The manufacturing sector continued to contract last month, but on a positive note, construction of manufacturing facilities soared as more U.S. companies pushed to onshore their operations. While the broad ISM Manufacturing PMI weakened further, there were a few reasons for optimism, including declining goods prices, faster delivery times and lower inventory levels among manufacturers’ customers.

ISM Manufacturing reached a new cycle low of 46 as high interest rates continued to weigh on customer orders. June’s reading, which was the eighth-consecutive month below the expansion-contraction threshold of 50, missed projections calling for 47 and worsened from May’s 46.9 level. While all segments of the Index contracted during the month, prices and backlogs reflected the sharpest declines, as a lack of customers placed downward pressure on seller pricing power while production capacity finished up older orders. The lack of new orders also compelled manufacturers to trim workers, with employment registering a contraction of 48.1 during the period. The contraction is positive for reducing inflation as the tight labor market has contributed to wage inflation. Many companies have passed higher labor costs on to customers by increasing their prices.

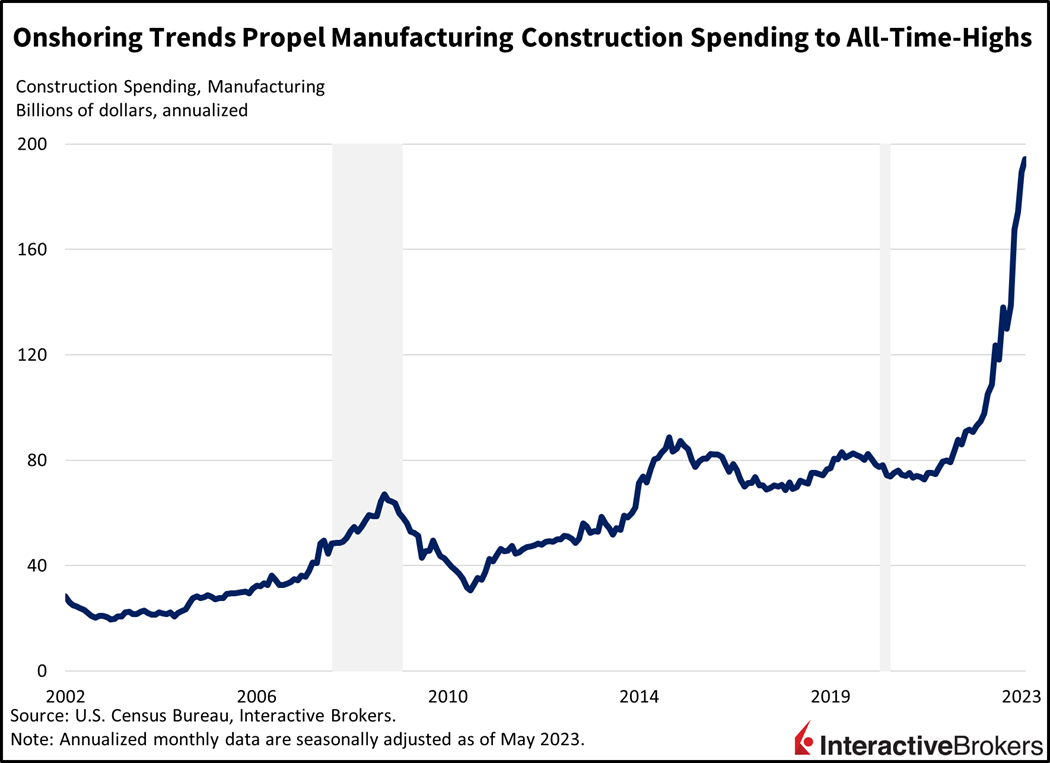

Onshoring Bucks Trend of Manufacturing Contraction

May construction spending, on the other hand, was up 0.9% month-over-month (m/m), exceeding the consensus expectation of 0.6%. Driving the monthly gains were the residential and manufacturing categories, each rising 2.1% and 1.0% m/m, respectively. The residential segment has benefitted from renewed demand while inventory of existing homes for sale has remained low because homeowners have little incentive to sell in a weaker real estate market and assume larger mortgage payments on another home purchase due to mortgage rates almost tripling since pandemic era lows. Residential construction spending grew for the second consecutive month while manufacturing construction spending rose for the fifth consecutive month to a fresh all-time high. Within the construction industry, the manufacturing segment continues to grow as companies want to onshore manufacturing operations in order to prioritize security and reliability over short-term profitability.

