Investors are carefully listening to Fed Chairman Jerome Powell’s remarks on Capitol Hill as they digest a round of strong labor market data. Powell is emphasizing that the committee on monetary policy wants more positive developments on inflation before tilting toward a less restrictive posture. Meanwhile, ADP and BLS data reflect persistent strength in the job market even as figures arrived roughly in-line with projections. Indeed, hiring accelerated and wage pressures remained lofty while the decline in job openings has slowed significantly. Against this backdrop, stocks are recovering from yesterday’s selloff while yields decline as Powell acknowledges that the likelihood of another rate hike is low.

Strong Demand for Workers Continues

The private sector accelerated its hiring in February while providing robust wage gains. Private employers added 140,000 jobs last month, narrowly missing expectations of 150,000 but accelerating from January’s 111,000. Employment increases were broad across sectors with leisure and hospitality leading with 41,000 additions. The construction sector added 28,000 positions while trade, transportation and utilities gained 24,000. Meanwhile, financial activities gained 17,000 and the other services category and the education and health services segment added at more tempered rates of 14,000 and 11,000, respectively. Trailing were the manufacturing category and professional and business services segment which both added below 10,000 workers while the resources and mining category and information sector shed 4,000 and 2,000, respectively. Across company sizes, headcount growth was dominated by mid- (50-499 employees) and large-sized (500+ employees) businesses as the segments added 69,000 and 61,000, respectively, while small businesses (1-49 employees) added just 13,000.

Workers Get a Raise

Larger paychecks continued to be required to incentivize workers to swap companies, with job leavers widening their pay growth gap relative to their job-staying counterparts. Indeed, wage bumps accelerated for job changers, as the segment sported a 7.6% year-over-year (y/y) growth rate relative to January’s 7.2%. Compensation increases for job stayers decelerated to its slowest pace since August 2021, meanwhile, descending from a 5.3% y/y clip to 5.1% during the period.

