Investors are cheering this morning’s Consumer Price Index, which reflected an unchanged month-over-month price level in October. Rather than strengthening expectations for a Federal Reserve pause in changing its interest rate, this morning’s doughnut figure charged up wagers of Fed cuts, with probabilities for a 25-basis point interest rate reduction rising to 29% and 48% at next year’s March and May meetings. Market players are responding by scooping up stocks and bonds aggressively amidst a seasonally buoyant period for capital markets.

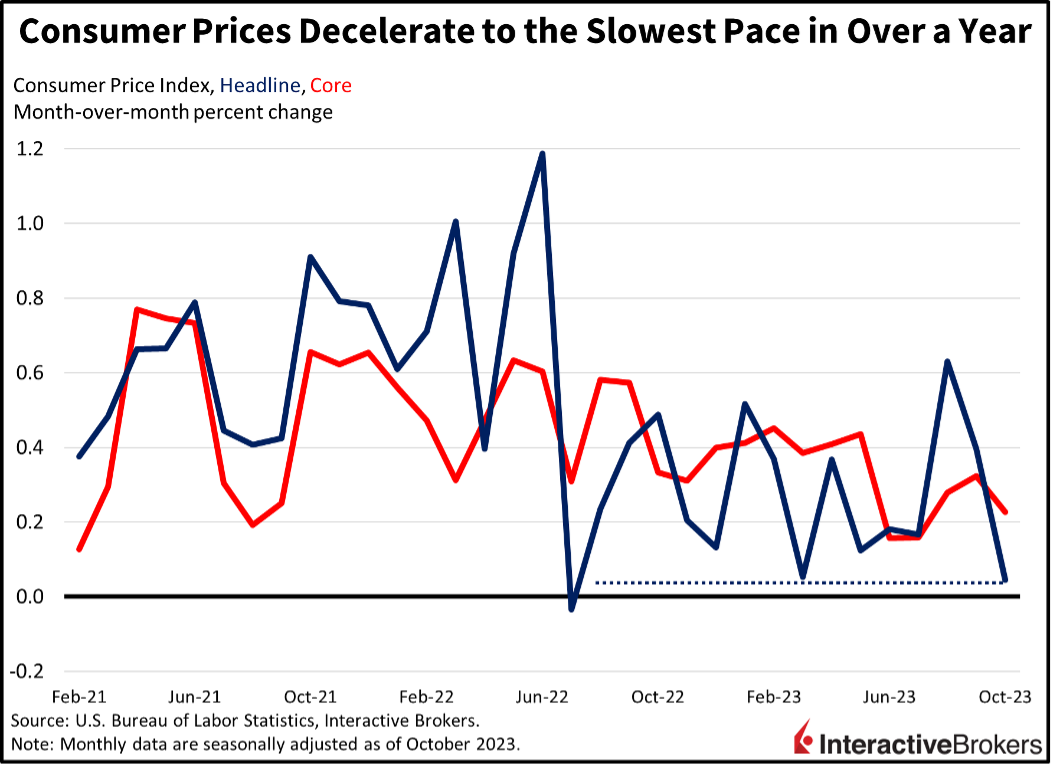

Consumer Prices Decelerate to the Slowest Pace in Over a Year

October’s headline Consumer Price Index (CPI) provided the best month-over-month (m/m) reading since July 2022 from a disinflationary perspective. Last month’s 0% result was better than expectations of 0.1% while reflecting improvement from September’s 0.4% increase. Progress was also evident from a year-over-year (y/y) angle, with consumer prices rising only 3.2%, better than the 3.3% projection and September’s 3.7%. Core inflation, which excludes food and energy and is considered a better gauge of the medium- to longer-term trajectory of price pressures, also rose below economists’ estimates. The core CPI rose 0.2% m/m and 4% y/y, relative to anticipations of 0.3% and 4.1%. Compared to September, core slowed from that month’s 0.3% and 4.1% figures.

