Mortgage rates exceeding 7% are weighing upon real estate activity with today’s July housing data depicting an unexpected drop in building permits one day after homebuilder sentiment registered a significant decline. The data shows how the highly cyclical real estate market is dependent on long-term interest rates that have recently been on a tear, making home ownership—which is already out of reach for many Americans—even less affordable.

July Building Permits came in at 1.442 million seasonally adjusted annualized units (SAAU), well below the consensus projection of 1.463 million and essentially unchanged from June. The Northeast, South and West gained 3.8%, 1.2% and 0.6% but a 7.7% decline in the Midwest constrained progress. Additionally, gains in single-family permits were offset by declines in multi-unit dwellings, resulting in an unchanged overall reading. Broadly speaking, an excessive number of multi-unit dwellings have been built, causing a decline in construction plans for those types of homes. On the other hand, 1.452 million SAAU housing starts exceeded the 1.448 million expected by analysts and increased from June’s 1.398 million total.

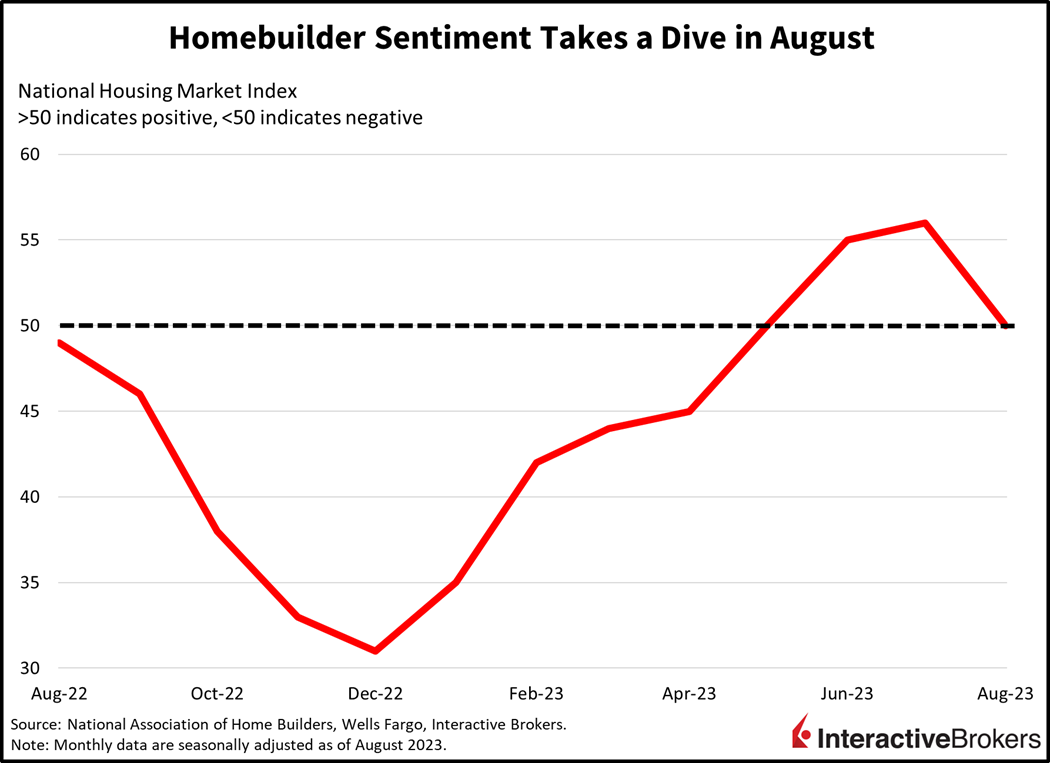

Homebuilder Sentiment Drops

Despite the increase in housing starts, homebuilders are battening down the hatches, with rates above 7% significantly impairing buyer traffic as reflected in yesterday’s homebuilder sentiment report. August sentiment declined sharply from 56 in July to 50 and disappointed with forecasters expecting an unchanged month-over-month (m/m) reading. The 50 level is the border between negative and positive sentiment. The m/m drop is the first since December and the lowest level since May. Builders reported an increase in price discounts, which climbed from 22% in July to 25% in August. They also complained about commodity prices pushing up construction costs. Weighing on sentiment mostly was the buyer traffic component, which fell from 40 to 34. Current sales conditions and sales expectations also hurt results, declining from 62 and 59, respectively, to 57 and 55.

