Stocks are striving to achieve a fifth consecutive daily gain despite this morning’s economic data providing mixed messages on price pressures. While Personal Consumption Expenditures (PCE) inflation data met expectations, consumer spending, initial unemployment claims and euro zone inflation were hotter than anticipated. Market players are taking notice on the eve of the week’s main event, nonfarm payrolls, with yields on shorter-duration Treasuries rising because today’s data doesn’t point to a softer Fed, unlike yesterday’s ADP report and Tuesday’s Job Openings and Labor Turnover Survey. Still, August wasn’t terrible for equities as we approach the seasonally weak month of September.

Services Remain Problematic

This morning’s PCE report for July offered little surprises relative to economists’ estimates. The Fed’s preferred inflation gauge, the core PCE, rose 0.2% month over month (m/m), in-line with projections and June’s reading. On a slightly more disappointing note, the figure rose 4.2% year over year (y/y), also as expected, but higher than the 4.1% from the previous period. The headline, non-core PCE, depicts a similar development, accelerating from 3% in June to 3.3% in July. Looking under the hood, prices for goods accelerated their decline from -0.1% to -0.3% while services prices accelerated from 0.3% to 0.4%.

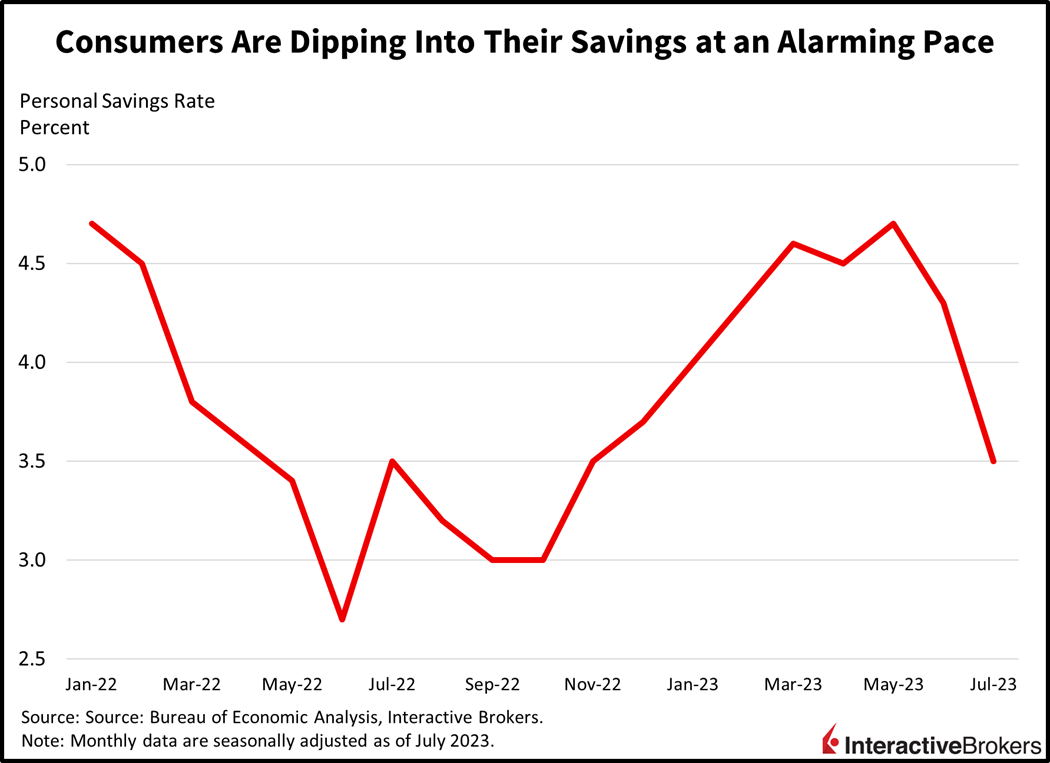

Services inflation picked up steam as consumer spending rose 0.8% during the month, the fastest pace since January’s 1.9%. July’s spending numbers came in a tenth hotter than expectations and two tenths stronger than June’s. To boost their spending power, however, consumers dipped heavily into their savings as personal income only rose 0.2% during the month, worse than forecasts calling for an unchanged reading of 0.3%. In fact, the personal savings rate dipped to 3.5% during the period, a sharp decline from June’s 4.3% and the lowest level since November of last year. For comparison, the personal savings rate reached a cycle low of 2.7% in June 2022, the lowest level since 2005.

Across the Atlantic, August eurozone inflation came in at 5.3% y/y, the same pace as the previous month. August’s figure disappointed forecasters that foresaw progress pointing to inflation dropping to 5.1%. On a m/m basis, prices rose 0.6%, a sharp reversal from July’s -0.1% reduction. Core inflation did achieve progress, however, dipping from 5.5% to 5.3%, exactly as expected. Price pressures were boosted by energy, non-energy industrial goods, and processed food, alcohol and tobacco whose prices rose 3.2%, 0.6% and 0.3% m/m, respectively. Unprocessed food and services did provide some relief, with the former’s prices falling 0.6% while the latter’s rose just 0.2%.