Gasoline and Automobiles Offset Price Gains Elsewhere

While most segments of the CPI rose, price declines in crude oil, its derivative products and automobiles fully offset inflationary forces. Indeed, gasoline and fuel oil declined 5% and 0.8% m/m while new and used automobiles declined 0.1% and 0.8%. Price gains, on the other hand, were led by transportation services, energy services (heating and electric), food at dining establishments and medical care commodities with prices increasing 0.8%, 0.5%, 0.4% and 0.4%. Shelter, which composes a large chunk of household budgets, slowed, gaining only 0.3% from 0.6% in the prior period. Meanwhile, medical care services, food at markets and apparel rose 0.3%, 0.3% and 0.1%.

Investor Optimism Strengthens

Bulls are grabbing the market by the horns today with stocks and bonds soaring higher. Interest rate sensitive indices are leading as optimism of a lighter Fed propels prices higher. The small-cap Russell 2000 and tech-heavy Nasdaq Composite indices are up 4.6% and 2.2% while the S&P 500 and Dow Jones Industrial indices are higher by 1.9% and 1.5%. Sectoral breadth is as green as ever, with all sectors higher as Real Estate and Consumer Discretionary lead with gains of 5.5% and 3.4%. Bond yields are tumbling as market players look to lock-in the rate of the moment. Yields on the 2- and 10-year maturities are down 18 basis points (bps), dropping to 4.85% and 4.46%. Lower yields and rate cut expectations are creaming the greenback, with the Dollar Index down 122 bps to 104.44. The greenback is losing ground relative to the euro, pound sterling, franc, yen, yuan and Aussie and Canadian dollars. Bullish demand forecasts from OPEC+ and the IEA, which raised the 2024 outlooks for oil, are propping up the commodity, with WTI crude up 1.4% or $1.08 to $79.56 per barrel. Risk-on sentiments and a lighter dollar amidst Fed optimism are also helping, as crude oil is dollar-denominated and benefits from increased economic activity stemming from interest rate relief.

Consumers Struggle with Inflation, High Interest Rates and Growing Debt

Disinflation is a welcome development, but consumers are still feeling the headwinds of higher prices, as illustrated by Home Depot’s third-quarter earnings report. The company’s net revenue declined 3% y/y from $38.87 billion to $37.70 billion. Despite the decline, revenue beat the analyst consensus expectation of $37.6 billion. Home Depot’s earnings per share (EPS) of $3.81 fell y/y from $4.24 but beat the consensus expectation of $3.76. Same-store sales declined 3.1% y/y, which was better than the analyst forecast of a 3.6% decline but was the fourth-consecutive quarterly decline.

Home Depot and other retailers face a challenging environment, with the New York Federal Reserve reporting that as of the third quarter, credit card debt, which currently has record-high interest rates exceeding 20%, hit an all-time high of $1.079 trillion, representing a $154 billion y/y increase. Meanwhile, the percentage of accounts that are 90 days or more delinquent increased y/y from 3.69% to 5.78%. Delinquency rates for mortgages and auto loans have also increased. A decline in home sales due to high mortgage interest rates is also limiting the number of projects that prospective home buyers complete. That trend is being offset slightly by homeowners deciding to renovate their existing properties rather than moving. Home Depot CEO Ted Decker said the company experienced a decline in sales of big-ticket discretionary items due to inflation making the items harder to sell. Additionally, homeowners are taking on smaller projects. In a CNBC interview, however, Home Depot Chief Financial Officer Richard McPhail said the company’s customers, and in particular, homeowners, are in good shape financially with significant savings. The company also narrowed its full-year guidance. It believes sales will drop 3% to 4% compared to an earlier forecast of a 2% to 5%. It estimates an EPS decline of 9% to 11%. It previously estimated an EPS decline of 7% to 13%.

Market Bonanza Enjoys Prospects of Quicker Fed Cuts

Market players have shifted their focus from reaping the benefits of a Fed pause to hoping for Fed cuts at a brisk pace. The result is an outright market bonanza, with stocks looking to add to their 16% year-to-date gain as we close out the year. But is the loosening of financial conditions amidst bullish sentiment in markets an inflationary development? We’ve seen renewed hawkish commentary from the Fed several times this tightening cycle following a cool inflation report that boosts animal spirits. At this juncture, markets are exuberant and likely ahead of themselves as Treasury issuance and a lurking Fed remain headwinds.

Visit Traders’ Academy to Learn More About the Consumer Price Index and Other Economic Indicators.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.