Investors Await Fed Minutes

Markets are quietly awaiting the release of the 2:00 pm Eastern Time minutes from the Federal Reserve’s July meeting, which are likely to detail levels of dissidence and accord among the central bank’s Federal Open Market Committee regarding last month’s fed funds rate increase. Most major U.S. equity indices are near the flatline, but the Dow Jones Industrial Average is up 0.3%. Most sectors are up, while the health care, real estate, consumer discretionary, and communication services categories are weighing on overall performance. Investors are scooping up Treasures at the margin, with most yields across the curve down a basis point (bp) or two. The dollar is equally quiet, with its index down 1 bp to 103.19. As market players across asset classes patiently await the opportunity to go risk-on or off, WTI crude oil is near the flatline as well, with prices down 0.1% to $80.90 per barrel.

Corporations Warn of Weakening Consumers

With a weakening real estate industry and Home Depot yesterday providing disappointing guidance because many homeowners have completed large projects or are refraining from doing so because of high financing costs, other businesses are pessimistic about retail spending. Just this morning, Target lowered its full-year same-store sales guidance to a decline in the mid-single-digit range from an earlier estimated range of a single-digit decline to a single-digit increase. CEO Brian Cornell says that inflation has caused consumers to spend a larger portion of their budgets on groceries and beverages, which represent only a small percentage of the company’s sales. For the second quarter, Target’s revenue of $24.77 billion missed the $25.16 billion that analysts anticipated. Its earnings per share (EPS) of $1.80, however, exceeded the $1.39 expected by analysts. In the year-ago quarter, Target generated an EPS of only $0.39 because it aggressively lowered its prices to clear a glut of inventory. Consumer weakness extends abroad with Tencent, which is a Chinese online gaming provider, generating $20.46 billion in revenue, which missed the expected $20.79 billion in revenues. After aggressively cutting costs and divesting from non-core business, Tencent’s second-quarter earnings rose 41% year-over-year but missed expectations.

Fed Minutes Could be Pivotal for Investor Sentiment

Bulls hope that August’s lethargy doesn’t persist, while bears sport Rolls-Royce umbrellas as they pray for a volatility spike during a weak seasonal period for equities.

With higher interest rates slowing down the real estate industry, today’s 2 p.m. release of Fed minutes could take on increased significance. Investors are likely to focus on how many Fed policymakers supported the July 25 bp increase to the fed funds rate. A unanimous vote in support of the increase or even a large majority that favored the increase could imply that the Fed is still hawkish and may be likely to stick with its rate hiking campaign, causing additional challenges for the real estate sector. Meanwhile, the U.S. government has an elevated deficit and will aggressively ramp up its bond issuance, which puts upward pressure on yields for Treasuries, which by extension would boost interest rates for corporate bonds and mortgages. The Treasury market, furthermore, no longer has one of its largest clients—the Federal Reserve—snatching up debt because the Fed is reducing its balance sheet as it moved from quantitative easing to quantitative tightening. With 7% mortgage rates already causing pain in the real estate market, a rate of 7.6% will likely push prices lower, toward a new cycle low. In the meantime, bulls hope that August’s lethargy doesn’t persist, while bears sport Rolls-Royce umbrellas as they pray for a volatility spike during a weak seasonal period for equities.

Visit Traders’ Academy to Learn More about Building Permits and Other Economic Indicators.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.

Leave a Reply

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

When can I cash in

US Stocks…LOOKOUT BELOW!