Stocks are swinging between gains and losses this morning after an ISM report of persistent services sector expansion negated positive investor sentiment resulting from ADP data depicting a cooler-than-expected labor market. Treasury yields are finally catching a bid, with a sharp oil price decline dampening inflation expectations. In the meantime, continued disagreements in Congress in the aftermath of the house speaker being ousted from his role and ongoing labor conflicts continue to add uncertainty to the mix.

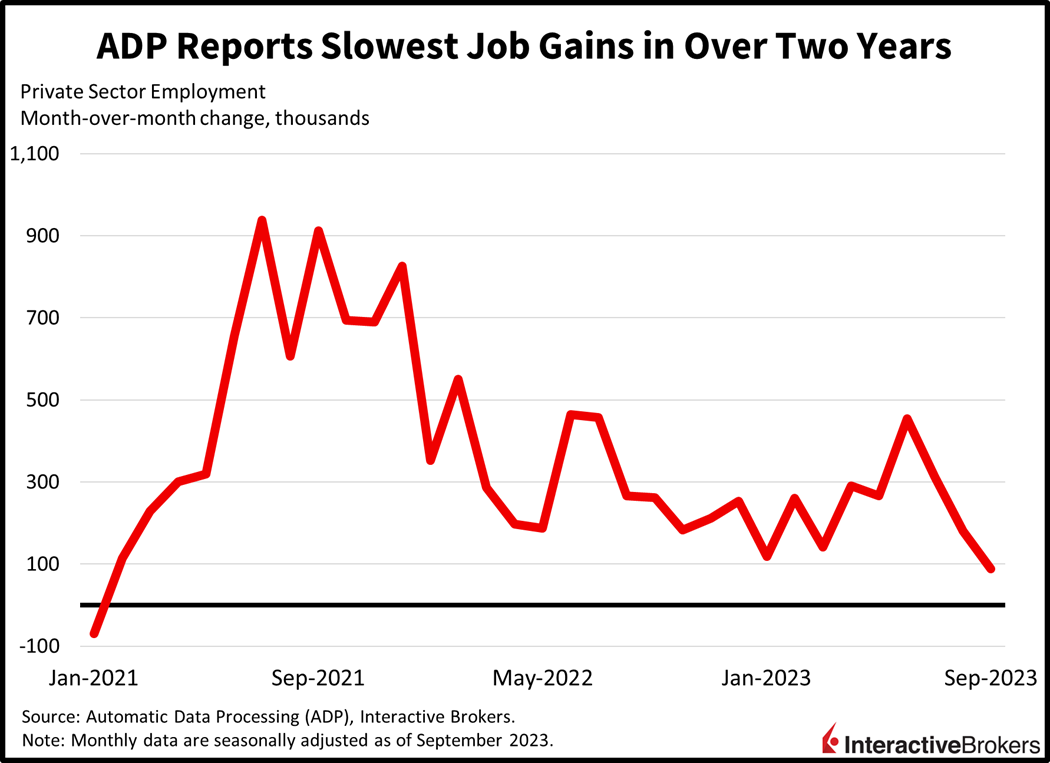

Hiring Eases in September

Payroll processor ADP this morning reported that private companies added only 89,000 employees in September, the weakest number since January of 2021, when businesses shed workers. September’s results significantly missed projections for 153,000 new hires and dropped considerably from August’s 180,000 employment gain. In September, gains were led in the following sectors that added the noted number of workers:

- Leisure and hospitality, 92,000

- Financial activities, 17,000

- Construction, 16,000

- Education and health services, 10,000

The other services, natural resources and mining, and information sectors gained at more modest levels.

Sectors that shed positions included the following:

- Professional and business services, 32,000

- Trade, transportation and utilities, 13,000

- Manufacturing, 12,000

Large businesses weighed heavily on results as they trimmed 83,000 jobs. Thankfully, small and mid-size businesses with 1-49 and 50-449 employees offset the reduction, adding 95,000 and 72,000 jobs, respectively. Wage gains cooled, an important development for a data-dependent Federal Reserve that has frequently mentioned wage pressures as a concern. Job stayers’ wages rose 5.9% year-over-year (y/y) while compensation for job changers grew 9%. This compares to 6% and 9.7% in August.

Labor Disputes Extend Across Industries

Among labor disputes, the United Auto Workers strike against the Big Three car companies continues. Ford Motor sent a counteroffer to the union that would increase pension contributions, increase wages for temporary workers and shorten the amount of time that new hires need to work before reaching higher pay levels. Meanwhile, the union continues to negotiate with General Motors and Stellantis. The Union has 25,000 of the approximately 150,000 union workers for the Big Three companies on strike.

