Recent corporate earnings reports are failing to offset growing fears about the Hamas-Israel conflict and other geopolitical tensions, causing markets to decline and oil prices to surge today. In the meantime, investors are waiting for this afternoon’s scheduled presentations from Fed speakers Waller, Williams and Bowman that could potentially shift sentiment intraday. And while construction data released this morning was close to analysts’ expectations, some financial institutions are reporting headwinds from declining commercial real estate (CRE) values.

Residential Real Estate Construction Falters

Elevated mortgage rates, peak prices and diminishing credit availability have led to the U.S. Census Bureau reporting this morning that building permit issuance in September declined while housing starts missed expectations.

Building permits last month declined 4.4% month-over-month (m/m) to 1.473 million seasonally adjusted annualized units (SAAU) from 1.541 million in August. The results slightly beat expectations of 1.45 million permits. While housing starts rose 7.0% m/m to 1.358 million SAAU, from 1.269 million, they missed the analysts’ consensus expectation of 1.38 million.

A 14% m/m decline in apartment building permits hampered future construction plans, while single-family permits rose 1.8%. Starts reflected the opposite relative to apartment buildings, sporting a 17.1% multi-family increase while single-family grew 3.2%.

New permits dropped in all four of the nation’s regions that produced the following noted m/m declines:

- Northeast, 11.7%

- Midwest, 9.1%

- West, 4.8%

- South, 2.0%

Starts were a different matter with the Northeast down 24.5% m/m while the Midwest, South and West grew 35.3%, 6.5% and 5.6%.

