Investors are taking weaker-than-expected economic data in stride while waiting for the Federal Reserve to disclose its interest rate decision at 2:00 pm today. Employment and manufacturing data from ADP and ISM reflect an economy that is feeling the long and variable effects of tighter monetary policy, as bulls cross their fingers for a light-hearted Powell this afternoon. Meanwhile, corporate earnings continue to come in mixed, with considerable disparity in businesses’ ability to increase prices.

Employers Hire Slowly

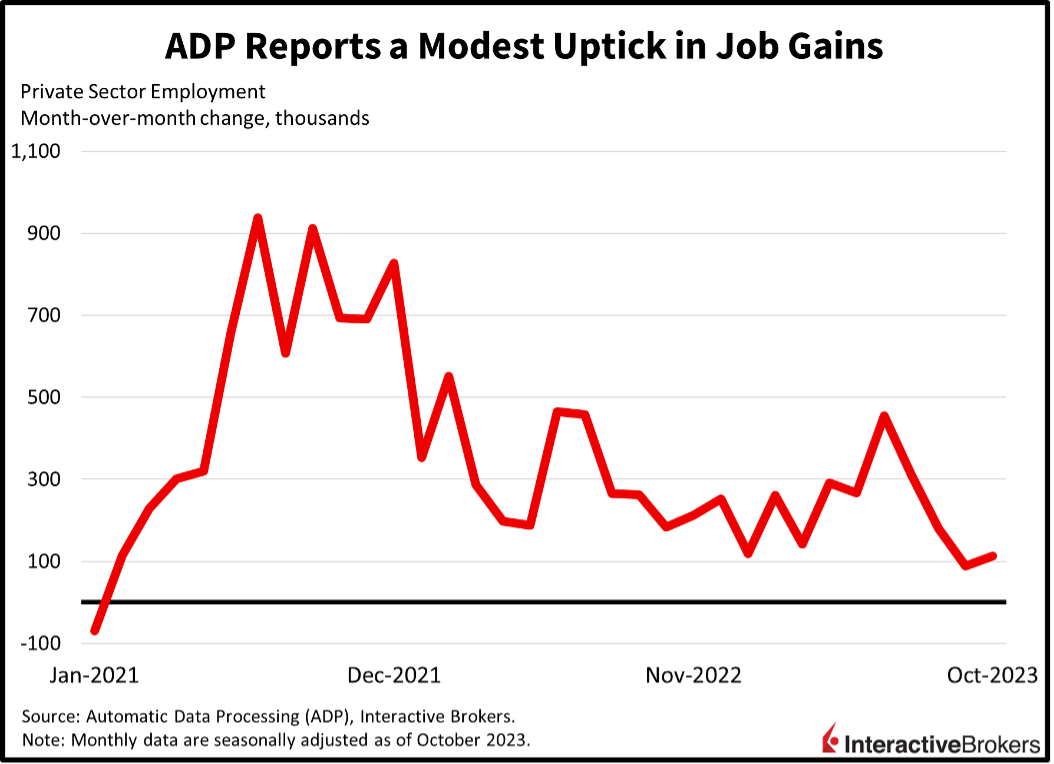

Hiring rose at a subdued pace last month, according to payroll processing company Automatic Data Processing (ADP). Private-sector employment rose 113,000 in October, much cooler than projections of 150,000. Job gains did pick up from September’s 89,000 figure, however.

Employment additions occurred across all firm sizes as well as most sectors. Mid-sized firms (50-499 employees), small firms (1-49 employees) and large firms (500+ employees) added 78,000, 19,000 and 18,000 jobs, respectively. Sectoral hiring had a non-cyclical tilt once again, with education and health services adding 45,000 which represents 40% of total job gains. The trade, transportation and utilities, financial activities, and leisure and hospitality sectors added 35,000, 21,000 and 17,000. The construction and manufacturing sectors added less than 10,000 jobs. The professional and business services, natural resources and mining and other services sectors lost 10,000, 1,000 and 1,000 jobs while the information sector came in unchanged on the month. Wage gains also slowed, with the year-over-year (y/y) growth rate for job stayers and job changers dropping to 5.7% and 8.4% from 5.9% and 9%. October saw the slowest y/y gains since July 2021 for job-changers and October 2021 for job-stayers.

Manufacturing Continues to Contract

While the job market is still strong, manufacturing conditions are continuing to weaken, with October representing the 12th-consecutive month of contraction for the sector, according to the Institute for Supply Management (ISM). The organization’s Purchasing Managers’ Index for manufacturing declined to 46.7, a sharp drop from September’s 49 level. New orders were anemic for domestic and international destinations, pushing manufacturers to work down their backlogs, reduce their inventories and discount prices. Weak demand also weighed on employment, with the segment registering a score of 46.8, considerably below the contraction-expansion threshold of 50.

Help Wanted Signs Remain

Job openings increased marginally in September as employers remained committed to hiring for the right candidates. For hire signs increased to 9.553 million from the 9.497 million recorded in August, according to this morning’s Bureau of Labor Statistics Job Openings and Labor Turnover Survey. The figure beat expectations of 9.25 million. Job openings rose mostly in the leisure and hospitality, finance and trade, transportation and utilities sectors with gains of 181,000, 94,000 and 88,000. Job openings declined the most in the other services, professional and business services and government sectors with reductions of 124,000, 105,000 and 81,000. Separations and quits were little changed month-over-month (m/m).

