Last week, we wrote about the steepness of the CBOE Volatility Index (VIX) futures curve and what it may portend about investor expectations for the coming months. We noted that the curve was about as steep as it was in the weeks leading up to the election. At that time, the election was expected to induce a volatile reaction, and that proved to be generally correct. Although I stand by my hypothesis, that investors fear a “buy the rumor, sell the news” reaction to the passage of the stimulus bill, I add another factor to that theory.

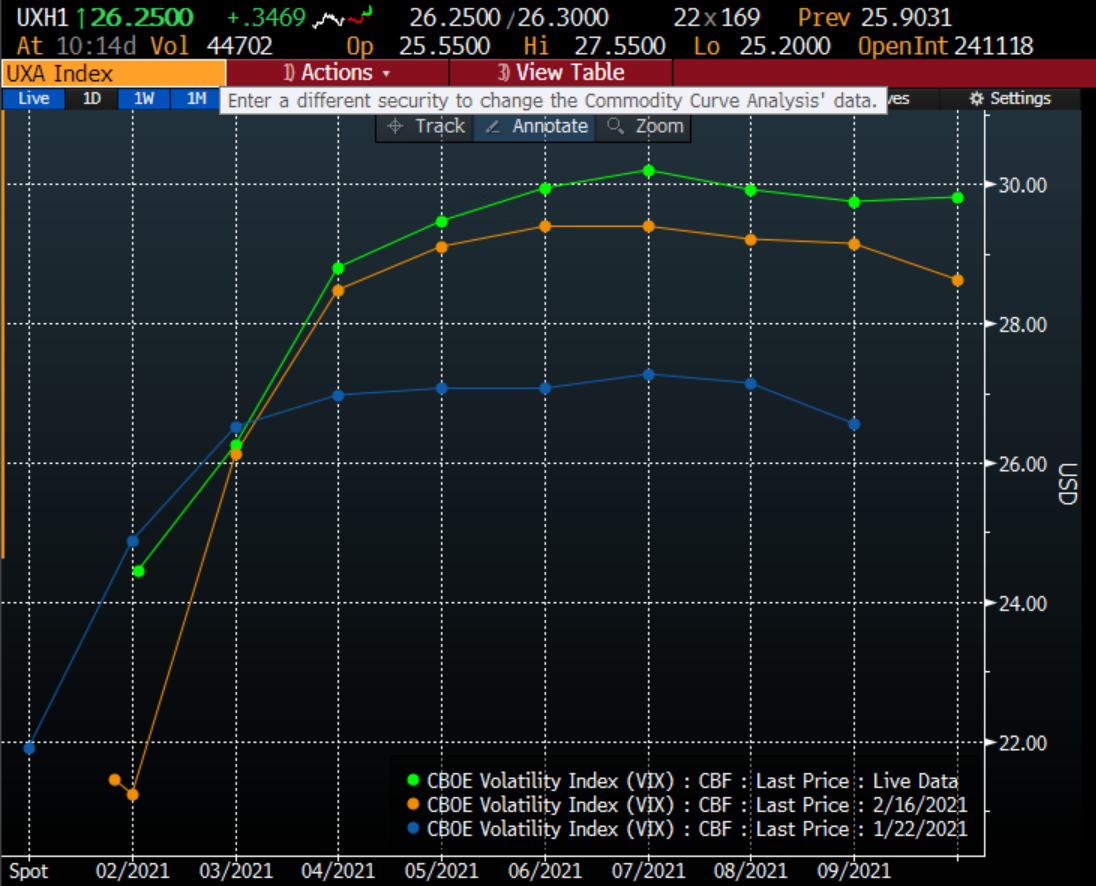

What struck me most is the timing of the bump. Consider the chart below. The curve has flattened, but that is largely because spot VIX rose in response to this morning’s sharp selloff, not because of a diminution of future concerns.

VIX Futures Curves – Today (green), 1 Week Ago (orange), 1 Month Ago (blue)

Source: Bloomberg

Notice that the bump begins in earnest with the April futures. Is there anything else that is on the horizon for investors in April? I’ll give you a hint: like death, they are inescapable. Yes, April 15th is when taxes are due.

Successful investing, and especially successful trading, creates taxable earnings. Last year’s spectacular rally certainly created gains for those who participated – as long as the investor realized some of his gains. The issue is particularly acute for those who used options and other short-term trading methods to create gains. By definition, those are short-term and are taxed as ordinary income at the filer’s rate. When we think about the remarkable rise in stock and options volume, we must assume that a fair amount of those trades led to realized profits for those who created that volume. And that could create a problem for the market.

Let’s think about a new investor. If he simply bought and held, he is likely to be sitting on gains, and many of those will be non-taxable. Gains only become taxable when someone sells a profitable investment. Yet I find it hard to believe that most of the volume that we have seen was simply by “buy and hold” investors. Trading has become a popular pastime, and a potential taxable event is created each time a trader exits a position. Let’s say that the new investor in our example was actually a profitable trader. He is now potentially liable for a significant amount of taxes that need to be paid.

Unlike income from wages, where taxes are mostly withheld by employers, taxes from trading income are largely accumulated. If an investor keeps all his money in the market without reserving cash for any potential tax liability, he will find himself needing to liquidate some of his holdings to raise cash to pay taxes. I will assert that many new investors have both taxable gains and only small cash reserves. Taxes could create an outflow for the markets in April.

I acknowledge that there are two potential problems with this scenario. First, the VIX index is a 30 day look ahead. April VIX futures expire on the 21st of the month – after the 15th when taxes are due. I don’t see this as a dealbreaker, however. Seasonal declines for the market usually begin in May, not April. There are inflows into IRA accounts that tend to offset the money withdrawn for taxes. My assertion is that the money removed around that date will be greater than the money flowing in, but that the full effect may not be felt until weeks later. Second, it is entirely possible that savvy investors will put aside their stimulus money to reserve for future tax liabilities. Even if that is the case, it means that the effect of the stimulus upon the markets would be muted. The money would never enter the market and instead go back to the Treasury.

There are many moving parts to consider regarding VIX and its futures. So far I have posited that a “buy the rumor, sell the news” response to stimulus and looming tax liabilities are raising fears in the volatility market beyond the current concerns about inflation. We will continue to monitor VIX futures to see if those signals remain in effect.

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: Tax-Related Items (Circular 230 Notice)

The information in this material is provided for informational purposes only and does not constitute tax advice and cannot be used by the recipient or any other taxpayer to avoid penalties under any federal, state, local or other tax statutes or regulations, or to resolve any tax issue.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more information read the "Characteristics and Risks of Standardized Options" also known as the options disclosure document (ODD) or visit ibkr.com/occ

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.