In another development, 75,000 Kaiser Permanente workers started an expected strike today, the largest strike within the health care industry in decades. The strike involves workers in five states and Washington, D.C. Unions representing the employees are seeking a 24.5% wage increase while the healthcare organization is seeking increases ranging from 12.5% and 16%. The union also maintains that staffing shortages are causing employees to burn out.

Labor organizations are also seeking to preserve union jobs. Members of the International Chemical Workers Union employed at global biotherapeutics company CSL Behring in Bradley, Illinois, recently rejected a proposed contract because it would allow the company to continue using non-union contractors and hundreds of the company’s employees are now striking.

Services Sector—A Thorn in the Side of Jerome Powell

While the Federal Reserve may rejoice in ADP data showing moderating wage pressures, central bank Chairman Jerome Powell’s long-time nemesis—the thriving services sector—remained firm in September, its ninth-consecutive month of expansion, according to the ISM. The sector’s index score of 53.6 was in-line with expectations, but weakened slightly from August’s score of 54.5. Reduced momentum concerning customer ordering and employment weighed on the September headline. Inflationary pressures remained strong despite less demand from consumers, however, with the prices index growing to the tune of 58.9, unchanged from the previous month. Services are labor-intensive and the toughest segment to slow down from the Federal Reserve’s perspective. Additionally, Powell has noted that while goods are demonstrating disinflation, the services sector has shown stubborn inflation. He has maintained that in addition to a softening labor market, the services sector will likely have to slow so that the Fed reaches its 2% inflation goal.

Consumption in Euro Area Weakens

Euro area ordering also slowed, with August’s retail trade reflecting a 1.2% month-over-month (m/m) and 2.1% y/y contraction in volumes. August’s figures were significantly worse than expectations of -0.3% and -1.2% and July’s -0.1% and -1%. The transaction volumes of ecommerce, gasoline, food, drinks and tobacco and goods which are inflation adjusted contracted 4.5%, 3.0%, 1.2% and 0.9%. Wholesale prices did accelerate against this backdrop of slower ordering, however, rising 0.6% in August according to the Producer Price Index, matching projections.

Equities Follow a Bumpy Path

Markets are swinging back and forth today as the bears try to conquer the pivotal 4,200 level on the S&P 500 while bulls try to preserve year-to-date gains. Major indices are mixed, with the Nasdaq Composite and S&P 500 indices up 0.8% and 0.2% while the Russel 2000 and Dow Jones Industrial indices are down 0.6% and 0.1%. The consumer discretionary, technology, materials, homebuilders, communication services, real estate and consumer staples sectors are up between 0.2% and 1.3% while the other four sectors are lower by 0.1% to 2.9%. Players are scooping up Treasuries on the back of slower employment growth reflected in both ADP and ISM data, with the 2- and 10-year maturities down 9 and 6 basis points (bps) to 5.06% and 4.74%. Lower yields are weakening the dollar, with the greenback’s Index down 34 bps to 106.72. The U.S. currency is weakening relative to the pound sterling, euro, franc, Aussie dollar and yen while it gains against the yuan and Canadian dollar. Crude oil prices are getting smoked on prospects of a global economic slowdown even as Riyadh and Moscow commit to output cuts through year-end. WTI is down $3.51 or 3.93% to $85.88 per barrel.

McCarthy Loses Gavel, Generating Uncertainty for a Budget Agreement

In Washington, D.C., the House of Representatives appears to be in a state of disarray after Democrats and Republicans voted to oust Kevin McCarthy as house speaker. Legislators appointed Rep. Patrick McHenry of North Carolina to serve as interim speaker while they seek a permanent replacement for the position. Since this is the first time that a house leader has been removed from the role, legislators have no playbook for how the process should progress. As the confusion swirls throughout the house, legislators have less than 40 days to strike a budget deal before a stopgap funding measure expires. With extreme polarization in Washington, a budget agreement will be no modest accomplishment.

Navigating Uncertainty

McHenry is getting accustomed to swinging the leadership gavel while he oversees the House of Representative’s search for a permanent leader. In the private sector, employers are trying to address growing labor disputes as many workers seek wage increases that may exceed increases in the cost of living. In Washington, passing the gavel to a budget hawk could be a mixed blessing. On one hand, Washington needs to significantly curtail its spending, as rising bond yields, outstanding debt, and approximately 20 years of deficit spending are hurting confidence in fiscal policy and supporting inflation. The country’s increased debt service loads, furthermore, are funneling money away from other government initiatives. However, passing the gavel to a strong budget hawk increases the risks of legislators failing to reach a budget deal, resulting in a painful government shutdown. Meanwhile, the fate of striking unions could play a major role in inflation as higher wages increase consumers’ disposable income, which could increase demand for goods and services and eventually lead to businesses passing higher labor costs onto customers.

Visit Traders’ Academy to Learn More About Economic Indicators.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.