Bulls Move On 200-Day Moving Average

Stocks are up for the third consecutive day as bond yields plunge following this morning’s weaker economic data. Relief in yields is propelling rate-sensitive technology shares, with the tech-heavy Nasdaq Composite Index up 1% while the S&P 500, Dow Jones Industrial and Russell 2000 gain 0.7%, 0.6% and 0.2%. Sectoral breadth is positive with all sectors higher as technology, energy and communication services lead with gains of 1.2%, 1.1% and 0.9%. Market bulls are attempting to take out the pivotal 200-day moving average which lies at 4243, just 15 points higher at the moment, and preserve this year’s rally. Bond yields are tumbling across the curve, with the 2- and 10-year Treasury maturities down 9 and 13 basis points (bps) to 5% and 4.8%. The dollar is higher, as the greenback gains against the yen, yuan, pound sterling, franc and Aussie and Canadian dollar while it’s down relative to the euro. The greenback’s Index is up 6 bps to 106.78. The yen is down to a 33-year low versus the dollar, as the Bank of Japan’s tightening efforts are deemed ineffective from the perspective of market players. Oil prices are higher despite a U.S. inventory build as concerns about potential supply disruptions resulting from the Middle East conflict attracts buyers. WTI crude is up $1.55 per barrel or 1.9% to $82.86.

Today’s Earnings Insights

The personal computer market has languished following remote workers splurging on home office equipment during the Covid-19 pandemic. The personal computer market appears to have bounced back, however, according to AMD, while earnings reports from Norwegian Cruise Lines and Heinz-Kraft depict the wide disparity in businesses’ ability to increase their prices in response to higher input costs.

AMD reported strong third-quarter results that included increased demand for personal computer processors, but its overall guidance was weaker than expected. At a time when consumers’ finances are stretched and many businesses are seeking to contain costs, revenue for AMD’s client group rose 42% y/y to $1.5 billion, a result of strong sales of PC chips. Its data center sales, however, were flat y/y. Sales for its gaming products declined 8% y/y and its networking technology sales were also weak. However, the company’s adjusted earnings per share (EPS) of $0.70 cents beat the analyst consensus expectation of $0.68 cents and climbed 4% from the year-ago quarter, when the company produced an EPS of $0.67. AMD’s revenue of $5.8 billion beat the consensus expectation of $5.7 billion and climbed 4% y/y from $5.56 billion. The company expects current-quarter sales to total about $6.1 billion, which missed the $6.7 billion expectation of analysts.

Norwegian Cruise Lines provided an encouraging view of consumer spending but lowered its guidance, citing higher fuel costs. The cruise operator has enjoyed resilient demand from customers despite having increased its ticket prices. It previously expected a full-year adjusted EPS of $0.80 but has reduced its outlook to $0.73. In addition to higher fuel costs, the company expects the Hamas-Israel conflict and unfavorable currency exchange rates to weigh on results. The company also said it anticipates a current-quarter adjusted loss of $0.15 compared to the consensus expectation that the company would break even. For the third-quarter, however, Norwegian Cruise Lines generated revenue of $2.54 billion, which beat analysts’ expectations and increased from $1.6 billion in the year-ago quarter. Onboard purchases and other sales accounted for $300 million of the y/y increase. It generated $345.9 million in profits, up from a $295 million loss in the third quarter of last year. Its adjusted EPS of $0.76 beat the consensus expectation of $0.69 and swung from a loss of $0.64 a share in the year-ago quarter.

Kraft-Heinz, however, has been less successful than Norwegian Cruise Lines with price increases as shown by its sales volume declining. Kraft-Heinz is well known for making ketchup, Philadelphia Cream Cheese and Jell-O and its net sales of $6.57 billion missed the analyst consensus expectation of $6.72 billion despite increasing from $6.51 billion y/y. The company said its sales volumes suffered from consumers pushing back on higher prices for condiments and packaged meals. Nevertheless, its price increases and supply chain improvements resulted in the company producing an adjusted EPS of $0.72, exceeding the consensus expectation of $0.66. The company forecasted full-year adjusted profit in the range of $2.91 to $2.99 per share, compared with its earlier guidance of $2.83 to $2.91.

Hawkish Pause

The market is widely expecting an interest rate pause from the Fed this afternoon, with investors firmly focusing on the monetary policy outlook. Top of mind will be if Powell leaves the door open for another hike in December or January or if he emphasizes the patient, wait and see approach. Any hint of monetary policy easing, or rate cuts, will be celebrated by markets and lead to a renewed loosening in financial conditions alongside an uptick in inflationary pressures. Market bulls are hoping that this morning’s weaker data moves the needle towards the doves. Bears meanwhile, are hoping that Powell countlessly repeats, “we will keep at it until the job is done”.

Visit Traders’ Academy to Learn More About ISM-Manufacturing and Other Economic Indicators.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.