Markets Retreat

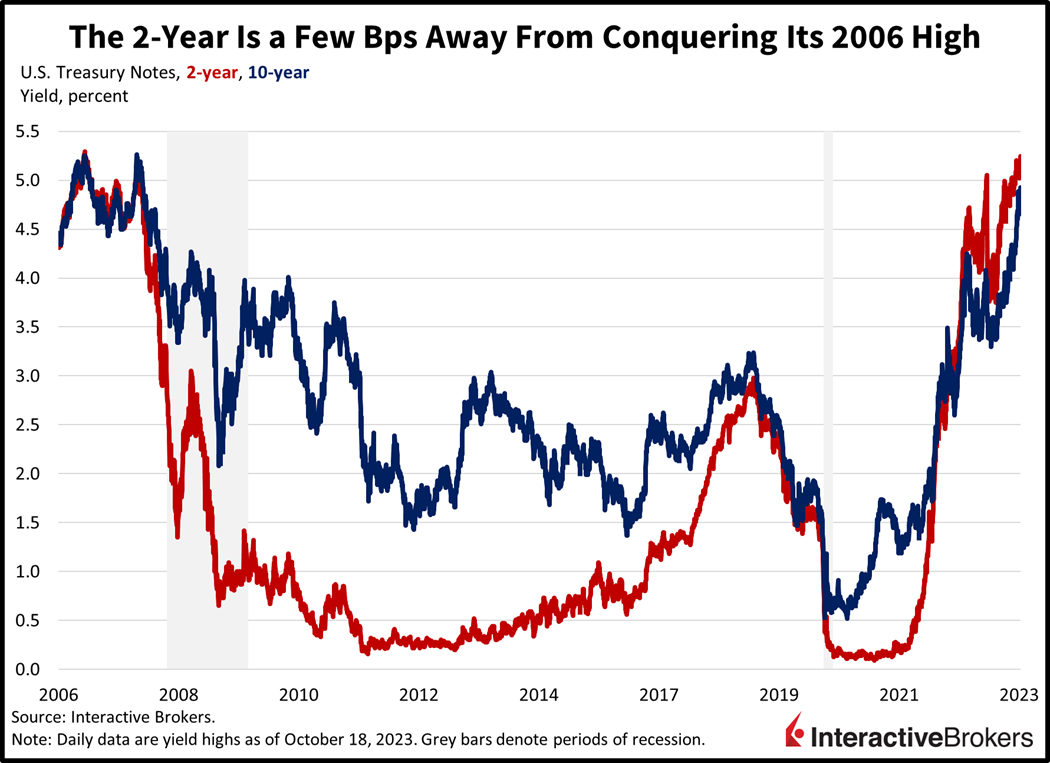

Stocks and bonds are down notably as economic and political uncertainties weigh upon sentiment against the backdrop of persistent monetary policy tightening. All major U.S. indices are down, with the small-cap Russell 2000 leading the declines while the Nasdaq Composite, S&P 500 and Dow Jones Industrial indices are down 0.9%, 0.8% and 0.5%. Sector breadth is deeply negative, with all sectors lower except for consumer staples and energy, which are up 0.7% and 1% thus far in the session. The homebuilders and materials sectors are down the most, 2.5% and 1.9%, as basement sentiment alongside declining plans for future construction weigh on both areas. Treasury bonds just reached their highest yields since prior to the Great Financial Crisis in 2008. The 2-year and 10-year maturities are up 3 and 9 basis points (bps) to 5.244% and 4.928%. If the 2-year yield tops 5.283%, we’d have to go back to 2001 to experience a yield that high. For the 10-year, breaking the pre-GFC high would require a move above 5.29%. Higher yields and stronger Fed tightening expectations are propping up the dollar, with its index up 0.4% to 106.63. The greenback is gaining against the Aussie and Canadian dollars, yuan, yen, euro and pound sterling. Global risk-off sentiments are generating interest for the Swiss franc, which is up 20 bps versus the dollar. Concerns over geopolitics and energy supplies are driving up the price of oil, with WTI crude up 0.5% or $0.43 to $88.10 per barrel. One third of global energy supplies exist near the Middle East conflict.

CRE Weighs on Bank Earnings

While geopolitical risks, monetary policy tightening and higher interest rates are weighing upon investor sentiment, banks are facing headwinds from weakening commercial real estate (CRE) values as illustrated by the following:

- U.S. Bancorp, in its third-quarter earnings release, reported that combined balances of CRE loans that are either delinquent by more than 90 days or nonperforming increased from 0.46% to 1.33% y/y in the quarter ended September 30. The level also increased from 0.87% in the quarter ended June 30. With higher interest rates increasing the risk of loan defaults across the bank’s debt offerings, the financial institution has allocated $515 million to credit-loss provisions, up from $362 million a year earlier. For the third quarter, however, an increase in net interest income, which is the difference in what it pays its depositors and the interest it collects on loans, resulted in the company generating an earnings per share (EPS) of $1.05, exceeding the analysts’ expectation of $1.02.

- M&T Bank also increased its allowance for credit losses. In the third quarter of last year, it maintained $115 million in credit loss provisions. For the second and third quarter of this year, however, it maintained $150 million in provisions. It says the increase reflects weakening CRE property values. Despite increasing its expectations for an uptick in delinquent loans, it generated $690 million in profits, or $3.98 a share, up from $647 million, or $3.53 a share y/y. Analysts expected an EPS of $3.88. M&T taxable-equivalent net interest income climbed from $1.69 billion to $1.79 billion y/y, helping the company exceed analysts’ earnings expectations.

- Morgan Stanley reported increasing its credit loss provision y/y from $35 million to $134 million, a result of worsening CRE conditions. Even with the increased projection for loan losses, Morgan Stanley generated an EPS of $1.38, exceeding the analyst consensus expectation of $1.27. Despite the bank’s equity and bond training revenues significantly exceeding expectations, Morgan Stanley’s EPS declined from $1.47 in the year-ago quarter with weakness in investment banking hurting results.

Labor Turmoil Shows No Indication of Moderating

Labor conflicts with the three-largest auto manufacturers took an unusual turn when Ford Motor Company Chairman Bill Ford said the United Auto Workers strike shouldn’t be a feud among the two organizations. Rather, the union and Ford should work together to fight competition from non-unionized companies such as Toyota, Honda and Tesla. UAW President Shawn Fain responded that it’s a conflict between automakers everywhere and corporate greed. Ford has also threatened to eliminate a shift at its Rouge truck factory in Dearborn, Michigan.

In another matter, General Motors has delayed its investor day scheduled for November 16 until early next year to allow its leaders to focus on union negotiations. Stellantis, furthermore, has cancelled its participation in the January Consumer Electronics Show, saying the cost of the strike is preventing the company from showing off its latest technological achievements in its automobiles. Some 34,000 UAW members are currently picketing against the Big Three car makers.

House Counts Votes for Rep. Jordan

Over in Washington, the House of Representatives is currently voting for a new speaker. Representative Jim Jordan from Ohio’s 4th district is trying to secure the Speakership after failing to achieve the 217 necessary votes during the first round. Jordan is a deficit hawk and one of the initial organizers of the Freedom Caucus. If elected, Jordan’s conservative views on spending and taxes raises the odds of a government shutdown in November as he’s unlikely to acquiesce to budget proposals from the opposing party. For market players, a lack of political clarity in Washington amidst heightening geopolitical tensions abroad increase the chances of a choppy, volatile environment.

Visit Traders’ Academy to Learn More About Building Permits and Other Economic Indicators.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.