Equity traders are shrugging off this morning’s hotter-than-expected Producer Price Index and Retail Sales results on the heels of yesterday’s hot Consumer Price Index. Bond traders are taking notice of the inflationary pressures in the pipeline, however, and are selling Treasuries. Across the Atlantic, meanwhile, the European Central Bank hiked its key interest rates 25 basis points (bps), a move that markets had placed a 50-50 likelihood of occurring. The hike could serve as a precedent for other central banks that are considering raising rates to fight inflation. Many central banks are likely to reason that the risk of doing too little outweigh the risks of doing too much.

Inflation Picks Up

This morning’s PPI shows that August wholesale prices rose 0.7% month-over-month (m/m), the fastest growth in 14 months. The figure arrived significantly higher than projections calling for 0.4% and July’s 0.3% increase. Year-over-year (y/y) producer prices rose 1.6%, meaningfully above the 1.2% consensus estimate and the previous period’s 0.8%. Core wholesale prices, which exclude food and energy, were well behaved, however, rising 0.2% m/m and 2.2% y/y, exactly as anticipated and slower than the previous month’s 0.4% and 2.4%.

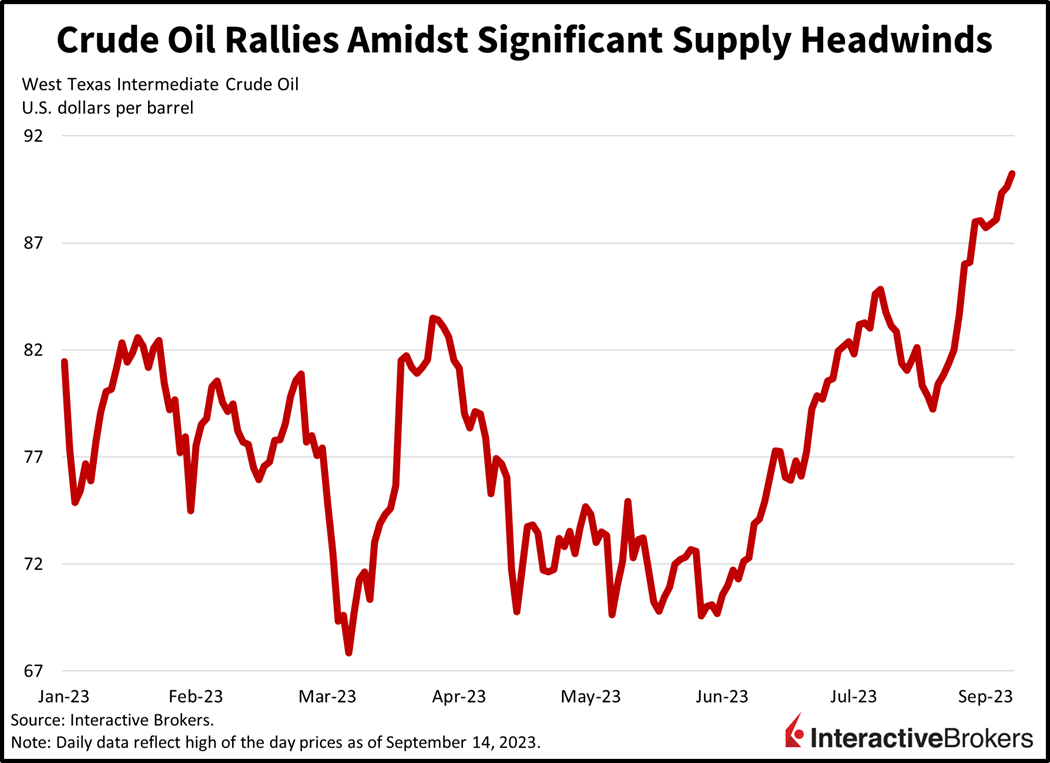

Wholesale prices for energy jumped 10.5% as gasoline soared 20% in August, with oil prices climbing after an earlier announcement that Saudi Arabia and Russia will extend production cuts until the end of this year. Price gains also occurred with diesel fuel, jet fuel, home heating oil, beverages and beverage materials, iron and steel scrap. On an encouraging note, prices for fresh and dry vegetables fell 11.5%. Prices for residential electric power and industrial chemicals also declined.

