What’s going on here?

UK prices rose at their slowest pace in two years, so the writing on the wall may finally be optimistic.

What does this mean?

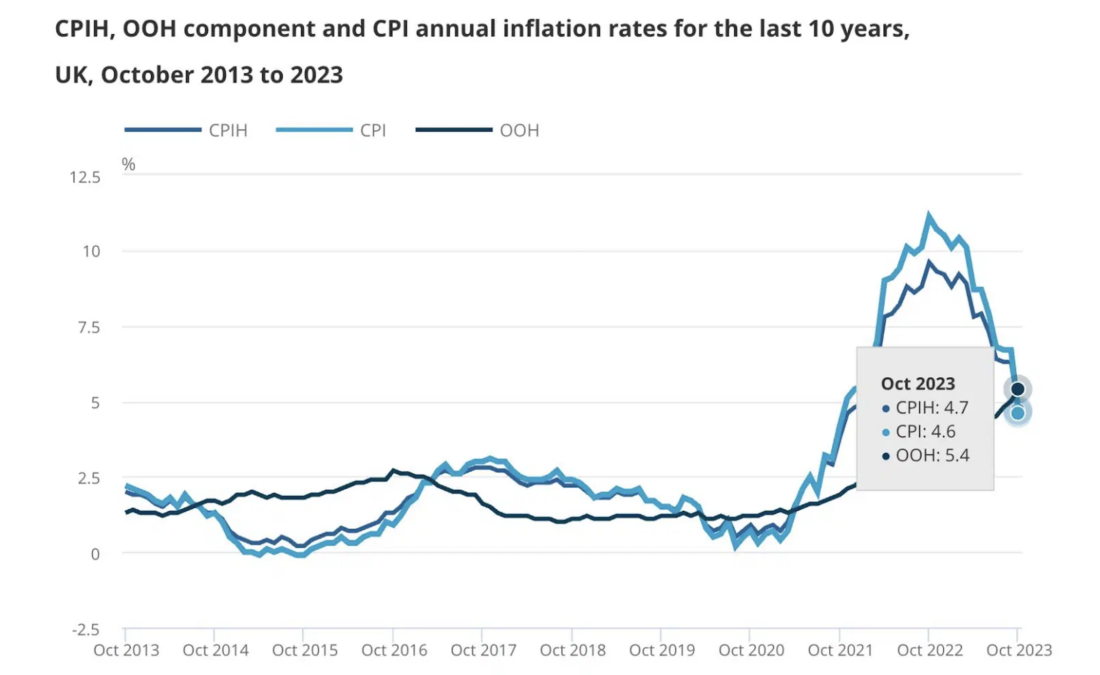

British prices were 4.6% higher this October than last, which plots inflation at twice the Bank of England’s (BoE) target. But Brits will take that: October’s uptick looks tame compared to September’s 6.7%, and marks the slowest pace of increases this year. What’s more, lower energy prices aren’t the only catalyst, with both core – excluding volatile food and energy prices – and services inflation landing lower than economists expected. And the British government will be celebrating, too, finally fulfilling the promise it made in January to halve inflation before the end of the year.

Why should I care?

For markets: Stocks are ready and waiting.

That slowdown didn’t come easily: the BoE pulled interest rates to extreme heights in an effort to curb inflation. So now that prices seem to be letting up, the central bank could consider cutting those rates – or at least leaving them where they are – to support the economy. Investors already believe the BoE will trim rates three times next year, starting from June. And that could help stocks dust themselves off: lower rates plump up the present value of stocks’ future cash flows, giving their valuations a leg up, while also making it cheaper for companies to borrow money and invest in themselves.

The bigger picture: It’ll be a bumpy ride.

Thing is, worldwide events like supply chain kinks and war were partly behind Britain’s price bumps. While that impact has mostly leveled out, the remaining inflation could be harder to budge. And even if prices stop climbing, their current level is enough to pinch workers without inflation-related pay rises. Mix in heating geopolitical tensions and transforming technology, and the takeaway is clear: the end of inflation doesn’t mean the end of volatility.

—

Originally Posted November 16, 2023 – Last Month’s UK Inflation Reading Was A Work Of Art

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Finimize and is being posted with its permission. The views expressed in this material are solely those of the author and/or Finimize and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.