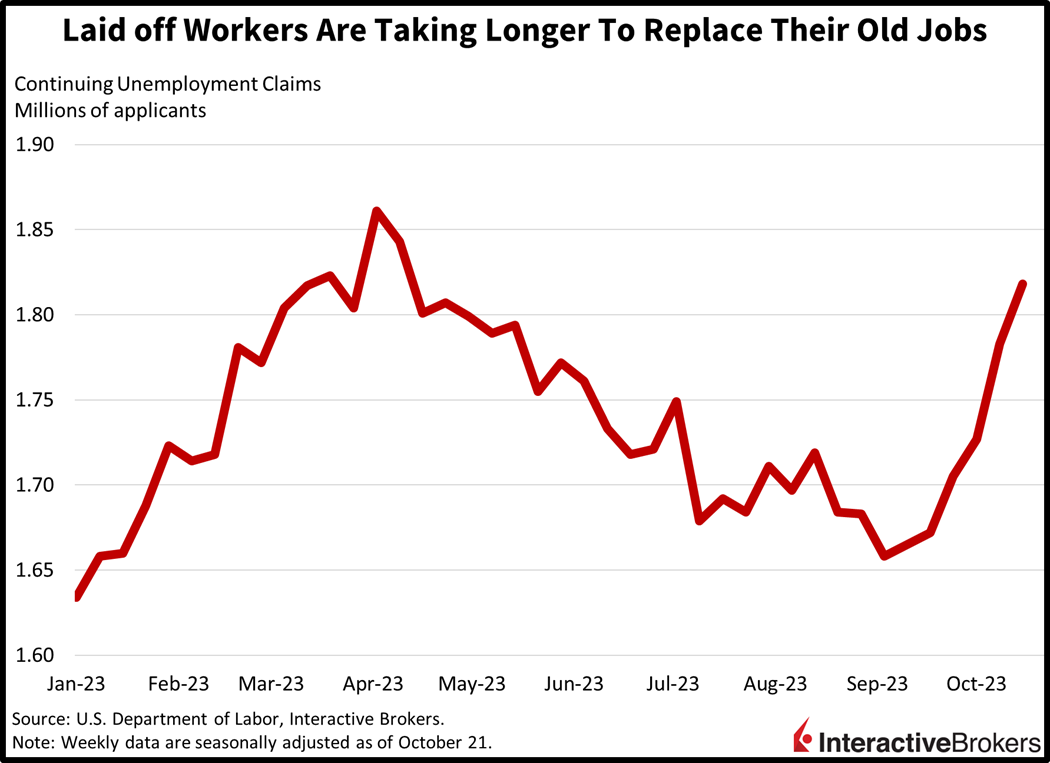

Investors are giving a thumbs up to Federal Reserve Chairman Jerome Powell’s commentary yesterday, causing equities to rally on optimism that the central bank is done hiking. However, much of his speech focused on how bringing down inflation is the Fed’s main objective. This morning’s report that continuing unemployment claims have increased for a sixth-consecutive week, which signaled an easing of the tight labor market, further emboldened market bulls during what is typically a strong seasonal period for equities.

Fed Gets a Tailwind in Inflation Battle

Perhaps the greatest dovish tilt in yesterday’s presentation was when Powell mentioned that rising yields on the long-end of the Treasury curve are doing some of the central bank’s work. He also remarked that the risks of over tightening monetary policy are in better alignment with the risks of under tightening, signaling reduced hawkishness going forward. Powell did preserve optionality, however, by leaving the door open for one more hike. Additionally, he emphasized that the Fed needs to be sure that favorable inflation data is pointing to a persistent decline in price gains before it can consider loosening monetary policy. Meanwhile, market players believe the Fed is done tightening and are front running the possibility of interest rate cuts in the near future even though Powell reminded the crowd that rate reductions are not a part of Fed members’ conversations.

Unemployment Stints Grow Longer

On the labor market front, this morning’s unemployment claim release depicted a persistent rise in continuing unemployment claims, which have increased for six-consecutive weeks. While initial unemployment claims remained subdued, the rise in continuing claims points to laid-off workers taking longer to replace their old jobs. Continuing claims rose to 1.818 million for the week ended October 21, the loftiest level since April. The figure also arrived higher than the 1.8 million expected by analysts and the previous week’s 1.783 million. Initial unemployment claims rose to 217,000 for the week ended October 28, higher than the 210,000 consensus and the previous week’s 212,000.

Labor Slack and Productivity Help Inflation

In another deflationary development this morning, third-quarter productivity rose at the fastest pace since the second quarter of 2020. Nonfarm productivity rose 4.7% quarter-over-quarter (q/q) annualized, higher than the 4.1% estimate and the previous quarter’s 3.6%. Increased labor supply and improved productivity put downward pressure on inflation, as it alleviates cost pressures on companies through balanced wage bargaining and lighter headcounts at the margin.

