There are some mornings when I stare at a blank screen, wondering what to write. This morning is not one of them.

No one is calling me to ask why US indices are down over 2%. The reason is obvious. The bulk of the blame lies with the FOMC and Chair Powell, with some falling on the ECB and President Lagarde. These key central banks sent messages that investors were not eager to hear. I say investors, rather than traders, because traders react instantly while investors take a bit longer to consider their moves. That is why we saw a modest selloff yesterday after an afternoon of jumpy trading, while this morning we see concerted, broad-based selling. Those with cooler heads considered the FOMC’s statement, economic and rate projections, and of course, the press conference and realized there was little reason for near-term optimism. When the ECB matched the Fed’s 50 basis point hike and strident rhetoric, that added to the general malaise in equities.

Quite frankly, the reaction is not out of line with what we wrote yesterday. Among the points we made:

- “The key will be to see if the Chair or the Committee pushes back upon the interest rate narrative that is priced into fixed income markets.”

Is there any doubt that a dot plot with a median estimate of 5.125% (vs. 4.625% in September) does anything other than push back vigorously against the fixed income market’s assumptions for peak rates in May and cuts in the fourth quarter of 2023?

- “Fed Funds futures are more optimistic about the pace of rate policy than the Fed’s dot plot implies”.

It was true yesterday and remains true today. Fed Funds futures traders remain resolute in their views. As of this morning they still show rates peaking at 4.9% in May and dropping to 4.4% in December. Someone will be proven wrong over the coming months.

