Earlier this week, I wrote about the recent phenomenon that major market averages had significant pops in the final hour of the past three trading weeks. Even though I am writing this a few hours before the close of trading, it seems useful to check whether circumstances indicate that a similar move is possible today. If a similar move arrives today, it could have profound effects for anyone with open SPY options positions this afternoon.

The linked article has extensive graphs demonstrating the late day moves, but I will include a snapshot of Friday’s activity in the SPDR S&P 500 ETF Trust (SPY) as an illustration of the phenomenon that we have been seeing. I focus on that product because unlike index options, ETF options expire at the close of business. This also would be the nexus of any concerted efforts to move the broad market higher or lower.

SPY 1 Day Chart, April 9, 2021

Source: Bloomberg

Take special note of the pop that we saw at about 3:15. SPY broke above its highs for the day and then shot up about 2 more points in the next 45 minutes or so. Bear in mind that 2 points in SPY is roughly equivalent to 20 points in SPX, so this was not a trivial move. If this was a one off occurrence or off smaller magnitude, I would have written it off as stop loss orders triggering some short covering ahead of a weekend. No big deal, right? But when we consider that we saw nearly identical activity occurring in the final hour ahead of each of the prior two weekends, it seems instead like a pattern. Traders (and their algorithms) become very adept at spotting and exploiting patterns.

I posited that there were gamma effects at work in the options market that aided the rallies through prior intraday resistance. It would be one thing if the break of intraday resistance would have simply affected SPY and ES futures traders. It is another if traders exploited the need for those traders who were short call options to cover their delta positions in a panicky manner. Consider that last week there was significant volume and open interest at the 410 level in SPY. In the last hour of the day, when those calls were still slightly out of the money, they carried low prices and low deltas. As SPY moved above the 410 level, the prices and deltas moved very quickly. Any trader who wanted to stay hedged, avoiding the risk of suddenly being exposed to a higher likelihood of finding himself becoming short SPY over the weekend, would have been incentivized to cover his short calls or buy SPY. It is entirely possible that the buying that was unleashed could have driven SPY to the 411 level, repeating the process once again, and then again as it approached and crossed the 412 level. This is the definition of a gamma squeeze, a term that was thoroughly obscure before this year’s gyrations in GameStop (GME) and other meme stocks.

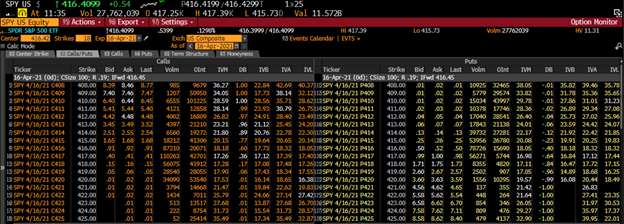

That is why it is crucial for traders, particularly those using expiring SPY call options, to assess their susceptibility to a similar ramp, and to do so quickly. Let’s take a peek at the current state of trading in expiring SPY options:

SPY Options Montage for 4/16/21 at 11:35 EDT

Source: Bloomberg

When this snapshot was taken, SPY was trading at 416.41, meaning that the 417 calls were slightly out of the money. The ETF had traded above that strike earlier in the day, so it is not surprising to see those calls with the highest volume at over 110,000 contracts. There is still a fair amount of premium in those options at $0.40, and they sport a delta of 0.36. That delta reading means that anyone who is short those one of those contracts would need to buy 36 shares of SPY to cover their theoretical short exposure. The difficulty for traders on expiration is that the delta is highly subject to change. If the stock slipped below 416 we would expect that delta to fall. If it rose above 417, the delta would rise. That is gamma at work, and the effects of gamma become more profound the closer we get to expiration. Thus, if we were at 3:15 and leapt from, say, 416.40 to 417.25, that theoretical short position could quickly become 80 shares or more as the delta of the 417 calls leapt higher. It is therefore not unreasonable to expect some panicky buying by those who are short calls. If SPY rose quickly enough, we can see that there are plenty of people who have positions in the 418 calls who would be getting nervous. That is what would fuel a squeeze.

The high volume and proximity to the 417 strike tells me that the conditions could be present for another late gamma squeeze in SPY. Does it mean that it will happen? No. But do I think that some traders might give it a try if SPY is similarly priced at 3:00 PM or so? Sure, why not? Remember, traders love to exploit patterns.

At this point I will act like a fire marshal. I see dry tinder that is similar to the type that caused conflagrations in the past. That dry tinder is a significant amount of slightly out of the money calls in SPY. My suggestion would be to remove that fire hazard from your property. If you are short these calls, ask yourself whether the risk/reward justifies holding them to expiry or whether you should be covering them – hopefully for a profit. I can’t tell you what to do, but I can do my best to inform you of potential risks and offer a path to reducing them.

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: Margin Trading

Trading on margin is only for sophisticated investors with high risk tolerance. You may lose more than your initial investment. For additional information regarding margin loan rates, see ibkr.com/interest

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more information read the "Characteristics and Risks of Standardized Options" also known as the options disclosure document (ODD) or visit ibkr.com/occ

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.