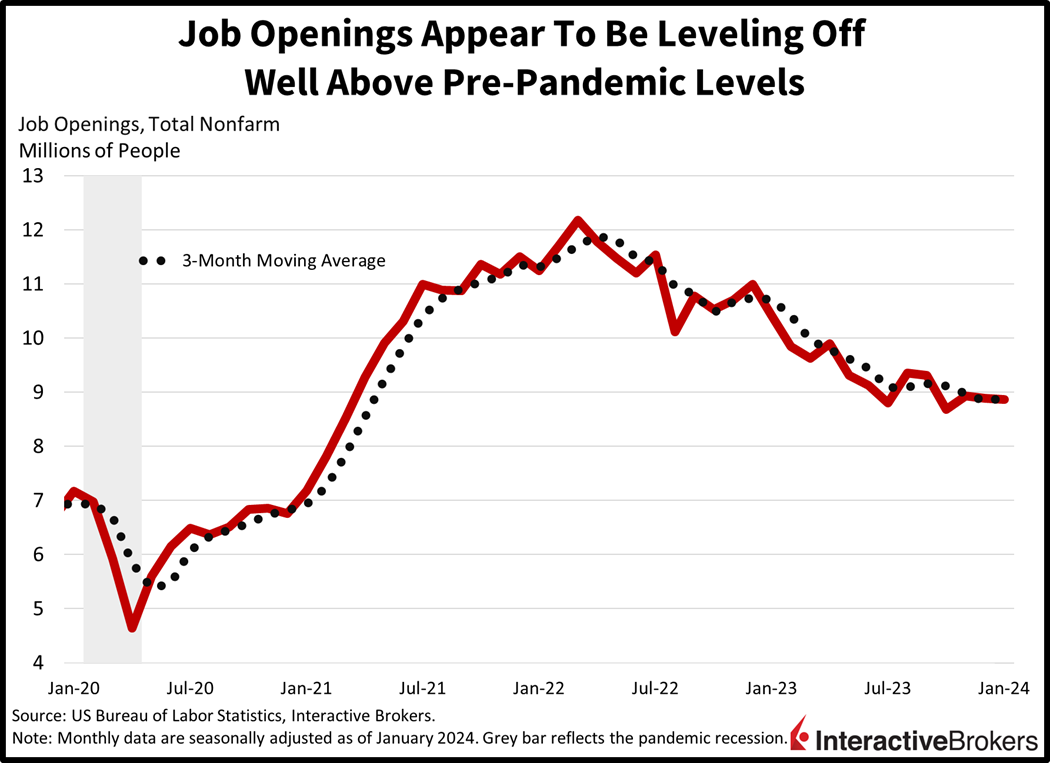

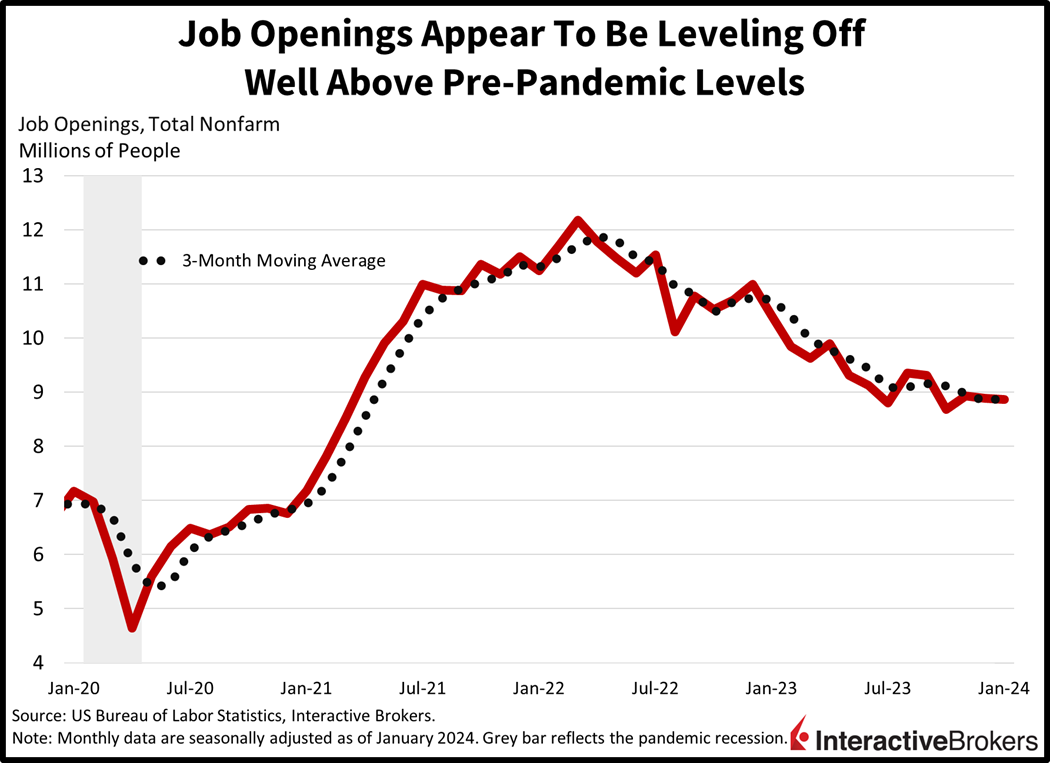

Government Data Depicts Tight Job Market

Job openings declined slightly at the start of the year as labor conditions loosened marginally. January job openings slipped to 8.863 million, slightly below estimates of 8.9 million. January’s figure was just 26,000 above December’s 8.889 million job openings but still roughly 2 million above the pre-pandemic level. Job quits, released in the same JOLTS report from the US Bureau of Labor Statistics, also reflected softer labor conditions. Workers quit their jobs at a slower rate during the period, from 3.439 million job resignations in December to 3.385 million in January, indicating workers’ lower confidence in their ability to replace their employers. The job quits trend has been consistent with rising continuing unemployment claims, which have reclaimed the pivotal 1.9 million level. Tomorrow’s unemployment claims report will provide a timely update of these trends as real-time job vacancy data continues to point to modest downward shifts.