Equity and Bond Bulls Pounce

Stocks and bonds are rallying today, with market players taking a victory lap. All major U.S. indices are firmly in the green, with the Russell 2000, S&P 500, Nasdaq Composite and Dow Jones Industrial indices up 1.9%, 1.5%, 1.5% and 1.2%, respectively. All sectors are higher by at least 1% with real estate and consumer discretionary leading with gains of 3.3% and 2.2%. Treasury yields are close to the flatline on the short-end but tumbling at the long-end with the 2-year maturity up 2 basis points (bps) to 4.98% while the 10-year tumbles 13 bps to 4.66%. Lower yields in aggregate are weighing heavily on the dollar, with the greenback’s Index down 46 bps to 106.18. Indeed, the U.S. currency is down against the euro, pound sterling, franc, yen, yuan and Aussie and Canadian dollars. Crude oil is looking to break a three-day losing streak, as risk-on sentiments amidst lower interest rates drive the commodity higher. WTI crude is up 1% or $0.81 per barrel to $81.66.

High Interest Rates Hurt Solar Industry as Consumers Travel and Shop Online

Higher financing costs have become a headwind for the solar energy industry, but have yet to impact traveling and e-commerce as illustrated by the following examples:

- Marriott International reported strong third-quarter results that included robust demand for its hotel rooms and provided an optimistic outlook for revenues. In the third quarter, Marriott generated an adjusted earnings per share (EPS) of $2.11, barely above the $2.10 anticipated by analysts. Its revenues of $5.93 billion, however, significantly exceeded the consensus estimate of $5.89 billion. The company increased its international revenue per available room (RevPar) 22% with RevPar growth in Asia ex China increasing 36% y/y. In the U.S. & Canada RevPar grew by more than 4%, a result of higher prices and increased occupancy. The company expects robust demand for its facilities to continue and it increased its full-year 2023 worldwide RevPAR growth guidance to 14% to 15% y/y. It previously estimated an increase of between 12% and 14%. It said it now expects to return $4.3 billion to $4.5 billion to shareholders through share repurchases and dividends.

- Shopify, which provides tools for businesses to sell products online, strengthened its guidance after announcing third-quarter results that beat analyst expectations. The news sent the company’s stock price soaring 20% this morning. Its adjusted EPS of $0.24 substantially beat the analyst consensus expectation of $0.14 and climbed from a $0.02 loss per share in the year-ago quarter. Its revenue of $1.714 billion climbed y/y from $1.366 billion and significantly beat the analyst consensus expectation of $1.61 billion. Its earnings were supported, in part, by the company laying off 20% of its workforce this spring. However, the company experienced a 22% increase in the value of merchandise sold on its platform. The company also expects its 2023 revenue to increase in the mid-twenties percentage range.

- Sunrun, which provides residential solar energy and battery systems, reported that its earnings were challenged by higher interest rates. Sunrun’s third-quarter revenues totaled $563 million and declined from $631 million in the year ago quarter. Its net loss attributable to shareholders was $1.06 billion, or $4.92 per share, a result of the company taking a $1.2 billion impairment charge following the decline in the market capitalization of Vivant Solar, which Sunrun acquired in October 2020. Sunrun offers solar and battery system installations as flat-out purchases or through lease arrangements. Higher interest rates, however, have extended the amount of time that a solar system will require to pay for savings on utility bills, making purchases of the systems less attractive for homeowners. Additionally, higher interest rates make lease options less profitable for solar operators because they increase companies’ financing costs, which erodes profits generated from the lease agreements. Sunrun is responding by increasing its focus on installing battery storage systems, which have more attractive profit margins than solar systems. Additionally, in some areas, batteries can be used when utilities charge higher peak demand rates, improving the value proposition of energy storage systems.

Investors Wait for Apple and Payrolls

Looking ahead to this evening and tomorrow, earnings from Apple followed by Friday’s Jobs report are likely to be significant drivers of investor sentiment. With Apple being the last and largest of the magnificent seven tech giants to report, a robust earnings report alongside softer than expected payrolls are likely to propel the bulls further forward. A disappointment, however, may bruise the recent stock rally, and turn the focus to the negative effects of the Fed’s previous rate hikes and balance sheet runoff. For tomorrow’s nonfarm payrolls, I’m expecting 155,000 jobs, 0.2% growth in average hourly earnings and a 3.8% unemployment rate.

Visit Traders’ Academy to Learn More About Unemployment Claims and Other Economic Indicators.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.

Leave a Reply

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Excellent coverage, Thanks.

Nothing makes us happier than satisfied readers.