ZINGER KEY POINTS

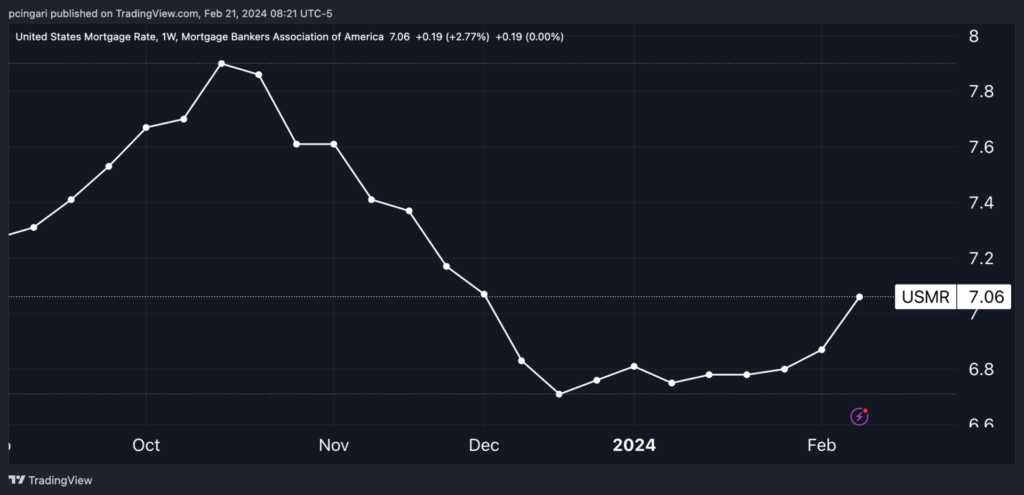

- 30-year fixed-rate mortgage rates hit 7.06% for the week ending Feb. 16, 2024, the highest since early December.

- Mortgage applications fell by 10.6% as rates climbed, reflecting reduced affordability and buyer caution.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances of $726,200 or less witnessed a further increase recently, reaching 7.06% for the week ending Feb. 16, 2024.

It marks the highest point observed since early December, as reported by the Mortgage Bankers Association on Wednesday.

The rate increase led to a sharp decline in mortgage applications, which fell by 10.6% from a week earlier, reflecting reduced affordability and buyer caution.

Why Are Mortgage Rates Rising Again?

After plummeting from a peak of nearly 8% in October 2023 to 6.7% by January, mortgage rates have reversed course, embarking on an upward trend over the past three weeks with a 28 basis point surge.

This shift mirrors the ascent in Treasury yields, a critical benchmark for setting mortgage rates. The unexpected resurgence of inflationary pressures in January has dampened market optimism about an imminent aggressive rate-cutting cycle by the Federal Reserve in the early part of the year.

Instead, recent comments from Fed officials have adopted a tone of caution, emphasizing a deliberate approach to rate adjustments while awaiting more definitive data on inflation’s path.

The resurgence of mortgage rates above the 7% mark is largely attributed to the latest inflation data for January, which indicated a rise, thereby dampening the anticipation of immediate rate cuts by the Federal Reserve.

Mike Fratantoni, the MBA’s chief economist, highlighted the sensitivity of potential homebuyers to rate fluctuations, noting the compounded pressure of higher rates and home values in a market already constrained by limited supply.

Chart: 30-Year Mortgage Rates Soar Above 7%

Mortgage Rates, Treasury Yields Rise As Inflation Surprises

Market reactions have been notably influenced by two inflation reports that surpassed expectations, leading to an adjustment in rate cut expectations from 125 to 100 basis points.

The consumer price index (CPI) marked a 3.1% year-over-year increase, slightly above the forecasted 2.9%. Additionally, producer prices saw a 0.3% rise month-over-month in January, marking the most significant gain in five months, and surprising expectations of a muted 0.1% surge.

The yield on 30-year Treasury notes has escalated from around 4% at the start of February to the current 4.45%, signaling the highest level since early December 2023.

Investors and market participants now await further insights from the minutes of the latest Federal Open Market Committee (FOMC) meeting, set to be released on Wednesday at 2 p.m. ET. This forthcoming disclosure is anticipated to shed light on the Federal Reserve’s stance and future policy directions, potentially impacting mortgage rates and broader financial markets.

—

Originally Posted February 21, 2024 – Mortgage Rates Climb Above 7% As Hot Inflation Dampens Expectations For Fed Cuts

Disclosure: Benzinga

© 2022 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Benzinga and is being posted with its permission. The views expressed in this material are solely those of the author and/or Benzinga and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.