Inventory Management Increasingly Important

As consumers rein in spending, retailers’ inventory management, social media marketing and the ability to profitably provide bargains have become increasingly important. Separately, the tech sector continues to experience earnings growth in some pockets as illustrated by CrowdStrike. Those trends were demonstrated by the following examples:

- Abercrombie & Fitch beat fiscal fourth-quarter estimates for sales and revenues and provided guidance that exceeded the analyst consensus expectation. For the current quarter, it expects sales to grow in the low double-digit percent range, significantly stronger than the analyst expectation. It expects current-year sales to increase 4% to 6% while analysts anticipated 4%. Abercrombie, which has emphasized social media marketing through influencers, attributed its strong quarter to tight inventory control, financial discipline and staying close to customers.

- Ross Stores, which operates Ross Dress for Less and dd’s Discounts, posted results that grew y/y and surpassed the analyst consensus expectation. Ross attributed the strong results to customers increasingly seeking bargains for branded items and the company making its operations more efficient.

- Foot Locker beat expectations for revenue and earnings after adjusting results for one-time expenses. On a non-adjusted basis, however, the company experienced a loss while in the year-ago quarter it posted a profit. The company also extended its target for becoming profitable by two years to 2028, which caused its share price to drop 20% in premarket trading. Foot Locker’s earnings were hurt by the company marking down its prices to reduce its inventory.

- Nordstrom beat expectations for earnings and revenue but said an excessive amount of inventory for the wrong products caused it to mark down its prices and sales were weak at Nordstrom Rack, its off-price retailer. Its share price dropped approximately 10% after the company estimated its full-year revenue would range from a decline of 2% to an increase of 1% y/y.

- CrowdStrike, which provides cybersecurity, beat earnings and revenue expectations and provided better-than-expected guidance. For the quarter ended January 31, CrowdStrike produced net income of $54 million compared to a loss of $48 million in the year-ago quarter. Additionally, its fiscal first-quarter revenue and earnings guidance exceeded expectations. The company believes some of its future growth will be driven by its user friendly platform, rising cyberattacks, new regulations and artificial intelligence.

Markets Rally on Easing Fears of Another Fed Funds Hike

Markets are breathing a sigh of relief as Powell alludes to the current fed funds rate being at peak. All major US equity indices are up with the Russell 2000, Nasdaq Composite, S&P 500 and Dow Jones Industrial indices having gained 0.8%, 0.7%, 0.7% and 0.4%. Sectoral breadth is terrific with all segments higher as energy, utilities and technology lead: they’re up 1.1%, 1.1% and 1%. Energy is leading as oil traders bid up the commodity in response to stronger Fed easing expectations and Riyadh’s raising the prices at which they sell oil to Asian countries. WTI crude oil is up a sharp 2.9%, or $2.26, to $80.35 a barrel. In fixed-income land, bonds are catching a bid and are being led by the long-end. The 2- and 10-year Treasury maturities are trading at 4.55% and 4.11%, 1 and 4 basis points (bps) lower on the session. The dollar is a lot lower as currency traders cheer “peak fed funds” with its index down 41 bps to 103.34. The US currency is down relative to all of its major developed market counterparts, including the euro, pound sterling, franc, yen, yuan and Aussie and Canadian dollars.

Hot January and February Data May Shift the “Dots”

While Powell didn’t commit to interest rate reductions in the near future, his positivity concerning the trajectory of inflation amidst confidence that the central bank’s current rate is likely at its peak is enough for market participants. His statements concerning a likely rate cut by the end of the year also helped investor sentiment, as they roughly align with the market’s projections for a few rate cuts by year-end. Further clarity will be provided as Powell’s testimony continues throughout tomorrow. This Friday’s nonfarm payrolls and this Tuesday’s Consumer Price Index will also provide significant information. Perhaps most importantly, however, will be the Fed’s update to its Summary of Economic Projections (dots) exactly two weeks from today. Dots that point to one or two cuts rather than the three the market is anticipating may surprise folks, with incoming data likely to move the needle following hot January data.

Visit Traders’ Academy to Learn More About ADP Employment and Other Economic Indicators.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.