The homebuilding industry continues to weaken under the strain of higher interest rates, tighter credit conditions and elevated prices for existing homes, but new data is painting a mixed message: housing starts dropped significantly in August while applications for new projects increased. Separately, data released yesterday indicates that homebuilder sentiment has declined as median household incomes relative to monthly mortgage payments remain out of whack. In the meantime, stocks and bonds are selling off on the eve of a Fed meeting that will feature updates to the central bank’s summary of economic projections.

Groundbreaking Declines in August

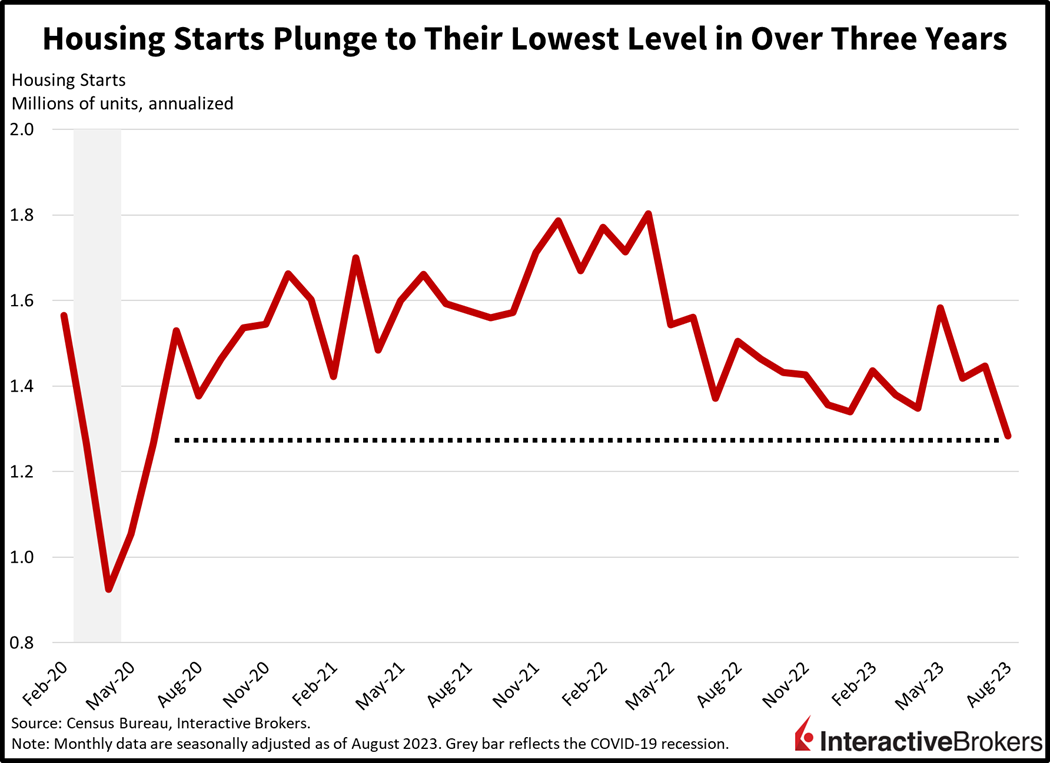

August housing starts fell to 1.283 million seasonally adjusted annualized units (SAAU), much less than the median forecast of 1.44 million and July’s 1.447 million. The result marks the lowest level since July 2020. The 11.3% month-over-month (m/m) decline was driven by a sharp 26.3% drop in apartment construction and a 4.3% contraction in single-family builds. The Western region fared the worst with a 28.9% decline while the Midwest and South fell 7.5% and 4.9%, respectively. The Northeast offset some of the damage, with activity rising 1.0% during the period.

August permits provided some relief, however, coming in at 1.543 million SAAU, trouncing expectations calling for 1.443 million which would’ve been unchanged from the previous month. Permits tell a much different story than starts, coming in at the highest level since last October. Of course, filing a permit application is much cheaper than actually beginning construction. The 6.9% m/m growth in permits was supported by a 14.8% uptick in apartment buildings and a 2.0% increase in single-family residences. Permits benefited from growth spanning from sea to shining sea, with activity in the Midwest, West, Northeast and Southern regions rising 14.3%, 9.4%, 9.3% and 3.9% m/m.

Homebuilders Bemoan Lack of Buyers

Homebuilder sentiment plummeted to a level not seen since April as the volume of nest seekers declined in response to low real estate affordability. The National Association of Home Builders/Wells Fargo homebuilder sentiment index released yesterday fell from 50 in August to only 45 for September. While it is the second consecutive monthly decline, it fell short of the consensus expectation to match August’s results. NAHB maintains that potential buyers are waiting for mortgage rates, which are now north of 7%, to decline. Expectations for sales in the coming six months fell from 55 to 49 and 32% of survey respondents said they lowered prices this month, which is the highest percentage since December. On a positive note, homebuilders’ recent quarterly earnings calls included observations that supply chains, materials costs and labor market conditions have improved and demand is being supported by a shortage of homes in the resale market. Existing homeowners are reluctant to relocate because buying a home in a new location would require financing with mortgages that have substantially higher interest rates than many existing mortgages, resulting in monthly expenses climbing by the thousands.

Investors Fret Over High Interest Rates

Markets are tanking this morning as the threat of higher-for-longer interest rates negatively affects not just the real estate sector, but also equity valuations and earnings prospects across the economy. Leading the way lower is rate sensitive technology, with the Nasdaq Composite Index down 0.9% while the S&P 500, Dow Jones Industrial and Russell 2000 indices are lower by 0.7%, 0.7% and 0.4%. Nothing is working from a sector perspective, not even defensives, with the consumer discretionary, homebuilder and technology sectors down the most. Bond yields are climbing in anticipation of tomorrow’s important Fed decision and release of its summary of economic projections, with yields for 2- and 10-year Treasury maturities 2 to 3 basis points (bp) from their year-to-date highs. The 2- and 10-year are up 3 bps to 5.09% and 4.34%. The dollar is roughly unchanged as the greenback appreciates relative to the euro, yuan, yen and franc, while depreciating in comparison to the pound sterling and the Canadian and Aussie dollars. WTI Crude oil is taking a break after reaching new year-to-date highs earlier in the session on the back of constrained supplies from OPEC +, dwindling inventories in the States and hotter-than-expected data out of China. Still, it’s trading at a high, $91.73 per barrel, down 48 cents from the previous close. Furthermore, the oil futures curve is in backwardation, with spot contracts from the current month pricing much higher than later months due to expectations of supply shortcomings.

Higher Interest Rates Kick In

As the Federal Reserve meets today and tomorrow to assess the impact of its rate hikes and balance sheet reduction upon the economy, the housing market is likely to be an important consideration and a key indicator that monetary policy tightening is slowing economic growth and cooling the job market. The Fed is also likely to assess the impact of higher mortgage interest rates on housing affordability, which is at a near-record low. While this low affordability is an issue across age groups, it is particularly noticeable among Gen Z and Millennials, according to a recent survey by real estate brokerage Redfin. Among survey respondents, 18% of millennials and 13% of Gen Z individuals believe they will never be able to afford a home. Among Gen Z and Millennials planning to purchase homes, roughly one-fourth will use a cash gift from a family member for down payments while others are working two jobs to save for a down payment. Indeed, home prices and rents are a significant driver of inflation and quality of life.

Visit Traders’ Academy to Learn More About Building Permits and Other Economic Indicators.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.

Leave a Reply

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

thanks for your study and reports!