Among services, the largest price increase was residential real estate services, while the following other categories also saw increases:

- Truck transportation of freight; machinery, equipment, parts, and supplies wholesaling

- Automotive fuels and lubricants retailing

- Services related to securities brokerage and dealing

Consumers Keep their Wallets Open

August retail sales also came in scorching, as consumers were compelled to pay more to fill up their gasoline tanks. Sales grew 0.6% m/m, much higher than the consensus’s call for 0.2% and slightly higher than July’s 0.5%. In fact, retail sales excluding gasoline and automobiles only rose 0.2% as pain at the pump constrained consumers from spending much elsewhere.

Indeed, gasoline station sales rose a sharp 5.2% m/m, dwarfing the second-highest category, apparel stores, which only registered a gain of 0.9%. Electronics and appliance establishments, health and personal care outlets, food markets, general merchandise shops, automobile dealerships and building materials suppliers also contributed to a strong headline figure, rising 0.7%, 0.5%, 0.4%, 0.3%, 0.3% and 0.1%, respectively. Consumers took breaks from restaurants, bars and nightclubs and from ecommerce shopping, however, with both categories slowing materially from the previous month. The former slowed from 0.8% m/m to 0.3% while the latter decelerated from 7.2% to 0%. Weighing on the headline were sporting goods stores, miscellaneous suppliers and furniture showrooms with declines of 1.6%, 1.3% and 1%.

Labor Market Strength Persists

Unemployment claims data this morning depicts continued labor market tightness amidst low levels of layoffs. Initial claims for the week ended September 9 came in at 220,000, lighter than projections of 225,000 but a bit loftier than the previous week’s 217,000. The four-week moving average of initial claims continued to lose momentum for the second-consecutive week, dropping from 229,500 to 224,500. Continuing claims for the week ended September 2, meanwhile, arrived at 1.688 million, also lighter than forecasts of 1.695 million but higher than the prior week’s 1.684 million.

ECB Lowers Outlook as it Raises Key Rate

The persistent and far-ranging nature of inflation was illustrated this morning when the European Central Bank hiked its key interest by 25 bps, marking the 10th consecutive increase and an all-time high rate of 4%. The hike is stoking optimism among investors that it may be the last rate increase needed to contain inflation. The bank also revised its inflation forecast upward for this year and next year while lowering its outlook for GDP growth.

Economists at the bank believe inflation for this year and next year will be 5.6% and 3.2%, respectively, higher than the June forecasts of 5.4% and 3%. Inflation is forecast to subside to 2.1% in 2025 compared to the 3% rate forecasted by the bank in June. GDP growth for this year was revised down from the 0.9% June estimate to 0.7%. The June 1.5% and 1.6% estimated GDP growth rates for 2024 and 2025, furthermore, were lowered to 1% and 1.5%.

Equities Gain and Bond Investors Sell

Stocks are running in stride despite hot economic data and the 25-bp ECB hike. Cyclicals and technology are leading with the Russel 2000 and Nasdaq Composite indices up 1.3% and 0.8%. The Dow Jones Industrial Average and the S&P 500 indices aren’t far behind, as each is up roughly 0.7%. Participation is wide and broad, with every equity sector higher. Yields and the dollar are telling a different story, however, with the 2- and 10-year maturities up 2 bps each to 4.99% and 4.28%. The Dollar Index is up 34 bps, meanwhile, as the ECB’s hike has investors nervous that the region will fall into recession this quarter. The greenback is appreciating against the euro, pound sterling, franc, and yuan but weakening relative to the yen and the Aussie and Canadian dollars. Crude oil is resuming its run, climbing above $90 per barrel for the first time in 10 months on a frustrating supply story. As Riyadh and Moscow remain in cahoots to hamper production and exports, WTI crude oil is up 1.33% to $90.01.

Fed Meeting Greeted with Strong Inflationary Tailwinds

With September already looking like another fiery month on the inflationary front, inflation risks are tilted to the upside into year-end against the backdrop of deteriorating energy supplies

The news of extended oil production cuts is occurring just as the Federal Reserve will meet next week to discuss its monetary policy. The Fed, which has been deluged recently with stronger-than-expected economic data, is likely to run alongside the ECB as both central banks flaunt their abilities to fight inflation. With investor sentiment running hot alongside inflationary pressures, the committee is likely to maintain its hawkish rhetoric in an effort to subdue economic animal spirits. While gasoline and jet fuel prices aren’t directly reflected in the core PCE, the Fed’s preferred inflation gauge, airline and motorcoach bus tickets are, as well as many other categories of which the commodity is an integral input. With September already looking like another fiery month on the inflationary front, inflation risks are tilted to the upside into year-end against the backdrop of deteriorating energy supplies.

Visit Traders’ Academy to Learn More About Retail Sales and Other Economic Indicators.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.