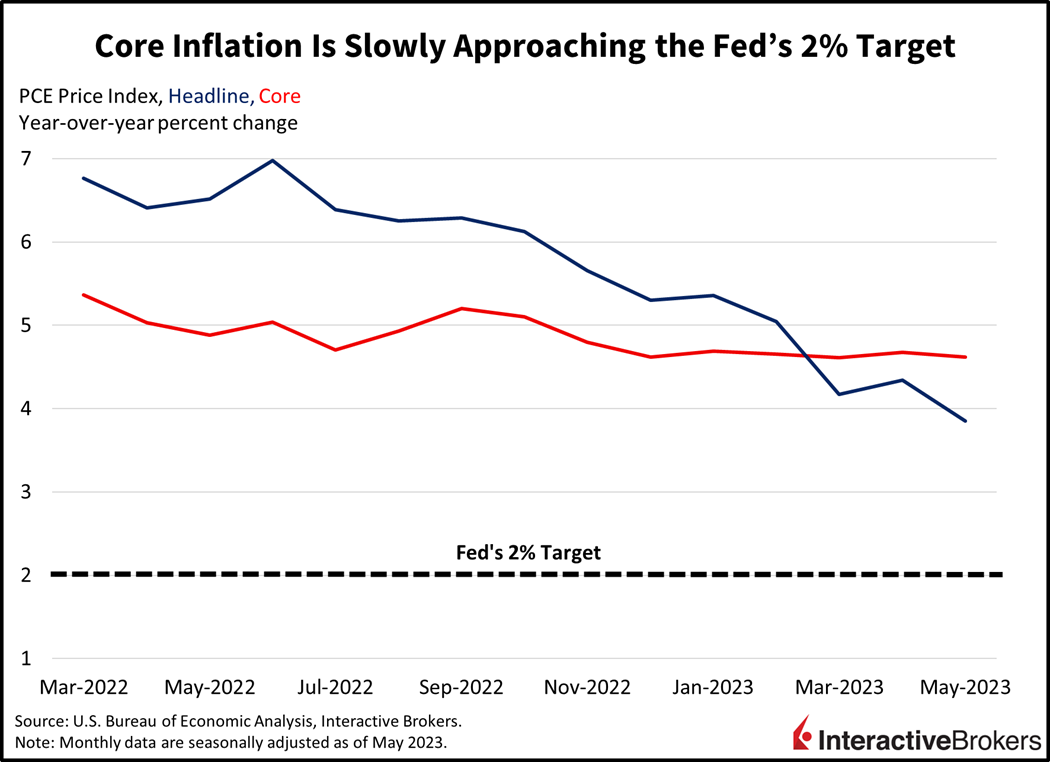

Inflation is continuing to moderate but at a snail’s pace with today’s Personal Consumption Expenditures price index depicting only modest progress in the battle against price gains during May. The rate of improvement illustrates that price gains are highly persistent and slowing at a pace that is likely to contribute to the Federal Reserve continuing with its hawkish monetary policy tightening just two days after Fed Chairman Jerome Powell said the fed funds rate will probably stay elevated even after the 2% inflation target is reached.

For May, the core PCE index, which excludes energy and food costs and is a favorite among Fed policymakers for assessing inflation, increased 0.3% month-over-month (m/m), matching the consensus expectation and declining slightly from the 0.4% rate in April. On a year-over-year (y/y) basis, the index climbed 4.6%, a 10-basis point (bp) decline from April. The broader headline number was less dramatic, increasing only 0.1% in May and 3.8% y/y. In April, the headline number increased 0.4% m/m and 4.3% y/y.

Also in May, individuals’ income increased 0.4%, exceeding the consensus forecast of 0.3%. On an encouraging note for inflation, consumers showed restraint in spending which increased only 0.1% in May, trailing the consensus forecast of 0.2% and resulting in the personal savings rate climbing from 4.3% to 4.6%.