Traders Prepare for July 4

Markets are muted during today’s shortened session on the eve of Independence Day. Equities are near the flatline while bond yields are climbing 1 to 3 basis points (bps) across the curve. The 2- and 10-year Treasury maturities are up 3 and 2 bps to 4.91% and 3.84%, widening the inversion to 107 bps. The Dollar Index is quiet as well, climbing only 4 bps to 102.95 as we await a big Jobs report this Friday that may shift Fed tightening expectations. Equities are quite unchanged with the only major index firmly in the green being the Russel 2000, which is up 0.3%. The S&P 500 Index is flat with mixed performances among sectors. Crude oil is up 0.3% to $70.84 per barrel on news that Moscow and Riyadh will both reduce oil supply in August. Saudi Arabia’s 1 million barrel per day production cut serves as an extension of a previous announcement. Coming on the heels of the Saudi extension this morning, however, Russia’s statement that it would cut oil exports by 500,000 barrels per day in August came as a surprise.

Tesla and BYD Post Strong Results

Tesla is bucking the trend of weak sales for goods. The company, which has an approximate 62% share of the U.S. electric vehicle (EV) market, posted second-quarter deliveries that significantly exceeded expectations, a result of government subsidies for EV buyers and the company dropping its prices. Automobile manufacturer BYD, which is competing for customers in China, one of Tesla’s key markets, also generated strong second-quarter results. Tesla’s stock soared roughly 6.8% this morning as investors focused on the company delivering 466,000 vehicles, up from 423,000 in the first quarter and exceeding the analyst consensus expectation of 448,350. On a year-over-year basis, deliveries climbed 83%, a result of the company increasing production in Austin, Texas, and in Germany. Additionally, in the year ago quarter, deliveries were dampened in China by Covid-19 restrictions. However, the strong delivery results alleviated fears that Tesla could face excessive inventory. The results combined with Tesla’s upcoming launch of its Cybertruck model, also fueled optimism that Tesla can continue to grow its deliveries in the coming quarters. Tesla deliveries jumped after the company reduced its prices and added three months of free charging. Additionally, new rules provide buyers of certain EVs with a $7,500 tax credit. Tesla is scheduled to announce earnings and other results on July 19. While some investors believe Tesla’s strong deliveries point to its potential for growth in the coming quarters, the company faces stiff competition from BYD. Of the 700,244 cars BYD sold in the second quarter, half were EVs.

Services Industries Could Follow Manufacturing Into Contraction Territory

Services have therefore been less susceptible to the Federal Reserve’s rate hikes. Nevertheless, the services industries are likely to slow as consumers deplete their Covid-19 stimulus savings and resume college tuition payments in October following last week’s Supreme Court decision to throw out college debt forgiveness.

While investors have bid up equity valuations based on expectations of strong earnings growth amidst a soft landing, the continued decline in manufacturing doesn’t bode well for the bottom line. Manufacturing weakness is clearly beneficial for fighting inflation because it illustrates slowing demand by consumers; however, this weakness is likely to spread into the services sectors, which despite decelerating modestly are still strong and supporting price increases. Unlike the services industries, spending on goods is highly influenced by interest rates as consumers typically tap debt for buying big-ticket items. Services have therefore been less susceptible to the Federal Reserve’s rate hikes. Nevertheless, the services industries are likely to slow as consumers deplete their Covid-19 stimulus savings and resume college tuition payments in October following last week’s Supreme Court decision to throw out college debt forgiveness. As weakness spreads to the overall economy with the Fed hiking concurrently, downside risks to economic performance and earnings remain elevated.

Visit Traders’ Academy to Learn More about ISM-Manufacturing, Payroll Employment and Other Economic Indicators.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.

Leave a Reply

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Thanks. Good stuff!

Thank you, Rebecca. We hope you’ll continue to follow Traders’ Insight.

Thank you for this informative article! I look forward to future Traders’ Insight articles.

Thank you for commenting, Julio! We are happy to hear you will continue to follow Traders’ Insight!