ZINGER KEY POINTS

- Mortgage rates reach 7.31%, the highest in 23 years.

- Mortgage applications have plummeted by 4.2% in the week ending August 18, 2023, the fifth consecutive week of decline.

The U.S. housing market is facing a seismic shock. Mortgage rates skyrocket to levels not seen in over two decades.

The average contract interest rate for 30-year fixed-rate mortgages has surged by 15 basis points (bps). The rates reached a staggering 7.31% for the week ending Aug. 18. This marks the highest rate since December 2000, according to data released by the Mortgage Bankers Association of America (MBA).

Treasury Yield Surge Fuels Surge In Mortgage Rates

The surge in mortgage rates is intrinsically linked to the recent surge in long-term Treasury yields.

“Treasury yields continued to spike last week as markets grappled with illiquidity and concerns that the resilient economy will keep inflation stubbornly high,” said Joel Kan, an MBA economist,

As 10-year benchmark yields breach 3.3%, the loftiest point since November 2007. The 30-year Treasury yield crossed 3.4%, reaching heights unseen since May 2011, and the broader market is contending with heightened “risk-free” rates. These rates, acting as a gravitational force, are pulling the entire spectrum of interest rates.

This trend is propelled by higher-than-expected issuances and hawkish comments from the Federal Reserve. The yield surge has also pushed real yields on Treasury-inflation-protected securities (TIPS) to their highest levels since 2009. This further complicates the economic landscape.

U.S. Homebuyers Grapple with Unforeseen Challenges

As the real estate market navigates these uncharted waters, U.S. homebuyers find themselves facing an unexpected challenge.

Mortgage applications have plummeted by 4.2% in the week ending Aug. 18, the fifth consecutive week of decline.

Requests for home loan refinancing have slipped by 2.8%, while applications for new home purchases have seen a considerable drop of 5%.

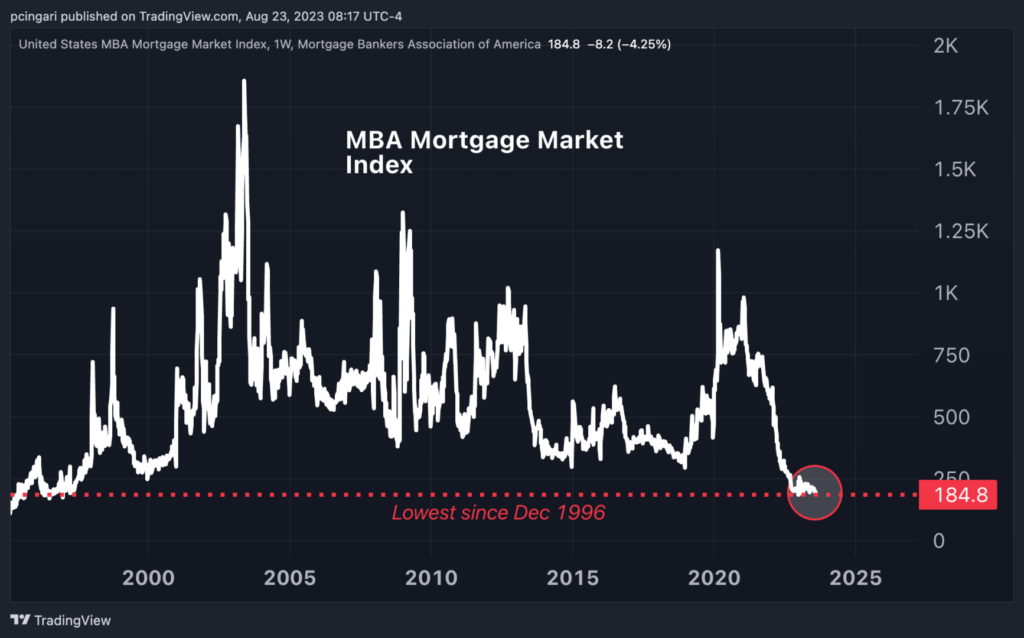

- The MBA Mortgage Market Index, a key gauge of mortgage application trends, has taken a significant hit, falling by 4.1% to a score of 184.8 points. This level hasn’t been observed since December 1996, a testament to the gravity of the situation.

Chart: Mortgage Market Gauge Hit The Worst Level Since December 1996

All Eyes On Jackson Hole

The Jackson Hole Symposium, hosted by the Federal Reserve this week, is anticipated to provide clarity on the economic horizon and shed light on the path that interest rates might take.

Investors and industry stakeholders await with bated breath to hear from Fed Chair Jerome Powell, whose speech is scheduled this Friday.

—

Originally Posted August 23, 2023 – Mortgage Rates Climb To 7.31%, Highest in 23 Years: Shocking Chart Reveals Tremors in Housing Market

Disclosure: Benzinga

© 2022 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Benzinga and is being posted with its permission. The views expressed in this material are solely those of the author and/or Benzinga and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.