There is no way to put lipstick on yesterday’s pig of a market move. CPI was above expectations, the debate about the Fed’s next move flipped from a 50 or 75 basis point hike to 75 or 100, and major US indices fell by 4%-5%. Today we are seeing a modest bounce – most investors prefer that to continued selling, but this morning’s trading has been largely trendless.

Despite yesterday’s debacle, key US indices – the S&P 500 (SPX), NASDAQ 100 (NDX), and Russell 2000 (RTY) are now basically flat for the month. That they were only giving back a few days’ worth of gains is something we noted yesterday. As usual, the various 1%+ up days that we experienced last week were another bout of “socially acceptable volatility”, while yesterday’s “rug pull” was the plain, old nasty kind of volatility – only more so.

What we saw yesterday was not appreciably different from the market’s reaction to Fed Chair Powell’s Jackson Hole speech. At the time, traders began to anticipate a “pivot” from the Federal Reserve. That speech was clearly designed to remove any uncertainty about the Fed’s resolve to fight inflation – even if rate hikes and quantitative tightening (QT) bring about economic weakness. The market’s mindset flipped instantly from debating whether the FOMC’s next move will be a 50 or 75 basis point hike to whether the hike at the next meeting – a week from today – will be 75 bp or a full 1%. (Interestingly, stocks rose even as the likelihood of a 75 vs. 50 bp hike rose steadily last week. On the 6th the likelihood of a 75 bp hike was about 73%; it was 93% prior to yesterday’s CPI report.)

As I write this, Fed Funds futures are pricing in about a 1/3 chance of a 1% hike. I wrote yesterday that I remain in the 75bp camp, saying:

While I never wavered from my opinion that the next move would be 75bp even when there was about a 50-50 chance of a 50bp hike, I am not in the camp of 100bp next week. A full 1% would seem as though the Fed is panicking. While various Fed talking heads have noted that they are willing to run the risk of a slower economy in order to win their inflation fight, a 1% move could easily be interpreted as an overreaction and more likely to be recessionary.

This creates an opportunity for traders. If we fell yesterday on fears that the Fed might panic into a larger than expected rate hike, we have the potential to recoup some of those losses if the rate hike is “only” 75bp. Remember, we rallied even as the probability of a 75bp hike steadily rose last week. In theory, we should also see some improvement if we now revert to that same hike.

The problem is that we could have a rocky path until next week’s rate announcement. Before then, we have to reckon with the quarterly expiry of futures and options on Friday and the start of accelerated QT. The former is a “known unknown”. Anyone with a calendar has the ability to recognize that Friday is a major expiration. The open interest in SPX 4,000 strike options expiring Friday morning is over 200,000 contracts. That likely explains why we found support at that level for a while yesterday before melting down under selling pressure. The open interest in the 3,900 strike is about half that, and a re-test of that level prior to Friday would be critical. That level held wonderfully earlier this month, yet was not tested since.

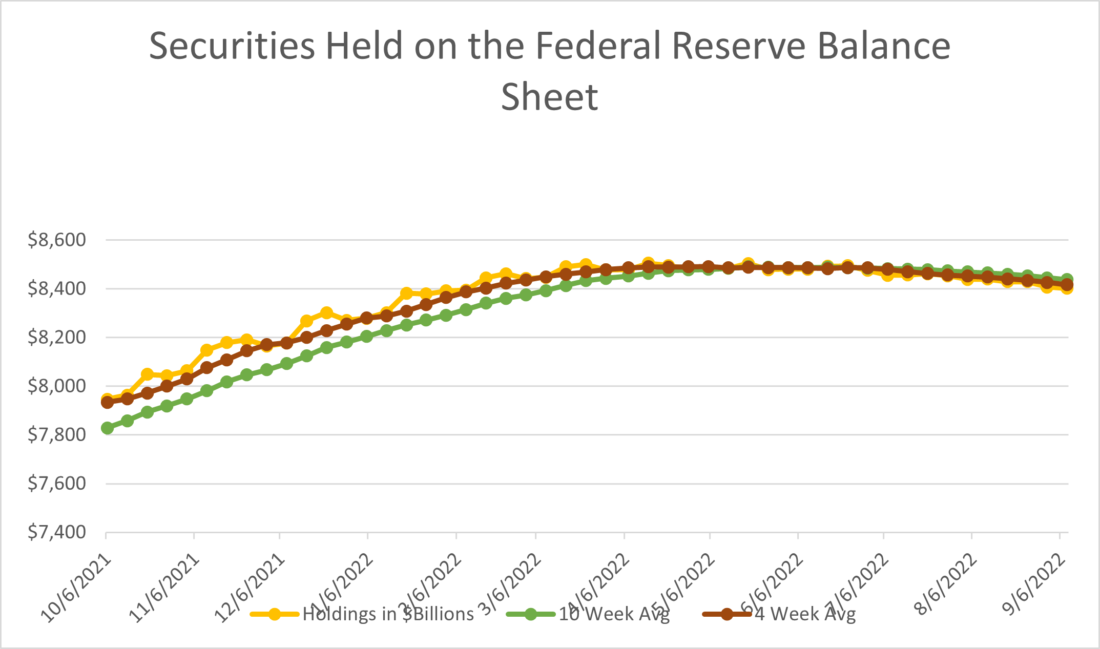

The growing onset of QT remains an “unknown unknown.” The Fed will be doubling its pace of balance sheet reduction from $47.5bn per month to $95bn, starting this month. We’ve had very little experience with QT in our lifetimes, and what little we’ve seen hasn’t been great (see late 2018 and so far this year). The chart below shows that the pace of balance sheet reduction has so far been modest. A faster pace would have an uncertain effect – at best – on asset prices. And remember, monetary policy typically operates with a lag. It’s not clear whether markets have felt the effect of the QT we have seen so far, let alone a doubled pace.

Considering yesterday’s drop, today’s dip buying appears to be relatively muted. If you choose to buy the dip because you believe that we are short-term oversold or that rate worries are overstated, that’s one thing. If you choose to buy reflexively, simply because you’re conditioned to “buy the dip”, that’s another. It can be OK to hunt for bargains when markets are “on sale”, but only if you’ve considered the rationale behind your discount shopping.

Source: Federal Reserve, Interactive Brokers

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more information read the "Characteristics and Risks of Standardized Options" also known as the options disclosure document (ODD) or visit ibkr.com/occ