investments can go down as well as up, and investors may not get back the full amount invested.

Equity securities are subject to price fluctuation and possible loss of principal.

Special risks are associated with investing in foreign securities, including risks associated with political and economic developments, trading practices, availability of information, limited markets and currency exchange rate fluctuations and policies; investments in emerging markets involve heightened risks related to the same factors. To the extent a strategy focuses on particular countries, regions, industries, sectors or types of investment from time to time, it may be subject to greater risks of adverse developments in such areas of focus than a strategy that invests in a wider variety of countries, regions, industries, sectors or investments.

Value securities may not increase in price as anticipated or may decline further in value. The investment style may become out of favor, which may have a negative impact on performance.

Active management does not ensure gains or protect against market declines.

IMPORTANT LEGAL INFORMATION

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. This material may not be reproduced, distributed or published without prior written permission from Franklin Templeton.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The underlying assumptions and these views are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. There is no assurance that any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets will be realized. The value of investments and the income from them can go down as well as up and you may not get back the full amount that you invested. Past performance is not necessarily indicative nor a guarantee of future performance. All investments involve risks, including possible loss of principal.

Any research and analysis contained in this material has been procured by Franklin Templeton for its own purposes and may be acted upon in that connection and, as such, is provided to you incidentally. Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. Although information has been obtained from sources that Franklin Templeton believes to be reliable, no guarantee can be given as to its accuracy and such information may be incomplete or condensed and may be subject to change at any time without notice. The mention of any individual securities should neither constitute nor be construed as a recommendation to purchase, hold or sell any securities, and the information provided regarding such individual securities (if any) is not a sufficient basis upon which to make an investment decision. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute.

Disclosure: Franklin Templeton

The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. Because market and economic conditions are subject to rapid change, comments, opinions and analyses are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy.

This information is intended for US residents only.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Franklin Templeton and is being posted with its permission. The views expressed in this material are solely those of the author and/or Franklin Templeton and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.