What’s going on here?

Reports out this week showed signs of US housing activity coming back to life.

What does this mean?

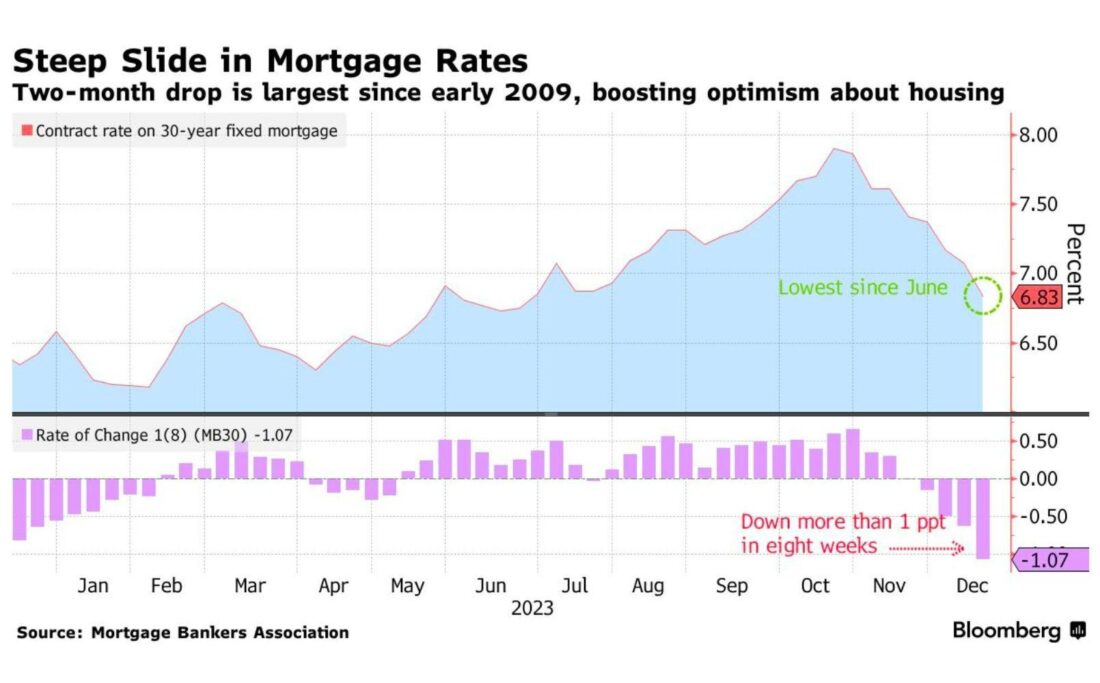

Sky-high mortgage rates have been putting Americans off the housing market, forcing them to forgo the dream of a yard and swing set for a little longer. But with the Federal Reserve hinting at potential rate cuts next year, investors have been buying up Treasuries to lock in the benefits of higher rates before they go. That’s been lowering their yields, and because mortgage rates tend to mirror the bond market, it makes sense that mortgage rates just hit their lowest since June after a five-week slide. So now, Americans have been lining up outside open houses again. Plus, housing construction is up, sales of pre-owned homes have picked up from a 13-year low, and builders are feeling optimistic about future business.

Why should I care?

Zooming out: It’s tarot time.

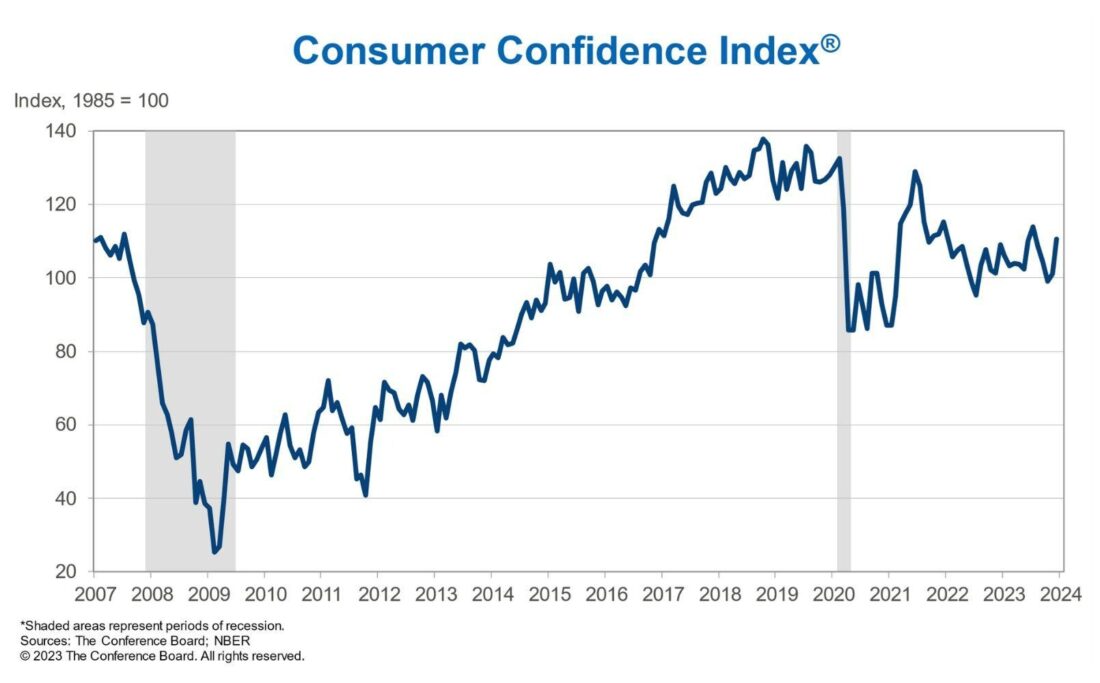

Economists don’t book psychic appointments: they use the housing market as their crystal ball. Stats like home sales, building permits, and house prices indicate how the economy as a whole is faring – and the latest promising signs are backed up by December’s US consumer confidence rising by the most since early 2021. So with the housing market seeming stable and Americans feeling financially confident, it’s no wonder Goldman Sachs pumped up its economic growth predictions for the last quarter of this year.

The bigger picture: London’s crying.

Homeowners in Britain won’t be quite as cheery, mind you: the average UK home turned 1.2% cheaper between this October and last, the quickest fall in over a decade. The steepest price drops are happening in the capital, too, with folk swapping London life for cheaper, roomier abodes elsewhere. But since the country’s inflation started falling in line in November, the Bank of England may start feeling the pressure from testy homeowners to cut its 15-year-high interest rates.

—

Originally Posted December 21, 2023 – It Looks Like The US Housing Market Is Finally On The Mend

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.

Leave a Reply

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Finimize and is being posted with its permission. The views expressed in this material are solely those of the author and/or Finimize and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Kinda tough to process the “housing market seeming stable and Americans feeling financially confident” narrative when 401k loans/deductions are skyrocketing along with all consumer debt. Oh, and auto repos have gone parabolic. So who’s confident outside the 2%ers? And when does Uncle Sam’s credit card get declined? Best to deep dive your research and not buy into the utter nonsense sprayed by hilariously inaccurate government agencies.