Corporates Hold on To Labor

Also this morning, initial unemployment claims data fell below estimates, illustrating that while the pace of hiring and job openings is losing steam, employers aren’t outright firing employees in aggregate. Initial jobless claims for the week ended August 26 totaled 228,000, short of predictions of 235,000 and lower than the previous week’s 232,000. Continuing claims for the week ended August 19 did come in slightly higher than estimates, however, with 1.725 million claims exceeding both the 1.703 million anticipated and the 1.697 million from the previous week. Indeed, companies still have an appetite to earn returns and make money, even if tighter monetary policy and a tough economic environment challenge margins.

Technology Supports Revenue and Earnings Growth

Certain companies are benefiting from embracing technology that is helping them capture market share as illustrated by the following:

- Salesforce, which provides technology for automating sales and customer services, reported adjusted earnings per share (EPS) of $2.12 for the second quarter compared to the analyst consensus expectation of $1.90. The company’s revenue of $8.60 billion climbed 11% y/y and exceeded the analyst consensus expectation of $8.53 billion. Despite the growth in EPS and revenue, Salesforce experienced softness in the U.S. with companies taking more time to reach purchasing decisions. The softness was particularly noticeable in the technology, retail and consumer goods sectors. Salesforce anticipates that its current-quarter adjusted EPS will range from $2.05 to $2.06 on $8.7 billion to $8.72 billion in revenue. Analysts expected an adjusted EPS forecast of $1.83 and revenue of $8.66 billion.

- CrowdStrike Holdings, which provides cybersecurity, reported second-quarter net income of $8.48 million, or $0.03 a share. In the year-ago quarter, it lost $49.3 million, or $0.21 a share. Its adjusted EPS of $0.74 exceeded the consensus expectation of $0.56. CrowdStrike said its artificial intelligence services played a significant role in revenue increasing from $535.2 million to $731.6 million y/y. The results beat the consensus expectation of $724.2 million.

- Chewy, furthermore, illustrated that the secular growth of technology is extending beyond the business world with consumers increasingly embracing the company’s autoship services. The online pet supply retailer said its second-quarter sales increased 14.3% y/y, with its sales through autoship, which automatically sends items to customers at scheduled intervals, increased 75.5%. Chewy expects full-year 2023 revenue to range from $11.15 billion to $11.35 billion, consistent with the company’s previous outlook. The analyst expectation was $11.3 billion.

Equities Advance One Step at a Time

Markets are cautiously trading in a tight range ahead of tomorrow’s big payroll release. Equity indices are continuing their winning streak, with technology leading as the Nasdaq Composite Index rises 0.6%. Participation is mixed today with an offensive tilt, as the defensive health care, utilities and consumer staples sectors are all down on the session. Real estate, financials and energy are also down, with all other sectors higher. Bond yields are 2-3 basis points (bps) lighter on the long-end while the short-end is higher by 1-2. The dollar is getting bought up, with its Index up 52 bps to 103.71 as the greenback gains against the euro, pound sterling, and franc on concerns that ECB tightening on the back of a hot inflation reading will push the region into recession by year-end. WTI crude oil is on pace for its sixth-consecutive gain on concerns that Riyadh will extend its voluntary production cut for the third month in a row through October.

All Eyes Look to Tomorrow

This week’s double header of weaker-than-expected job market data from the ADP National Employment Report and the Job Openings and Labor Turnover Survey has stoked optimism that the Fed may ease its hawkish stance or at least not have to become more aggressive in fighting inflation. Today’s data, however, points to continued inflation supported by strong services spending. Services, which are labor intensive, will be top of mind for investors as they look to tomorrow’s Payroll Jobs Report for additional guidance on labor markets. The analyst consensus expectation of 170,000 new jobs, however, is likely to be excessive, with real-time data showing that employers are slowing hiring while focusing on maximizing output with the labor they currently have. To that end, new jobs may be as low as 150,000. This number would imply that the job market is cooling, but labor is still tight with August being the 32nd consecutive month of job gains. Even though the market appears to be cooling, many employers are facing pressure to raise their wages as demonstrated by organized labor actions in Hollywood, UPS, American Airlines, General Motors, Starbucks, Amazon and others. These higher wages are likely to continue to support inflation as companies are compelled to pass the increased labor costs on to customers. Tomorrow’s average hourly earnings figure shall be interesting: I’m expecting 0.4%, a tenth higher than the consensus.

Visit Traders’ Academy to Learn More about Economic Indicators.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.

Leave a Reply

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Indeed, All Eyes Look to Tomorrow. Your perspective adds depth to what I already know about tomorrow’s report, and I appreciate your work.

Thank you, Jose, and IBKR, for putting the economic analysis a part of raders’ Insight. Much needed to undrstand the moves, and conjugates very well with Steve’s analyses of the moves post-facto.

Thank you for commenting, Proshanto! We appreciate it.