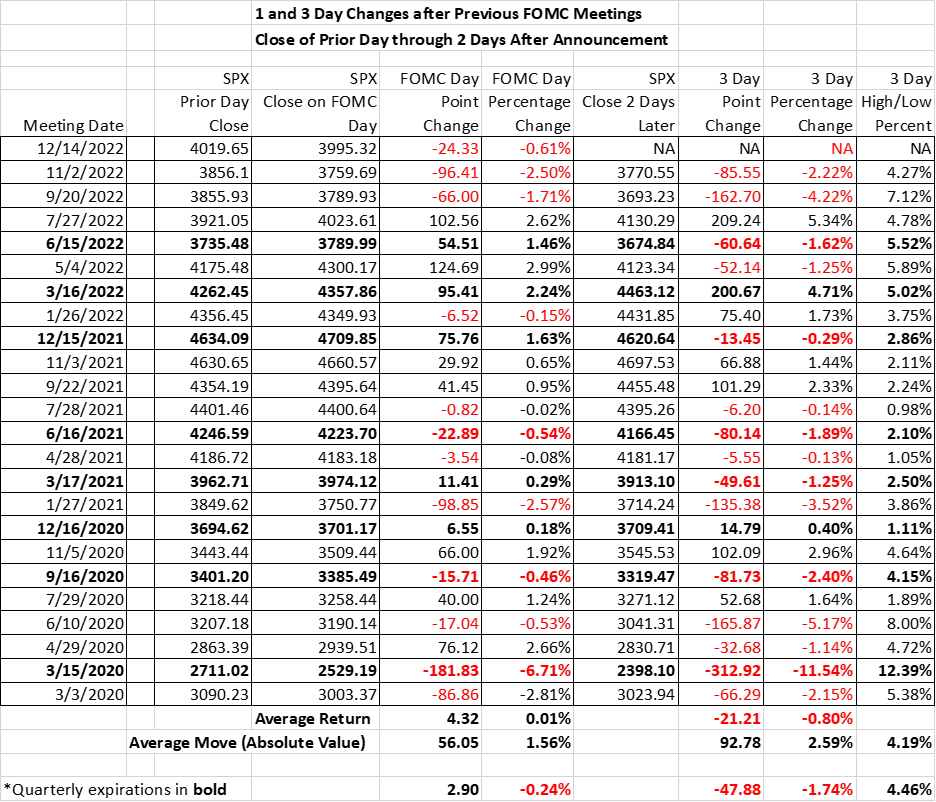

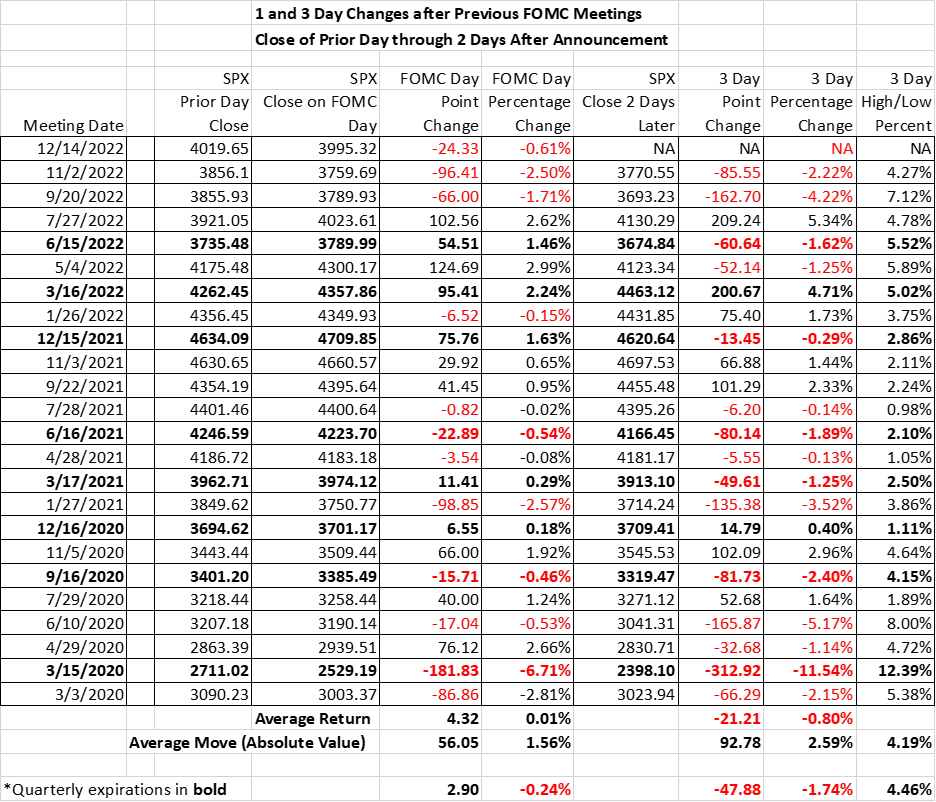

- “The one takeaway [from our table showing reactions to FOMC meetings] is that the equity market tends to reverse after a consensus expectation goes beyond the Fed’s comfort level…Around the past two meetings, when investors began to hope for something accommodative – a pivot, a peak, a pause – equities reacted negatively when none was forthcoming.”

This was the case yesterday afternoon and this morning. Remember, our table focuses on three-day moves, not just the immediate reaction. As noted above, traders react while investors consider. It is therefore appropriate to consider the moves over the two days that follow a Fed meeting as highly – if not more highly – than the reaction in a couple of hours after the announcement. This is especially true when an FOMC meeting coincides with a quarterly expiration, as it does now.

- “For those of us who focus upon equities, it is important to remember that we have a quarterly expiration on Friday. That increases the likelihood that any moves can be exacerbated by expiring futures and options positions.”

I believe that the effect of tomorrow’s expiration is already having an outsized impact on today’s market moves. As of this morning, there were about 125,000 expiring put and call options on SPX with a 3900 strike. These options expire on the open, which makes them more difficult to hedge than those that expire on the close. Remember that expiring options can act either as a magnet or a slingshot, depending upon the nature of the holders and the moves in the underlying. Their presence largely explains why we have spent much of the morning around that strike, but it also raises the specter that an outsized move in either direction – whether this afternoon or in tomorrow’s pre-market – can quickly metastasize into something even more significant.

- “At some point, probably not today, however, equity investors will need to decide which is more important to them – easy money or a decent economy. Odds are we’re not getting both.”

That dichotomy is even more stark today than it was yesterday. The Fed and ECB are both signaling that they have no plans to ease monetary policy anytime soon. Sure, that could occur if inflation manages to return to 2% without significant economic weakness, but that seems like a rather tight needle to thread. The other possibility is that the economy weakens sufficiently to spur central banks to end their restrictive policies. Those policies include balance sheet reduction, aka “quantitative tightening” or “QT”, which Powell mentioned only twice yesterday and seemingly only in passing.

If you’re an equity investor hoping for the latter scenario — an economy sufficiently weak to spur fresh rate cuts — be VERY careful what you wish for.

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more information read the "Characteristics and Risks of Standardized Options" also known as the options disclosure document (ODD) or visit ibkr.com/occ