Individuals increased their spending in May by $18.9 billion with spending on services increasing by $52.0 billion while spending on goods declined by $33.1 billion. Spending for outpatient health care, international travel and air travel drove the biggest increases in the services sector.

While individuals increased their savings rates, their view of the economy also strengthened with today’s final University of Michigan Consumer Sentiment number for June increasing from the initial estimate of 63.9 to a revised 64.4. The final number is up 9% from May while the year-ahead economic outlook is up 28% from May. While consumers are struggling with high prices, their optimism has been supported by the debt ceiling resolution and softening inflation. At the same time, many consumers can celebrate increased asset values—a welcome change after experiencing losses last year, when the S&P 500 Index dealt a punishing 18.11% loss. However, so far this year it’s up 15%. Home values have also started to improve. After climbing to an all-time-high in June of last year, the S&P Case Shiller U.S. National Home Price Index declined for six consecutive months in the second half of 2022 and then in January 2023 as mortgage interest rates increased and home affordability worsened. Based on the most recent data available, which is for April, the index subsequently climbed and accelerated for three consecutive months bringing home prices up 1% year-to-date (YTD).

While consumers can celebrate increasing home values and equity prices, those who had qualified for student loan forgiveness were hit with a setback today when the Supreme Court struck down President Biden’s executive order that would have negated up to $20,000 per person in tuition debt. The forgiveness program would have extended to an estimated 40 million borrowers and involved approximately $400 billion.

Markets are rallying this morning as we approach the mid-year point with equities higher and bond yields lower. The S&P 500 Index is up 1.1% after slipping from a fresh YTD high of 4449.19 this morning. Technology is leading while all sectors except real estate are participating. The Nasdaq Composite Index is up 1.4% while the Dow Jones Industrial Average and the Russell 2000 Index are each up 0.6%. Bond yields are down, but not significantly after today’s PCE release reflected largely in-line data. With yields ranging from unchanged to down 4 basis points, the 2-year maturity is unchanged at 4.88% while the 10-year is down 4 bps to 3.82%. With softer odds of a second consecutive rate hike at the September Fed meeting looming at 19% following July’s widely expected hike, the Dollar Index is down 43 bps to 102.90. Risk-on sentiment is spreading to energy markets as well with WTI crude oil up 1.4% to $70.83 per barrel. Crude oil is on track to achieve its first monthly price gain of the year and hovering near breakeven prices for some domestic producers.

Sentiment Improves but Spending Clout Weakens

Data for May and June illustrate a paradox that could lead to a decline in corporate earnings and an easing of consumer demand that has been propelling inflation. Consumer sentiment has strengthened while pandemic-era savings relative to increases in wages has weakened. The resulting increase in the savings rate is positive for consumers’ financial well-being but could point to individuals becoming cautious as they deplete payments from record levels of fiscal stimulus intended to prevent the Covid-19 pandemic recession of 2020 from worsening. At the same time, student loan borrowers who haven’t had to make debt payments since 2020 will now have to manage the additional burden of making loan payments in October. The combination of dwindling fiscal stimulus and having to resume loan payments could cause consumers to curtail their spending, which is already losing momentum. Meanwhile, investors are assessing expectations that the Federal Reserve will keep interest rates elevated even

Investors who have driven up valuations based on expectations of strong earnings growth are likely to struggle with the impact of softening revenues on earnings while living in a world with the 2- and 10-year yields north of 5% and 4%.

when inflation hits the central bank’s 2% target, which policymakers anticipate won’t happen until 2025. Investors who have driven up valuations based on expectations of strong earnings growth are likely to struggle with the impact of softening revenues on earnings while living in a world with the 2- and 10-year yields north of 5% and 4%. Visit Traders’ Academy to Learn More about Personal Income & Outlays and Other Economic Indicators.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.

Leave a Reply

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Your ability to boil down many data points into an understandable and actionable capsule is very helpful to me.

Thanks

Thank you for commenting, Roy! We appreciate it.